Vermont LLC (6-Step Guide) – How to Form an LLC in Vermont?

Create a Vermont LLC With Professional Help (from $0+state fees)

Are you looking to start a small business? If so, consider a Vermont LLC. This structure can protect your personal assets such as your home and car while potentially saving you money on your tax return.

Plus, if you are considering what state you would like to form your business in, Vermont might be the right choice. Though Vermont has the smallest state economy in the country, they have proven to be stable and great for small business owners. In fact, 99% of all businesses in the state are small businesses that employ the majority of the state’s workers.

So, if you are considering forming a small business or restructuring an existing one, consider a Vermont LLC. Let’s consider a few more reasons why this structure may be right for you. Then, we will show you how you can form a Vermont LLC in 6 easy steps.

If you want to skip the hassle of starting a Vermont LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

Why Would You Want a Vermont LLC?

You may wonder why a Vermont LLC is a good choice, especially when the state has such a relatively small economy. There are actually several reasons. First off, Vermont is great for growing a small business.

Every year Vermont sees more than 3,000 new LLC formations. This adds to a pool of greater than 11,000 existing LLCs. Plus, with small businesses comprising 99% of Vermont’s businesses and more than 80% making it past their first year, this state is truly great for small businesses.

Finally, the Chamber of Commerce rates this state in the top ten for both entrepreneurial activity and export intensity. This shows Vermont’s popularity among those looking to start their businesses and market their product nationwide.

Quick Vermont LLC’s Pros & Cons

Now that we have looked at why you would want an LLC, why don’t we consider some of the pros and cons? This might help you to decide if a Vermont LLC is right for you.

Pros

There are a number of pros to forming a Vermont LLC. So, let’s take a look at a few of these.

With the ability to establish both voting and no voting member classes, you will be far more capable of receiving investment. This will give you the freedom to build a business of any size and complexity.

By adapting loss and profit distribution beyond matching the capital you and other members invest, it will allow you to better control income and manage assets far more closely.

This is also great for planning for the future because it can allow you to plan for passing down your estate by giving non-voting interests to those who don’t have an interest in running the company.

In spite of the impression this duty of loyalty may have given you, the Vermont LLC Act does give a considerable degree of flexibility even to this section. According to this act, you are free to specify certain actions or categories of activities that will not violate a member’s duty of loyalty as long as they are reasonable. The Act also contains a provision to allow members to potentially perform transactions between this LLC and another business belonging to one or more of the members. To do this, your LLC’s operating agreement can specify a minimum number or percentage of members and uninvolved managers needed to allow the transaction after all facts material to the transaction are provided to everyone involved.

Even if you do not include such a rule in your operating agreement, your business is still protected from losing control. When a member chooses to transfer their membership share, the transferee will not receive full membership. They will only receive the financial distributions to which a member would have been entitled. The only way in which the transferee can become a member would be if all other members unanimously voted to allow it.

Additionally, if a member loses their rights if they make an assignment to creditors, lose their interest in a bankruptcy, or chooses not to contest a petition for appointment of a trustee or other form of control over their property, they will automatically cease to be a member. This can be avoided by providing otherwise in the LLC’s operating agreement or by a unanimous vote of the LLC’s members.

Cons

There are a few different cons to consider, too, before you settle on forming a Vermont LLC. It is important to take a quick look at these before you decide.

This higher cost of living could make it harder for you to find dedicated high-quality workers without offering a higher salary than you would like. After all, you will have to make up for the higher cost of living, including an above-average housing cost in many areas.

However, even considering this, you may find that the benefits of living and working in Vermont make the cost a worthwhile expense.

You may also run into some high administrative costs if your business requires either licenses or permits, which many business owners claim have raised in price lately. If your business requires property, this can also be a problem as local property taxes are often quite high as well.

If you want to know all the expenses that you’ll have incorporating in Vermont — see our Vermont LLC costs guide.

However, despite this, many small business owners do find that the process is very easy and painless. Generally, outside of the above-average cost of taxes, the state makes it very easy to get your business up and running.

Most credit this steady loss to Vermont’s high percentage of the aging population. However, by recruiting outside the state, many employers claim it can be made relatively easy. This way, potential employees can witness the natural beauty and environment of Vermont and experience it first-hand. Oftentimes this may be enough to attract skilled professionals to move in order to live and work in Vermont. Another solution that may be cheaper as well is to partner with freelancers in order to scale your company as needed without permanently employing workers.

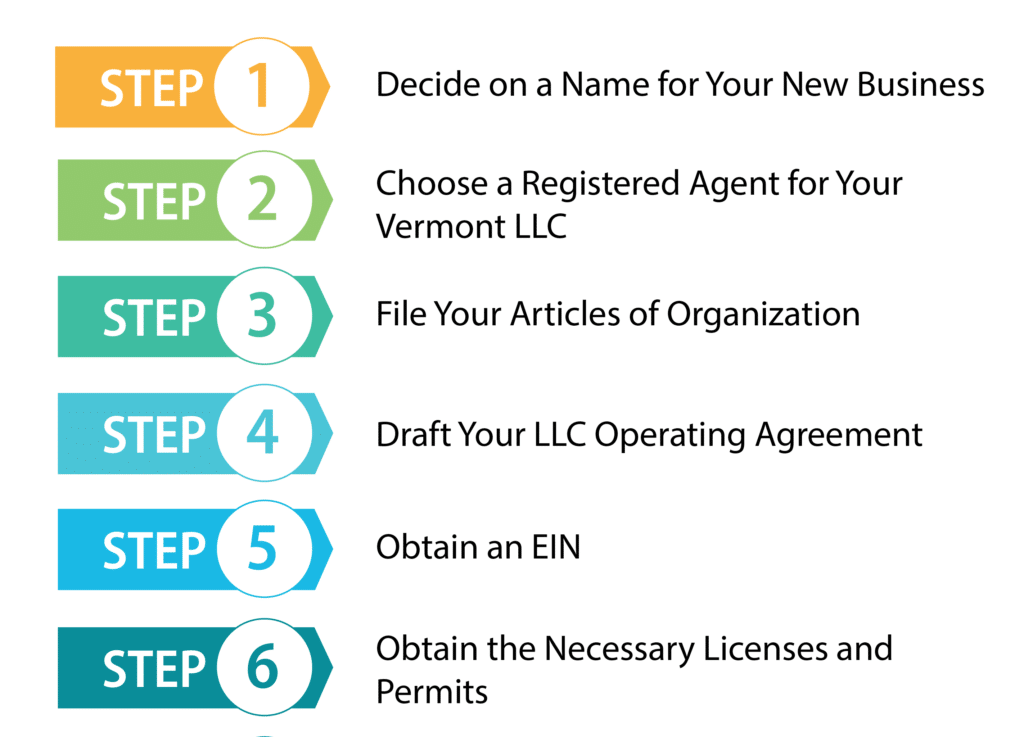

How to Form Your Vermont LLC in Six Easy Steps?

Now that you have seen why you may want to form a Vermont LLC, as well as a quick look at the pros and cons, let’s get down to business. There are only six easy steps standing between you and your new Vermont LLC, so let’s get started!

Step 1: Decide on a Name for Your New Business in Vermont

Your first step to starting your new Vermont LLC is settling on a name for it. This step may be easy if you have already chosen one that happens to meet the rules Vermont applies. Even if you haven’t, that’s okay. Just follow these steps and make sure that whatever name you choose meets Vermont’s rules which we will also take a look at.

Rules for Naming Your Vermont LLC

There are a few rules you need to follow when choosing a name for your new business. First of all, your name needs to include a designator such as a limited liability company, LLC, or L.L.C. You also cannot include certain words that would lead others to confuse your company with another business designation such as Inc., corporation, or others.

Also, in order to include some words such as a bank, lawyer, or university that require certain licenses or registrations to perform, you first have to receive approval. Typically, your LLC will have to possess a member with the correct license, or your business itself will require the appropriate charter in order to qualify.

Finally, your name mustn’t resemble another business entity’s name closely enough to lead to confusion. To do this, you will need to perform some searches to guarantee that your Vermont LLC’s name is unique. Let’s take a look at how to do that.

Choosing a Unique Name

Choosing a unique name can be difficult sometimes when you are in a competitive industry. It can seem like every good name that shows who you are and stands out is taken. But, don’t give up hope; use the Vermont Business Search and just keep trying using different keywords until you find the right one.

After you find a good option that hasn’t been claimed in the state of Vermont, it is a good idea to consider whether a good domain name is available for it. A good domain name is important for ensuring your business can create a website down the line. Even if the same or a similar name is being used, you may be able to simply modify it a little or use a different top-level domain (TLD). These are the .com, .gov, and other identifiers at the end of URLs. Often .com may be taken, but by using other options such as .net or .biz, you may be able to use it.

However, also remember to consider social media. You will almost certainly want to be able to create a social media account for your business on a variety of platforms. So, make sure to search a few platforms such as Facebook, Twitter, and any other platforms you may want to build a presence on and make sure that a good social media handle is open. This will make it a lot easier for customers to look up your business and connect.

Doing Business As (DBA)

It is always good to plan a name that you are pretty sure you can stick with. But, sometimes you may want to change, and though changing the name of a Vermont LLC is certainly possible, it is not easy.

The better option is often to register a DBA. This is essentially an assumed name for your business that will allow you to operate under it without officially changing your registered business name. These can easily be registered on the Vermont Secretary of State website.

Step 2: Choose a Registered Agent for Your Vermont LLC

Every Vermont LLC is required to choose a registered agent in order to do business. This means that you will need to select a person or business that will receive legal correspondence such as tax forms, service of process, or any other official mail on behalf of your business.

This registered agent can even be you or someone you know. You could also choose another member of your LLC or hire a service to act as your registered agent.

However, in order to qualify to act as a registered agent, an individual or legal entity must:

Should You Choose a Registered Agent Service?

Often times when you are considering who you should choose as your registered agent, you may think of nominating yourself. Though this can work, there are a number of reasons to consider hiring a service instead.

First of all, you will be putting your name and address out there for anyone to see on public records. This is a particularly large downside for Vermont LLC owners who can otherwise receive considerable anonymity from forming an LLC. Unfortunately, acting as your own registered agent will often result in a lot of unwanted visitors, junk mail, and salespeople. This can be particularly troublesome if your home and business address are the same.

You also have to consider whether you will be present at the address you provide during all regular business hours. For many business owners, this will not be the case. If you own a bar or restaurant, you may not be present during regular business hours, and for many, you may work away from your business address, making it impossible to be present.

For these reasons and more, it is often a good idea to choose a registered agent service. These organizations keep an office in every state to receive correspondence and forward it to you.

Step 3: File Your Articles of Organization

Once you have chosen a name and registered agent for your business, it’s time to file your Articles of Organization. This is the document that will officially establish your business as a legal entity, and you will need to file this with the Vermont Secretary of State.

The easiest way to file is to create an account and register using the Vermont Secretary of State’s website. First, you will need to provide the name of your LLC, an email address, and the card number you will use to pay the $125 filing fee. After this, you will need to provide some more details about your business to fill out the Articles of Organization, including:

- Your Business Name, Address, and NAICS Code

- Name and Address of Your Registered Agent

- Name and Address of the LLC’s Founders

Alternatively, you could file through mail as well. To start this, you will need to make a request for the form with the Business Services Division of the Vermont Secretary of State. The paper form will arrive with additional instructions to help you fill out the form, but you will use the same information as you would use on the online form. Once submitted, this option can take up to ten business days to be approved.

Step 4: Draft Your Vermont LLC’s Operating Agreement

Vermont does not require an operating agreement, but you’ll definitely want one for your LLC. An operating agreement specifies the structure of your LLC and explains the rights and responsibilities of the members. Making an operating agreement will also allow you and any other members of your LLC to make some decisions concerning your LLC that would otherwise be controlled by state default laws. It will probably lower the likelihood of any serious arguments between your members in the future since the rules governing your LLC should be spelled out in your operating agreement. You’ll be able to put almost anything you want in your operating agreement, but there are some things you’ll want to make sure you include.

Member-managed LLCs work well for members who have the time and desire to handle the day-to-day operations of the business and make all of the decisions. You can split up the responsibilities among the members as desired, but the members will be handling all of the management activities.

A manager-managed LLC tends to work better for larger LLCs or for those LLCs whose members don’t have the time to manage an LLC or prefer to just have the LLC as an investment. Although, this type of management can be difficult for some small LLCs due to a lack of funds for paying a manager. However, this is an option you can consider.

You’ll also want to include which votes require a majority and which require a supermajority. You can even require that some votes, such as those for dissolution, have a unanimous vote.

You should also include the vote that will be required to end your LLC. Being such a serious decision, you might want to require a supermajority to end the LLC or even a unanimous vote. You’ll also want to include how any assets will be divided after your LLC’s debts are paid.

Step 5: Obtain an EIN

An EIN is a nine-digit number that the IRS uses to identify your business for tax purposes. This number is also known as a Federal Tax Identification Number. You will probably need to get an EIN. Not all businesses need this number, but most do. You will be required to have one if your LLC has more than two members or hires any employees. Also, banks often require your business to have an EIN if you want to open a business bank account.

You won’t have any trouble obtaining your EIN as you can get one for free on the IRS website. It’s easy to apply. You can do so online, by mail, by fax, or by phone (if you are an international applicant). However, remember that you will need a Taxpayer Identification Number to apply. A Social Security Number will work.

If you want to get your EIN quickly, applying online is best. It’s the fastest way to obtain your EIN; you’ll receive your EIN as soon as you finish applying. Just remember that you need to finish the application in one session because if you leave the application, it will not be saved. You cannot return and finish it.

You can also apply by mail or fax. To do this, you’ll need to fill out Form SS-4, which you’ll find on the IRS website. Once you fill out the form, you can send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It should take four weeks to process.

Or, if you choose to fax the form, the number is (855) 641-6935. It should take about four business days to receive a fax back.

If you are an international applicant, you have the option of applying by phone. You can call from 6 a.m. to 11 p.m. Eastern Time on weekdays. The person calling needs to have the authority to answer the questions on Form SS-4 as well as receive the EIN.

Step 6: Obtain the Necessary Licenses and Permits in Vermont

Obtain a Vermont State Tax Permit

Your business may not need a Vermont State Tax Permit; not all businesses do. But, if your business engages in certain types of activities, it will. Businesses that lease or sell personal property or offer taxable services will need this permit. You can apply for this permit on the Vermont Department of Taxes website.

Licenses and Permits

Your business will need different licenses and permits depending on the line of business you are in as well as the area your business is located in. You may need to do a bit of research to find what permits and licenses your business needs, but it’s essential to find out which ones your business needs and obtain them in order to keep your business in good standing.

Steps for Growing and Maintaining Your Vermont LLC

Once you’ve formed your LLC, you’re ready for business. But, there are still a few things you can do to help your business grow and thrive. So, we’re going to explain what these things are and how they can help your business.

1. Start a Business Website

You’ll want to start a business website. This will help you to attract more customers to your business and make your business appear more professional. If people see your business or hear about your business, they may want to look it up online to find out more about it, so you want to have a website to tell them about your business. This is true even if your business is a brick-and-mortar business and you don’t conduct any business online. It will still give you a chance to inform people about your business and encourage them to visit your business.

You don’t need to worry that creating a website may be too difficult. You’ll find plenty of tools online that can help you start a website. Also, if you decide to get some help from an LLC formation service in forming your LLC, they may have a business website as one of their features.

2. Get Business Insurance

Having an LLC does protect your personal assets from being taken to satisfy your business’s debts in most situations. This may make it tempting to save some money by skipping business insurance, but this isn’t a good idea. Although your personal assets generally cannot be taken to satisfy business debts, your business assets can be taken to satisfy debts or a court judgment. If you have a lot of money tied up in your business, this could be financially devastating. So, it’s best to purchase business liability insurance to protect your business assets.

You should also consider purchasing liability insurance for the members of your LLC because the business’s limited liability will not protect the members in cases of wrongdoing or negligence. If your LLC provides a professional service, you should purchase professional liability insurance. This insurance will cover your business for claims resulting from errors or malpractice.

Another insurance you may need to obtain for your business is Workers’ Compensation Insurance. You will be required to get this insurance if you hire any employees. It covers employees on the job in cases of injuries, sickness, or death.

3. Start a Business Bank Account

All LLCs should have a business bank account. It is one of the best ways for you to keep your business finances separate from the finances of you and any other members of your LLC. This is something you really need to do. If your LLC should ever be sued and the court finds that your LLC’s finances have been mixed with any of the members of your LLC, the court could decide to remove your business’s limited liability. If this happens, the personal assets belonging to the members of your LLC could be taken to satisfy any court judgment or debts.

Having a business bank account should also make your bookkeeping easier as you won’t need to separate your business transactions from your personal transactions. You’ll also find the account will help people see your business as more professional. Instead of having your customers write out their checks to you or one of the other members, they can write out their checks to your business. Also, when you write out checks, they will be from your business account.

It’s also a good opportunity for you to form a relationship with a bank. If you open a business bank account and keep a good record, it could increase the likelihood of the bank approving a line of credit or loan later. You may also be able to get a credit card from the bank and start building a credit history.

Create a Vermont LLC With Professional Help Today

By forming an LLC in Vermont, you can take advantage of all the great things Vermont has to offer a business while protecting your personal finances from most of the risks associated with forming a business. But, forming an LLC may be complicated and take a lot of time. So, if you want some help, we list two excellent LLC formation services.

#1: Form a Vermont LLC With ZenBusiness

ZenBusiness was formed in 2015, so it hasn’t been around as long as many LLC formation companies. But, it has become one of the top LLC formation companies and gets excellent customer reviews. Their packages are reasonably priced, and you can get 50% off registered agent services with all of their packages. They also provide a free operating agreement which is something every LLC should have.

Check out our full review of Zenbusiness here.

#2: Form a Vermont LLC With IncFile

Incfile is an excellent LLC formation service. Unlike most LLC formation services, Incfile has a free package. All you have to do is pay state filing fees. This is great if you’re on a tight budget. You’ll also get a free year of registered agent service and a one-hour free business tax consultation. Additionally, you get lifetime company alerts. These alerts remind you of any upcoming filing requirements to help ensure you keep in good standing with the state.

Here’s a full review of Incfile.

Final Thoughts

Vermont may not come to mind when you think of the top states to form a business in, but you may be surprised by how much a Vermont LLC has to offer. Small businesses make up 99% of those operating in Vermont, and it is easy to see why.

With a Vermont LLC, you will receive considerable freedom in how you can structure and operate your business while receiving considerable protection for all of your personal possessions. Plus, with the flexibility the state provides in this structure, it is easy to customize the membership to limit liability and control for certain members, making it easy to receive outside investors. If you are ready to get your business started, there is no need to look any further than a Vermont LLC.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs