Maine LLC (5-Step Guide) – How to Easily Create an LLC in Maine

Start a Maine LLC With Professional Help Today [jump to offer]

The process of getting an LLC for a business can be undoubtedly burdensome. This is an inexcusable fact, especially when you want to get it done as quickly as possible. But, do you know there is an easy way to do so? Well, this 5-step guide is filled with details of how to get started in the process and keep your business running smoothly.

In Maine, many businesses are rising, and that is because the business structure of having a Maine LLC is well-regulated. It is easy to file taxes, and more importantly, it is quicker to manage and regulate your Maine LLC. With a state like Maine with great industries, it is wise to enjoy the benefits, and protection Maine LLC gives.

So, if you are on the verge of having a Maine LLC or are asking why you need a Maine LLC, let’s look at the key reasons and check out the pros and cons of having one. Then finally, we would look at the easy ways you can form your Maine LLC.

Why Would You Want a Maine LLC?

Aside from the benefits peeped into in the introductory part, there are yet so many reasons why Maine LLC is a good idea for every business owner in the state. Regardless, let’s look at these few highlighted reasons why Maine LLC may be your best bet.

Quick Maine LLC Pros & Cons

Having seen why you should choose to have a Maine LLC, check out these pros and cons.

Pros

Cons

Although Maine LLC has cons, they are not substantial to be used as a decisive measure compared to the pros.

Although there are free and affordable Maine LLC that you can settle for, it is not cost-effective compared to any other structure that doesn’t need filling. This is because you will have to pay some annual fees and additional state fees that could be beyond budget.

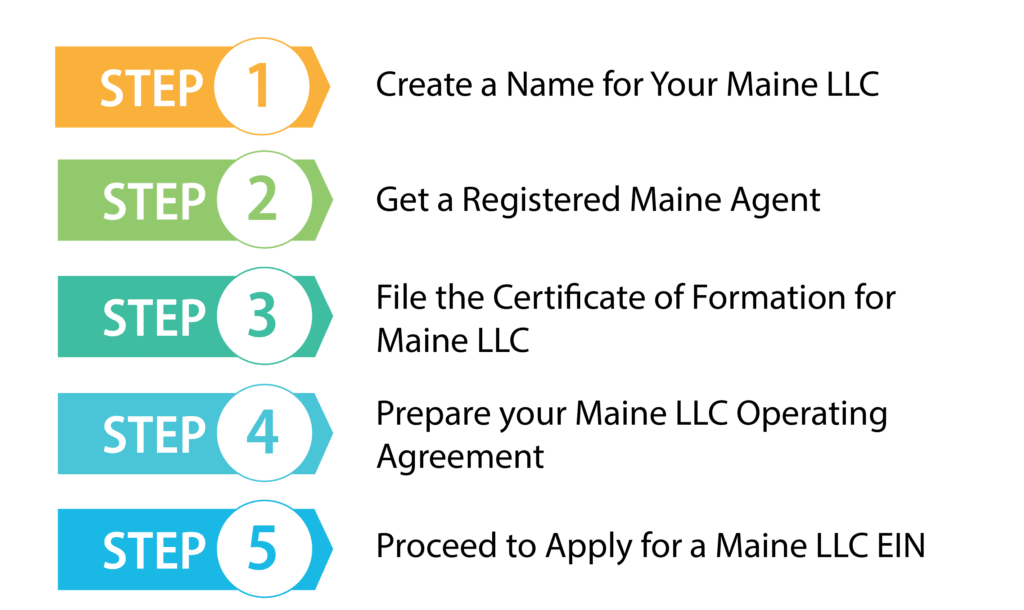

How to Form Your Maine LLC in Five Easy Steps

Forming your Maine LLC can be done quickly using these five steps. If you are already settled that this is what you want for your business, don’t worry, all you need to get it down is detailed below.

Step 1: Create a Business Name for Your Maine LLC

Before doing any paperwork at all, you first have to choose a name for your Maine LLC. You will have to follow some specific guidelines as they are requirements to getting a legal name for Maine LLC.

Step 2: Get a Registered Agent in Maine

You are already settled with the name for your Maine LLC, and it is trademarked; the next thing is to choose a registered Maine agent to stand in for you. Some people act as Maine agents, but that could be a wrong move because of the demand for a registered agent. What a registered agent does is stand as the middle man to get the legal document concerning your LLC. This work will surely be time demanding; hence, hiring an agent in Maine and above 18 years is the best option for you. There are some specific business advantages a registered agent will provide for you.

To know more – read our full guide on Registered Agents.

Step 3: File the Certificate of Formation for Maine LLC

Having done steps one and two, the next step is to file for certification of formation (full guide here). You need to complete the form, which can be done online as explained in the Maine certificate of formation. The content of the form you need to fill includes:

Also, the file Maine certificate of formation LLC is attached with a cover letter that has the following information.

After filling these forms, to submit the form, you will have to do it in person to the address of the state’s secretary with a separate fee. The address you will send it to will be the address where the Secretary of State’s office will return documents which are written below:

101 State House Station

Secretary of State Department

Division of Corporations, UCC, and Commissions

Augusta, ME 04333

This filling can be tiring as it involves so much paperwork but some agencies can help with these processes.

Step 4: Prepare your Maine LLC Operating Agreement

Every Maine LLC is expected to have a legal document that shows your business’s ownership and operating structure. If you have done the previous steps, it is essential you move on to create the operating agreement to lay out the functioning of your business. The operating agreement contains specific rules and functions that are agreed upon by LLC members of your business.

Here’s our full guide on operating agreements.

Though it is mandatory to prepare an operating agreement for Maine LLC, it also has some crucial benefits you wouldn’t want to miss. By creating the operating agreement, your business automatically looks more formal, and that is an excellent way to protect your LLC reputation. It will also help to contain all forms of controversies that might occur among the LLC members since there will be a document to refer to.

Now, in the operating agreement document, some specific three things need to be outlined.

After preparing the operating agreement, please keep it safe with other documents and move to step five.

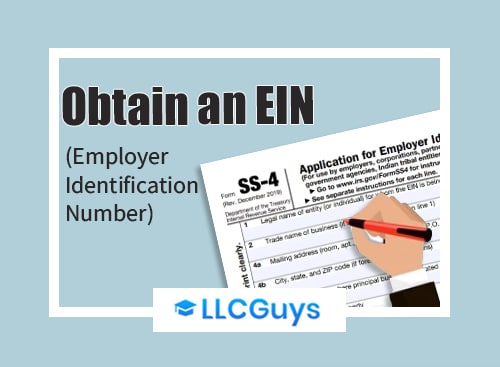

Step 5: Proceed to Apply for a Maine LLC EIN

A Maine LLC EIN is the Employer Identification Number associated with your LLC. Some call it a Tax Identification Number because it is used for most tax dealings. You have to apply through the Internal Revenue Service(IRS) website or mailing to get this number. But if you don’t want to go through any online stress or mail it, you can use outsourced agencies to get the number for you.

Here’s our full guide on how to get an EIN.

The next big question is, “why is EIN necessary?

So, whether you had an EIN before converting to LLC or not, you must make another one as LLC requires a specific one for the conversion.

Form an LLC in Maine With Professional Help Today

Instead of going through the pressure of having to do all the Maine LLC processing yourself, get professional service help, of which the recommended two are justified below.

1. Create a Maine LLC With ZenBusiness

The reasons why ZenBusiness is highly recommended is extensive. First, they offer affordable LLC, which are good for managing business funds. Also, you get a registered agent to do all the paperwork for a discounted price of 50%. That is not all. They have some juicy features packaged for users to enjoy. You also get supported by them all the way, whether there is a need to or not. They also give at least two amendments per year for free if you obey all the legal requirements. So, if you purchase any of the ZenBusiness plans, there are so many things they would do for you, which will ultimately keep you standing right with the state.

Read our full ZenBusiness review here.

2. Create Maine LLC With Incfile

Everybody likes free deals, and Incfile gives just that and more. Even though it is free to form your Maine LLC with Incfile, you get to enjoy similar benefits as some paid agencies offer. However, you would have to pay the state when you file without additional charges to Incfile. More so, you have access to a registered agent without having to pay for at least one year, which is enough to kick start your business. So, if you are on a budget, it is a great option to go for Incfile and get the best still.

Here’s our full review of IncFile.

Final Thoughts

Maine is already known to be a flourishing business state with about a steady 10% GDP increase from 2014 to 2019. This increase has contributed to the growth of significant development industries like healthcare, manufacturing, agriculture, and so many others. Therefore, having a Maine LLC in a state like this will mean better thriving opportunities. Plus, you will enjoy the liberty of running your company in a regulated state with lesser taxes to pay. No doubt, Maine LLC formation is a smart choice for any business owner.

FAQs About Maine LLC

1. How long does it take to process Maine LLC?

The process of getting a Maine LLC I do want to take more than 5-10 business days, and it can be faster depending on the agency handling it for you. You might have to pay extra, but it can be done to speed up your business establishment.

2. How is taxing structured for Maine LLC

If your company has a Maine LLC, you will be exempted from paying federal income taxes as a company. But the members of your LLC are to pay the taxes based on their personal income. They will pay Maine sales tax, and you will pay self-employment taxes. You only get to pay as a company if you sell taxable goods and services.

3. Where do I file the operating agreement and annual report?

No doubt, having an operating agreement is a must-have for Maine LLC, but you don’t have to file it to the State secretary’s office. On the other hand, the annual report would be filed to the Stats Secretay’s office, and that should be done on June 1 every year. Yet, both must be done whether or not they would get to the State’s office.

4. What do I need to do to dissolve the Maine LLC?

Peradventure, you don’t want to have a Maine LLC anymore; you can dissolve easily with no fees attached by submitting an application. This application that contains the dissolution will be filed directly to Maine’s State Secretary.

5. How do I choose a reasonable tax structure for my Maine LLC?

You can choose to separate your business account from your personal account, which is an excellent way to avoid some imposed tax. Though regular LLCs don’t have this structure but you can do it yourself or through the help of a tax professional since it is a better structure.

6. What are the specific permits and licenses Maine LLC requires?

There are so many licenses and permits you will need at the state and federal levels. Also, different locations have specific licenses you need to have. So, it is best to allow business license agents to research for you so you won’t miss out on any needed permits.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs