Wyoming LLC (6-Step Guide) – How to Easily Form an LLC in Wyoming?

Get Professional Help to Create an LLC in WY [from $0 + state fees]

When you’re looking to start a business, an LLC often stands out as one of the best options out there. This structure offers limited liability and pass-through taxation, saving you big money by being taxed on your personal return. Plus, you may not know this, but Wyoming makes a great choice for forming an LLC as well.

With no personal income tax, you can take home an even bigger share of your hard-earned money, and formation is particularly affordable in this state as well. So, now that you know a little about how great a Wyoming LLC can be let’s take a closer look at why you would want a Wyoming LLC, some of its pros and cons, and how you can form your own in only six easy steps.

If you want to skip the hassle of starting a Wyoming LLC yourself, consider using professional help for the best price in the market:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

Why Would You Want a Wyoming LLC?

The biggest reason you may want a Wyoming LLC over other states starts with their incredibly strong LLC laws. Wyoming was the first state in the country to introduce LLC laws roughly 18 years before others followed, and they have continuously worked to keep them strong. In addition, this state has low initial and annual fees, so formation and maintenance are affordable. And if you want to know the full cost of incorporating your LLC there — read our Wyoming LLC cost guide. It has all the fees and charges comprehensively laid out!

Other reasons to choose a Wyoming LLC include:

Quick Wyoming LLC Pros & Cons

Before you settle on a Wyoming LLC, let’s take a quick look at all the pros and cons so you can make a clear judgment on whether a Wyoming LLC is right for you.

Pros

There are a large number of pros to forming a Wyoming LLC, and these include:

This can also save you and your business a lot of time in filling out a business and personal state tax return. In most states, even an LLC is required to fill out an informational return regardless of what they do or do not owe, even if they are a disregarded entity. Wyoming’s simple tax system and lack of a state income tax can make it extremely easy to run an LLC in this state.

Though it is universally recommended that an LLC acquire an operating agreement, this state does not require an LLC to write one as some states do, even if you certainly should write one. What this does mean is that you can start your business and then take the time to create a well-crafted operating agreement.

Annual reports, which are the primary state cost and maintenance requirement after you form your LLC, are also easy and affordable in Wyoming. In this state, all you must include in the annual report is a confirmation of the business’ name, addresses, and registered agent information. The filing fee is known in this state as the Annual Report License Tax and will only cost $60 for a company with assets below $250,000 within the state and $0.0002 for every dollar of company assets above $250,000 within the state.

This fee is much more affordable than many other states which charge franchise taxes on a yearly basis in addition to annual report fees. For example, California charges LLCs an impressive $800 annual franchise tax. This can lead to a far worse deal for LLCs which benefit from pass-through taxation and potentially actually worsen your tax burden.

In some cases, this protection has not proven to be absolute. In certain states, the law has permitted the owners of an LLC to be held accountable for debts incurred by the business. This can potentially occur in any state, but the standard for this to happen varies considerably based on the state of formation.

Luckily for a Wyoming LLC owner, this standard is one of the strictest in the country. Back in 2016, this only took another step in the right direction by making it even harder to circumvent an LLC’s protections. The state amended its existing LLC Act to make a failure to abide by company formalities, not reason enough to make owners liable for business debts. Instead, there must be other factors listed in this act as well. It also ensured this standard applies to disregarded and pass-through entities, as well as ensuring the protection applies to single-member LLCs as well as multi-member.

When doing business in Wyoming while residing or holding a primary business in another state, you have to look out for which state laws apply. In many types of civil cases, judges have the primary discretion as to which state’s law will apply, and in most cases, they will favor the law of the state where the lawsuit was filed. This often happens regardless of the controlling law chosen in a contract unless it can be shown by a part that the laws of one state truly have a greater interest in the case.

However, fortunately, when it comes to overcoming LLC liability protections, case law has strongly settled that it is the state of formation that applies, not the state where the suit was filed. This means that when you form an LLC in Wyoming, you can be confident that Wyoming’s limited liability protections will apply, meaning it will be difficult to hold your personal assets liable.

One of the most distinctive features of an LLC is that a creditor cannot satisfy a member’s personal liabilities by directly seizing business assets. In a number of states, the only remedy they may seek is what is called a charging order. Instead of seeking business assets, what this will do is place a lien on any financial distributions a member would have received from the company. This will prevent any creditors who take a member’s financial holdings in the LLC from being able to directly interfere in the LLC’s activities or assets.

Unfortunately for LLCs located in some states, this protection varies depending on location. In states such as California and Colorado, a creditor can request courts to force an LLC to sell assets as a result of the lien a charging order places. But, luckily for LLCs located in states with strong protections, such as Wyoming, this is impossible in their locations.

Single-member LLCs in states with weak protections often suffer the most. The reason for this is that laws protecting LLCs from being interfered with financially were often designed solely to protect other members of the business. This means that with a single-member LLC, there are no other members there that need protection. As a result, there are very few states that offer single-member LLCs the same level of business protection as multi-member LLC. However, surprisingly Wyoming is one of the very few places that does offer that very same protection from charging orders!

One way to use a domestic asset protection trust is to use it as an additional layer of separation between you and your business. After all, if you do not directly own the assets, a creditor cannot use them to satisfy any personal obligations.

One other useful way to combine a Wyoming LLC with this type of trust is to establish a private trust LLC. With any trust, there is going to be a trustee who will manage the trust’s assets. In Wyoming, this can be a private trust company that is trusted to manage the funds.

By establishing a private trust company, you can, first of all, avoid the often exorbitant fees associated with paying a dedicated trustee to manage the funds, and second, you can still keep a measure of indirect control over your assets by making yourself a manager of the private trust LLC.

Additionally, your annual report will only require one individual’s name, and this can be that of an agent. In this case, the agent will simply sign the report again, leaving your name off the public record.

The simplest solution to this is to establish a US-based LLC as a subsidiary. This will allow your offshore business to receive its tax savings while the US-based LLC deals with local customers and possesses a business bank account. Due to its unique ease of formation and ability to protect assets, a Wyoming LLC makes perhaps the single best choice for this role.

Cons

As far as the formation and running go, a Wyoming LLC has few cons to consider, but like with any major decision, there are a few to consider.

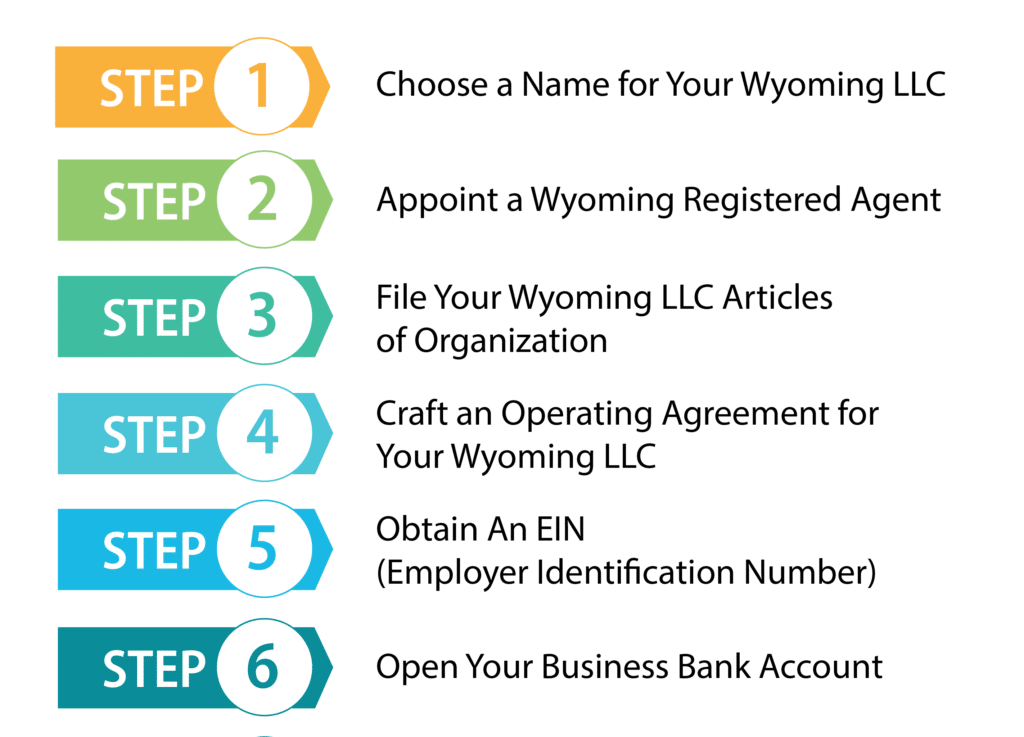

How to Form Your Wyoming LLC in Six Easy Steps

Now that you have had a chance to consider all of the advantages and disadvantages of forming a Wyoming LLC, chances are you have found the pros really do outweigh the cons. So, let’s get down to business, and fortunately, there are only six easy steps standing between you and your brand-new Wyoming LLC.

Step 1: Choose a Name for Your Wyoming LLC

This first step isn’t too complicated, but it is definitely important. The name you choose for your Wyoming LLC will be the first impression customers, and investors will have when they see your company. In order to catch their eye, this name should be unique but descriptive of your business.

Also, though most states will regulate how close your name can be to an existing business, Wyoming is particularly strict about this. Also, the state will consider it your responsibility to ensure that the name you choose is distinguishable enough from other businesses, and if you choose to file and they find that it isn’t unique enough, they will deny your formation. They will not return your $100 filing fee, and you will have to start the process all over again.

Luckily, checking to make sure the name you choose is unique enough isn’t that hard. All you have to do is perform a Wyoming LLC name search, and here is how you can do that:

- Go to the Wyoming Secretary of State website business entity search tool.

- Use keywords from the name you choose to search, not the whole name. Also, leave off designators such as LLC and punctuation as these are not needed and can cause the tool to leave off relevant results.

- Just click to select “contains,” not “starts with,” and there is no need to worry about a filing ID, so now click search.

- If the search engine comes back with no results, then you are probably safe in choosing that name; however, if it comes back with names that appear similar to the one you have chosen, then it will probably be turned down if you try to file with it. It is best to be safe because no one wants to lose a $100 filing fee.

One final detail to keep in mind is that the search results will show whether a business is active or inactive on the search tool and if one has been inactive for at least two years, you can use the same name or a similar name.

Required and Restricted Words and Phrases

There are some requirements you will need to follow in finalizing your chosen name. First of all, you will need to include a designator at the end of your business name. This isn’t so hard, and you have the opportunity to choose between three variants including:

- Limited Liability Company

- L.L.C.

- LLC

Some limitations for naming do exist in order to avoid confusing the public. You cannot use any words or phrases that may cause others to misidentify your company as a corporation or a government entity. Also, some words that may cause others to identify your company as providing a specific professional service such as a bank or law office may require government permission to use.

Step 2: Appoint a Wyoming Registered Agent

The next step is to choose an individual or company to serve as your registered agent. A registered agent is an individual or company that is appointed to receive official correspondence on the part of your business (here’s our full guide on registered agents). This includes legal matters such as service of process and tax forms.

Your Wyoming LLC’s registered agent can be a member of your LLC, a friend or family member, another company, or even yourself. However, in order to qualify, an individual must be 18 years of age or older and possess a valid street address located in the state of Wyoming, and this does not include P.O. Boxes. Any registered agent must be available at all times during traditional business hours to receive official correspondence.

Most businesses will choose a commercial registered agent service to act on behalf of their company. This makes the process much easier for small business owners and all others, in fact. This is particularly helpful for those who do not have a physical address to use in Wyoming at all.

Many business owners do not operate during traditional business hours or travel, making it difficult to ensure there will always be someone there to receive correspondence. So, definitely carefully consider before choosing to have yourself or another individual act as your Wyoming LLC’s registered agent.

Step 3: File Your Wyoming LLC Articles of Organization

Now you are ready to really get your Wyoming LLC started by filing your Articles of Organization. These are the official documents that you will file with the Wyoming Secretary of State to get your LLC formally started.

Now there are two ways to perform the filing, either online or by mail. The end result will be the same, and both will cost the same filing fee of $100; however, by filing online, you will get faster processing. So let’s quickly address both methods.

The first one is to file your Articles of Organization online through the Wyoming Secretary of State’s website. This is generally the best way to do it and will result in the fastest processing by a large margin. This will result in instantaneous processing and approval.

Alternatively, you can download and print out the form, fill it out, and mail it to the Wyoming Secretary of State at:

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

This may take between three to five business days to be processed and approved.

No matter which method you choose, once your LLC’s Articles of Organization are approved, your company has been officially formed; however, before you go and start, let’s take a look at what the form requires to ensure you are ready to get started. Either method you choose will ask for the same information such as:

If you are filing online, you can be instantly approved and receive your approval paperwork via email immediately. This includes a Certificate of Organization, filing receipt, and an official stamped copy of your approved Articles of Organization.

You can download a Certificate of Good Standing for your Wyoming LLC as well. This document isn’t necessary, but it is nice to keep around for a few purposes.

Step 4: Craft an Operating Agreement for Your Wyoming LLC

Wyoming does not require LLCs to create an operating agreement. However, it is still a very important step to complete. A properly set up operating agreement can give your business a solid set of rules to work from. This can establish roles and responsibilities for members and protect you, and your business should any disputes arise between members. A signed operating agreement is what a judge will look at in solving any disputes, and many banks will require one in order to open a business bank account or receive loans.

Information You Should Include in an Operating Agreement

There are some basic pieces of information that any Wyoming LLC operating agreement should include, such as:

Your operating agreement should make sure to specify which type of management your LLC will use. If it is manager-management, the agreement should specify your manager’s compensation, rights, responsibilities, as well as what, if any, recourse members have in case of a dispute.

However, an LLC is capable of divvying up compensation between members in any way it chooses. This could be dividing up profits and losses by ownership percentage or any other means. Alternatively, if your company chooses to be taxed as a corporation, members could receive salaries as well as distributions. Whatever method your company chooses, make sure to include it in the operating agreement.

Member exit is a little more complicated. You will need to address a procedure for how members can leave and what happens to their ownership share. Can a member give their share away? Often times an operating agreement will provide a clause granting other members the right to purchase existing member’s shares before any others. This can help keep the business in the hands of its existing members.

Step 5: Obtain An EIN (Employer Identification Number)

An Employer Identification Number (EIN) is a nine-digit number, similar to a Social Security Number, that is used to identify your business for tax purposes. This number is also often known as a Tax Identification Number. Most businesses will need an EIN.

You will definitely need an EIN if you intend to hire any employees or if your LLC has two or more members. Additionally, most banks will require you to have an EIN in order to open a business bank account. The number may also be required to apply for some licenses and permits you may need to obtain.

It’s easy to obtain an EIN for your business, and it’s free. You apply for one online, by mail, by fax, or, if you are an international applicant, by phone.

To apply online, go to the IRS website and follow the instructions to apply online. Once you finish the application, you will receive your EIN immediately. Just be sure to finish the application in one sitting as it cannot be saved.

If you choose to apply by mail, it will take approximately four weeks to get your EIN. Just fill out Form SS-4 And send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

To apply by fax, you’ll still need to fill out Form SS-4; then, you can fax it to (855) 641-6935. You should get a fax back in about four business days.

If you are an international applicant, you can apply by phone from 6 a.m. to 11 p.m. Eastern Time. The phone number to call is 267-941-1099. Make sure that the person who calls has the information and authority to answer any questions on Form SS-4. Also, the person will need to have the authority to accept the EIN.

Step 6: Open Your Business Bank Account

Once you form your LLC, you will want to open a business bank account. Although this step is not required, it is an important step for your LLC. In order to maintain the limited liability your business receives by forming an LLC, you are required to keep your business and personal finances separate. Doing this helps show that the LLC is its own entity and helps your business maintain its limited liability, which is what keeps your personal assets safe from being used to satisfy your business’s debts.

If you don’t keep your business and personal finances separate and your business is ever sued, the courts could remove your business’s limited liability, which could allow your personal assets, such as your home and car, to be used to satisfy your business’s debts.

Another advantage that you’ll find comes with a business bank account is a more professional image. Your customers will perceive your business as being far more professional if they write their checks out to your business rather than one of the LLC members. You can also accept credit cards, which customers often expect these days. Also, writing your checks out to suppliers from a business bank account looks more professional and can help your business to appear more trustworthy.

Additionally, you will be building a relationship with a bank. This could help you in the future if you decide you want to apply for a loan or open up a line of credit.

Maintaining Your Wyoming LLC

Even after forming your LLC, there is something you will need to do to get your business underway and maintain your LLC. Don’t worry, these are not difficult at all and include:

1. Annual Reports

One of the most important things you need to do to maintain your LLC is to send in your annual report. Not filing this report is actually the most common cause of an LLC getting shut down. So, since the state is quite adamant about this and the penalties can be severe, you should be careful to file this report on time. However, the state will send three reminders to your registered agent. So, you really just need to keep up with your official mail and then not put off sending in the report. Just remember, though, the report is due whether or not you receive the reminders.

The annual report is always due before the first day of the month in which your LLC was formed. So, you may want to set a reminder for this. The fee for filing the report is generally $60 or $.0002 multiplied by the value of your company’s assets, whichever is greater.

2. Obtain the Necessary Licenses and Permits in WY

The state of Wyoming doesn’t require a general business license which is one of the many advantages of starting a business in Wyoming. This is one of the reasons many people living in other states decide to start a business in Wyoming.

This does not mean you won’t need any licenses or permits, though. You may need a license or permit for the profession you are in, such as being a plumber or beautician. Also, some localities require licenses or permits. So, it’s a good idea to contact your local government to see what may be required. If you fail to obtain any licenses or permits you need, you may face penalties.

Form a Wyoming LLC With Professional Help Today

When you are getting your business started, you often don’t seem to have enough time in the day. If you need help getting your LLC formed, these are some of the best services for it.

#1: Create a WY LLC With ZenBusiness

ZenBusiness is an LLC formation service that has very reasonable prices and gets excellent customer reviews. They also offer their registered agent services for free with any of their packages. Additionally, you can get an operating agreement for free, which is something you’ll definitely want for your LLC. Plus, ZenBusiness will file your annual report for you. All you have to do is answer a few simple questions.

Read our review of Zenbusiness here.

#2: Create a WY LLC With Incfile

Incfile is one of the most affordable LLC formation services out there. They are one of the few LLC formation services that offer to form your LLC for free. You will only need to pay state filing fees. They will even provide you with free registered agent services for a year. Incfile also gives you lifetime company alerts to ensure you are aware of any upcoming deadlines so you can stay in good standing with the state.

Read our full review of Incfile here.

Final Thoughts

A Wyoming LLC has a lot to offer any entrepreneur looking to start a business or upgrade their existing one. With no state income taxes and a low cost of formation, you are virtually guaranteed to take home more of your hard-earned money. Wyoming has some of the best laws for LLCs in the country and makes an excellent place to form your business, so don’t delay and form your Wyoming LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs