How to Start an LLC?

A Comprehensive Guide For New Startups

Start an LLC Quickly With the Help of Professionals

It is significantly easier and inexpensive to form an LLC than you would believe. You don’t have to invest thousands of dollars to start a business these days. You’re not alone if you’re anxious to get your small business off the ground yet fearful of the initial setbacks.

Every successful entrepreneur has experienced something similar to what you’re going through right now. To assist you, we will teach you the most important aspects of incorporating an LLC without the “fancy” jargon.

You will essentially have 2 choices:

Go through all the documents, templates, file with the State and try incorporating an LLC yourself OR

Hire a professional service like:

- Zenbusiness ($0+state fees) or

- Northwest Registered Agent ($39+ state fees) to form an LLC for you

An LLC is one of the best business structure options available for a small business.

Here are a few of the ways starting an LLC can help you:

- In an LLC, members are not liable for the business’s debts. Not only this, but they can choose the management structure they want.

- Unlike a C corporation, the profits of an LLC are only taxed once.

- It’s as easy as eight steps to form an LLC.

You will know the following by the conclusion of this article:

- How to Form a Limited Liability Corporation (LLC)?

- What are the most crucial actions you’ll need to complete after forming an LLC?

- At every step of the journey, how will you save time and money?

So, how can you get started forming an LLC for your business? Let us help you get started today.

- Start an LLC Quickly With the Help of Professionals

- What is an LLC?

- The Main Advantages of Forming an LLC

- The Eight Steps on How to Form an LLC in Any State

- Step 1: Pick Your State

- Step 2: Choose Your LLC Name

- Step 3: Choose Your Registered Agent

- Step 4: File Your Incorporation Documents (Articles of Organization)

- Step 5: Decide on Your LLC’s Management Structure

- Step 6: Draw Up an Operating Agreement

- Step 7: Obtain Your LLC’s EIN (Employer Indentification Number)

- Step 8: File to do Business In Other States

- Get Professional Help in Starting an LLC (Quick & Hassle-free)

- Conclusion

What is an LLC?

In the United States, an LLC; which stands for Limited Liability Company; is a corporate structure that shields its owners from personal liability for the company’s debts or liabilities. This structure combines the attributes of a sole proprietorship and a partnership. An LLC can have one owner or several owners.

An LLC helps protect your assets should your business be sued or go bankrupt. You may lose your business, but your personal assets would be safe from creditors.

For an individual that owns an LLC, the income from the business will pass through the business and be taxed as personal income. If an LLC has more than one member, it is taxed as a partnership.

The profit passes through the business, and each person’s share is taxed as personal income. In both of these cases, the advantage is not having to pay both personal and corporate income taxes. Although, you also have the option of being taxed as an S-Corporation or a C-Corporation.

LLCs are hybrid companies that combine the advantages of a corporation with a partnership or sole proprietorship. While the limited liability aspect of an LLC is comparable to that of a corporation, flow-through taxes for LLC members is a feature of a partnership rather than an LLC.

- An LLC is a form of corporate structure that shields its owners from personal accountability for the firm’s debts and obligations.

- The laws governing LLCs differ from state to state.

- With the noteworthy exception of banks and insurance firms, any company or individual can be a member of an LLC.

- Profits earned by LLCs are not taxed directly. Members share in their earnings and losses, which they record on their individual tax returns.

The Main Advantages of Forming an LLC

The fundamental reason why business owners want to form LLCs is to restrict their personal responsibility as well as that of their partners or investors. Many people think of an LLC as a cross between a partnership, which is a simple business arrangement between two or more owners, and a corporation, which provides liability protection.

Although LLCs have certain appealing characteristics, they also have a number of drawbacks. An LLC may be required to be dissolved if a member dies or files for bankruptcy, depending on state legislation. A company can continue to exist indefinitely.

If the founder’s ultimate goal is to start a publicly traded firm, an LLC may not be the best choice.

There are several advantages to forming an LLC beyond the limited liability.

Some of these advantages are listed below.

The Eight Steps on How to Form an LLC in Any State

Once you’ve decided to proceed with forming your business as an LLC, there are a few steps you have to take to get you to your goal.

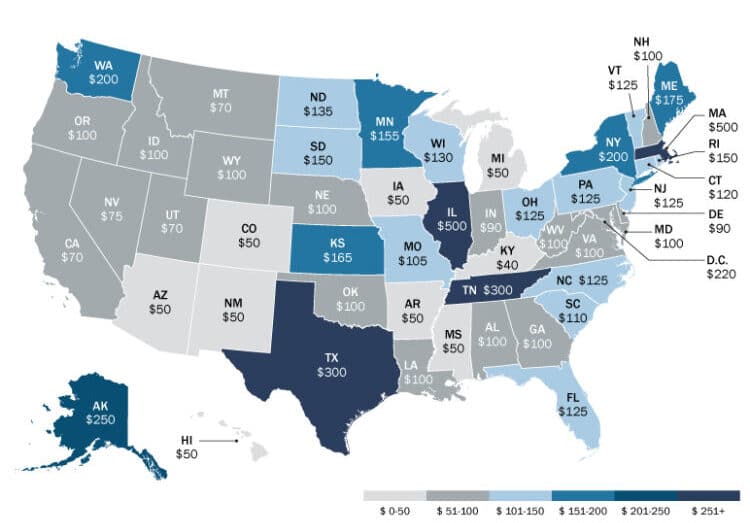

Step 1: Pick Your State

The first step in forming an LLC is choosing the state of formation, which is where your LLC will operate. For most small business owners, this will be where you live. If your LLC has physical operations in more states than the one, you will need to register a foreign LLC in all other states you do business in.

There are some benefits to forming LLCs in states other than the one you live in, though. Some states, such as Delaware, have particularly friendly laws to attract business formation. However, every time you register an LLC, this means more paperwork and fees, so consider the costs and benefits of registering in every state you choose.

You must submit articles of formation with your state’s corporate filing office, which is usually the Secretary of State, in order to create your LLC. Instead of “certificate of formation,” certain states (including Delaware, Mississippi, New Hampshire, New Jersey, and Washington) use the phrase “certificate of formation.” The document is also known as a “certificate of incorporation” in two additional states (Massachusetts and Pennsylvania). To discover more about the unique criteria for creating an LLC in your state, select your state from the list below:

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

The articles of organization are normally completed online or utilizing a form accessible on your Secretary of State’s website. You’ll need the name of your LLC, its registered agent’s name and address, and other basic information including how it will be handled and the identities of the LLC owners. When you submit the articles, you’ll have to pay a filing fee. The costs in most states are low, usually under $100.

We highly suggest you create your LLC in your home state.

There are three major reasons to avoid incorporating your new LLC in a state other than your own: In the end, you’ll have to pay your home state taxes.

- You’ll very certainly have to pay twice for registered agents, annual filings, franchise fees, and other expenses.

- It’s inconvenient, to say the least.

- Keep in mind the following rule: Taxes are paid where money is earned.

It makes no difference where you founded the LLC in your home state. They are concerned about the location of the company’s operations.

You’ll have to pay taxes in the state where your LLC is “doing business.”

What does it mean to “conduct business”? Of obviously, states cannot agree. Texas advises you to solve the problem on your own. However, if you’re incorrect, you’re responsible. On the other side, California prefers to keep things simple. Your business is regarded to do business there if you live there. If you have an out-of-state LLC and your home state believes it is doing business in their state, they will force you to register it as a Foreign LLC. You will essentially own two limited liability companies (LLCs). You’ll have to pay the taxes you were trying to avoid in the first place, as well as double the fees for formation, registered agent, and yearly report filing.

____________________________________________________________

Case: You live in California and have been operating an e-commerce shop for three months. You feel it’s time to get serious about the store now that it’s started to make money. You incorporate an LLC in Nevada and opt for S Corporation taxation in the hopes of avoiding California’s state corporate income tax.

Outcome: Although you formed your LLC in Nevada, California considers your LLC to be doing business in California. That’s because your principal place of business in California is your home address (where you are operating your online store from).

____________________________________________________________

You now have two LLCs. You’ll have to pay the taxes you intended to dodge, as well as yearly filing and registered agent costs twice.

For most of us, forming a domestic LLC in our home state is less expensive, quicker, and easier.

Step 2: Choose Your LLC Name

Now it’s time to choose a name, and you quite possibly already have one in mind. But first, you need to make sure that the name you choose isn’t already taken and meets the guidelines your state of the formation allows. There are several websites that offer business name searches to check if the name is already taken, and here are some common state naming rules for LLCs.

- The name of the company must include the words limited liability company or any of its abbreviations such as LLC.

- The name must not include words that might lead one to confuse it with a government agency.

Some words are often restricted, such as bank or university, and may require additional filing or an individual who is licensed to perform the function such as a doctor to be a member of the LLC. At this point, many people become trapped. They seek the ideal name for their tiny firm. Our recommendation is to not overthink things. Move on when you’ve decided on a name that makes sense for your company.

This is why:

You are not obligated to use the name you choose for your LLC. The majority of your LLC’s name will appear on legal papers. If you don’t want your consumers to see your LLC’s name, they won’t. A DBA, commonly known as a Fictitious Business Name, can be filed at any time (FBA). DBAs provide you with the freedom to choose your own trade name. Your LLC name stays the same with a DBA, but your brand name might be changed.

____________________________________________________________

Case: Lawn Patrol LLC is the name you choose for your lawn care company. Customers tend to give you additional landscaping work as your firm grows. You expand by hiring more people. You start offering the following services in addition to grass care:

Hedge and tree trimming and pruning

Planting and caring for flowers and plants

Watering system installation and maintenance

Now that you’re doing more landscaping, you realize that Lawn Patrol LLC is too specific and may cause confusion among potential clients.

____________________________________________________________

The answer is to seek the trade name Landscape Patrol through a DBA request. The rights to utilize the fake company name Landscape Patrol will be owned by your LLC, Lawn Patrol LLC. It’s worth noting that a DBA does not require the addition of an LLC. It may be whatever you choose as long as it complies with your state’s name regulations. Now you may use your new trade name, Landscape Patrol, to generate new flyers, mailers, a website, and contracts.

Requirements for Naming Your LLC

Although state regulations differ significantly, the following requirements are universal:

It has to be a one-of-a-kind name.

“Limited Liability Company,” “LLC,” or “Ltd.” must be included.

It must not contain terms or phrases that may be mistaken with government agencies, such as “IRS,” “Department of State,” “Police Department,” and so on.

Protected terms such as “College,” “Hospital,” and “Bank” cannot be used unless there is a compelling cause to do so.

Obtain a Domain Name

We recommend getting a matching.com domain as soon as you’ve decided on a name. The cost of a domain is around $10 per year. The name of an LLC is made public after it is formed. Squatters scan public databases for matching.com domains for new LLCs and register them automatically. If you try to register your domain months after forming your LLC, you may discover that it has already been purchased and is now for sale at ten times its initial price! Many.com domains in English are now controlled by squatters who have no intention of ever constructing a website. It’s possible that yours is already taken. It’s worthwhile to double-check.

You may also establish a branded email account using GoDaddy once you have your domain name.

If you follow all of our suggestions, you should end up with something similar to this:

Lawn Patrol – LLC Name

Landscaping Patrol – Company’s DBA

www.landscapingpatrol.com – Website Address

[email protected] – Corporate Email Address

That appears to be a professional job!

Step 3: Choose Your Registered Agent

The registered agent for your LLC is the one that will receive legal papers such as a suit on behalf of your company. This can be an individual or a business hired to serve the function.

Most states require every LLC to have a registered agent nominated during formation. This can be a member of your LLC, but the registered agent must have a physical address in the state of formation and be available at all times during normal business hours.

Knowing first what a registered agent is, a registered agent is a person or company designated by an LLC or Corporation to accept service of process, government communications, and compliance paperwork on behalf of the company.

When incorporating an LLC, partnership, or corporation, most states require you to appoint a registered agent. When you submit your Articles of Organization with the Secretary of State or another official government body after deciding on your business structure, you will be required to include a registered agent office.

Definition of Process Service – The act of telling an individual or entity that a lawsuit is underway against them, or in this example, against their corporation, is known as service of process. Service of process is accepted by registered agents.

Here’s why having a Registered Agent is crucial.

A registered agent’s principal objective is to help your firm maintain efficient corporate compliance by alerting you of legal notices or sending annual report filing reminders, in addition to receiving official mail on your behalf. A registered agent is essentially a gatekeeper for company companies, allowing you to take proper action and handle possible difficulties quickly.

Whether you manage a small business or a huge organization, you can anticipate your LLC’s appointed registered agent to receive the following documents when the company is formed:

- Forms of taxation

- Documents of legal significance

- Official letter from the government (ie. annual report)

- Summons (also known as a service of process) – is a legal document that serves as notice of a lawsuit.

Is it possible for me to act as my own Registered Agent?

Yes, you can be your own business’s registered agent (e.g., Single-Member LLC). You can also select an officer or member of your company, or even a trusted acquaintance, as your registered agent, as long as they satisfy the following requirements:

is at least 18 years old

has a physical address in the state in which it was founded

is available during regular business hours (in person)

Hiring a professional registered agent service is another alternative.

Is it necessary for me to employ a Registered Agent Service?

It offers advantages to choose someone else as your LLC or corporation’s registered agent. We’ll go through the primary benefits of employing a low-cost, nationwide third-party registered agent service officer like ZenBusiness or NorthWest in this section, including:

- Conformity to the Law

- Mindfulness

- Flexibility

- Privacy

Conformity to the Law

Registered agents assist firms in staying current with state regulations by sending periodic reminders and, on occasion, making yearly report filings and other formal government notifications.

Copies of your corporation papers will be kept by registered agent services. You’ll have a backup of all your crucial business and legal papers in case of theft, natural catastrophe, or other unforeseen losses.

Mindfulness

Registered agents provide you with peace of mind, allowing you to devote your time, energy, and attention to running your small business. Here are some of the things a professional, third-party registered agent service may perform to help you relax:

Make expanding your company your first focus. Important tax and legal documentation for your LLC will be sent to you automatically and securely kept.

Assist you in maintaining a healthy work-life balance. Business and personal correspondence are kept separate to avoid work from taking over your personal life.

Personalize your advice. If your company has an issue or has any inquiries, you have further help.

Flexibility

If you want to be your own registered agent, you must be accessible to receive official government letters and service of process notifications at the physical location you indicate during regular business hours.

Instead of keeping track of deadlines and being available during business hours, designated registered agents to allow you to focus on your business.

You can use a registered agent service to:

Maintain a flexible work schedule. Every weekday from 8 a.m. to 5 p.m., a registered agent must be accessible. You can set your own working hours by appointing a

third-party registered agent service.

Create an LLC in a different state. Registered agents must be legal residents of the state in which the company is established. You may incorporate an LLC in any of the

50 states by using a nationwide registered agent service.

Create an LLC in numerous states. If you want your company to have a physical presence in numerous states, you’ll need to designate a registered agent in each of them.

Privacy

We all appreciate our own space. The actual address of your registered agent service will be displayed on the public record, not your personal or business address. If you run a business out of your house, this is very crucial to consider.

A registered agent service for an LLC will protect your privacy by:

Keeping you from being personally served with a lawsuit. You don’t want to get a summons in front of your family, coworkers, or, even worse, customers.

Making their physical address, rather than yours, public. As a consequence, you’ll be less likely to get spam messages.

Thus, be critical in selecting the most suitable registered agent for your LLC!

Step 4: File Your Incorporation Documents (Articles of Organization)

Now it’s time to start filing! You will need to fill out formation documents, often known as a business’s “articles of organization”, however, the name can be slightly different depending on the state. It could also be called “certificate of formation” or other similar names. So, you will need to fill these documents out and send them along with the filing fee and a few other details. Including:

- The name of the business

- The name as well as contact information for all members of the LLC

- The LLC’s address (However, if the LLC has multiple addresses, you will need to decide on a primary address that will serve for tax purposes as well as other official mail.)

- If you want your LLC to cease at a specific date, choose the duration.

- The registered agent’s information (address, name, etc.)

- Other information about the LLC (This includes an explanation of the LLC’s purpose as well as its mission statement).

This is when things start to get interesting!

Your limited liability corporation is formally formed when you file your articles of formation with the Secretary of State.

The articles of incorporation can be filed online or by mail. The amount of the filing fee varies by state. When filing this paperwork, it’s critical to supply accurate information. As part of their formation packages, formation providers frequently file them for free. That is the route we advocate. From start to end, formation services manage the whole LLC creation or incorporation procedure online. They are the quickest and simplest way to form an LLC. They are less expensive than typical choices such as employing a lawyer or CPA since they file everything online. In the table below, we’ve evaluated and collated price information for the most common formation services. You may read in-depth evaluations by following the links.

Official package pricing stated by the different formation businesses is not included in the prices listed in the table below. Our pricing is standardized to make it easier to compare them to those of our rivals. We used the one-time payment rates of various commercial services for this.

| Service | Basic Formation | Full Formation | Full Formation + Website |

| ZenBusiness | $0 | $39 | $249 |

| Northwest Registered Agent | $39 | $39 | – |

| LegalZoom | $178 | $477 | – |

| Incfile | $0 | $149 | – |

| Rocket Lawyer | $140 | $290 | – |

Basic Formation: This section covers the fundamentals of forming a company entity. At the very least, submitting Articles of Organization and creating an Operating Agreement for an LLC or corporate bylaws for a corporation are required.

Full Formation: Includes, at the very least, a registered agent service, which most business owners will find indispensable.

Full Formation + Website: This package includes a website, domain, security certificate, and other services to secure your company’s online presence in addition to full formation services.

Step 5: Decide on Your LLC’s Management Structure

Due to choosing to file as an LLC, you have the benefit of choosing your management structure. There are two primary options to choose from member-managed or manager-managed.

A member-managed LLC means that all LLC members are involved in running and making decisions for the LLC. A manager-managed LLC places management responsibility in the hands of a manager or managers who do not need to be members of the LLC.

You have the option of picking your management structure if you file as an LLC. Member-managed or manager-managed are the two main choices available.

Let’s discuss what make each Management Structure different from another!

Management By Members

When Should an LLC Have a Member-Managed Structure?

The number of members of a limited liability company (LLC) is quite low.

The members are capable — and willing — to participate in the business’s day-to-day operations.

What Does a Structure Managed by Members Look Like?

Members of a member-managed LLC are actively involved in the company’s activities. Every member has a say in both day-to-day operations and big-picture matters, and all key business decisions require a vote. Because the administrative power is distributed among the members rather than centralized in the hands of one or more managers, this LLC form is also referred to as “decentralized management.”

____________________________________________________________

Case: Michael and Melissa Thompson, a married couple, decide to open a bed-and-breakfast together. They want to form a limited liability company (LLC) and share equal ownership of the company. Michael and Melissa wish to be the sole members rather than hiring outside management, so they choose a member-managed LLC structure.

____________________________________________________________

Management By Managers

When Should an LLC Have a Manager-Managed Structure?

The number of members of a limited liability company (LLC) is rather big. The members do not want to be involved in the business’s day-to-day operations.

What Does a Structure Managed by Managers Look Like?

Members of a manager-managed LLC acknowledge that delegating administrative authority to one or more designated managers is a more efficient approach to run their company’s day-to-day operations. Manager-managed LLCs don’t need members to vote on every business decision; instead, they give the manager(s) complete control.

Because it concentrates administrative control in the hands of one or more managers, this LLC form is also referred to as “centralized management.”

____________________________________________________________

Case: Forty members of a religious community decide to create a neighborhood shop selling religious literature, clothes, movies, and other items. The majority of the members work full-time and have no prior business experience. They prefer to designate another member of the congregation to operate the company in exchange for annual pay for these reasons. A manager-managed LLC form is the best solution in this circumstance.

____________________________________________________________

Choosing a management structure for your LLC is a crucial decision, so take your time and think about your alternatives thoroughly.

Step 6: Draw Up an Operating Agreement

The operating agreement of an LLC outlines its structure, such as management structure, member roles, and its ownership. This legal document is typically not required, but it is typically a good idea anyway. Here are some sections that you should include when making an operating agreement.

- Organization: This describes where and when the company was created as well as its members and ownership structure.

- Dissolution: This describes how the LLC can be dissolved.

- Contribution of Capital: This describes which members will contribute to the LLC and how funds will be raised in the future.

- Distribution of Profits: This describes how profit and loss will be allocated.

- Changes of Membership: This describes how members can be added or removed.

The operating agreement is the most important document for your LLC. It provides the guidelines for how your organization works internally and with the public. It’s so vital to make sure your business structure works for you.

Although operating agreements are not required in most jurisdictions, having one is a good way to get your business off to a good start and offer it the best chance of success. The goal of a limited liability corporation is to protect your personal assets. If your firm is sued or goes bankrupt, your personal assets, such as residences, automobiles, and money, are not a danger. And without personal liability protection, your business organization is more like a sole proprietorship, meaning creditors can go for your personal assets.

The consequence can be a disaster for your business and your life.

The LLC operating agreement specifically spells down the relationship between you, other LLC members, and the company. It guarantees that you and other members have the full protection of the LLC company structure and that the firm functions smoothly.

Operating agreements guarantee these safeguards in many different ways:

- They determine the rights and obligations of LLC members. The LLC operating agreement should specify if one LLC member is in charge of running the business or keeping the books.

- They define what a non-member manager is allowed to do. Managers have additional responsibilities to the firm and its members. These should be stated in the operating agreement.

- They spell out what the LLC is allowed to do legally. The operating agreement should also spell forth how the company is authorized to conduct its operations from day today.

- They describe how new members can join the firm. They also provide guidelines for how an LLC member who wishes to depart might do so.

- They set forth how and when profits are paid to members. They can also design several sorts of membership and payment structures.

- They say whether members or management are in charge. They also outline how to hire and terminate managers.

- They say how and under what conditions the LLC should cease. You may not wish to close your company right now, but you may in the future. It’s best to consider and plan ahead of time before it becomes a problem.

- They tell how to amend the rules. Your LLC operating agreement may need to be amended in the future. The guidelines for making adjustments should be spelled forth in the operating agreement.

If you check most states’ legislation, you’ll discover that they typically have their own “default” standards for how these things work under an LLC. In most circumstances, operating agreements enable you to adjust the regulations to meet your specific scenario.

If you don’t have an LLC operating agreement in place and something unexpected happens, your LLC’s destiny may be determined by state law at the moment. You gain control over your firm and its destiny once you have a contract in place.

Putting together an operating agreement may sound scary. The easiest method to accomplish it is to seek advice from a lawyer or a business formation provider on what your company requires.

Step 7: Obtain Your LLC’s EIN (Employer Indentification Number)

Next, you will need to acquire an EIN, which stands for an employer identification number. This is kind of like a Social Security number for your website. This will be necessary for hiring employees or opening bank accounts for your business. You can quickly and easily apply for an EIN number online on the IRS website.

Your LLC’s nine-digit tax identification number is called an Employer Identification Number (abbreviated: EIN) or, mistakenly, EIN Number. Consider it the social security number for your LLC. These numbers are used by the IRS to maintain track of businesses for tax purposes.

All LLCs that earn money or intend to hire staff must get an EIN from the government. To create a business bank account, most institutions also demand an EIN.

You must apply for an EIN through the IRS. You can submit your application online or by mail using form SS-4. After completing the online form, you will obtain your EIN instantly.

Single-member LLCs are not required to apply for an EIN. You can use your social security number instead. However, we highly recommend acquiring an EIN to avoid identity theft and separate personal resources from business finances.

Step 8: File to do Business In Other States

This may not apply to everyone, but for most LLCs, it is likely business will be conducted across state lines. Once you have registered in your home state, you will need to qualify in states where you will be performing significant business. However, the standard of significant business is different depending on the state.

Often this will include having a physical presence in the state such as a storefront; additionally, sales greater than $500 often require registering. At this point, you will need to file for a foreign qualification in the state. However, before performing any business, make sure you check the rules concerning foreign qualifications in the state.

When an LLC develops across state boundaries, it is deemed “foreign” by all states save the one it was created in. It is vital to register as a “foreign LLC” in any new states you conduct business in. Failure to do so might lead to penetrating your corporate veil, incurring financial penalties, and voiding of crucial legal contracts.

What constitutes as “conducting business” might differ between states. In most states, an LLC is deemed to be in operation if it has any of the following:

- A bank account for a business

- A business location might be an office, a store, a warehouse, or something else entirely.

- Property ownership

- A distributor or a representative of a manufacturer

- Meetings or commercial transactions

- Employees

For special conditions or state requirements for registering your overseas Limited Liability Company, we recommend consulting a lawyer.

Foreign LLCs vs. Domestic LLCs

Any LLC that operates inside the state in which it was formed is referred to as a domestic LLC. Foreign limited liability companies are normally subject to the same fees and taxes as domestic limited liability companies. As a result, we advise against registering your company in more states than necessary. While there is a lot of buzz about forming a company in places like Delaware or Wyoming, this will just result in you paying an additional set of maintenance costs.

Get Professional Help in Starting an LLC (Quick & Hassle-free)

These are TOP-3 LLC Formation Services That Will Form an LLC For You

Sometimes you aren’t looking to research all the laws and do the work of forming an LLC yourself. If this describes you, then don’t worry. There are many LLC formation companies that are happy to do the job for you.

Here are three of the best LLC formation services out there that will make the filing process super-easy:

Service #1: ZenBusiness

Pros:

ZenBusiness (full review here) is a very popular LLC formation service with many positive online reviews for its good customer service. They have many other positive features which we will list as well. They also have a couple of aspects which could be better, and we will mention these too.

Cons:

Service #2: IncFile

IncFile is one of the top LLC formation companies in the business. It has a lot of advantages that we will list below along with a few disadvantages.

If you want to know more, check out our full IncFile review here.

Pros:

Cons:

Service #3: Northwest Registered Agent

Northwest Registered Agent is a well-respected company with several advantages, but they do have a couple of disadvantages to consider as well. Overall their support is pretty much unrivaled. Here’s a full review of Northwest.

Pros:

Cons:

Conclusion

Forming an LLC isn’t too difficult, and using one of these three LLC formation services can make it a breeze. If you want to save a little bit of money — feel free to form it yourself, I bet it will be a worthwhile experience.

Don’t let the ease of forming an LLC yourself fool you. The benefits of using a formation service are many and can include cost/time savings and protecting yourself from making any novice and unnecessary mistakes.

LLCs provide an excellent balance of freedom and security. They protect members from personal accountability while also providing a variety of tax benefits. Of course, an LLC may not be the best option for your company.

It’s critical to comprehend some of the complexities of incorporating an LLC.

It’s good to remember that following the regulations, holding yearly meetings, and keeping your documentation up to date might assist if you are sued or if you are audited by the IRS, for example.

Just incorporating the LLC won’t bring any advantage until you put in place an operating agreement, have yearly meetings, and pay attention to the finer points. One thing to think about is whether you’d have to pay yourself unemployment benefits, which isn’t essential if you’re a single owner.

Keep in mind that some banks may charge LLCs more costs than sole proprietorships. To remain on top of LLC documentation and quickly manage the process of setting up an LLC, consider turning to a competent tax attorney or CPA or use our recommended LLC formation services mentioned above.

And if you have any suggestions or thoughts on how we can improve this guide — don’t hesitate to contact us!

Get Some More Knowledge About Business & LLCs