Alaska LLC (6-Step Instructions) How to Start an LLC in Alaska?

Form an Alaska LLC With The Help of Professionals Today

If you are looking to form a business in a business-friendly state with affordable taxes, then look no further than an Alaska LLC. This state may not be your first thought when it comes to starting a new business, but it will probably be your last one when you consider the low tax rates with no sales tax and low fees for formation. Plus, with an Alaska LLC, there is no risk to your personal assets and pass-through taxation, keeping your tax burden even lower. So, let’s take a closer look at the reasons an Alaska LLC may be right for you and how you can form your business in only six easy steps.

Also, if you’re wondering about Alaska LLC costs – we got a guide just for that here.

If you want to skip the hassle of forming an Alaska LLC yourself, consider using professional help:

Why Would You Want an Alaska LLC?

There are a number of reasons that you may want an Alaska LLC, and these center primarily around the state’s extremely business-friendly policies and the savings and protection it can offer you. Let’s take a closer look.

Quick Alaska LLC Pros & Cons

Before settling on a business structure, including an Alaska LLC, it is important to consider all the pros and cons in order to determine whether or not it is right for you. Since we know you are likely busy, let’s make it quick and take a look at the biggest advantages and disadvantages of an Alaska LLC.

Pros of an Alaska LLC

First, let’s look at the pros of an Alaska LLC, and there are several. Here are the biggest:

Next, the corporate tax is based on the particular business’s income, with businesses that earn $25,000 and below paying nothing at all and a high of 9.4% for businesses with a taxable income equal to or greater than $222,000. However, for most LLC owners, this will only matter if you choose to be taxed as a C-type corporation which generally is only an issue for large and complex businesses that are willing to deal with the double taxation that comes with the status.

Luckily for smaller and mid-sized businesses and, for that matter, every business owner, there are no individual income taxes either. These tax policies are why Alaska is a favorite choice for offshore business owners both from other states and international investors.

Cons of an Alaska LLC

Like every state, Alaska has its own cons to consider when forming an LLC. Here are the most significant:

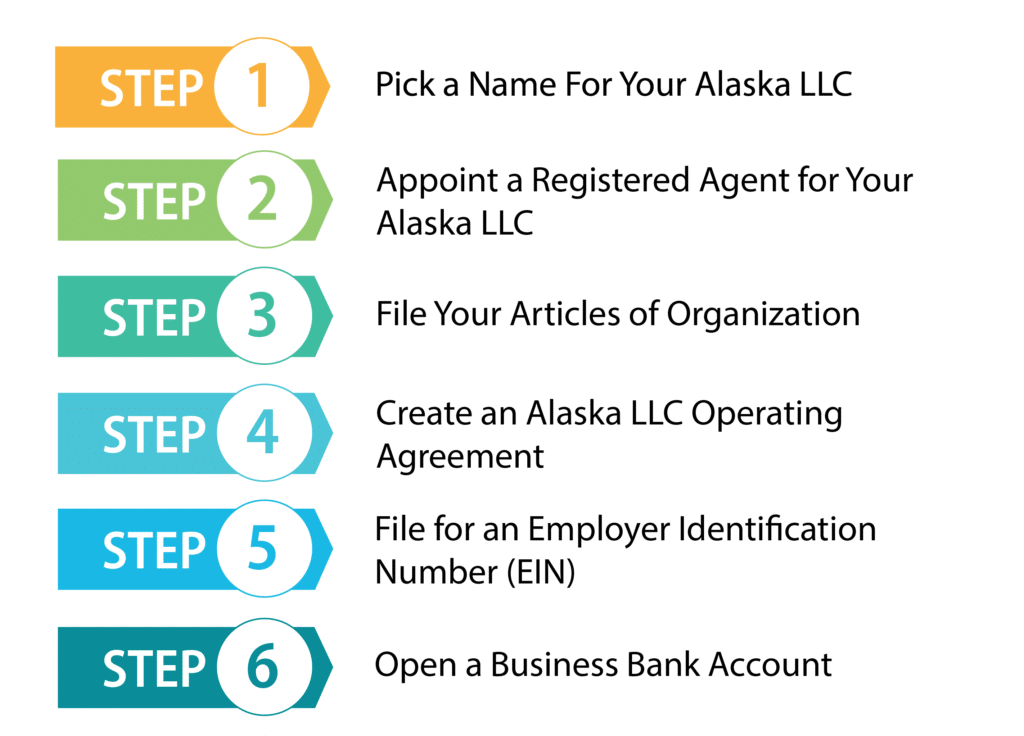

How to Form Your Alaska LLC in Six Easy Steps

Now that we have taken a look at the reasons that an Alaska LLC might be right for you, it is time to show you how you can form your own. There are only six steps to forming your Alaska LLC, so let’s get started.

Step #1: Pick a Name For Your Alaska LLC

Your first step in forming your Alaska LLC is to choose a name, and this is one of the most lasting and crucial steps of all. Your company’s name is the first impression that you will make on potential customers and will affect how you rate on search engines. So, you want it to be catchy, give an idea of what your business can provide, and be unique.

Notably, being unique is more than just a helpful suggestion; it is also required by the state. Every taxable entity in the state is required to have a unique name from all previously registered entities. To check if your ideas are unique, perform a name search on the Alaska Department of Commerce, Community, and Economic Development website. Type in keywords from your chosen name and see if it is unique from all of the names in the search results. If it is, then your name is likely fine.

Now you may want to check if there is an available domain name for it as well. This is important because, in time, most LLC owners will want to have a business website, and the domain name should match your business name so that customers will easily be able to find your business’s website. Remember that even if the .com for the name is taken, there are other TLDs available such as .biz and .net, so check if these are available as well

For essentially the same reason as you might want a business website, you should also consider social media for your business as well. So, check if there are suitable social media handles available on some of the major social media websites such as Facebook and Twitter. If there aren’t any suitable options available, you may want to rethink your name.

Additional Naming Requirements

The State of Alaska has a few additional rules to keep in mind for business naming. First of all, you will need to attach an LLC designator to the end of your name to allow the public to easily identify your business as an LLC. This simply means attaching “limited liability company” to the end of your business name or any of its abbreviations such as “LLC” or “L.L.C.”

For the same reason, the state will not allow you to include words or abbreviations that may allow the public to mistake your business as being another structure such as Corp or Non-Profit. You will also only be able to use words such as bank or law center if your business actually has permission to do business as this type of entity or your members have the appropriate licenses.

Remember that no matter what name you choose, it is important to be confident that you will be satisfied with it for the long term. Attempting to change your business name can really be a pain, and you will generally be paying some fees along the way to do it.

If you do become dissatisfied with your business name, the easiest way to deal with it is to file for a DBA (doing business as). This is also known as an assumed name or trade name, and it allows you to operate under a different name without having to officially change your LLC’s name.

Step #2: Appoint a Registered Agent for Your Alaska LLC

The state of Alaska requires every LLC to appoint a registered agent in order to receive important correspondence. This registered agent will receive important documents from the government such as tax forms, important notices, and perhaps the most significant service of process. This is an important responsibility so you will want to choose someone you can trust.

Your options are also pretty open, and you can choose anyone that is 18 or older who has a physical street address located within the state of Alaska and is available at all normal business hours to receive correspondence. This could be yourself, a family member, a friend, another member of your LLC, or a professional service.

This last option choosing a registered agent service is the most popular option for business owners, and it is easy to see why. You can trust that you will always be in compliance because they won’t be absent when correspondence does arrive. Also, this means that you or whomever you otherwise would choose does not have to worry about being at the given address at all normal business hours. This is particularly useful for businesses that do not operate in a set location or during regular business hours, as well as for those that work from home and do not want their home address given on the public record.

Step #3: File Your Articles of Organization

Now that you have chosen your registered agent, it is time to file your Articles of Organization with the Alaska Division of Corporations, Business, and Professional Licensing. This will officially register your business as an LLC, so this is an important step. You will need to include your registered agent on this document, so make sure you have completed the previous step before attempting this one.

In order to file this document, you will need to complete one of two available filing methods. You can file online by creating an account on the Alaska Division of Corporations, Business, and Professional Licensing website. This will require you to create an account. Then you can answer some questions about your business and pay the $250 filing fee by credit card. This is the fastest way to do it, and though the website is not the most user-friendly, it is the easiest way to get the job done.

You may also file by mail, and to do this, you will need to download the form, complete two copies, and mail them along with the $250 filing fee to the following address:

State of Alaska Corporations Section

PO Box 110806

Juneau, AK 99811-0806

Step #4: Create an Alaska LLC Operating Agreement

Now that your business is officially started, it is time to create an Operating Agreement for how it will be owned and run. This will protect all of the LLC’s members, allow it to run smoothly, and is required by most banks in order to open a business bank account or receive a loan.

So, this important document should include a few general sections in addition to anything you think will help your business run smoothly. These include:

You will likely want to have a voting threshold in place for admitting a new member, so make sure to have a procedure for this before it happens. For withdrawal, there will likely be more confusion, and often this will involve having to decide how to deal with a member’s share of ownership in the company. What will happen to a member’s shares of ownership once they choose to leave? Will they be purchased by the other members, or can they simply be given or sold to anyone? This can be an important topic that should be addressed to avoid potential loss of control in the company.

Step #5: File for an Employer Identification Number (EIN)

Most businesses will want to file for an EIN from the IRS at this point. This number acts kind of like a Social Security Number for your business. Luckily you can receive this number for free by registering with the IRS.

You will need this number to hire employees, which many businesses will wish to do at some point. Also, many different financial processes, including some local taxes, will require the number. You will also need it to open most business bank accounts or to receive a loan from most banks.

You can complete the process online for free very easily at the IRS website. Filing online will allow you to receive an EIN as soon as you complete the process. You can file by mail as well by completing Form SS-4 and sending it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you choose to file by mail, expect a response in up to four weeks.

You can file by fax as well, just fax the form to (855) 641-6935, and you can expect a response in about four business days. International applicants have an additional option of filing for an EIN by phone. To file this way, call 267-941-1099 from 6 am to 11 pm Eastern Time.

Step #6: Open a Business Bank Account in Alaska

Unlike sole proprietors who can sometimes make do with a personal bank account, you will want to open a business bank account for your Alaska LLC. This is an important step for your business now that you are done with the formation and here is why:

Steps for Growing and Maintaining Your Alaska LLC

With your Alaska LLC formed and ready to do business, the only thing left is to run your business. Here are a few steps to maintain your business and keep it growing strong.

1. Purchase Business Insurance

All businesses should purchase business insurance. For LLCs, it can be tempting to save some money and skip the business insurance since you know your personal assets are likely safe should your business be sued. However, you should think about your business assets. These assets can be taken to satisfy business debts or judgments, and business insurance will help protect these assets. You certainly do not want to lose your business because of an unfortunate accident, so business insurance is definitely worth the cost, particularly if your business makes up a significant portion or even all of your income. Plus, there are a few more reasons you may want to consider it so let’s take a look:

In many cases, you still may not be required to have business insurance, but it is best to consider it anyway in order to shield your business assets as well as to provide just an extra layer of protection for your personal ones as well.

2. Start a Business Website

You’ll want to start a business website for your business. This will give you a chance to try and attract customers to your business. This is true even if your business is a brick-and-mortar business that does little to no business online.

You want to show people what your business has to offer so as to give potential customers reasons to choose your business. Also, since many people today will search online before shopping at a business, if your business isn’t online, customers will likely find another business to shop at.

You don’t have to worry about it being too difficult to create a website since there are many tools available online to help you create a website without having any previous experience in doing so. You should be able to have your business website up and running in no time.

Form an Alaska LLC With Professional Help Today

Busy entrepreneurs often have difficulty finding the time to go through all the steps of forming an Alaska LLC with their busy schedules. If this sounds like you, here are two of the best companies that can help you get it done.

#1: Start an LLC in Alaska With ZenBusiness

ZenBusiness is a very popular LLC formation service that gets great customer reviews. Their packages are reasonably priced and include some excellent features. ZenBusiness provides a free operating agreement with all their packages which is something all LLCs should have. They also will file your annual report for your LLC if you want them to, which will save you some time and trouble. Additionally, they offer 25% off of registered agent service with all of their packages.

#2: Start an LLC in Alaska With Incfile

Incfile is a great choice for starting your LLC, especially if you’re trying to stay on a budget. Incfile is one of the few LLC formation services that has a free package. All you have to do is pay the state filing fee. Incfile even includes a year of free registered agent service, which is a really good deal since purchasing this separately would probably cost anywhere from $100 to $300. Incfile also includes free lifetime company alerts. These alerts will inform you of any upcoming state filing requirements which should help you to stay in compliance with your state.

Final Thoughts

An Alaska LLC can get your business off on the right foot with business-friendly policies, low taxes, and a considerable degree of protection for your personal assets. So, with all of the benefits and few disadvantages, there is no reason not to get started forming your own Alaska LLC.

FAQs

What Taxes Will My Alaska LLC Have to Pay?

Alaska Federal Taxes

Your LLC will likely not have to pay federal taxes. Instead, because an LLC is a pass-through entity, the profit from your LLC will pass through the LLC and be taxed on the individual tax returns of its members. This is the default tax status of LLCs. However, if you choose to have your LLC taxed as an S-Corp or C-Corp, this will change.

State Taxes

As long as your members are natural persons, your LLC will not need to file a state tax return. However, if you have a multi-member LLC and any of the members are a company, then you will need to file an Alaska Partnership Information Return.

Local Taxes

Taxes for local governments vary, and it is important to check to find out what taxes your local government charges. It is also important to check with a tax professional to make sure you are paying the correct taxes to avoid breaking any laws or being charged any penalties.

Self Employment Taxes

One tax many LLC members have to pay is self-employment taxes since most LLC’s profits are passed through the LLC and are taxed on the members’ individual tax returns. If you are not active in the LLC, you may not have to pay self-employment taxes. However, again, you will want to check with a tax professional to make sure you pay any necessary taxes.

How Much Will It Cost Me to Start an LLC In Alaska?

Filing for an LLC in Alaska yourself will cost you a $250 filing fee.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs