South Dakota LLC (6 Step-Guide) – How to Form an LLC in South Dakota

Start Your SD LLC With Professional Help (From $0 + state fees)

If you are trying to decide where to form your LLC (Limited Liability Company), South Dakota may not have come to mind. With one of the smallest state populations in the country, many may overlook this state. But, the truth is a South Dakota LLC holds many advantages

South Dakota is one of the most business-friendly states in the country, and with an LLC, you can protect your personal assets while benefiting from reduced taxes. This is a great combination with South Dakota, which holds few taxes for business owners (to know the full costs involved, see our South Dakota LLC costs guide). Let’s take a closer look at some of the benefits that a South Dakota LLC can offer you and how you can form one in only six easy steps.

If you want to skip the hassle of starting a South Dakota LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Start Your SD LLC With Professional Help (From $0 + state fees)

- Why Would You Want a South Dakota LLC?

- Quick South Dakota LLC Pros & Cons

- How to Form Your South Dakota LLC in Six Easy Steps

- Step 1: Choose Your South Dakota LLC’s Name

- Step 2: Select a Registered Agent for Your South Dakota LLC

- Step 3: File Articles of Organization For Your South Dakota LLC

- Step 4: Draft an Operating Agreement

- Step 5: Obtain an Employer Identification Number for Your LLC in South Dakota

- Step 6: Open a Business Bank Account for Your South Dakota LLC

- Additional Steps for Growing and Maintaining Your South Dakota LLC

- Form a South Dakota LLC with Professional Help Today

- Final Thoughts

Why Would You Want a South Dakota LLC?

There are many reasons that you would want a South Dakota LLC, so let’s take a look at some of the biggest.

Quick South Dakota LLC Pros & Cons

You are probably in a hurry to get started filing for your business, but before making such an important decision, it is important to consider the pros and cons. Don’t worry. We will make this quick and painless so that you can get started on the fun part.

Pros

As we said, South Dakota is one of the most business-friendly states in the country, so unsurprisingly, there are a number of pros. Here are some of the largest:

Cons

South Dakota, as we have said, is quite business-friendly, but that certainly doesn’t mean that there are no cons to forming your LLC here. Cons for forming here include:

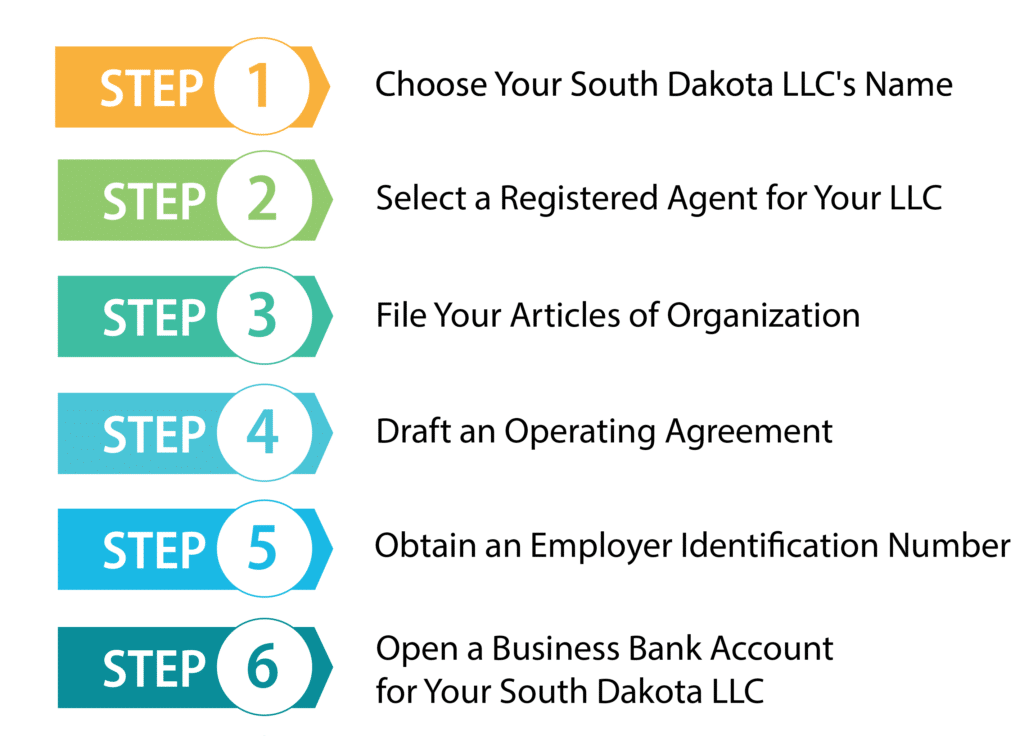

How to Form Your South Dakota LLC in Six Easy Steps

Now that you have seen why you might want a South Dakota LLC and some of the biggest pros and cons, hopefully, you are still with us. If so, that’s great! Now let’s get down to the nuts and bolts of forming your South Dakota LLC. Luckily we only have six steps ahead of us.

Step 1: Choose Your South Dakota LLC’s Name

Your first step is not a difficult one, and it may even be fun. It is time to choose your LLC’s name. It is a good idea to choose a creative name that still gets the idea of what product or service your business provides across.

Your business name will also need to be unique from all other businesses that have previously registered in South Dakota. To ensure your business name is unique, you will need to do a quick search on the South Dakota Secretary of State’s Business Information Search Tool.

Simply choose keywords from the name you have chosen and type them into the search bar. Then look at the results and see if any other businesses have a name that too closely resembles yours. If not, then your name should be okay to use.

Once you are satisfied, add a designator to the end of your LLC’s name. This can be “limited liability company,” “limited company,” or any of the abbreviations of these phrases. Abbreviations include “LLC,” “L.L.C.,” and “LC.”

Reserve a Domain for Your LLC (optional)

Once you choose a name for your LLC and find out that it is available, you’ll want to see if the domain name for your business is available. A website is important for any business today, and you want one with the same name as your business so that customers will easily associate it with your business. If a suitable domain name isn’t available, you may want to consider choosing another name for your South Dakota LLC.

Step 2: Select a Registered Agent for Your South Dakota LLC

All LLCs are required to have a registered agent. The registered agent must have a physical address in South Dakota. A P.O. Box is not acceptable. The registered agent is required to be available during all business hours to receive service of process and other official notices.

Who Can Be a Registered Agent?

You can choose anyone to be your registered agent as long as they are 18 years or older and have a physical address in South Dakota. You can even be your own registered agent. However, there are some advantages to using a registered agent service, which we will list below.

Step 3: File Articles of Organization For Your South Dakota LLC

Filing your Articles of Organization is what actually forms your LLC in South Dakota. The Articles of Organization include important details about your LLC. Once these documents are filed and approved by the South Dakota Secretary of State, your LLC will be officially registered with the state.

There are a number of details you will need to provide in these articles, such as:

It will cost $150 to file your Articles of Organization online and $165 to file by mail. To file by mail, send the documents to:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501

Step 4: Draft an Operating Agreement

The next step you should take is to draft an operating agreement. South Dakota does not require LLCs to have an operating agreement, but you should definitely have one. An operating agreement is a legal document that describes the structure of your business as well as the rights and responsibilities of its members. This agreement can be very helpful for avoiding arguments between members in the future and maybe even lawsuits due to arguments between the members. There are no specifics on what has to be included in an operating agreement, but there are a number of things you should include, which we will discuss below.

Another type of management is manager-managed. In this type of management, the members of the LLC choose a manager to run the business for them. This manager runs the day-to-day affairs of the business and makes the decisions for the business. The members act as advisers to the manager. Although the manager does not need to take their advice. If the members of the LLC want to reserve any decisions for themselves, they should mention these in the operating agreement. You should also mention in the operating agreement how any arguments between the members and the managers will be dealt with.

You want to mention if the member will be required to offer to sell their shares to other members first or if they will even be allowed to sell their shares to outsiders. If they are allowed to sell their shares to outsiders, will there be any restrictions on who they can sell to?

You’ll want to include what kind of vote will be required to dissolve the LLC, such as a majority, supermajority, or unanimous vote. You should also include how any assets that are left after any debts are paid will be divided. Additionally, you could include whether or not any of the members will be allowed to continue with the idea of the business after the LLC is dissolved.

Step 5: Obtain an Employer Identification Number for Your LLC in South Dakota

An Employer Identification Number (EIN) is a nine-digit number similar to a Social Security Number. It is sometimes called a Federal Tax Identification Number as well. The IRS uses this number to identify your business for tax purposes.

You’ll need to have this number for your LLC if your LLC has two or more members or intends to hire employees. You’ll also need this number to open a business bank account.

How To Apply

Applying for an EIN is free, and you can apply online, by mail, or by fax. Also, foreign applicants can apply by telephone. If you have a Social Security Number, you can apply online at the IRS website. It doesn’t take long, and you will receive the number as soon as you complete the process. Just be sure to complete the process in one session. The form will not be saved if you leave it before finishing.

You can also print Form SS-4 and mail it to the IRS at:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you want to fax the application, just fill out and print Form SS-4. Then, after you fill it out, fax it to (855) 641-6935. If you are an overseas applicant, you can apply for an EIN by calling 267-941-1099 from 6 am to 11 pm Eastern Time Monday through Friday.

Step 6: Open a Business Bank Account for Your South Dakota LLC

Although a business bank account is not required for forming an LLC, it is still a vital step. LLC members are required to keep their personal finances separate from their business finances. If an LLC is sued and the court finds that business and personal finances were mixed, the court could decide that the LLC is not a separate entity and remove its limited liability. This is called piercing the corporate veil. Should this happen, the members’ personal assets would be at risk.

One of the best ways to keep this from happening is to open a business bank account for your LLC. This account would keep your business finances separate from any of the members’ personal finances.

A business bank account has other advantages as well. It makes bookkeeping and taxes easier. It will save you the trouble of having to separate all your business transactions from your personal transactions. This makes bookkeeping a lot easier, and you’re less likely to miss any deductions come tax time because all of your transactions will be in one convenient place.

Having a business bank account also allows you to form a relationship with your bank. This could come in handy should you want to get a loan or a line of credit in the future.

Required Documents

There are a few documents that will generally be required in order to open a business bank account. Generally, these will simply be documents that you will have just acquired in the previous steps of forming your LLC. So, here are the ones you will generally want to keep handy for if your bank wants to look at them.

Additional Steps for Growing and Maintaining Your South Dakota LLC

Now that the work of forming your business is done, you can take a step back to relax. But the work of growing and maintaining your business is just getting started. Here are a few steps you can take to get started.

1. Business Website

All businesses today should really have a business website. Having a business website will not only make your business appear more professional but also attract more customers to your business. There are many reasons that a business website can even be useful for businesses that do not conduct any business online.

Brick and mortar businesses can use a website to inform customers about their business and convince them to visit their company’s physical location. Though social media is a great way to get started and expand your business’s online presence, you should really have a business website, even if you have social media accounts. This website will give you a place to put the information you might not want to put on a social media account and will add a great deal of credibility to your business.

You don’t have to worry that a website is too difficult to start. There are a lot of tools you can find online to help you create an excellent website for your business. Additionally, if you are using an LLC formation service, you may find that one of their services is creating business websites. So you may choose to take advantage of this service.

2. Business Insurance

All LLCs should purchase business insurance. It is true that LLCs have limited liability which will protect your personal assets from being taken to satisfy business debts, but this does not protect your business assets. If your business is sued, your business assets can be taken to satisfy any judgments. This could make it difficult to continue to run your business which is a particular problem for those whose business is their main source of income. This is why it is so important to get liability insurance for your business. You need to protect your business assets as well as your personal assets, and business insurance can do just this.

It’s also a good idea to purchase liability insurance for all of your LLC’s members. The members of your LLC can be sued in cases of negligence or wrongdoing. However, having personal liability insurance for your members should protect them in these cases.

Another insurance your business is likely to need if you have workers is Worker’s Compensation Insurance. Most states require any business with employees to have this insurance. This insurance will cover your employees in case of injury, illness, or death that occurs on the job.

Form a South Dakota LLC with Professional Help Today

Every entrepreneur has trouble finding enough time in the day, and this can leave it difficult, if not impossible, to get the time to file your South Dakota LLC. However, you don’t need to go it alone. There are countless services out there that can help you through the process, and these are two of the best!

#1: Form Your SD LLC with ZenBusiness

ZenBusiness is one of the newer LLC formation services, but they have become quite popular. They are known for their excellent customer service. Almost all of their online reviews are positive. Their service is quick and easy to use. Also, they provide 25% off of their registered agent service with all of their packages.

#2: Start Your SD LLC with Incfile

Incfile is one of the best LLC formation services out there. It’s particularly good for someone trying to start an LLC on a tight budget because it is one of the few services out there with a free option. All you have to do is pay the state fees. Also, Incfile will provide a year of free registered agent service with any of their packages. This is a great feature since all LLCs are required to have a registered agent. Incfile will also provide you with lifetime company alerts to help you stay in compliance with the state.

Final Thoughts

A South Dakota LLC may not come to mind as one of the best options for your business formation, but it definitely ranks there. Despite the low population, this business-friendly state can help your business grow, and with limited personal liability as well as a reduced tax burden, it is hard to go wrong with a South Dakota LLC.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs