Wisconsin LLC (Guide) – How to Start an LLC in Wisconsin?

Get Professional Help In Forming a Wisconsin LLC (from $0+state fees)

People who are forming their business for the first time may question what is the best state to form their LLC in. Although the formation process in most states is similar, all have slightly different specifications and requirements. In most cases, the LLC should be formed in the state where your business will be located. For example, if your business will be located in Wisconsin, then you should also form your LLC in Wisconsin.

There are many reasons you might want to consider forming your LLC in the state of Wisconsin. For a start, the state has a steadily growing economy and every year is forming thousands of new LLCs to help the economy grow even further.

If you want to skip the hassle of starting a Wisconsin LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

What is An LLC?

As a new business owner, you may have heard of the term LLC, and for good reason. The term stands for Limited Liability Company and is currently one of the most popular US business structures available to business owners. It comes with a range of benefits such as being relatively easy to set up, offers personal liability protection, and having the benefit of pass-through taxation. Essentially it is all the good bits of other business structures rolled into one.

You can have an LLC that is owned by just one person, or an LLC that is owned by multiple people, which are called ‘members’. These are known as either single-member LLCs or Multi-member LLCs.

For many small business owners, it offers the perfect combination of simplicity and personal asset protection. There are relatively few restrictions on the ownership and management of the LLC.

Wisconsin LLC Pros and Cons

Pros of a Wisconsin LLC

Cons of a Wisconsin LLC

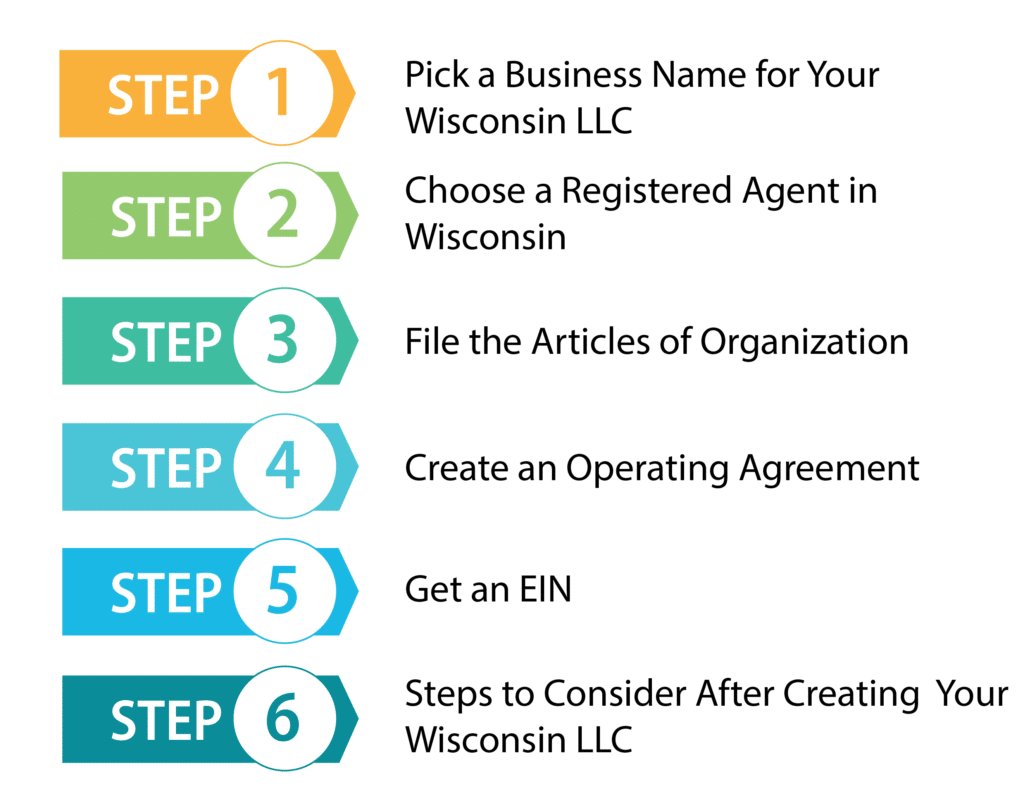

How to Form an LLC in Wisconsin

Forming an LLC in Wisconsin is pretty easy, as you’ll follow general steps that are similar to most other states, with just a few differences. Follow the step-by-step guide below and form a Wisconsin LLC to get your business up and running.

Step 1: Pick a Business Name for Your Wisconsin LLC

Like all states, Wisconsin has some guidelines when it comes to picking a business name, and you can’t just choose anything that takes your fancy. It is a very important step as you have to make sure that it complies with Wisconsin regulations, or it will not be accepted by the state. You should also ensure that it is easily searchable by potential clients, so it is usually a good idea to pick a name that reflects the type of business that you are going to be running.

Naming Guidelines for Wisconsin

The process to find out if your chosen business name is available is very simple and free. You can do a simple name search using the Business Entity Search with the State of Wisconsin. You’ll be able to quickly and easily see if the name has already been taken or not.

See if the domain is still available for your business

At this point, it may be a good idea to also see if the URL for your business name is still available, as this is key for if a potential customer is looking for your business online. Even if you are not planning on making a business website right away, then it is still a good idea to purchase your web domain at this stage if it is available, so that others do not take it before you get the chance to.

Get a DBA name

Not all businesses need a Doing Business As name, but some may benefit from it. It can serve as your company’s brand name, or if you want to branch out part of your company to do something else. This doesn’t have to be done at this stage of the process.

Step 2: Choose a Registered Agent in Wisconsin

All LLCs in the state of Wisconsin are required to have a registered agent. A registered agent is either an individual or a company that is in charge of receiving important legal documents on behalf of your business. Eventually, they are the connection between your business and the state. Who can be a registered agent for your business is pretty flexible. It can be yourself, someone you know such as a friend or someone else in the company, or a registered agent service provider. The registered agent service needs to be authorized to transact business in the state. As long as they are over 18 and be a resident of Wisconsin, chances are they can be your LLCs registered agent.

Some people do decide to be their own registered agent, but this can be quite restrictive and time-consuming, as you always have to be available during business hours.

Step 3: File the Articles of Organization

For many people, this may seem like the most important part of the Wisconsin LLC formation process, as you’ll actually be filing your Articles of Organization to the state. The articles will need to be filed with the Department of Financial Institutions. This can be done either online or by mail. If you are filing by mail, then you should download the form to fill out before posting it.

There are fees involved with filing your Articles, regardless of if you are filing by mail or online. Online costs $130 while mail is slightly more expensive at $170, and these are payable to the Department of Financial Institutions.

Step 4: Create an Operating Agreement for Your Wisconsin LLC

Not all states actually require you to have an operating agreement, and Wisconsin is one of those states, although it is still very much advised. It is good practice to have one, and can come in handy further down the line, especially if your business comes to an end or you need to settle a dispute.

An operating agreement is a legal document, and it outlines all the operating procedures of the LLC, as well as the ownership of the LLC, such as details about the business owners. They can help to ensure that all the owners of the business are on the same page about the business and agree on how it is run. As this is a legal document, it needs to be signed by all the owners, and then if there is a dispute in the future, this can help to settle matters carefully.

As the operating agreement is not required by the state, you don’t actually have to file it. Instead, it is an internal document that you should keep with your other important business documents.

Step 5: Get an EIN

Most businesses (including LLCs in Wisconsin) should have an EIN, which stands for Employer Identification Number. There are several reasons a business would need an EIN, such as if you want to open a business bank account, if you need to hire any employees or file and manage Federal and State Taxes.

The process of getting an EIN is simple and quick. You can get it for free from the IRS, and it can be done either online or by mail. If you apply online, you should very quickly get your 9 digit number. They are used to help identify the business for tax purposes, much like how a social security number works.

Apply online for your EIN here, just follow the simple application steps and you’ll be provided with your number.

Step 6: Steps to Consider After Creating Your Wisconsin LLC

Those are the main stages that are needed when forming an LLC, but the work is not yet done. Once that LLC has been formed, there are still many things you need to do, one of the most important of which is to separate your personal and business assets. You can do this in several ways:

Get Insurance

You will need to get insurance as a business in Wisconsin, as this will help you manage risks. There are a few different types of business insurance, so you’ll have to work out which type is right for your business.

Keep Your Wisconsin Company Compliant

After forming your LLC, you will need to ensure that it stays compliant with the state to avoid any unnecessary fees and fines. There are federal, state and local government regulations to consider, so it is important that you do your research to ensure you don’t miss anything.

The business licenses and permits that are required for your business will depend on where you are doing business and the type of business that you are running. The costs of all of these licenses and permits also vary greatly.

You will also need to look into Wisconsin LLC taxes. Again, these will depend on the nature of your business, with some requiring you to register for more than one form of state tax. These could include sales tax, employer taxes, insurance tax and various others.

Filing Your Annual Report

Every year you will have to file an annual report with the Wisconsin Department of Financial Institutions. You can file this online along with a $25 fee. This is due by the end of the quarter in which the LLC was formed. Make sure you don’t miss your state filings.

Form a Wisconsin LLC With Professional LLC Service Providers

Although Wisconsin is not the most difficult state to form an LLC in, there are still many people who would prefer to get a little outside help with the whole process. To a new business owner, it can be very confusing and time-consuming, and getting help from an LLC formation service company can help to free up that much needed time that can be used for running and growing your business. Although there are many different LLC formation services out there, some are better than others. You should always consider which is right for your business, whether that’s a company that provides great customer service, one that is affordable, one that has lots of good reviews online, or one that also provides many other services. A couple of the best are listed below.

#1 – Form a Wisonsin LLC With Zenbusiness

Zenbusiness is one of the more popular LLC formation service companies, and for good reason. It is one of the most affordable on the market, providing a basic formation package for a starting price of just $39. It has everything you need to successfully form an LLC, and all the hard work will be done for you. Although it is a relatively new service compared to others, it already has thousands of positive reviews online, so you can rest assured that the job will be done right the first time. Plus, they have a helpful customer service team that will help you every step of the way.

#2 – Form a Wisonsin LLC With IncAuthority

IncAuthority is another great option if you are looking for a good formation company to help you form your LLC. The company has been supporting small business owners since 1989, so it has a lot of experience behind it. One of the biggest draws for this company is that they provide LLC formation services for free, so all you have to worry about is the state fees, plus, you’ll get a full year of registered agent services for free as well. It has great customer service and is very simple to use. It does, however, have a few upsells that you could actually get for free. For example, they charge a fee if you want them to get you an EIN, and some of their premium bundles can be a little pricier than what other companies would charge.

FAQs About Wisconsin LLCs

Is it worth using a Registered Agent service?

Yes, it is often worth using a registered agent service. They are usually very affordable, and will free up your time to concentrate on more important things, such as running your business. The advantages that come with using a professional service will likely outweigh the costs involved, and if you do your research, you should be able to find some very affordable options.

How long will it take to set up an LLC in the state of Wisconsin?

The time it takes to form an LLC in Wisconsin varies depending on the number of forms that have been submitted. Filing online is usually immediate, whereas if you file by mail, then this can take up to 5 business days.

How much will it cost to start an LLC in Wisconsin?

The main costs associated with forming an LLC in Wisconsin is the filing of the Articles of Organization. If you file online, the cost is $130, or if you file by mail then this costs $170. This is the minimum amount that it will cost.

Every year you will also have to file an annual report, which will cost $25 every year to the Department of Financial Institutions. If you are using an external company as your registered agent, then you will also have to consider the fees that they charge. The cost of a registered agent varies greatly, and if you use an LLC formation service, many will provide a registered agent as part of the package free of charge for the first year.

There are a few other option fees associated with starting an LLC in the state. If you want to reserve your business name before forming your LLC, then this is an additional $15 filing fee. There is also a $15 fee for filing for a Doing Business As name, which is a business name that can be used in conjunction with your legal business name.

Do I still need to apply for an EIN in Wisconsin if I already have one for my sole proprietorship?

Even if you already have an EIN for your sole proprietorship, you still need to get a new one when converting to an LLC. As the process is simple and free, then this should not be too much of an issue.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs