Mississippi LLC (6-Step Guide) – How to Form an LLC in Mississippi

Start an MS LLC With Professional Help

When starting a business, one of the first steps you will need to take is choosing a state and structure of formation. One option a lot of entrepreneurs may overlook is a Mississippi LLC (especially those who live in Mississippi). This structure offers entrepreneurs the chance to limit their personal liability in the case of business failure or lawsuit.

Additionally, the state of Mississippi has struggled a great deal to create business-friendly initiatives that have brought a number of positive changes to the business environment. From low taxes and fees to many subsidies, this state has a lot it can offer business owners. Let’s take a closer look at this structure and why it might be right for you, and then how you can form a Mississippi LLC in only six easy steps.

If you want to skip the hassle of starting a Mississippi LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Start an MS LLC With Professional Help

- Why Would You Want a Mississippi LLC?

- Quick Pros & Cons of Mississippi LLC

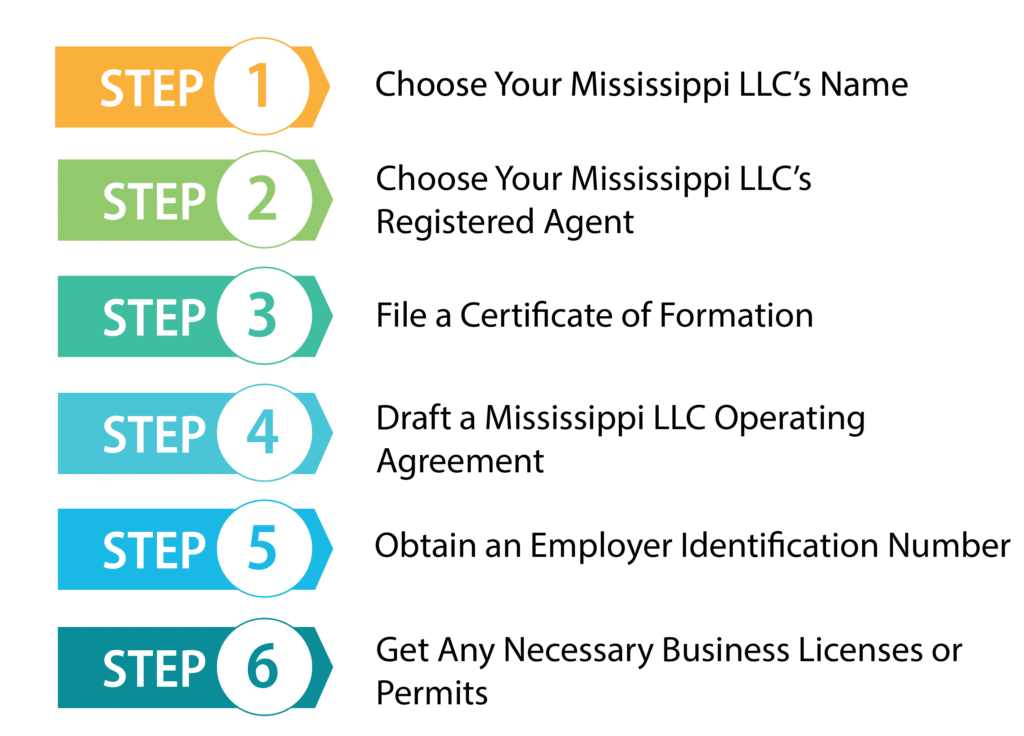

- How to Form Your Mississippi LLC in Six Easy Steps

- Step 1: Choose Your Mississippi LLC’s Name

- Step 2: Choose Your Mississippi LLC’s Registered Agent

- Step 3: File a Certificate of Formation (aka Article of Organization)

- Step 4: Draft a Mississippi LLC Operating Agreement

- Step 5: Obtain an Employer Identification Number for Your MS LLC

- Step 6: Get Any Necessary Business Licenses or Permits

- Steps for Growing and Maintaining Your Mississippi LLC

- Form a Mississippi LLC With Professional Help

- Final Thoughts

Why Would You Want a Mississippi LLC?

There are a number of reasons why this structure might be right for you. Here are a few reasons why you might want a Mississippi LLC:

Quick Pros & Cons of Mississippi LLC

Now that you know why you would want a Mississippi LLC, it is important to consider the pros and cons of this structure to make an educated decision. We know you are busy, so let’s just take a look at the most important pros and cons.

Pros

There are a number of pros to a Mississippi LLC, but let’s take a look at some of the biggest.

Cons

Mississippi does have a few cons to consider before you choose to form your business here. The biggest include:

How to Form Your Mississippi LLC in Six Easy Steps

Now, if you are still with us, wonderful! Let’s get started looking at how you can form a Mississippi LLC that will give your business a leg up on the competition.

Step 1: Choose Your Mississippi LLC’s Name

The first step you need to accomplish in forming your Mississippi LLC is to choose a name for it. A really great name should be unique, catchy, and give potential customers an idea of what product or service your business can provide. Your name must also be easily distinguishable from all other business names previously registered in Mississippi.

To do this, you will need to perform a quick business name search on the Mississippi Secretary of State website. Here you can select words from the names you are considering and enter them in the search tool to see if any of the names that have previously been registered are too close.

If none are, then you’re name will likely work just fine. Now, it is a good idea to check online and see if a good domain name and social media handle are available for your chosen name. If not, you may want to consider choosing another name. If they are available, then you may want to consider snatching them up before they are taken.

Even if you do not want to start a business website now, you may want to down the line, and it is important that your business website resembles your company’s name so customers can easily find it. With so much business being done online these days, it is important even if you won’t be performing e-commerce to ensure customers can find your physical location online.

Once you have found a good name that you are completely satisfied with, you will need to add a designator to the end of it. This is simply a way to let the public know that your business is an LLC, and you can choose to use the words “limited liability company” or any of its abbreviations, including “L.L.C.” and “LLC.”

Step 2: Choose Your Mississippi LLC’s Registered Agent

Now that you have chosen your LLC’s name, it is time to pick who will represent your LLC to the state as its registered agent. Your business’s registered agent will represent your Mississippi LLC and receive official correspondence on its behalf. This includes receiving notice of lawsuits, subpoenas, and tax forms, among others.

This makes it important that whoever you choose for the role be reliable to forward these documents to you to review. This is also important because your registered agent is legally required to be available during all normal business hours to receive correspondence.

You have a lot of leeway in who you can choose to act as your LLC’s registered agent. This can be any individual over 18 years of age with a legitimate street address located within the state, which means no P.O. Boxes. Any person who would like to act as a registered agent must also be willing to list their name and address on public record.

You or any other member of your LLC could act as a registered agent or even family and friends. However, most business owners hire a registered agent service that can receive the correspondence on their behalf and forward it to them. There are a number of reasons for this, so let’s look at some of the most important.

Step 3: File a Certificate of Formation (aka Article of Organization)

Now comes the step where you actually form your LLC. You will file your Certificate of Formation with the Mississippi Secretary of State. Once your Certificate of Formation is approved, your LLC will be formed. You can file the certificate online or by mail, and it will cost $50.

There are a few pieces of information you will need for your Certificate of Formation, and we will list these below.

You can file your Certificate of Formation online at the Mississippi Secretary of State website or by mail.

Step 4: Draft a Mississippi LLC Operating Agreement

Mississippi does not require an LLC to have an operating agreement. However, you’ll want to have an operating agreement. This legal document details the structure of your LLC along with the rights and responsibilities of the members. An operating agreement can help reduce the chances of arguments between the members of your LLC, as well as helping to show that your LLC is a separate entity.

There are no rules as to what needs to be in an operating agreement, but there are some things you should include.

Step 5: Obtain an Employer Identification Number for Your MS LLC

An Employer Identification Number is a nine-digit number similar to a Social Security Number. This number, also known as a Federal Tax ID, is used by the IRS to identify your business for tax purposes. You will need one of these numbers if your LLC has more than two members or you intend to hire employees. You will also probably need this number if you want to open a business bank account.

How To Apply

You can apply for an EIN by mail, by fax, or online. Also, foreign applicants have the option of applying by telephone. If you have a Taxpayer Identification Number, such as a Social Security Number, you can apply online at the IRS website. This is the fastest way to get an EIN, and you will be given your EIN upon finishing the process. You’ll need to finish the process in one session as the form cannot be saved.

To apply by mail, print Form SS-4 and mail it to the IRS at:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Step 6: Get Any Necessary Business Licenses or Permits

Once you file your Certificate of Formation and it gets approved, you start your LLC. But you may still need to do a few things to legally operate your business in Mississippi. Although Mississippi does not require a business license, you may need to register your business with the Mississippi Department of Revenue or the Mississippi Secretary of State for payroll taxes, sales taxes, or franchise taxes.

Also, you’ll want to check with the local area your business is in to see if they require any business licenses. In addition to this, you need to consider whether any licenses or permits are required for the industry you are operating in. It’s important to make sure you get any licenses or permits you need for your business to avoid any penalties or fines.

Steps for Growing and Maintaining Your Mississippi LLC

Now that you have finished forming your Mississippi LLC, let’s look at a few ways you can grow and maintain your new business.

1. Build a Business Website

Most businesses today are going to want to get a website for their business. This is true even for businesses that do not actually conduct their business online. Websites can help both online and brick-and-mortar businesses by giving the business a chance to tell potential customers about their business and what they have to offer. Also, if someone happens to drive by your business, they may want to look it up online to find out more about it. So, you want to have a website available for them to look at. If you don’t have a website, they may just look up a similar business that does have a website.

You’ll also find making a website these days isn’t very hard. There are plenty of tools online that can help you build your website. Also, if you are getting help forming your LLC from an LLC formation service, they may have a service that will build your website for you.

2. Obtain Business Insurance

Now that you formed an LLC, your personal assets are protected in most cases from being used to satisfy any business debts. But after all the hard work and money you put into your business, you probably want to protect your business assets as well. The best way to do this is to obtain business insurance. Business liability insurance will help protect your business assets should your business be sued. Obtaining this insurance is a particularly important step if your business is your primary source of income.

It’s also a good idea to obtain liability insurance for yourself and any other members of your LLC. Although your personal assets will be protected in most cases because your business is an LLC, your personal assets could be at risk in any situation involving negligence or wrongdoing. Therefore, since mistakes can happen, it is safest to be covered by general liability insurance. Another type of insurance your business may need is Worker’s Compensation Insurance. You will likely need this insurance if you hire any employees. This insurance will cover your employees in cases of illness, injury, or death on the job.

3. Open a Business Bank Account

Every LLC should open a business bank account. In order for your business to retain its limited liability, your LLC must be seen as a totally separate entity. To do this, it is essential to keep your business finances separate from your personal finances, and one of the best ways to accomplish this is by having a business bank account. Having a business bank account will keep all your business transactions separate. This is particularly important should your business ever get sued because if the court should find that your personal and business transactions are mixed, they could remove your business’s limited liability. This would leave your personal assets at risk.

A business bank account has other advantages as well. It can make bookkeeping and taxes easier by keeping your business transactions together in one place. You won’t have to go through your account and separate all your personal transactions from your business transactions. It also may make it easier for you to find any deductions you want to claim on your taxes.

Having a business bank account will also give you an opportunity to form a relationship with a bank. This could be very helpful in the future if you ever want to get a loan or a line of credit for your business. You may also be able to obtain a credit card from the bank, which could help you build a credit history for your business.

4. File Your Taxes

Filing your taxes is always an important part of running a business. But it’s particularly important in Mississippi to keep up with your taxes since if you miss a major tax filing, your LLC could be automatically dissolved. If this happens, your business will lose its limited liability, and the members of your LLC would no longer have their personal assets protected.

So, it’s important to find out what taxes you need to file and keep up with them. This could take a bit of work since in Mississippi, you have federal taxes, state taxes, and even local taxes to keep up with. If you are unsure about any of these, it could be a good idea to get in touch with a tax professional.

Form a Mississippi LLC With Professional Help

Starting a new business isn’t easy; you probably have a lot to do and not enough time to do it. But you don’t need to form your LLC on your own. There are many excellent LLC formation services out there that can help you, and we list two of the best services out there below.

#1: Start a Mississippi LLC with ZenBusiness

ZenBusiness is one of the newer LLC formation services out there. However, it has become one of the most popular formation services. One of the reasons for this is its great customer service. ZenBusiness gets excellent customer reviews about their great service. They also include some excellent features in all of their packages, such as a free operating agreement and filing your annual report for you if you want them to.

#2: Start a Mississippi LLC with Incfile

Incfile is one of the best LLC formation services available for someone starting their LLC on a tight budget. This is because they are one of the few LLC formation services that offer a free option. All you have to do is pay the state fee. This free package still comes with some great features, such as a year of free registered agent service and lifetime company alerts. These alerts will keep you informed of any upcoming state deadlines to help you keep in good standing with your state.

Final Thoughts

Forming a Mississippi LLC can be a great way to take your business ideas to the next level. With a low tax rate and a business-friendly environment combined with limited liability and pass-through taxation, this business structure has a lot to offer. So, consider whether this structure is right for you, and don’t hesitate to get started forming your Mississippi LLC today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs