Arkansas LLC (6-Step Guide) – How to Form an LLC in Arkansas

Start an Arkansas LLC With The Help of Professionals

Starting a business or changing your existing business structure can be complex, and there are many things to consider. Two of the largest questions you may have to consider are what your business structure will be and where you will start your business. An Arkansas LLC may just be the best answer to both of these questions.

An Arkansas LLC offers protection for your personal assets, and potentially lowers your taxes and the state holds well below-average costs of doing business. An Arkansas LLC has a lot to offer, so let’s take a closer look at this structure and then see how you can form an Arkansas LLC in only 6 easy steps.

Or you can instead hire:

- ZenBusiness ($49 + state fees)

- Northwest Registered Agent ($39/mo + state fees)

To create an LLC in Arkansas for you.

And if you’re looking for how much it would cost for you to start an LLC in Arkansas – read our Arkansas costs guide here.

Why Would You Want an LLC in Arkansas?

As we said, this structure has a lot to offer, and here are some of the biggest reasons why you would want an Arkansas LLC.

Quick Arkansas LLC Pros & Cons

Now that we have seen why you might want an Arkansas LLC, it is important to consider the pros and cons of such a big decision. Since, like any entrepreneur, you are likely in a hurry, we will make this quick and consider the most significant.

Pros

The biggest pros of an Arkansas LLC include:

Additionally, unless specified otherwise in an LLC agreement or agreed upon in writing by all LLC members, a person will no longer be a member of an LLC if they willingly make an assignment for creditors, file for bankruptcy or are judged insolvent or bankrupt, or chooses not to contest the appointment of certain categories of individuals over their property.

In Arkansas, a foreign LLC may defend itself in state court even if it is not registered to do business in Arkansas. However, a foreign LLC that is not registered with the state may not be the plaintiff in a case in an Arkansas state court. Additionally, if a foreign LLC starts to do business before registering with the state, once the LLC does register with the state, it will have to pay any taxes or fees that it would have paid had it registered before beginning to do business. Arkansas also charges $5000 per year as a civil penalty for each year the foreign LLC did business in Arkansas without being registered to do so.

Cons

Like with any major decision, there are some cons to consider, which include:

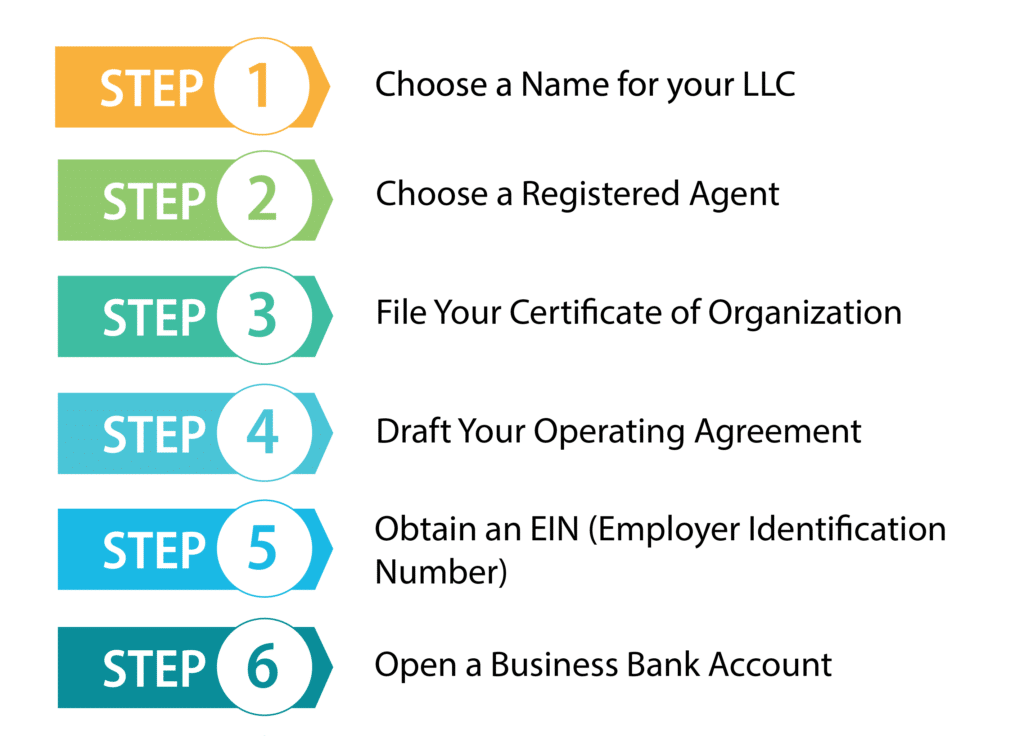

How to Form Your Arkansas LLC in Six Easy Steps

Now that we have covered the reasons you may want an Arkansas LLC, as well as the cons, let’s get down to the nitty-gritty. How can you form an Arkansas LLC? Luckily it is pretty easy, and you can do it in only six steps, so let’s get started!

Step 1. Choose a Name for your LLC

The first thing you need to do when forming your LLC is to choose a name. You’ll want to choose a name that is catchy to attract attention but also gives people an idea of what your business does. A good name can help your business attract more customers, which can help you to make more money.

Before you decide on a name, though, there are certain rules that Arkansas has for business names, such as:

Since Arkansas requires that a business’s name be unique, you will need to do a search to make sure your chosen name isn’t already taken. You can do your search on the Arkansas Business Entity Name Search. If the name you have chosen appears not to be taken, it should be safe to use. However, this is not guaranteed. You will not know for sure until you have filed your Certificate of Organization and it has been approved.

If the name you want appears not to be taken, and you are not ready to file yet, you may want to reserve the name until you are ready to file. You can do this by filling out an Application for Reservation of LLC Name. You can do this online at the Arkansas Secretary of State website, which will cost $22.50.

You can also file by mail by filling out Form RN-06 and sending it to:

Arkansas Secretary of State

1401 W. Capitol Ave.

Suite 250

Little Rock, AR 72201

You will need to include a check or money order for $25.

Before making a final decision on your business name, you may want to make sure that the name of your business is available as the URL. You will probably want to start a website, and it is good if you can get a URL that is the same as your business name. You should also check and see if a good social media handle is available for the business name you want. If you can’t find these things, you may want to consider a different name for your business.

You can also file for a doing business as (DBA) name on the Arkansas Secretary of State website. A DBA is a fictitious name you can use for your business instead of your legal business name. This is also known as a trade name and can be useful for LLCs that wish to use a name other than their legal name. If you choose to file online, this will cost $22.50.

You can also file by mail by filling out Form DN-18b and mailing it to:

Arkansas Secretary of State

1401 W. Capitol Ave.

Suite 250

Little Rock, AR 72201

It will cost $25 to file.

Step 2. Choose a Registered Agent

Arkansas requires all LLCs to have a registered agent to accept service of process and other important documents from the state. You can choose to be your own registered agent or pick a relative or friend. You can also choose to hire a registered agent service. There are certain requirements for the registered agent you choose, such as:

Should I Hire a Registered Agent Service?

It’s common for business owners to consider whether they should hire a registered agent service or be their own registered agent. It can be tempting to save money by being your own registered agent, but there are a number of advantages to hiring a registered agent service.

Step 3. File Your Arkansas LLC’s Certificate of Organization

Your next step will be to file the Certificate of Organization for your LLC. This is the step that will actually form your Arkansas LLC. You will file these documents with the Arkansas Secretary of State. Filing these documents will cost $50.

You can file your Certificate of Organization online or by mail. However, the quickest and easiest way to file these documents is online. You can do this at the Arkansas Secretary of State’s website. Just choose the option for a domestic LLC.

If you would prefer to file by mail, fill out Form LL-01, which is a Certificate of Organization for Limited Liability Company. You can then mail this form to:

Arkansas Secretary of State

1401 W. Capital Ave.

Suite 250

Little Rock, AR 72201

Be sure to include a check or money order for $50.

4. Draft Your Operating Agreement

Arkansas does not require your LLC to have an operating agreement unless you are applying for an Arkansas Sales Tax License, in which case you will need to include the operating agreement with your application. However, every LLC should have one. An operating agreement is a legal document that details your business’s structure along with the rights and responsibilities of its members. Having one can help avoid arguments between members.

Although there are no specific rules for what must be included in an operating agreement, there are some items that are typically included in an operating agreement that we will discuss.

Step 5. Obtain an EIN (Employer Identification Number) for Your Arkansas LLC

Once you form your LLC and draft your operating agreement, it’s time to get an Employer Identification Number (EIN). This number is a nine-digit number, a lot like a Social Security Number. It is often known as a Federal Tax Identification Number, and the IRS will use this number to identify your business for tax purposes.

You are required to obtain one of these numbers if your LLC has two or more members or if you intend to hire employees. There are other good reasons to get one of these numbers as well. It will help to establish your LLC as its own separate entity, and many banks require an EIN for opening a business bank account.

It is easy to get an EIN, and it’s free. You can do this online at the I.R.S. website. You can also file by mail or by fax by completing Form SS-4 and sending it to:

Internal Revenue Service

Attn: E.I.N. Operation

Cincinnati, OH 45999

You could also fax the form to (855) 641-6935.

Additionally, international applicants have the option of filing for an E.I.N. by phone. They can call 267-941-1099 from 6 am to 11 pm Eastern Time.

Step 6: Open a Business Bank Account

After you’re finished forming your LLC and you obtain an EIN, it’s a good time to open a business bank account. You’re not required to do this, but it’s still an important part of setting up your business. There are a number of reasons for this, and we will discuss some of these.

Required Documents

Opening a business bank account will take a few documents. Although which documents it will take can vary from bank to bank. These documents are likely to be ones that you will have on hand, so it should not be difficult to gather them. We will list a few of the documents you may need below.

Growing & Maintaining Your Arkansas LLC

Now you are done forming your Arkansas LLC, so let’s take a look at how you can get ahead on growing and maintaining your new business.

1. Create a Business Website

Most businesses today will want a business website. Many people today search online before they even start shopping, and you want to make sure potential customers are able to find you. After all, if they don’t find your business, they will find another one.

You shouldn’t have any trouble creating a business website. There are many tools available online to help you to do this that are quite easy to use. You should be able to get your website up and running in no time.

2. Business Licenses and Permits in Arkansas

One thing you want to do after you form your LLC but before you actually start operating your business is to make sure you have all the necessary licenses and permits to operate in Arkansas.

One permit many businesses will need to operate is the Arkansas State Tax Permit. You will need this permit if you offer taxable services or sell any personal property. You can apply for this permit on the Arkansas Secretary of State’s website.

You may need a variety of state, city, or county permits to operate your business. You should be able to find the information you need on the websites of the state, city, or county. However, if necessary, you can make some calls. You will want to make sure you have any of these permits or licenses you need to avoid any fines or penalties.

3. Business Insurance

It’s important to make sure that your LLC has the business insurance it needs. You should make sure your business has any required insurance, but you should also be sure to obtain insurance to help protect your business. The insurance you need will vary depending on the industry you’re in, but we will discuss a few of the common types of business insurance policies.

Form an Arkansas LLC With Professional Help Today

We know you’re busy so if you need some help forming your Arkansas LLC, here are some of the best businesses that can help you make it easy.

#1 – Start an LLC in Arkansas With ZenBusiness

ZenBusiness is an excellent LLC formation service that has very reasonable prices. They also get good customer reviews indicating that most people are quite happy with their service. ZenBusiness offers 25% off of their registered agent service with any of their packages. In addition to this, they include a free operating agreement, which can be quite useful since all LLCs should have an operating agreement. They will also file your annual report for you, which can save you time and help you stay in good standing with the state.

#2 – Start an LLC in Arkansas With Incfile

Incfile is an experienced LLC formation service that is particularly good for those who are trying to form an LLC on a tight budget. Unlike most LLC formation services, Incfile offers a free option. All you have to do is pay the state fee. They also have some good features with their packages, including their free package. Incfile includes a year of free registered agent service with all of their packages. They also provide lifetime company compliance alerts which will inform you of any upcoming state filing deadlines. This service will help you stay in good standing with the state.

Final Thoughts

An Arkansas LLC is a great way to give your business a head start. With reduced taxes and a good economic climate, you are in great shape for your business to thrive. Plus, if things don’t turn out as expected, your personal property is protected. So, there is no reason not to get started forming your Arkansas LLC.

FAQs

How Much Does It Cost To Form an Arkansas LLC?

The cost of filing for an Arkansas LLC is $50.

How Long Does It Take To Form an Arkansas LLC?

It typically takes two to three business days to form your Arkansas LLC.

Do Arkansas LLCs Have a Perpetual Duration?

Arkansas LLCs are perpetual unless the members fail to file their annual franchise tax report, which could in time lead to the LLC being automatically dissolved or if the members choose to dissolve the LLC.

Does Arkansas Have a State Income Tax?

Arkansas does not have a state income tax. However, there are other taxes that you may need to pay. So, to be safe and make sure you are paying all the necessary taxes, you may want to consult with a tax professional.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs