Nebraska LLC – How to Form an LLC in Nebraska (7-Step Guide)

Start Your Nebraska LLC Today, Hassle-free (from $0+state fees)

A limited liability company (LLC) is a business structure that combines some of the best aspects of a sole proprietorship and a corporation. It’s also a great way to protect your personal belongings in case of a business failure or lawsuit and even lower your tax burden.

Luckily, it’s easy to get your Nebraska LLC started; just follow these 7 steps below.

If you want to skip the hassle of starting a Nebraska LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Start Your Nebraska LLC Today, Hassle-free (from $0+state fees)

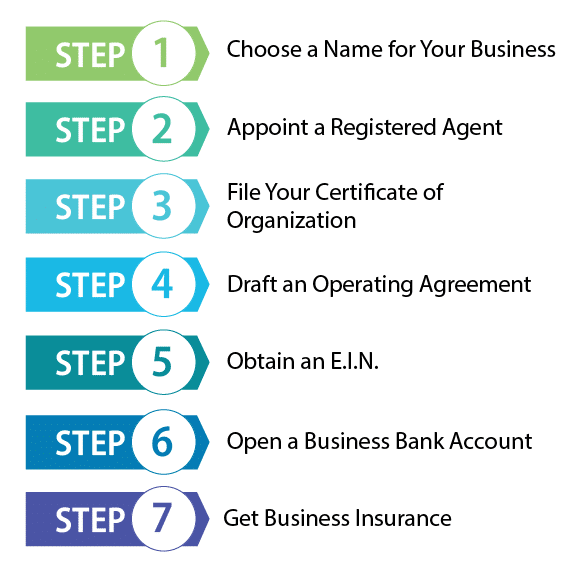

- 7 Steps on Starting an LLC in Nebraska

- Step 1: Choose a Name for Your Nebraska Business

- Step 2: Appoint a Registered Agent in Nebraska

- Step 3: File Your Nebraska LLC Certificate of Organization

- Step 4: Draft an Operating Agreement for Your Nebraska LLC

- Step 5: Obtain an E.I.N. in Nebraska

- Step 6: Open a Nebraskan Business Bank Account

- Step 7: Get Business Insurance (optional)

- Best Professional LLC Creation Services For Your New Nebraska LLC

- Final Thoughts

7 Steps on Starting an LLC in Nebraska

Step 1: Choose a Name for Your Nebraska Business

The first step, and possibly the most important, is choosing a company name. A good name should first of all be easily found by potential customers. Also, to keep from being rejected by the state, ensure it matches Nebraska’s business naming requirements.

These include:

It’s important to remember that confirming name availability only shows that a name appears to be available. The final decision will be made by the Secretary of State when you actually submit your Certificate of Organization.

Another thing you should consider is the availability of a good URL for your chosen name. If one is available and your chosen name appears to be, it can be a good idea to purchase the URL even before you file for your LLC.

Also, if you’ve chosen a name but you’re not quite ready to file for your LLC, you can reserve your name. For $15, you can reserve the name for up to 120 days. However, you can’t reserve the name online. You need to fill out an Application for Reservation of Limited Liability Company Name. Then, you send two copies of this to Secretary of State P.O. Box 94608 Lincoln, NE 68509.

Step 2: Appoint a Registered Agent in Nebraska

Nebraska, just like most other localities, requires an LLC to assign a representative of the business to receive service of process from the state, and this representative is referred to as a registered agent. This can be either an individual or a business entity; however, they must be either a resident of Nebraska or a business that is authorized to perform business in the state of Nebraska.

Additionally, whichever option you choose, the agent must have a physical street address within the state and is legally required to be available during all regular business hours.

Be Your Own Registered Agent

You or another member of your LLC can act as its registered agent, and this can save some money. However, remember that you will have to supply a physical street-side address within the state of Nebraska, and this does not include P.O. Boxes. If you work out of your home, this can be a dealbreaker for some because it means having their home address be a matter of public record.

You will have to be available from 9-5 every business day without fail. If your business does get served, this can be a source of great embarrassment as well in front of friends, family, and customers.

Registered Agent Service

You can select a registered agent service to act as your businesses’ point of contact for the state instead. This will cost your business. However, this can often be quite reasonable. It can also offer your business significant advantages, including:

Step 3: File Your Nebraska LLC Certificate of Organization

You’ll need to file your Certificate of Organization with Nebraska’s Secretary of State to form an LLC in Nebraska. There is no specific form you need to fill out for this. You can create your own document. You just need to include the required information. The information you need to include is listed below.

One of the members can be the registered agent, but then the member’s personal address would be available to the public. Many LLCs hire a registered agent service to be their registered agent, in which case the service’s address will be listed instead of any member’s personal address.

Fulfill Publication Requirements:

Nebraska requires LLCs to publish a Notice of Organization in a newspaper that is generally circulated where the LLCs principal office is located for three weeks.

The Notice of Organization needs to include the LLC name, the type of business the LLC is forming, the registered agent’s name and address, and the business’s office address. The notice must be filed within 45 days of forming your LLC, or your LLC will be canceled.

Step 4: Draft an Operating Agreement for Your Nebraska LLC

One of the things you should do when you’re starting an LLC in Nebraska is to create an operating agreement. Nebraska does not require LLCs to have an operating agreement, but it is a good idea to have one.

An operating agreement is a legally binding agreement that details the structure of your business, who its owners are, and how it will be managed. Having this agreement could help prevent arguments among LLC owners in the future. There are some things you should include in your operating agreement, and we will discuss these next.

You could also choose to have your LLC be manager-managed. In this type of management, the members choose a manager to run the LLC. The members will be able to advise the manager, but the manager will make the decisions for the LLC. Although the owners can reserve the right to make certain decisions by including this in the operating agreement. This type of management is good for large LLCs whose members prefer not to be actively involved in running the LLC.

You can require a different number of votes for different decisions. You could require a simple majority to approve most decisions but require a supermajority for major decisions, such as declaring bankruptcy or dissolving the business.

It’s a good idea to include how many members would need to vote to end the LLC, a majority of members, or a supermajority of members. Also, you should include how any remaining assets will be distributed after any debts are paid.

Step 5: Obtain an E.I.N. in Nebraska

An E.I.N. is an Employer Identification Number, and it is also often called a Taxpayer Identification Number. This number is assigned by the Internal Revenue Service(I.R.S.). It is a nine-digit number that the I.R.S. uses to identify a business for tax reasons.

There are several things you’ll need an E.I.N. for, so it’s probably best to obtain one while you’re establishing your LLC. You’ll need an E.I.N. when you file taxes or if you want to hire any employees. It is generally also necessary for opening a business bank account.

It is easy to obtain an E.I.N. and free as well if you do it yourself. You can get an E.I.N. online at the I.R.S. website; it costs nothing, and it’s easy to apply for. You can also request an E.I.N. by mail, but it takes longer to receive that way.

Step 6: Open a Nebraskan Business Bank Account

One of the primary reasons many business owners form an LLC is for liability protection. Owners typically want to protect their personal assets from being taken to satisfy business debts. However, in order to maintain this protection, businesses need to keep personal and business finances separate.

One good way to do this is to open a business bank account. This helps keep your business account separate from your personal account. Opening a business bank account has several advantages, which we will discuss.

Step 7: Get Business Insurance (optional)

If you are forming a business, it’s a good idea to get business insurance. This is true even for an LLC. An LLC protects the owners’ personal assets from creditors if the LLC cannot pay its debts. It does not protect the owners’ assets if they are sued for their own behavior. So, it’s best to get insurance that includes liability coverage for the owners.

Also, even if your personal assets are safe, you probably want to protect your business assets as well. You never know when a customer may get hurt on your property and sue your business. You also want to be insured against any claims of negligence.

You should also check to see if your state requires business insurance for your industry. Additionally, if you hire employees, you’ll most likely need worker’s compensation insurance. If you rent or lease your premises, your landlord may require you to have insurance as well.

Best Professional LLC Creation Services For Your New Nebraska LLC

It can be difficult and time-consuming to form an LLC on your own, so consider having one of these LLC formation services help you.

#2: Form a Nebraska LLC With Northwest

Northwest Registered Agent is our #1 rated LLC service so far. Considering it’s highly affordable price and unparalleled customer support along with a FREE Registered Agent service for the 1st year — it easily claims the first spot.

You can read more about Northwest Registered Agent in our review here.

#1: Form a Nebraska LLC With ZenBusiness

ZenBusiness hasn’t been around as long as some other popular LLC formation services, but it gets great customer reviews. It also has competitive prices with a number of useful features. It even provides a year of free registered agent service. But, one of its best features is its worry-free compliance guarantee which helps keep your LLC in good standing with your state.

Final Thoughts

Forming an LLC is a great way to protect your personal assets, and Nebraska is a fine place to do it. With an LLC, you can avoid corporate double taxation and form your business here without risking your personal assets. There’s no reason not to get started and begin filing your business today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs