New Mexico LLC (6-Step Guide) – How to Form an LLC in New Mexico?

Start a NM LLC With Professional Help [from $0+state fees]

If you are considering starting a business or looking for ways to grow your existing one, then it is time to consider a New Mexico LLC (limited liability company). This structure is perfect for business owners looking to limit risk to their personal assets and keep costs low. Also, it’s the 1st choice if you live and reside in New Mexico.

One unique advantage of a New Mexico LLC is the level of privacy it offers business owners. With a New Mexico LLC, you can receive an incredible level of anonymity that is unique to this state. So, let’s take a closer look at why you might want to use this structure for your business, its pros, and cons, and once we consider these points, we will show you how you can create a New Mexico LLC in six easy steps.

If you want to skip the hassle of starting a New Mexico LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

Why Would You Want a New Mexico LLC?

A New Mexico LLC offers some compelling reasons to form, particularly for those looking to form out of state. New Mexico offers incredibly affordable and private formation. New Mexico does not require individuals to live in the state to form an LLC and this does not make the process any harder for these individuals either. This has caused it to be particularly popular for foreign LLC formation.

Also, the state does not require Annual Reports or the associated fees. This leaves the maintenance of a New Mexico LLC incredibly affordable. Plus, with online filing, it is incredibly fast and easy to get started. Here are a few more reasons you might want a New Mexico LLC.

Quick New Mexico LLCs Pros & Cons

Before forming a New Mexico LLC, it is important to consider the pros and cons of such a big decision. However, we know you are busy, so we will make this as quick as we can so you can get back to work,

Pros of a New Mexico LLC

There are definitely a number of pros to a New Mexico LLC, and here are a few to consider.

Cons of a New Mexico LLC

Filing for a New Mexico LLC has a few disadvantages, but as with any major decision, there are some to consider. Let’s take a look at them.

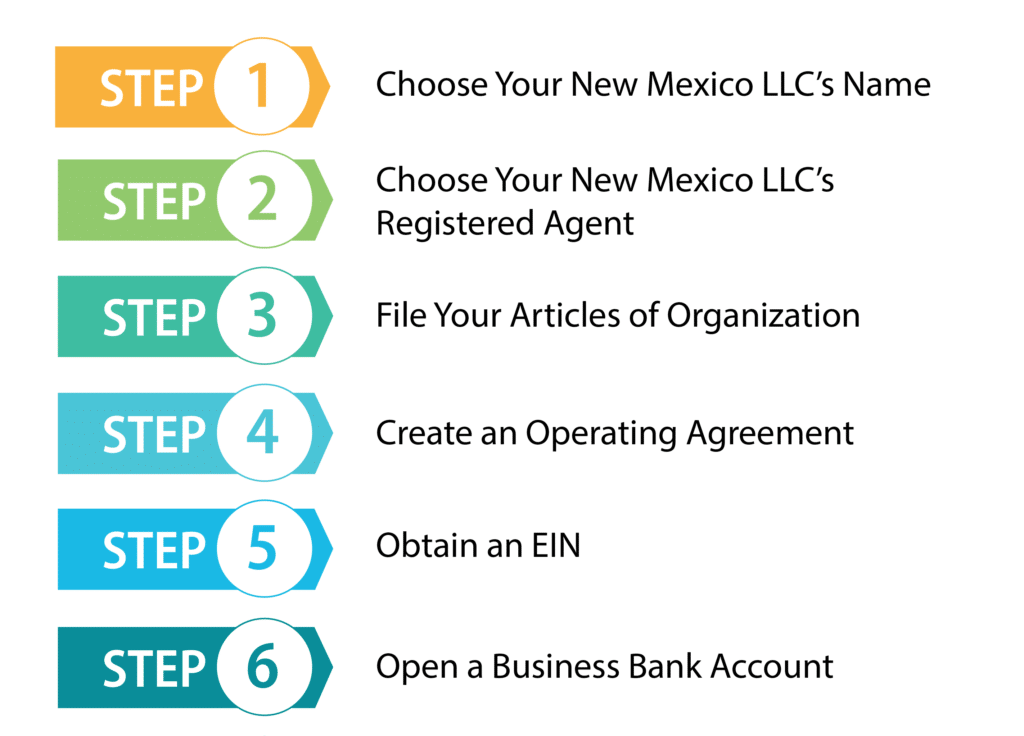

How to Form Your New Mexico LLC in Six Easy Steps?

Now you have had the opportunity to see why you would want a New Mexico LLC, as well as all the pros and cons. If you are still with us, then congratulations! Now it is time to see how you can form a New Mexico LLC in only six easy steps.

Step 1: Choose Your New Mexico LLC’s Name

Your very first step to forming your New Mexico LLC should be to choose a name. A good name should provide an idea of what your business provides. It also should be unique, both because this will make it stand out and because the Secretary of State will turn it down if it resembles another business’s name too closely.

In order to guarantee your LLC’s name is unique enough, you can check on the Business Search tool on the New Mexico Secretary of State’s website. This will search the Secretary of State’s database of all previously registered business names. By using keywords from your chosen name, you can ensure that it does not resemble any others too closely.

After finding a unique name, you will also need to follow a few other state guidelines. First of all, every New Mexico LLC must include a designator at the end of its name to let the public know it is a limited liability company. Acceptable designators include:

Most businesses just settle on using LLC, but you can choose from any of these depending on what you feel looks right. This designator is required to let the public know what your business is, and as such, you also cannot use any words that might lead others to believe your business is another type of entity.

This means not using words such as “corporation,” which would lead others to believe your business is a completely different type of entity. Here are a few words you should avoid to help guarantee your name is accepted:

The name you choose will be the first thing other see about your business, so be sure to pick one that will leave a good impression. Also, be sure it is unique and legal to be sure it will be accepted. You do not want to submit your Articles of Organization only for them to be rejected by the New Mexico Secretary of State and need to file again. Also, if you pick a name but decide not to file for a while, you can reserve a name for a period of time.

Step 2: Choose Your New Mexico LLC’s Registered Agent

The state of New Mexico requires every LLC to appoint a registered agent. This registered agent is a person or business who will receive official correspondence on your LLC’s behalf.

Whether you live in New Mexico or not, the registered agent you appoint can receive and perform official correspondence for you. Often if you choose a registered agent service, it will remind you about any important deadlines, scan and store important mail for you to review, and sometimes even perform some essential filings on your behalf.

You have a wide selection of options when it comes to who can serve as your LLC’s registered agent. You could opt to serve as the registered agent for your own LLC, or you can select a friend, family member, another member of your LLC, or a paid service.

Whoever you do choose must have a valid street address located within New Mexico. It is important to note that P.O. Boxes are not an acceptable address. Your LLC’s registered agent also must be present at the address you list and capable of receiving correspondence during all regular business hours. Also, If you reside out of state, your registered agent’s address can also serve as the business address for your LLC that will be used on record with the Secretary of State.

Why Should You Consider Using a Registered Agent Service?

(read our best Registered Agent Services guide)

When you pick your New Mexico LLC’s registered agent, you will want to strongly consider using a registered agent service. Most LLCs use these services, and there are a number of good reasons why. Let’s take a look at some of them.

Step 3: File Articles of Organization for Your New Mexico LLC

This is a vital step in forming your LLC. In fact, this is the step that actually starts your LLC. Once your Articles of Organization are processed by the New Mexico Secretary of State, your LLC is a legal entity. This is true for both single-member and multi-member LLCs.

It’s quite easy to file your Articles of Organization with the state of New Mexico. However, to make the whole process run smoothly, you’ll want to have certain information on hand. You’ll need to have your chosen business name, the name and address of your registered agent, and the names of all of the managing members of your LLC.

You have two choices for how to file your Articles of Organization. You can file them by mail or online. Either way, you will be filing them with the New Mexico Secretary of State. If you want to file by mail, you will fill out the form and send it with your $50 fee, and in approximately 15 business days, your LLC should be approved. If you choose to, you can pay extra to expedite your request. But, you will need to send a separate check or money order for the fee to expedite the order, and it must be sent with the $50 filing fee. You also have the option of paying a $100 fee if you want two-day processing or a $150 fee if you want one-day processing.

If you decide to file for your LLC online, you will get your LLC formed much more quicker. If you file for your New Mexico LLC online rather than by mail, it will take about three days for the processing to be completed. The fee is the same at $50, and you’ll have no need for expedited processing since instead of taking 15 days, it should take three days. So, if you are in a hurry to get your LLC formed, you’ll want to file online.

Step 4: Create an Operating Agreement for your NM LLC

An operating agreement is a very important document for your LLC, even if New Mexico does not require you to have one. If you do not create an operating agreement, you are risking your business. An operating agreement outlines all of the important details of your business, such as its structure and the right and responsibilities of all of its members. This can be vital in the case of arguments between members and may help keep the business together. We will discuss some of the important details you should include in your operating agreement below.

Ownership

In most cases, the ownership of an LLC will be based on the member’s initial investment. So, if you provided 20% of the money used to start the business, you would own 20% of the business. But, this is not a requirement. If the members want to give someone a larger percentage of the business, they can. This could be done because someone has more relevant experience, they will be expected to do more of the work or any other reason. It’s just important to include the percentage of ownership and the method used to determine ownership in the operating agreement, especially when the ownership percentages do not match the percentage of the initial investment.

Member-managed or Manager-managed

The members of your LLC will need to choose the form of management they want for the LLC. Member-management is the most common. In this type of management structure, all of the members of the LLC make the decisions for the business and handle the day-to-day management themselves. Although the members are free to split up duties as they see fit, they should still outline these duties in the operating agreement.

You can also choose to have a manager or managers run the business for you. In this case, all of the members need to agree on the managers. If the members choose to have a manager run the business, the manager will make all of the decisions for the business, and the members will act as advisors. The managers can choose to take the advice but are not required to. If the members want to reserve certain decisions for themselves, these decisions should be stated in the operating agreement.

Profits and Losses

The allocation of profits and losses can easily cause disputes, so it’s essential to include how this will be done in the operating agreement. Generally, profits and losses are allocated based on ownership percentages. This means that if someone owns 25% of the business, they will get 25% of the profits and losses, but the members can choose a different method. It’s just important to explain what method you will be using in the operating agreement.

Voting Rights

If your LLC is member-managed, there are likely to be many instances in which a decision will require a vote. You should clearly state how voting rights will be allocated. This is often based on ownership percentage, but it doesn’t have to be. You’ll also want to specify the required votes for decisions, such as whether a majority or supermajority is necessary to approve a decision.

Member Entrances and Exits

You may admit a new member at some point, so it’s best to have a process in place to do so. Once you have decided on a process, you’ll want to have this in your operating agreement. Most LLCs require a vote for admitting a new member and sometimes additional requirements as well.

It’s also good to include a procedure for exiting members in your operating agreement. You’ll want to address whether or not the member will be required to offer to sell their shares to other members before selling them to outsiders. This is a common requirement. If members are allowed to sell their shares to outsiders, does the new party need to have any qualifications? How will it be handled if a member gives their shares to a family member?

Ending Your LLC

You probably don’t want to think about it, but your LLC may end someday, and you want to be ready. One of the best ways to be ready is to put the terms of the dissolution in your operating agreement. Some things you’ll want to cover are how any assets remaining after your business’s debts are paid will be divided, as well as whether any members will have the right to continue the business and under what conditions. You’ll also want to state any requirements for a vote to end the LLC. What percentage of members will be required to vote to dissolve the LLC? Including these things in your operating agreement could avoid months of arguments and maybe even lawsuits.

An operating agreement may seem like a bother to create, but it could easily save you a lot of difficulty in the future. It can help avoid arguments between members, and in case of a lawsuit, help make it clear that your business is a separate entity. An operating agreement may be requested by other businesses at times, such as when opening a bank account.

Step 5: Obtain an EIN

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a nine-digit number used by the IRS to identify your business for tax purposes. It is a lot like a Social Security Number for your business.

You will probably need one of these numbers; most businesses do. Any business that hires employees is required to have one, and if your LLC has more than two members, you will need one. Also, most banks will require it if you want to open a business bank account. You’ll also find that some vendors will use your EIN during transactions.

It’s easy to obtain an EIN and free as well. You can apply for this number through the IRS website if you or another member of your LLC has a Taxpayer Identification Number; a Social Security Number will work as well.

You can also apply by mail, fax, or for international applicants, by telephone. If you choose to apply by mail or fax, just fill out Form SS-4, and then to file by mail, send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you are filing by fax, send the completed form to (855) 641-6935. International applicants can file by phone by calling 267-941-1099 between 6 a.m to 11 p.m. Eastern Time Monday to Friday.

Step 6: Open a Business Bank Account in New Mexico

Although your LLC is not required to open a business bank account, it is still a very important step. It’s important because your LLC’s finances must be kept totally separate from any of its members’ finances, or it could lose its limited liability status. If this happens, your personal assets would be at risk for satisfying business debts.

There are other advantages for your business in having a business bank account as well. It will make it easier to track your business’s revenue and expenses as your business transactions will be separate from any personal transactions. It will also allow your business to accept credit cards which could increase business since many people prefer to use a credit card.

A business bank account also gives you a chance to establish a relationship with a bank. This could be useful in the future if you want to obtain a loan or open a line of credit.

Steps for Growing and Maintaining Your New Mexico LLC

Just because forming your New Mexico LLC is done doesn’t mean your work is. Running any business requires continuous growth and maintenance. Here are a few ways to get a headstart on keeping your business running and growing.

1. Obtain Any Necessary Licenses and Permits for New Mexico

The state of New Mexico does not have a general requirement for a business license. However, a number of cities will require you to have a business license to operate. So, it’s essential to check the requirements for whatever locale you are operating in. There are other licenses and permits you may need as well, such as a professional license for certain occupations or a permit for transporting agricultural products. There are many different licenses and permits that might be necessary, and it’s important to find out if your business needs any and to make sure you renew them as needed.

2. Pay Your Taxes On Time

It’s essential to keep detailed records and pay any taxes you owe. There is no franchise tax for LLCs in New Mexico. But the members of the LLC will pay taxes. LLCs are pass-through entities, and this means the income for the LLC will pass through the business and be taxed on the individual tax returns of the members.

You can also choose to have your business taxed as a C-corporation or an S-corporation (full s-corp guide here). For some LLCs in New Mexico, it could be advantageous to be treated as a C corporation. The income tax rate that applies to the first $75,000 of taxable income for corporations is lower than the rates for non-corporate taxpayers. Although, it is always best to consult with a tax attorney to determine the best tax status for your LLC.

Form a New Mexico LLC With Professional Help Today

Forming your New Mexico LLC is a great way to start your business or upgrade an existing one. But, if you are too busy to do all the work of formation yourself, don’t worry. There are a number of companies out there that can handle the work for you. Here are two of the best.

#1. Form a New Mexico LLC with ZenBusiness

ZenBusiness offers very reasonable prices on all of its packages, and customers seem to be very happy with them. ZenBusiness gets excellent customer reviews with 4.8 out of 5 stars on Trustpilot. They also provide some very useful services with all of their packages, such as a free operating agreement and filing your annual report for you for free as well.

#2. Form a New Mexico LLC with IncFile

Incfile is a great choice for helping you to form your LLC, especially if you are on a budget. They are one of the few companies with a free option. All you need to pay is the state fee. You will also get a year of free registered agent service with any of their packages. In addition to this, you will get free lifetime company alerts. With these alerts, Incfile will inform you of any upcoming filing requirements so that your business can stay in good standing with the state.

Final Thoughts

A New Mexico LLC can be a great option for many businesses, and hopefully, yours is one of them. With a high degree of anonymity as well as low formation and maintenance costs, many entrepreneurs have found a lot to love with this structure. So, you can feel confident starting your business off as a New Mexico LLC today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs