Utah LLC (6 Step Guide) – How to Easily Form an LLC in Utah

Create a Utah LLC With Professional Help [from $0]

If you are looking to start a business, you may be interested in a Utah limited liability company (LLC). It is easy to see why you may want to form such a structure in Utah which has frequently topped the list of best states in which to form a business.

Furthermore, this business structure is a great deal as it can provide protection for any entrepreneur, particularly by shielding you and your loved one’s belongings from loss in case your business fails or suffers from a lawsuit.

Fortunately, with a Utah LLC., this protection comes without the cost of the higher taxes that you would pay with a corporation. So, to help you decide if this structure is right for you, let’s take a look at why you might want this structure, its pros and cons, and finally, how you can quickly and easily form your own LLC in Utah.

If you want to skip the hassle of starting a Utah LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

Why Would You Want a Utah LLC?

There are clearly many reasons to want a Utah LLC, as evidenced by how many entrepreneurs have chosen this state and business structure. Let’s take a look at a few of the reasons you may want to choose a Utah LLC.

Quick Utah LLC Pros & Cons

Now that you know why you might want to choose a Utah LLC, let’s take a quick look at the pros and cons before you decide whether a Utah LLC is right for you.

Pros

There are a number of pros to forming a Utah LLC, and these include:

If your business uses recycled material in manufacturing its products or is more directly involved in the collection or processing of materials, Utah can provide considerable benefits. This is in the form of the Recycle Market Development Zone (RMDZ).

By locating your business in an RMDZ zone, it can receive a number of financial benefits, including up to 5% tax credits on its machinery and equipment, a 20% state income tax credit, or simply up to $2,000 on certain operating costs, technical help from state economic development professionals specializing in recycling, and even discounts on business licensing fees and other costs of starting

Cons

Now, let’s look at some of the cons you can expect with your Utah LLC. These include:

In contrast, starting a Utah LLC will cost you a few different filing fees, including the annual report fee that you will have to pay every year.

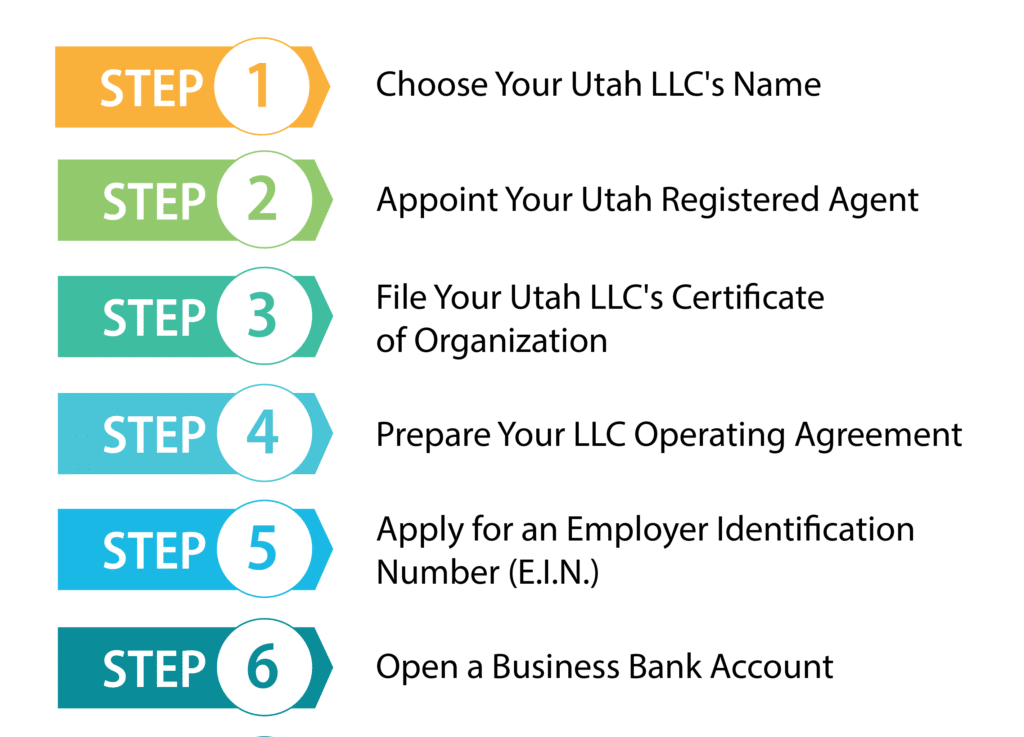

How to Form Your Utah LLC in Six Easy Steps

Hopefully, now you have decided that a Utah LLC is right for you, and if so, congratulations! Now it is time for you to get started forming your Utah LLC. Luckily, forming this structure can be done in six easy steps.

Step 1: Choose Your Utah LLC’s Name

The first step in forming your Utah LLC is to pick a good name for your new business. This name must be unique, and since this will be the first thing customers see about your business, it should clearly describe what your business provides.

Utah prohibits businesses from having names so close to another as to cause confusion, so before settling on a name, it is important to make sure it is distinct. To check if the name you choose is actually available, go to the Utah.gov business search tool. Here you can use keywords from the name you chose, without including LLC at the end, to ensure it is distinct from already taken names.

If it is too close to an existing name, it will be rejected when you go to file your Certificate of Organization, and this could really hold you up when you could be getting your business started. So, make sure to do yourself a favor and don’t skip this step.

Required Designators

The state of Utah requires LLCs to include a designator in order to indicate they are a limited liability company. There are a few options you can choose from in order to allow you some flexibility in naming, and these include:

- Limited Liability Company

- Ltd. Liability Company

- Ltd. Liability Co.

- LLC

- L.L.C.

- Limited Liability Co.

- LC

- L.C.

Ensure There Is a Suitable Domain Available (optional)

Before you settle on a name completely, you may want to ensure there is a suitable domain available for it. Even if you don’t want to start a website right now, you may want to at some point down the line. After all, a lot of business can be done online, and having a website can help potential customers to find your business.

In order to ensure customers connect you and your website, it is a good idea to keep it consistent with the name of your business. So, do yourself a favor and check to make sure a suitable domain is available.

Step 2: Appoint Your Utah Registered Agent

The state of Utah requires your business to select a registered agent in order to file your Articles of Organization. Your LLC’s registered agent is there to receive official correspondence from the state on behalf of your business. The most important of these is the service of process.

Your registered agent can be anyone age 18 or over with a street address located in Utah. This means the address you use cannot be a P.O. Box. It is important to put some thought into who you choose to represent your business as a registered agent as this individual can help your business in a number of ways.

If you choose to hire a member of your family, owner of your business, or a friend, they can act as a secretary. This can be convenient as they will need to be there during all ordinary business hours to accept official correspondence.

Why You Should Consider a Registered Agent Service

Using a registered agent service can offer your business several advantages, including:

Also, certain businesses operate at different locations or may even travel frequently, such as consultants. However, no matter where your business is actually operating, your registered agent must be at the address you designate during all traditional business hours, rain or shine.

Even if you choose to hire an employee to sit at the designated location during business hours, it could be risky if they take a sick day or have to leave for any reason. Compared to this, it is far safer and typically cheaper to use a registered agent service.

By using a registered agent service, you can use their address and keep your own off the record. This can avoid a number of annoying sales visits.

Plus, this means if you ever choose to move your business address, you won’t have to go through the paperwork of changing your registered agent’s address. This can be a particularly big problem if it is your home address. To switch your registered agent’s address, you will need to file official papers and pay related filing fees, and when you are already busy moving, this can be quite a pain.

With a registered agent service, your official correspondence, including service of process, will be handled privately and discreetly. Plus, this way, you can be sure you will be notified about all official notices in a timely manner.

Unfortunately, the issues official mail deals with often have tight deadlines. But, by using a registered agent, you can be sure that you will be alerted to official correspondence quickly so that you can deal with it just as fast and avoid unnecessary fees or non-compliance.

However, most registered agent services possess offices in every state. So, if you think your business will be expanding into other states, it may make sense to just start working with one now rather than filing to switch out your registered agent later on down the line.

Check out our Northwest Registered Agent review. They have one of the best registered agent services on the market.

Step 3: File Your Utah LLC’s Certificate of Organization

To register your LLC in the state of Utah, you will need to file a Certificate of Organization with the state. These documents are often referred to in other states as Articles of Organization and are simply a manageable legal form that will ask you to answer simple questions about your company.

After you fill this form out, it will need to be submitted with the Utah Division of Corporations with the $70 filing fee. You can fill this out online at the Utah Department of Commerce: Division of Corporations and Commercial Code website. You can also download the form, complete it on a computer (Handwriting is not allowed), print it out, and submit it by mail to:

Utah Division of Corporations & Commercial Code

P.O. Box 146705

Salt Lake City Utah 84114-6705

What Needs To Be Included?

The form will include a number of details that the state needs in order to get to know your business. These details will include:

Once you have completed all of the questions on the form, you will need to pay a $70 filing fee as well. This payment can be made online or through fax, or the mail. Once you file, it will typically take only two business days for online filing to be approved. However, if you file by mail, it will often take up to seven business days.

If you choose to pay by check, these can be made out to the Division of Corporations Commercial Code.

Step 4: Prepare Your LLC Operating Agreement

Now that your business is officially registered with the state, it is time to come up with an agreement for just how your business will function as well as all of its rules. This is your business’ operating agreement, and this will be a formal agreement between all of the members of your LLC as to how the business will be run, what capital contributions everyone will make, distribution of profit and losses, and the roles each member will fill. Let’s take a closer look at whether you need an operating agreement and what it should contain.

Do You Really Need an Operating Agreement?

Technically, no, you do not need to submit an operating agreement with the state. However, this is an incredibly important document to make for several reasons. First of all, it protects every member in case of disputes and lawsuits as courts will almost always use these documents in judging cases involving an LLC.

This document is also critical for your business’s finances as well as because banks will almost always require an LLC to have an operating agreement in order to open a business bank account or receive a loan. This document does not need to hold your business back down the line either, as the agreement can be edited with the consensus of all of the members.

When devising the agreement, you can use one of many templates available online. However, you should always consider contacting a professional for advice when crafting this critical document. Afterward, it can be submitted to the state to serve as an official record.

Now let’s take a look at what details your Utah LLC’s operating agreement should contain.

Distribution of Ownership

Typically ownership in an LLC will be divided based on the capital that each member invested in the business. This means that if you put in half of the starting capital, then typically, you would receive 50% of the company’s ownership. But, there may be times that this is not how you want to divide the company.

For example, if another member in the company came up with the idea for the service you are providing, but you just put in 50% of the capital, then it may be fair for them to receive as much of the company as you. So, if you wish to divide the company by some measure other than the quantity of capital each member puts in, then you will need to clarify that in the operating agreement.

Rules for an LLC Manager

For most LLCs, this may not be necessary if you wish to be member-run, but for situations where the members do not wish to perform day-to-day management of the business, it is critical to include this section. If your LLC wishes to hire a manager to take care of daily responsibilities, it is important to clarify precisely what role this manager will play in the company as well as the members’ responsibilities. It can also be useful to include resolution plans for any disputes that arise between a member of the company and any managers.

Profit and Loss Distribution

Most often, profit and loss will be distributed to members based on how much capital they invested in the company. This means that if one member invested half the starting capital, they would be entitled to half the profits. However, this does not have to be the case. This could, like with ownership percentages, be for many reasons, including trying to remain within a certain tax bracket.

Changing Owners

In the majority of states, if one of the founding members drops out, the LLC will automatically dissolve. Oftentimes, this will destroy a business whether or not other members want to continue.

This means that it is critical to include provisions for how a member can exit the business. This includes how their assets will be distributed amongst other members, as well as rules for compensation they will receive, if any, and whether the member is required to give written notice.

Another common way to handle this would be to adopt a separate buy-sell agreement outside of the operating agreement. This agreement works by requiring that owners sell their shares to only other co-owners or those they give approval to. This allows members to control how shares will be distributed and ensure the business continues to run.

Again, this is a critical topic for you to consider and discuss with any other members to ensure your company does not cease to exist if and when a member drops out.

Ending the Business

If you and any other members of your Utah LLC ever choose to dissolve the company, it is important to be able to fall back on the terms of your operating agreement. This should contain terms clarifying how any remaining assets will be divided up amongst members after any remaining debts have been paid.

This also should include any parts of the business that specifically will belong to a certain individual, such as by allowing a particular member the right to continue in the business without competing with other members.

It can be unpleasant to consider the idea of closing your business before you have even finished getting it started, but an agreement on this can prevent a lot of fighting and potentially years of court proceedings.

Remember that though an operating agreement is not required and may seem unnecessary now, it is crucial to keep your business running smoothly and prevent fighting between members and even managers. Additionally, these agreements can help when it comes to negotiating business deals with other companies or the government, as well as to open business bank accounts or receive loans. So, before you get your business underway, make sure you have a formal operating agreement.

Step 5: Apply for an Employer Identification Number (E.I.N.)

An Employer Identification Number (E.I.N.), or as it is sometimes called, a tax identification number, is easy for your business to apply for. This is issued by the Internal Revenue Service (I.R.S.) and acts kind of like a social security number for your business. Generally, you can start and finish this process within only a few minutes, and minimal information is needed.

All you have to do is fill out Form SS-4. This can be done online at the I.R.S. website by completing and faxing the form to (855) 641-6935, or you can download the form and submit it by mail to:

Internal Revenue Service

Attn: E.I.N. Operation

Cincinnati, OH 45999

Finally, international applicants can file for an E.I.N. by phone at 267-941-1099 from 6 am to 11 pm Eastern Time.

Why Do I Need an E.I.N.?

An E.I.N. can be critical for many businesses first of all because it is required in order for you to hire employees. This nine-digit number will also be needed if you wish to open a business bank account.

Though it is not absolutely necessary to file for an E.I.N., it is useful for doing certain things like opening a business bank account which is very likely something you will want to do down the line. Also, it can be critical in order to separate your personal finances from those of your LLC. This is critical in order to prevent your business from being considered a sole proprietorship and retaining the limited liability an LLC presents.

6. Open a Business Bank Account in Utah

One of the most distinguishing characteristics of an LLC is that it operates separately from its owners. This means that your business’s finances must be separated from your own. This does not mean that you have to open a business bank account, but it does mean that you could lose the legal protections an LLC offers if a court ever reviews your finances and determines that you did not do enough to separate your business and personal finances. Additionally, banks will often deny other forms of bank accounts from businesses making it difficult to deal with your finances any other way. Some other reasons to open a business bank account include:

What Will You Need To Start a Business Bank Account?

Though the exact documents you need will depend on the bank and type of account you choose, there are some types of documents every bank will ask for when opening a business bank account.

Some will ask for more or less depending on your state of formation or where you reside. Typically, it is easiest to open an account online.

But, whatever method you choose, here is what you will generally need to open a business bank account.

An E.I.N. will allow your business to establish a tax presence of its own and can be filed for in only a half-hour. Just remember to save the E.I.N. confirmation form to show to the bank.

Form a Utah LLC With Professional Help Today

#1: Create UT LLC With ZenBusiness

ZenBusiness is a very affordable LLC formation service that receives excellent reviews from its customers for its service. ZenBusiness provides some very useful features with all of its packages, such as a free operating agreement and 50% off of its registered agent services. Also, if you purchase ZenBusiness’s Pro or Premium Plan, you will get worry-free compliance. With this feature, ZenBusiness will take care of your filings with the state, so you won’t have to worry about falling out of good standing with the state. However, should you fall out of good standing for some reason, ZenBusiness will provide your business with support. Also, if you have worry-free compliance, you can file two free amendments a year. This can help you if you want to change your business name or address or make other changes to your business that require an amendment.

# 2: Create UT LLC With Incfile

Incfile would be an excellent choice for helping to form your LLC, especially if you’re on a budget. They are one of the few LLC formation services that will file your LLC for free. You only have to pay state filing fees. Additionally, they will provide you with a free year of registered agent services. You’ll also get lifetime company alerts that will let you know about any upcoming required filings. This will help you keep your business in good standing with the state.

Final Thoughts

Starting a Utah LLC is one of the best choices you can make for your business. With low taxes, reduced liability, and the freedom to run your business how you choose, it is hard to go wrong. Plus, Utah is considered one of the very best states for business in the country year after year. So, consider starting your Utah LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs