New Jersey LLC (7-Step Guide) – How to Form an LLC in New Jersey?

Get Your NJ LLC Formed Quickly (from $0 + state fees)

A New Jersey LLC (limited liability company) is a perfect business structure if you’re living or residing in this state.

So, if you are considering forming an LLC in New Jersey, you are in the right place. This process doesn’t have to be a hard one. Simply follow the seven steps in this guide, and you will have your LLC formed in no time.

And if you’re unsure how much will all of that cost you — we encourage also reading our New Jersey LLC cost guide. It will have all the fees and costs laid out. But now, let’s dive deeper into how you can start a NJ LLC yourself.

If you want to skip the hassle of starting a New Jersey LLC yourself, consider hiring professionals:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Get Your NJ LLC Formed Quickly (from $0 + state fees)

- The Advantages of Forming a New Jersey LLC

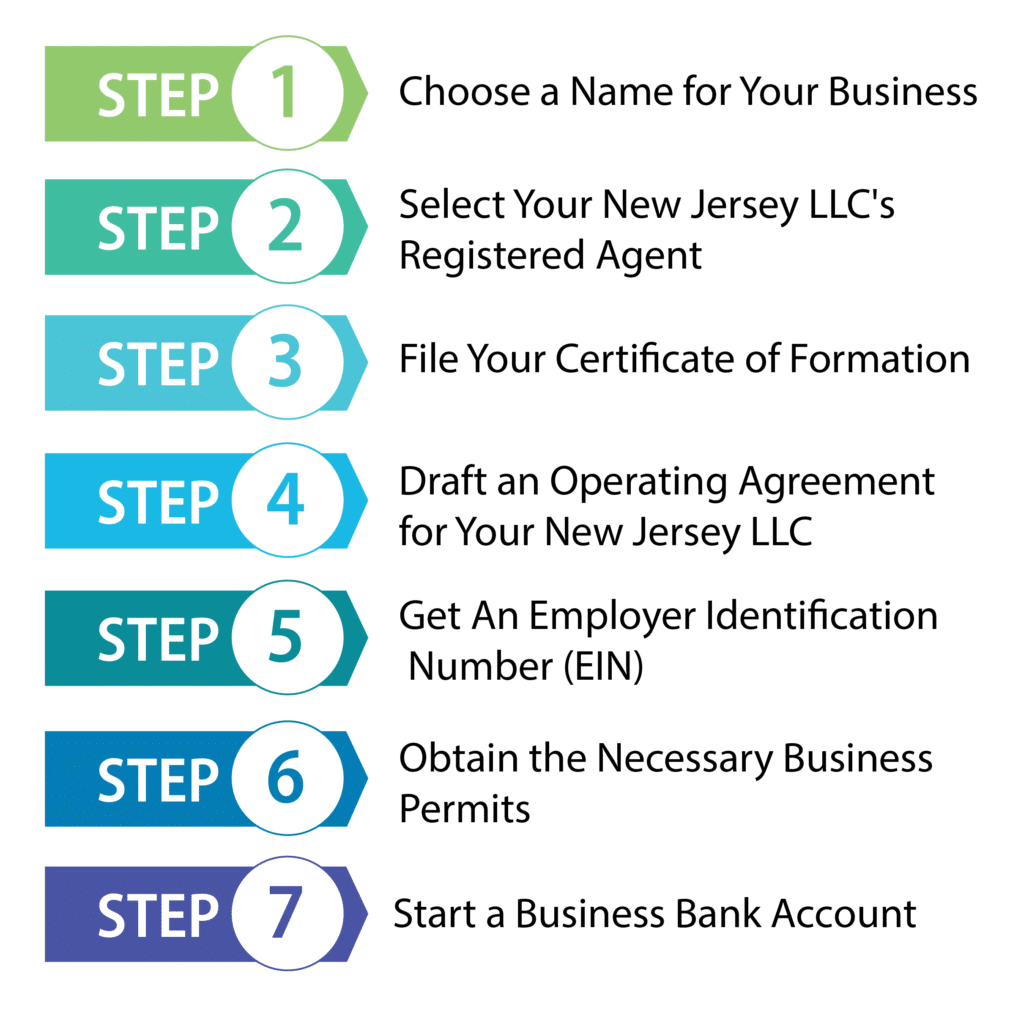

- 7 Steps on Forming an LLC in New Jersey

- Step 1: Choose a Name for Your New Jersey LLC

- Step 2: Select Your New Jersey LLC’s Registered Agent

- Step 3: File Your NJ LLC Certificate of Formation (aka Articles of Organization)

- Step 4: Draft an Operating Agreement for Your New Jersey LLC

- Step 5: Get An Employer Identification Number (EIN)

- Step 6: Obtain the Necessary Business Permits For Your New Jersey LLC

- Step 7: Start a NJ Business Bank Account

- Maintaining Your New Jersey LLC

- Get Professional Help in Forming an LLC in New Jersey

- Final Thoughts

The Advantages of Forming a New Jersey LLC

There are a lot of reasons to form a New Jersey LLC, including protecting your personal assets and reducing your tax burden. An LLC provides protection from personal liability to business owners in case of business failure or lawsuits filed against the business.

An LLC offers far greater flexibility in management structure than a corporation and far fewer recordkeeping and paperwork requirements. Also, unlike a corporation, an LLC offers pass-through taxation allowing an LLC’s members to receive earnings directly and pay personal taxes on them without first being taxed as an entity.

7 Steps on Forming an LLC in New Jersey

Step 1: Choose a Name for Your New Jersey LLC

Once you’ve decided to form your New Jersey LLC, it is time to choose a name for it. It’s possible you already have a name in mind, but to be certain that the name is available and hasn’t already been chosen by anyone else, you will need to conduct a name search.

The name search will check through New Jersey’s public records and ensure that the name you have chosen is available. New Jersey’s Business Name Search tool is available on the New Jersey Division of Revenue and Enterprise Service’s website.

On this tool, you can use the name you have chosen and variations on it to compare against existing business names and ensure that it is easily distinguishable. It is important to keep this in mind because your LLC’s name must be easily distinguishable from any other already in use within New Jersey; otherwise, it cannot be used.

You can also use New Jersey’s Name Availability tool available on the same web page, which offers yes or no answers as to whether a name is available. However, to be certain a name is easily distinguishable enough, it is still a good idea to compare it to similar existing names.

Naming Restrictions

There are a few additional rules when naming your LLC, including both required words or abbreviations as well as those your business is not allowed to use. Let’s take a look at these, starting with what your business is required to include.

Your LLC is required to end with one of the following designations:

- Limited Liability Company

- Limited Liability Co.

- Limited Company

- Limited Co.

- Limited

- L.L.C.

- LLC

- LC

- LTD.

- Ltd.

Your LLC is not allowed to use any of the following designations due to the risk of confusing your business with another form of business structure or other legal entity. The words and phrases your business is not allowed to use include:

- Non-Profit Corporation

- Professional Association or Professional Corporation

- Incorporated

- Corporation

- Corp.

- P.A. or P.C.

- Inc.

- LLP

- LP

Step 2: Select Your New Jersey LLC’s Registered Agent

The state of New Jersey requires a registered agent to be selected and listed when filing an LLC Certificate of Formation. Your business’s registered agent can be either an individual or a business and can even be a member of your LLC.

Your LLC’s registered agent will receive legal correspondence on behalf of your business. This correspondence could include tax information or notice your business is being sued.

Your registered agent must have a physical address located within the state of New Jersey that will be listed on public record. This will allow your LLC to be easily located if and when your business is served Service of Process if it is ever sued. The address of your registered agent cannot be a PO Box.

Who Can I Choose as a Registered Agent?

There are a number of options when choosing your LLC’s registered agent. It could be yourself or any other member of your LLC. It could even be friends or family with a physical address located in New Jersey. However, the most popular option and generally best for most business owners is choosing a commercial registered agent.

Regardless of who you choose to serve as your registered agent, they will need to be available at all times during regular business hours. This can be a significant limitation for businesses that operate at odd hours or involve being away from the office for a significant amount of time. If your business has only one employee, this could become an issue if they are ever unavailable due to sickness or even a lunch break.

Additionally, if your business is a foreign LLC or spends most of its time out of state, it is important to choose a trustworthy registered agent to handle your important documents. This can make a commercial registered agent a good option as well due to their ability to receive documents and scan them to be viewed at any time when you are away.

See our top-rated Registered Agent Services.

This can also be useful for those who operate their business from home to avoid their address being on public record. You may also find it can avoid an embarrassing situation in front of family, coworkers, and even customers if your LLC ever receives Service of Process.

Step 3: File Your NJ LLC Certificate of Formation (aka Articles of Organization)

Filing your Certificate of Formation aka Articles of Organization is the step that will actually start your LLC. You need to submit this form to register your LLC with the state of New Jersey. It will cost $125 to file your Certificate of Formation, and you will pay this fee to the New Jersey Division of Revenue.

Unlike many states, New Jersey doesn’t have a specific form to use when filing your Certificate of Formation. You can make your own Form, or you could download a template online. You could also use an LLC formation service to start your LLC.

Although you can create your own Form, there are some things you should include in the Form, such as:

It is possible to file your Certificate of Formation by mail or online. However, the online option is far faster and will allow you to get your business up and running quickly. If you choose to file online, your formation will often be approved in 30 minutes or less, and the registration with the New Jersey Division of Revenue will often be approved within two business days.

Within 60 days of approval, you will need to file the tax registration form, Form NJ-REG. This Form can be filed online at the NJ Treasury, Division of Revenue and Enterprise Service’s website.

Step 4: Draft an Operating Agreement for Your New Jersey LLC

New Jersey does not require an operating agreement, but your LLC should still have one. Having an operating agreement helps establish your LLC as a separate legal entity. It also allows you to make a lot of choices for your LLC that would otherwise be subject to state default laws.

An operating agreement is a legal document that describes the structure of your LLC and the rights and responsibilities of its members. What is included in an operating agreement varies, but there are a number of details that should be included in the agreement. The operating agreement should state the:

A manager-managed LLC is managed by a manager chosen by the members. This manager could be one of the members or someone from outside of the LLC. Once the manager is chosen, the manager will run the LLC and make all of the decisions for the LLC. The members will be limited to an advisory role. However, if the members want to reserve the right to make certain decisions, they can specify this in the operating agreement.

Step 5: Get An Employer Identification Number (EIN)

An EIN or Employer Identification Number is a nine-digit number used by the IRS to identify your New Jersey LLC for tax purposes. It is easy to obtain an EIN. You can simply go to the IRS website and apply for one. It won’t cost you anything, but you will need a Social Security number or Individual Taxpayer Identification Number to apply.

You can also obtain an EIN through the mail by filling out Form SS-4 and mailing the form to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 4599

Not all LLCs are required to obtain an EIN. A single-member LLC does not need one unless the owner is hiring employees. However, LLCs with two or more members do need an LLC, as do any businesses that are hiring employees. Businesses also generally need an EIN to obtain certain business licenses and to open a business bank account.

Step 6: Obtain the Necessary Business Permits For Your New Jersey LLC

You are not required to obtain any state licenses to do business in New Jersey, but there are some permits you might need to obtain. You may also find that some local areas require certain licenses, so it’s best to check with the local government in any area in which you operate.

One permit your business will find useful if you plan to buy goods from individuals or businesses and resell or manufacture them is a New Jersey Resale Certificate. If you obtain this permit and show it to the sellers, you will not be required to pay taxes on the goods you purchase.

To obtain this permit, you need to fill out Form ST-3 for goods you will be selling in-state. If you plan to sell the goods out of state, you need to fill out Form ST-3NR.

If your LLC is planning on selling retail goods, you will be required to obtain a New Jersey Sales Tax Certificate of Authority. You can obtain this certificate after your LLC is registered. Then, you will need to collect sales taxes for any sales and send the taxes to the New Jersey Division of Taxation. You will be required to collect these taxes whether the sales were made at a physical or online store.

Step 7: Start a NJ Business Bank Account

All LLCs should have a business bank account. So, you’ll want to open one as soon as you obtain your EIN. A business bank account will help you to keep your business and personal finances separate. Keeping these separate is absolutely essential for preserving your limited liability.

If you mix your personal and business finances, it could cause a problem should your business ever get sued. The courts may not see your business as a separate entity if you mix your personal and business finances and could decide to remove your limited liability which is called piercing the corporate veil. If this happens, your personal assets would be at risk.

Having a business bank account will also give your business a more professional appearance. Your business will look more professional to your customers when they are asked to write out their checks to your business rather than a member of your LLC. The same is true when paying suppliers; having a check written out from your business bank account appears more professional and will likely help your business to seem more legitimate.

Maintaining Your New Jersey LLC

After you form your LLC, you need to make sure you take the necessary steps to keep your LLC in compliance with state laws. So, we will discuss some of the things you need to do.

Annual Report Filing

New Jersey LLCs are required to file annual reports in order to remain compliant. Every year this report must be filed with the New Jersey Division of Revenue regardless of the amount of business activity that takes place or the income earned.

The annual report can be filed online or by mail, and the fee is $50. The annual report is due one year after the LLC is formed, and thereafter it will be due every year on the last day of the month in which the LLC was formed.

It is important to file your annual report by the deadline. If it is late, you may have to pay late fees or lose your Certificate of Good Standing. At worst, the state may even dissolve your business. These rules will apply to foreign LLCs as well.

New Jersey LLC Taxes

There are a number of tax requirements for LLCs operating in New Jersey, and these can seem a bit overwhelming for new business owners.

So, let’s take a look at some of these and see if we can clear them up a bit. In the first place, there are only three basic income taxes that an LLC has to worry about. These include federal, state, and local income taxes.

For Federal Income Taxes, your New Jersey LLC is a pass-through entity, and both profits and losses are allocated to each of its members without ever being taxed on an entity level. This means that tax forms are fairly simple and can be determined based on whether your business is a single-member or multi-member LLC.

Multi-member LLC

If you have a multi-member LLC, it will be taxed as a partnership. Therefore, you will need to file a Partnership Tax Return. To do this, you’ll need to file Form 1065 and provide all of the members with a Schedule K-1 to use when filling out their personal taxes. New Jersey LLCs that have two or more members must also pay a partnership tax. The partnership tax is $150, and you pay it when you submit your State Partnership Return. Fill out Form NJ-1065 for your return.

Single-member LLC

If you have a single-member LLC, you will be taxed the same as if you were a sole proprietorship. The IRS treats a sole proprietorship as a disregarded entity, which means the IRS just taxes you as if you had no LLC. So, the profits or losses are recorded on your individual income tax return.

Sales Tax

If you have a retail business, you are required to collect sales taxes on the purchases. Then, you need to file your taxes with the New Jersey Division of Taxation.

Get Professional Help in Forming an LLC in New Jersey

#1: Start a NJ LLC With ZenBusiness

ZenBusiness is one of the top LLC formation services. They have very reasonable prices and get excellent customer reviews. Also, they provide a number of good features with their packages, including a year of free registered agent service. They are also known for being a very socially conscious organization. ZenBusiness gives grants and loans to small businesses in need.

#2: Start a NJ LLC With Northwest Registered Agent

Northwest Registered Agent has decades of experience and a good reputation. They are known for having very knowledgeable customer service agents as well. However, their best feature is the privacy they provide. Northwest Registered Agent never sells their customers’ data. Additionally, they run their own servers and write their own code.

Final Thoughts

After completing the above steps, you’re done! As you can see, forming a New Jersey LLC isn’t that difficult, and it can save you a lot of money and reduce the risk to any of your personal assets in case of a business failure or lawsuit. So, why not get started filing your LLC today and start growing your business without worrying about losing your personal assets.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs