New York LLC – How To Start a New York LLC (7-Step Guide)

Form an LLC in NY From $0+state fees

When forming a business in New York, there are lots of decisions you will have to make. If you decide that an LLC is a right format for your business, there are a few steps that you are required to follow to ensure that it has been formed and processed correctly. All states have different requirements & costs when it comes to LLC formation, and New York is no different. Be sure to check you have completed all steps for your required state when going through the formation process.

And if you want to know all the fees associated with the formation process – read our full New York LLC costs guide.

In this guide, we will be looking at the steps of how to create an LLC in the state of New York yourself. Although this may seem a bit daunting at first, if you follow each step, the process may seem a little simpler.

If you want to skip the hassle of starting a New York LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form an LLC in NY From $0+state fees

- Who Can Form an LLC in New York?

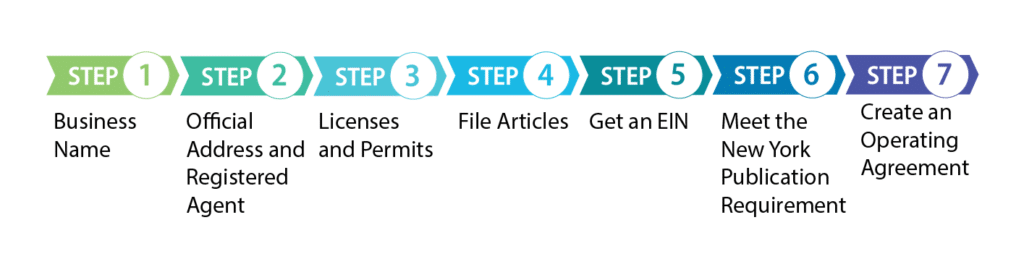

- 8 Steps In Order to Start an LLC in New York

- Step 1: Choose a New York Business Name

- Step 2: Register an Official Address in NY and Get a Registered Agent

- Step 3: Getting Licenses and Permits for NY

- Step 4: File Articles of Organization to the New York State

- Step 5: Get an EIN

- Step 6: Meet the New York Publication Requirement

- Step 7: Create an Operating Agreement for your New York LLC

- Types of New York LLCs

- Other Important Things to Remember After Forming a New York LLC

- TOP-2 LLC Formation Services To Help With Your New York LLC

- FAQs About New York LLC Formation

Who Can Form an LLC in New York?

Before you do anything, you should first check that you are eligible to form an LLC in the state of New York. The requirements are pretty simple. The business owner needs to be either a New York State resident or the business must be located in New York. If you are able to meet either of these, you can create an LLC in New York.

There will be industry, licensing and zoning rules that you will need to follow in order to operate legally. Some of these will be specific to where you are forming your LLC or the type of LLC you are forming, for example, home-based businesses will require special permits. Make sure you do your research before forming your LLC and get any necessary licenses and permits, so there are not any problems later on.

8 Steps In Order to Start an LLC in New York

Step 1: Choose a New York Business Name

The first step is arguably the simplest, you have to decide on a name for your LLC. There are certain guidelines that are outlined by the state of New York that your business name will have to meet in order to be accepted, however, you’ll still want to make sure that it relates to your business.

Your business name must include the term Limited Liability Company, although this can be abbreviated to LLC or L.L.C. it must also not contain any restricted words or phrases. These are words that are usually set aside for certain sectors, such as a doctor, but it is advisable that you check the full list of restricted words before coming to a final decision. It must also be completely unique from all the other business names in the state.

To find a name that has not been used before, you’ll have to check the Corporation and Business Entity Database of the state of New York. This is free to do, but if you do not feel comfortable doing it yourself, there are companies that will complete the search for you. If you want to officially check if your required name is still available, you’ll have to send a written request to the Department of State, which comes with a $5 fee. If your name is not available, you will have to submit the request again, along with another fee. If you want to, once you have found a name that is available, you are able to pay $20 to have it reserved for up to 60 days.

While you are in the process of picking a name, it may also be worth seeing if your desired URL is available. Even if you do not want to create a website right away, it might be worth buying to ensure you have your desired URL when you do decide to make a website.

Step 2: Register an Official Address in NY and Get a Registered Agent

The next step is to register the official address for your LLC. This is where all your official mail will be sent to. The New York Secretary of State serves as all New York LLCs registered agent, unless you decide to designate an additional registered agent, so when filling out your articles of organization, you will have to specify where you would like your official mail and service of process sent to.

The Department of State offers limited services when compared with other, paid-for registered agent services, so some businesses choose to use an additional registered agent to make use of these other services.

We have a great guide of the top-rated Registered Agent services here. Make sure to read it before choosing your own.

Step 3: Getting Licenses and Permits for NY

There are a few licenses and permits you may need when processing an LLC in New York. These depend on the location of the LLC, as different areas require different permits. When setting up your LLC, you should check with your local small business office to learn more about what is needed.

In New York, there are over 30 professions that will require a professional license from the state and include, but are not limited to, security guards, healthcare professionals and real-estate brokers. An easy way to see if you will need an additional permit is to use the state’s Business Express Wizard, which will help you to check what licensing regulations directly impact your business.

Step 4: File Articles of Organization to the New York State

You will then need to file the Articles of Organization Form, also known as the DOS-1336 Form. This important document establishes your LLC as a separate legal entity and includes lots of information about your business.

Filling out the form should be pretty self-explanatory, but you need to make sure you include signatures of all the LLC members, provide the information to show that the LLC name meets all the state requirements, an address in the state which can be reached should a suit be filed against the company, plus all the necessary fees. You will also need to state whether you are planning on starting a member-managed LLC or a manager-managed LLC.

Submitting the form costs a fee of $200 which can be paid in cash, check, money order or card. You can choose to either fill it out online which is available from the Department of State, or if you prefer, you can download, print it out, and then fill it out by hand. If you are filling it out by hand, be sure to use a black pen and clean white paper, so that it can be filed correctly.

Step 5: Get an EIN

The next stage is to get a New York LLC EIN, which stands for Employee Identification Number. This is something that you are able to do yourself, or alternatively, you can pay a company or individual to obtain it for you. This 9-digit number has several uses, such as being used to identify a business entity and to keep track of business tax reporting. You will need an EIN when you want to open a business bank account, and if and when you want to hire any employees.

If you do it yourself, it does not cost any money to get an EIN, and is obtained by the IRS by the person forming the company. Obtaining an EIN is the most effective method if you need the number quickly, as you will receive your number as soon as you have gone through the process. If you would prefer to have a copy of your EIN in paper form, then it is also possible to obtain it through the mail. Simply download the form, fill it in and then fax or mail it, however, if you do this, it can take around 4 weeks.

Step 6: Meet the New York Publication Requirement

New York is one of the few states that require you to publish a notice of your LLC formation. You have to publish either a notice related to your LLC formation or a copy of your articles of organization in at least two newspapers, one of which is weekly and one of which is daily. This has to be done within 120 days of formation.

You can’t pick any newspaper you want, it has to be approved by the local county clerk of the county you designate in your Articles of Organization. Once you have filed your publication, you’ll need to file your Certificate of Publication, with the affidavit of publication which you will receive from the publisher or printer of the newspaper, to the New York Department of State. The filing of the Certificate of Publication requires a $50 fee.

Step 7: Create an Operating Agreement for your New York LLC

Not all states require you to have an operating agreement, but in New York it is part of the LLC formation requirements. This could be either written or verbal.

What is an operating agreement?

This is a legal agreement that outlines the operating procedures and ownership of an LLC. By having an operating agreement, it may prevent conflict in the future, as all the owners of the business know where they stand, as everything is clear and outlined in the document. For example, if your LLC has more than one owner and gets dissolved, the operating agreement will show how all the assets will be distributed.

You can either create your own operating agreement if you feel comfortable doing so, or you can use one of the pre-made operating agreement templates that are available online, which may incur a small fee. Alternatively, if you are using an LLC formation service, depending on the package that you go with, some packages offer an LLC operating agreement, taking the stress off you. If you hire an attorney, they can either write your LLC for you, or look over it once you have completed it to make sure it includes all the necessary information.

Types of New York LLCs

A regular LLC is usually best for most LLCs in New York, but it is not the only option. In New York you are able to form a Professional LLC, which has specialized requirements and licensing. Only specific types of businesses are able to be a Professional LLC, which includes licensed physicians, attorneys, and councilors-at-law to name a few. The other type of LLC is Foreign LLCs, which can be used if your business is already operating in another state, and you are wanting to expand.

Other Important Things to Remember After Forming a New York LLC

Ongoing Commitments

Depending on the type of LLC you have and the type of taxation you opted for, you will have different tax responsibilities. If you are selling a physical product, you will likely have to register for a seller’s permit with the Sales Tax Certificate of Authority, allowing businesses to collect sales tax.

If the business has employees in New York, then it is required that you register for Unemployment Insurance Tax and Employee Withholding Tax. Then, if your business falls within different specific industries, you may be required to pay additional state taxes.

Unlike the majority of states, New York does not require its LLCs to file an annual report, however, depending on the circumstances, you may have to pay an annual fee.

File Your Biannual Statement to NY State

Although in the early stages of your LLC you won’t have to worry about it for a while, at the two year mark of your LLC formation, you will need to file your New York Biennial Statement. This is due at the end of the month that your LLC was formed, two years on. If you don’t file this report, then the result is your LLC falling out of good standing.

Get Business NY Insurance

Business insurance is an important part of running an LLC. By having the insurance in place, you will have peace of mind when it comes to managing risks. There are several different types of business insurance.

TOP-2 LLC Formation Services To Help With Your New York LLC

It is possible for you to form your LLC yourself, however, this can be quite time-consuming and may be quite confusing for some. It should be possible to work out yourself, however, if you want peace of mind that your LLC is going to be formed correctly, and give yourself more time to focus on your business, you can always hire a company to do the hard work for you. There are a huge number of LLC formation companies out there, but one of the best options is certainly Zenbusiness.

#1: Start a NY LLC With Zenbusiness

Zenbusiness makes legal filings easy and straightforward for small businesses, offering a wide range of other services in addition to business formation.

Pros

Cons

#2: Start a NY LLC With IncAuthority

IncAuthority began its journey in 1989, and has grown to be one of the most popular LLC formation services, having helped form over 250,000 businesses.

Pros

Cons

FAQs About New York LLC Formation

How much does it cost to form an LLC in New York?

There are several costs associated with forming an LLC in New York. For a start, to file your Articles of Organization, the New York Department of State Division of Corporations charges a $200 fee. Then, if you decide you would like to reserve your LLC name so that it doesn’t get taken by anyone else, there is a $20, which has to be paid before filing your Articles of Organization. If you are going through the process yourself, these are the main fees you will have to pay, however, if you use an LLC formation service, you will have to pay them the cost of the package you choose. Another option is to hire a lawyer, although this is likely the most expensive option.

If I want to dissolve my LLC in New York, how would I go about this?

When the time comes and you want to shut down your LLC, it is advisable that you dissolve it properly. This will limit your liability for lawsuits and any government fees if your business was not shut down properly. There is plenty of information out there that will take you through the process.

How long will it take to form an LLC in New York?

The time it takes to form an LLC in New York will vary per case, but on average it will take about 6 to 7 weeks, which includes processing the forms. Once you have formed your LLC, it is a requirement to publish your articles of organization or a notice relating to the formation on an LLC in two newspapers for 6 consecutive weeks within 120 days. If you don’t do this last step, all LLC transactions will have to be put on hold.

Can I be my own registered agent in New York?

Yes, it is possible for you to be your own registered agent in New York. Alternatively, someone else in your company can be your LLC’s registered agent, they simply have to meet a few different requirements. This is one of the cheapest options, but it can be quite restricting, which is why many people choose to use a registered agent service.

What is an LLC?

LLC stands for Limited Liability Company. It is a type of business structure that offers a lot of flexibility than other corporations. Despite this, it still has a lot of the same benefits.

Do I need a bank account for my LLC?

Yes, it is very much advised that you get a bank account for your LLC, so that it will keep your business finances separate from your personal finances. This is just one of the stages that helps to create a legal separation between you and your business.

How do I know if I can use my chosen business name?

One of the most important stages of forming an LLC in New York is picking the right business name. In order to see if your desired name is available, you will have to conduct a name searching at the Corporation and Business Entity Database of the state of New York. This is a free service, and allows you to see if anyone has already used your desired name, or whether you’ll have to think of something else.

Should I form an LLC in New York?

If you are basing your business in New York, then it may be a good idea to form an LLC. They have a lot of benefits including greater flexibility when it comes to factors such as management and taxation. The New York process of forming an LLC is very achievable, especially if you use a reputable LLC formation company to help you.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs