North Dakota LLC (6-Step Guide) – How to Start an LLC in North Dakota?

Get Professionals to Form an LLC in North Dakota (from $0+state fees)

When forming a new business, a very important decision you will have to make is what type of business entity you are going to use. One of the most common is an LLC, which stands for a limited liability company.

Today we’re going to talk about the state of North Dakota and how to create an LLC there. If you are interested in forming an LLC in North Dakota, then keep reading, as we will take you through the steps you will need to take, as well as lots of other helpful hints and guidance.

If you want to skip the hassle of starting a North Dakota LLC yourself, consider hiring professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Get Professionals to Form an LLC in North Dakota (from $0+state fees)

- Why Should You Form an LLC in North Dakota?

- North Dakota LLC Pros and Cons

- 6 Simple Steps on Forming an LLC in North Dakota

- Steps to Consider After Forming Your ND LLC

- Create a North Dakota LLC With The Help of Professionals Today

- FAQs About North Dakota LLCs

Why Should You Form an LLC in North Dakota?

An LLC is a very popular business entity for many businesses that choose to start a business in the state of North Dakota. There are many reasons for this, one is that it offers personal liability protection to the business owner, so if something were to happen to the business, such as it went into depth or got sued, the owner’s personal assets are protected, which is not the case in several other business structures. As it is a separate legal structure, the owner is not personally liable for lawsuits against the business.

Not only that, but this type of business entity also has the potential to save money on taxes, it is relatively easy to form and manage and has a very flexible management structure.

North Dakota LLC Pros and Cons

Pros

Cons

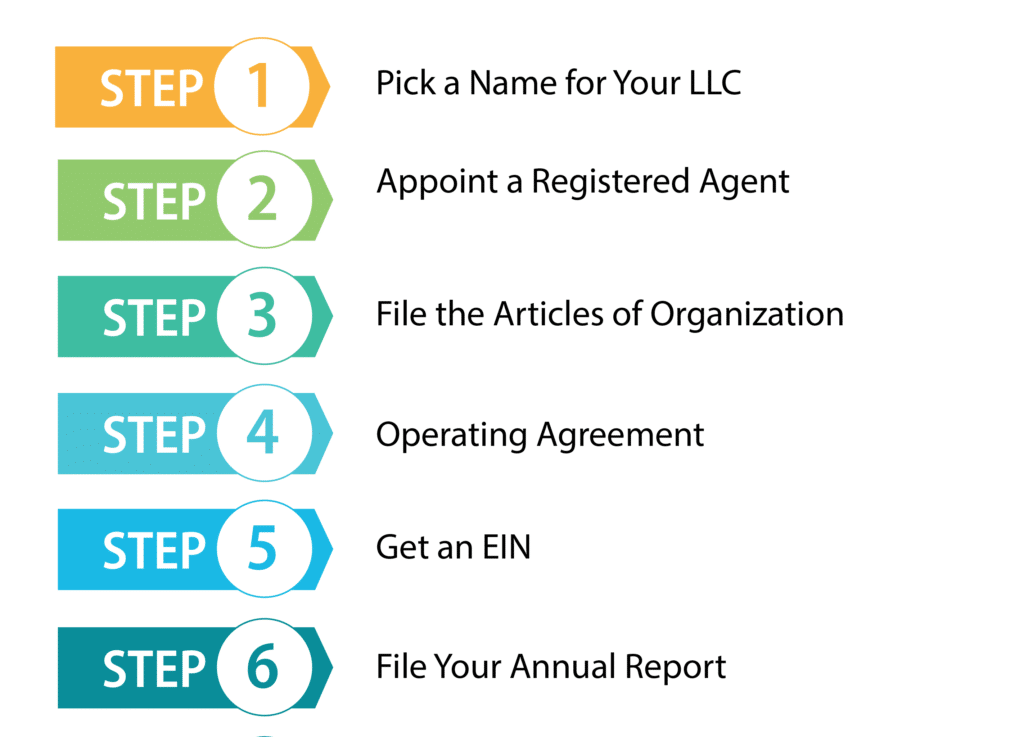

6 Simple Steps on Forming an LLC in North Dakota

Step 1: Pick a Name for Your ND LLC

The very first step of the business formation process is picking a name for your North Dakota LLC. If possible, you should pick a name that is easily searchable by your potential clients, but you also need to ensure that your business name complies with the North Dakota naming guidelines. So there is a lot to think about.

Follow the naming guidelines

The state of North Dakota has a few guidelines that need to be followed when it comes to picking a business name.

It is possible for you to reserve your name for 12 months to make sure that another business does not use the desired name before you get a chance to. This is done by filing a Reserve name Application with the North Dakota Secretary of State. There is a $10 filing fee, and this can be done both online or by mail or fax.

Step 2: Appoint a Registered Agent in North Dakota

Most states need you to have a registered agent before you can apply officially for your LLC. A registered agent is a business or an individual who is in place to accept legal papers on behalf of the state. Essentially they are the business’ contact with the state. For this reason, they must be a resident of North Dakota, or if it is a business you are using, they must be authorized to do business in North Dakota and both should have a street address in North Dakota. Other than that, who can be your registered agent is pretty flexible. In fact, you could even be your own registered agent if you wanted, but most people would not advise this as it can be quite time-consuming and tie you down to usual business hours.

So we highly suggest hiring a professional RA service. For that, you can take a look at our best Registered Agent services to get a good idea of what to choose.

Step 3: File the Articles of Organization for Your North Dakota LLC

Once you have a registered agent in place and you have decided on a name for your business, it is time to file your Articles of Organization (North Dakota Official form), which is how your North Dakota LLC is created. When filling out your Articles of Organization, you need to ensure it contains certain information, these include:

Once the Articles have been filled out sufficiently, you need to file them at the North Dakota Secretary of State, on the FirstStop website, or you can also do this by mail or fax. There is a filing fee of $135.

Step 4: Create Your ND LLC’s Operating Agreement

You don’t have to have an operating agreement to file an LLC in North Dakota, but it is advisable that you have one, as they can be hugely beneficial in the long run. For a start, they can prevent conflict in the future, as it is written down on paper from the outset the operations of the business. It outlines roughly how the business is run, which includes the duties, liabilities, obligations, powers, and rights of the members.

As an operating agreement is not strictly necessary, therefore it does not need to be filed with the Secretary of State. Instead, it should just be filed internally with other important business documents.

Step 5: Get an EIN For Your North Dakota LLC

The next step is to get an EIN. An EIN stands for Employer Identification Number, and if your company has more than one member, you must get one, even if you don’t have any employees. There are several reasons why it is advisable that you get an EIN, for example, it is needed if you are looking to open a business bank account.

If you have a one-member LLC, then you will need to get an EIN if you are looking to get employees or if you elect to have it taxed as a corporation. It is easy and free to get an EIN, just fill out the online EIN application form on the IRS website.

Step 6: File Your Annual Report

One of the requirements of having an LLC is to file an annual report every year. It must be filed with eh North Dakota Secretary of State by the 15th November every year, with a filing fee of $50. The very first annual report you need to file is due the year once you have initially registered with the Secretary of State.

Steps to Consider After Forming Your ND LLC

Although it may seem like your job is done once you have filed your Articles of Organization, there are still a lot of tasks to complete once you have formed your LLC.

Open a Business Bank Account

Opening a business bank account is a vital step for giving yourself personal liability protection, as it automatically separates the funds belonging to the business with the member’s personal funds. Although it is pretty simple in most cases to open a business bank account, there are several documents that you will need, such as:

Apply for Business Permits and Licenses in ND

You will not always need business permits, but depending on what your business does and where you are conducting business, you may need to purchase specific business licenses and permits. Some cities will require you to have a business license before you even start conducting business, so it is always worth checking the requirements of the city you are in. A professional license is needed for certain service-related businesses, such as an electrician, contractors, and many others. You may also need a sale and use tax permit, which is needed if you sell certain products or services. It is always worth checking first before getting started and potentially getting costly fines.

Get Business Insurance For Your North Dakota LLC

Business insurance is very important for all businesses to protect them if anything were to happen that is out of the business’ control. There are lots of different types of business insurance, but some of the most common can be found below.

Create a North Dakota LLC With The Help of Professionals Today

Many people will choose to form an LLC themselves. By following the steps above, it should be possible to form your LLC without any outside help, however, the process can very time-consuming and often confusing, especially for those that have never formed a business before. There is plenty of help out there, with many businesses offering LLC formation services. Some businesses have different strengths than others and come with different price tags, so it is worth conducting some research before you decide on a company to go with. We have outlined two of the best and most popular LLC formation service companies below.

#1: Starting North Dakota LLC With ZenBusiness

Zenbusiness is one of the most popular LLC formation services out there, despite the fact they are relatively new to the industry. They have been used by a huge range of new businesses, and many seem to have liked the service they have received thanks to the huge number of positive reviews that they have got online. The company has one of the lowest prices when it comes to LLC formation, with their most affordable package coming in at just $39, and has everything you need to successfully form a business, including a full year of registered agent service.

#2: Creating North Dakota LLC With Northwest

Northwest Registered Agent is another popular LLC formation service company. It has been around for longer than Zenbusiness and again has thousands of positive reviews online. One of the biggest positives of Northwest is its customer service. They are known for having incredible customer service, with the company representative responding very quickly, and do as much as they can to answer any questions and queries you may have. They are not the cheapest, but in many cases, you get what you pay for. This company also offers a year of registered agent service.

FAQs About North Dakota LLCs

How much does it cost to form an LLC in North Dakota?

The initial fee for filing for an LLC in North Dakota is $135, which means it is not one of the cheapest, nor one of the most expensive states to form an LLC in. Another fee you need to think about is the annual report fee, which is an additional $50 every year.

How long will it take to form an LLC in North Dakota?

It is very difficult to give an exact time frame about how long it will take to form an LLC in North Dakota, as every filing request is different. It will depend on how many other cases are in front of yours waiting to be filed, and how complicated your LLC is. Normally, it will take around 2-3 weeks for the paperwork to be approved.

Should I form an LLC in North Dakota?

If you have been operating as a sole proprietor, or are just starting a business for the first time, then you should definitely consider forming an LLC. There are multiple benefits that come with a business being an LLC, such as limiting the owner’s personal liability and offers plenty of flexibility when it comes to management, ownership, and taxation.

If I have a foreign LLC, can I do business in North Dakota?

If you have an LLC that has been formed outside of the state, then you need to still register with the North Dakota Secretary of State as a foreign LLC before doing business in North Dakota. You must also appoint a registered agent who is physicaly located in the state of North Dakota, so will likely be different from the registered agent that you already have. The filing fee is $135. Once you have finished the application, you must also file a certificate of existence or good standing from the home state of the LLC which is dated no more than 90 days before the date of the application. You also need to check whether your business name is available in North Dakota, as if the name is not available, you must adopt a trade name to use in the state. There is an additional $25 fee when you register your trade name.

Do I have to dissolve my LLC when I am done?

When you have decided it is time to stop doing business, you should make sure that you dissolve your LLC properly. By doing this, you will limit your liability for lawsuits and government fees. You should have written about how you are going to dissolve your LLC in your operating agreement, but you should also learn about the steps you need to take for the state specifically.

When is my annual report due?

You will need to file your annual report by November 15th, and this can be done either online or on the state’s FirstStop homepage. If you have not done so already, you will need to create an account for your business and click on the ‘File Annual Report’ section. If you are filing online, then you can simply pay the fee using a credit card, however, if you are mailing your report, you can print it out. There are also companies that will file your annual report for you, saving you both time and stress.

How will my LLC be taxed?

If you are running a single-member LLC, then you will be treated much like a sole proprietorship by the IRS, so any profits or losses will pass through you, as the owner of the business. Alternatively, LLCs can be elected to be taxed as a corporation or as a corporation.

If your LLC has more than one member, then the IRS will view your LLC as a partnership. Each member will have to file a Return of Partnership Income form, letting the IRS check that each owner is reporting their income properly.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs