Arizona LLC – How to Form an LLC in Arizona In 7 Steps? (Full Guide)

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Jump to Pros & Cons of Arizona LLC

A limited liability company (LLC) is one of the most popular business structures for many industries. Many business owners look to limited liability companies as a way to protect their assets and limit their tax burden while retaining the flexibility of a sole proprietorship or partnership.

These benefits vary more or less depending on the state but generally remain beneficial no matter where you live. Luckily, the benefits remain particularly strong for forming an LLC in Arizona.

So, now you are probably wondering how you can form your own LLC in Arizona. Fortunately, we can help you there; just follow the steps below to get started.

Additionally, if you’re wondering about the costs involved with an Arizona LLC — read our full Arizona costs guide here.

- Jump to Pros & Cons of Arizona LLC

- 7 Steps on Forming an LLC in Arizona

- Step 1: Choose an Official Name for Your Arizona LLC

- Step 2: Appoint Your Statutory (Registered) Agent in Arizona

- Step 3: File the Articles of Organization for Your Arizona LLC

- Step 4: Prepare Your AZ LLC Operating Agreement

- Step 5: Arizona Publication Requirements

- Step 6: Obtaining an EIN and Business Licenses For Arizona LLC

- Step 7: Choose How Your Arizona LLC Will Be Taxed

- Should I Form an LLC in Arizona?

- Pros & Cons of Forming an LLC in AZ

- Cost of Forming an LLC in Arizona

- Benefits of an Operating Agreement for an Arizona LLC

- Doing Business as a Foreign LLC in Arizona

- Is Single Member LLCs Allowed in Arizona?

- Professional LLCs in AZ

- LLC Processing Time in Arizona?

- Benefits of Opening a Business Bank Account in Arizona

- Conclusion

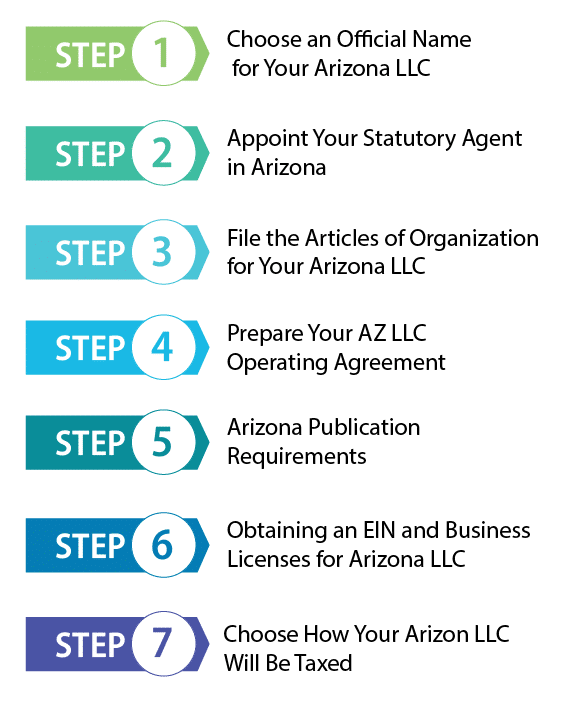

7 Steps on Forming an LLC in Arizona

Step 1: Choose an Official Name for Your Arizona LLC

The first thing you will need to do to register your LLC is to decide on a name for your business. Remember, when choosing that the state of Arizona requires all names for an LLC to contain either the words limited liability company or any of the abbreviations including “LLC” “LC,” “L.L.C.,” or “L.C.” For any who wish to register as a professional LLC, it is pretty much the same. You need to include the words “professional limited liability company”; alternatively, you may choose to use the abbreviations “PLLC,” “P.L.L.C.,” ”PLC,” or “P.L.C..”

In addition to including one of these phrases, your name must also be capable of being distinguished from the names of other businesses that have already filed with the Arizona Corporations Commission. You can see if your chosen name is available by doing a search on the Arizona Corporation Commission Business name database.

You can reserve your business’s name for 120 days if you need to. To do this, you’ll need to fill out an Application to Reserve Limited Liability Company Name and file it with the Arizona Corporation Commission. You can do this online or send it by mail. It will cost $45 online or $10 by mail. You can pay $35 to rush your order.

You can also use a DBA (Doing Business As) name for operating your business. All you need to do is start using your DBA. You are not required to register your DBA. However, you can register the name to allow others to know it is being used. Registering a DBA in Arizona costs $10.

Step 2: Appoint Your Statutory (Registered) Agent in Arizona

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Any business forming an LLC in Arizona must have a statutory agent. A statutory agent is often called a registered agent in other states. A statutory agent is a person or service who is authorized by your LLC members to accept legal documents on the LLC’s behalf. You can choose a full-time resident of Arizona to be your statutory agent or a company that is authorized to do business in Arizona. Whichever you choose, the statutory agent needs to have a physical address in Arizona and be available during business hours to accept legal paperwork. Also, to be the official statutory agent, the chosen person or business must fill out the Statutory Agent Acceptance form, which you will submit along with your Articles of Organization.

Step 3: File the Articles of Organization for Your Arizona LLC

You are required to file Articles of Organization with the Arizona Corporation Commission to start your LLC. There are certain things these articles need to include, and we will list these.

- The name of your LLC

- The business address for your LLC

- Whether the LLC is a professional LLC or a standard LLC

- If you are forming a professional LLC, you will need to list the service.

- The name of the statutory agent for your LLC

- The form of management, member-managed or management-managed

- The LLC’s organizer will need to sign the articles.

You can file your Articles of Organization online or fill them out and mail them to the Arizona Corporation Commission at 1300 W. Washington Street, Phoenix, Arizona 85007. You will also need to send your Statutory Agent Acceptance Form with your LLC formation documents.

If you choose to file by mail, approval time will typically be about 14 business days if you choose the standard filing option and pay the $50 filing fee. However, if you choose to expedite your filing and pay the $85 fee for expedited filing. In that case, you can expect it to be approved in about 9 business days.

Arizona allows you to file your Articles of Organization online, and this is a great way to get the paperwork approved sooner. However, you will need to make an account on the Arizona Corporation Commission’s website to get started. The fees are the same as with mail filing, and standard filing will take generally take the same amount of time. But, with online expedited filing, your documents may be approved in as little as 1 business day.

Step 4: Prepare Your AZ LLC Operating Agreement

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Arizona doesn’t require LLCs to have an operating agreement, but it’s still a good idea. An operating agreement lists the members of an LLC along with their rights and responsibilities and includes many other details about how the LLC will be set up and run. This agreement could help avoid arguments caused by a lack of understanding of which member has which responsibilities. You should include many things in your operating agreement, which we will list below.

- State whether your LLC will be member-managed or manager-managed.

- Policy for choosing managers

- Responsibilities of members

- The allocation of profits and losses

- Process for making important decisions

- What decisions require a vote

- How ownership interest can be transferred

- How new members can be added

- How the LLC can be dissolved

It is a good idea to have a lawyer draw up your operating agreement, but if this is too costly, you can easily find free templates. Make sure you take into account the industry your business is in and the state you will be operating in when drawing up your operating agreement. If you use a free template, these things may be left out, including, in some cases, specific requirements for the state you will be operating in. Also, be sure that the things that are included in the template are things you want in your agreement.

Step 5: Arizona Publication Requirements

If you are forming your business in any county other than Maricopa or Pima, you need to publish a Notice of LLC Formation within 60 days after your LLC’s Articles of Organization are approved by the Corporations Commission. The notice needs to be published in a prominent local newspaper in the county your business is located in for three consecutive issues.

It needs to include the name of your LLC, the file number you were given by the Arizona Corporation Commission, your LLC membership information, and the address of your statutory agent.

Failure to comply with publication requirements could result in your LLC being dissolved. However, you don’t need to file an affidavit of publication. But, you should keep the affidavit of publication in case you should need it. Both Maricopa and Pima counties publish the LLCs formed in their counties on their website, which satisfies the publication requirement.

Step 6: Obtaining an EIN and Business Licenses For Arizona LLC

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

LLCs with more than one member need to obtain an EIN (Employer Identification Number). Also, if you have a one-member LLC and choose to be taxed as a corporation or if you have any employees, you will need to obtain an EIN.

An Employer Identification Number is a nine-digit number that a business will use when filing taxes. This number is assigned by the IRS and identifies the business for tax purposes. The number works similar to a social security number and will be needed by your business for opening a business bank account, hiring employees, and registering for business permits and licenses, in addition to filing for taxes.

It’s quite possible that you’ll also need a number of licenses or permits to start doing business. It depends on the area you’ll be conducting business in. We will list a few of the commonly required licenses below.

- Professional License: Businesses such as accounting firms, dental offices, or salons need to be licensed.

- Transaction Privilege Tax License: The Transaction Privilege Tax is called a sales tax in most states. The Arizona Department of Revenue collects this tax from businesses for the privilege of conducting business in Arizona. You need to apply for the license with the Arizona Joint Tax Application form, and it will cost $12.

- Business License: Some cities may require you to obtain this license before you can do business.

Step 7: Choose How Your Arizona LLC Will Be Taxed

How your LLC will be taxed can vary, which is part of the appeal of an LLC. You can decide to have your LLC taxed as a C-corporation, an S-corporation, a sole proprietorship, or a partnership. Your business will still be an LLC; it will just be taxed as if it were one of these business types.

If you decide to have your corporation taxed as a sole proprietorship or partnership, the members of your corporation will record any profits or losses on their income tax statements along with paying self-employment taxes on their profits,

Alternatively, should you choose to have your LLC taxed as a corporation, the members will decide on a reasonable salary for the managers, which will be subject to payroll taxes. Then, the profits can be distributed among the members. The profits are not subject to payroll taxes.

Your LLC will need to register with the Arizona Department of Revenue if your LLC sells any goods for which sales taxes are collected or has any employees. You can do this online or fill out the Arizona Joint Tax application and mail it in.

Should I Form an LLC in Arizona?

It really depends on your situation whether or not an LLC will benefit you. Still, the benefits are as substantial in Arizona as in most other states. An LLC will protect your personal assets from being claimed to satisfy business liabilities. However, it will not protect you from being sued for personal tort liability due to your own behavior.

LLCs offer other benefits, though, such as management options, flexible membership, increased credibility, and tax benefits. We discuss some of the advantages and disadvantages of LLC formation below.

Pros & Cons of Forming an LLC in AZ

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Advantages of AZ LLC Formation

Disadvantages of AZ LLC Formation

Cost of Forming an LLC in Arizona

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

You’ll need to file your formation paperwork with the Arizona Corporations Commission, which charges a $50 fee plus $35 if you want the paperwork expedited. Also, you may need to pay $45 to reserve a business name online or $10 if you reserve the name by mail if you want to reserve the name before filing your formation paperwork.

If you want help forming your LLC, you may also end up paying a fee. Although, a few services, such as IncFile, provide some formation services for free. You may find one of these services quite helpful since registering for an LLC can be complicated.

Benefits of an Operating Agreement for an Arizona LLC

Operating agreements are not required for forming LLCs in Arizona, but it is still a good idea to have one. Drawing up an operating agreement and having all of the LLC’s members sign it could help prevent disagreements over company policies or member’s roles in the LLC. The agreement will also help you keep your limited liability status. Also, you may prefer to choose your own rules rather than depending on default state laws.

To know more about Operating Agreements and download its template — click here.

Doing Business as a Foreign LLC in Arizona

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Any LLC that wants to do business in Arizona needs to register with the Arizona Corporation Commission. This includes LLCs formed in other states, which are called foreign LLCs. To register a foreign LLC, you can fill out an Application for Registration of a Foreign Limited Liability Company. You will need to pay a $150 fee, but it will not need to be published.

Before filing the form, you’ll want to make sure your business name is available in Arizona. You can do this by checking the business name database on the Arizona Corporation Commission website. If your business name is not available, you can use a fictitious name, a DBA (Doing Business As) name. However, this will require registering your DBA in each Arizona county you intend to do business in.

Foreign LLCs are required to have a statutory agent in order to operate in Arizona. This person or service needs to be available during business hours to accept legal documents and must be physically located in Arizona.

Is Single Member LLCs Allowed in Arizona?

Arizona does allow single-member LLCs. They are treated the same as multi-member LLCs. So, the formation process is the same as well.

Professional LLCs in AZ

If you are a licensed professional who wants to form an LLC, you’ll need to form a professional limited liability company (PLLC). Professionals in this category include certified public accountants, architects, lawyers, and dentists, among others. You will likely fall in this group if you need an Arizona state license to practice. If you want to form a PLLC, everyone in it will need to be licensed.

LLC Processing Time in Arizona?

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

The LLC formation documents are processed by the Arizona Corporation Commission. The time it takes to process the documents varies, but it probably won’t take more than 30 business days for regular processing. Whereas expedited processing should take no more than five business days. The Arizona Corporation Commission lists the current processing times on their website every week. Just remember, these times do not include the time it takes to notify you or mail your Articles of Organization once they’ve approved or rejected your formation paperwork.

Benefits of Opening a Business Bank Account in Arizona

It’s best to open a business bank account in the state of Arizona for your business. Doing this will help keep business finances separate from personal finances, which is vital for liability protection.

You’ll need to make sure you have several documents to open a business bank account, and we will list these below.

Conclusion

An LLC is a great way to protect your assets and lower your tax liability while avoiding the stifling rules and documentation required of a corporation. Fortunately, Arizona is a great state to form in.

Unlike some states such as California, Arizona does not impose special Franchise taxes for LLCs. So, your taxes can remain low as a pass-through entity the same as a sole proprietorship, assuming you do not elect to be taxed as a corporation.

Register your LLC in Arizona today with ZenBusiness for just $49. Save your valuable time and money!

Arizona does require publication, but this is generally easy to arrange, and by forming your LLC in either Maricopa or Pima County, Arizona, you can skip this step altogether. Altogether filing fees are as low as $50, which is quite affordable compared to most states.

So, if you are considering forming your LLC in Arizona, you have made a good choice. Don’t hesitate to follow these 7 easy steps and start forming your LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs