Indiana LLC (6-Step Guide) – How to Form an LLC in Indiana

Create Your IN LLC Quick With Professional Help (jump down to offer)

An Indiana LLC may be a perfect choice for your business. This structure offers you protection for all of your personal belongings, including your home and vehicle. Plus, Indiana is almost always rated as one of the best states for small businesses.

This state offers a low-cost option with a lot of potential for entrepreneurs. Plus, with an LLC, you may be able to lower your tax burden, saving you a lot of money while protecting the things you hold dear. So, let’s take a closer look at why you may want to form an Indiana LLC and how you can do it in only six easy steps.

If you want to skip the hassle of starting an Indiana LLC yourself, consider using professional help:

Why Would You Want an Indiana LLC?

There are many reasons why you would want an Indiana LLC, from protecting your personal assets to potentially lowering your tax burden. In more detail, these benefits include:

If you’re thinking about costs to form an Indiana LLC – here’s our full Indiana LLC fees guide.

Quick Indiana LLC’s Pros & Cons

Now that you know why you may want an Indiana LLC, let’s take a look at the pros and cons of this state and business structure. That way, you can make an informed decision on whether this structure is right for your business.

Pros

There are a number of advantages to forming an Indiana LLC, from their low costs of maintenance to their flexibility and the ease they provide when dealing with other members. Let’s take a closer look at all of the benefits an Indiana LLC can provide.

Plus, the definition of person for filing your LLC’s Articles of Organization can include any individual or legal entity in Indiana. This does not even have to be one of the LLC’s members, which means that you can have any other individual or business entity file for your LLC on your behalf.

Plus, the Indiana LLC Act allows you to choose how you want to structure membership in your LLC by giving you the ability to form different classes of membership with different duties, powers, and even rights as members. This means you could give membership in the LLC without giving the right to vote or any responsibilities. This can be great for planning estates or attracting investment because it means that you can give membership interest away without any corresponding responsibility or power. Correspondingly this means you can distribute your membership amongst heirs and give financial rights alone to those who do not wish to participate in running the business and full membership to those who do.

The operating agreement can go even further by directly limiting any liabilities that a member or manager may otherwise owe for a breach of their duty. This can give an extremely considerable degree of freedom in establishing what duties any given member or manager may owe to other parties in the agreement.

The Indiana LLC Act even allows members and managers to transact business with the LLC itself unless the operating agreement forbids it. This is an incredibly useful arrangement that otherwise is often seen as a conflict of interest. However, it means that members or managers of your LLC may be able to take advantage of mutually beneficial arrangements that otherwise might have been off the table.

Cons

There are actually very few cons to forming an LLC in Indiana. This state offers a good state for formation in nearly every way, and an LLC business structure has few disadvantages. However, here are some cons to consider before you settle on forming an LLC in Indiana.

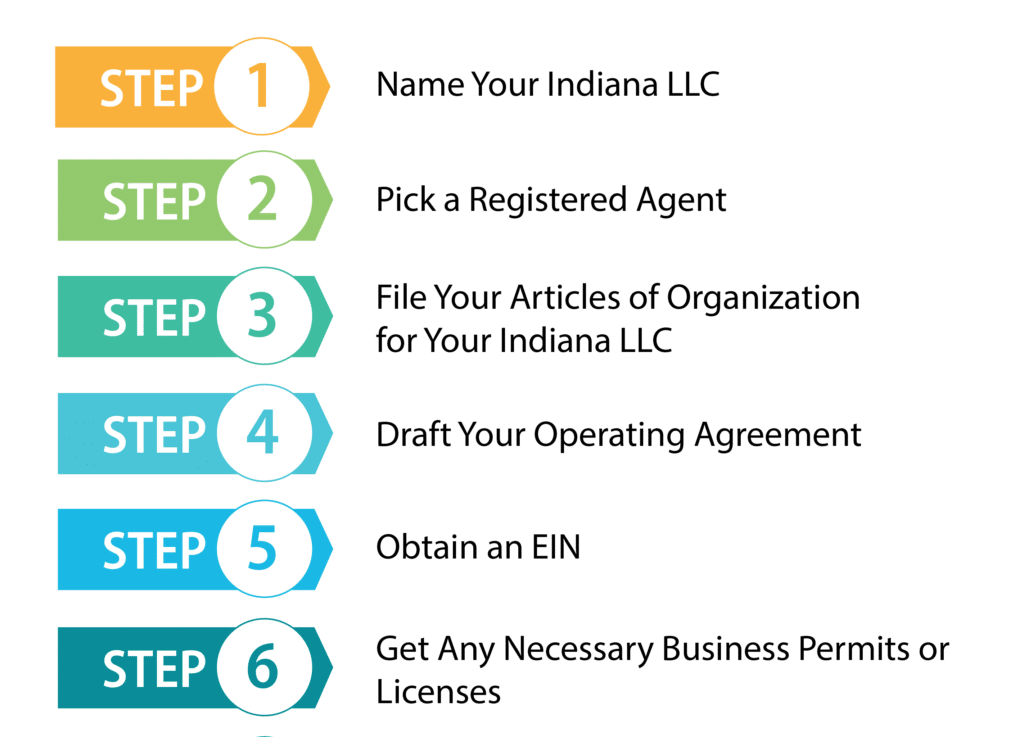

How to Form Your Indiana LLC in Six Easy Steps

Forming your Indiana LLC is quick and easy. Most of these steps can be completed in well less than a day. So, without further ado, let’s look at the six steps you need to do in order to form your Indiana LLC.

Step 1: Name Your Indiana LLC

The first thing you’ll need to do when forming your LLC is to pick a name for your business. When you’re forming an LLC in Indiana, you are required to choose a unique name. However, in addition to choosing a name that is unique, you’ll want to take the time to ensure your business’s name will be easy for your customers to remember and give a good impression of your business.

The State of Indiana has some rules you’ll have to follow when naming your LLC, such as:

- The name you use for your LLC must include the words “limited liability company” or an abbreviation of these terms, such as L.L.C. or LLC.

- You cannot use a name that will give the impression that your business is a government agency.

- You are also not allowed to use words, such as university, bank, or attorney unless your business provides one of these services, in which case you’ll need to show proof that someone in your business is licensed to provide this service.

- The name you choose cannot already be in use by some other LLC in Indiana. You can check this by looking on Indiana’s state business registry to see if the name you want is already registered by another business. Make sure you check the name you want with the exact spelling you intend to use. Then, if the name is not taken, you can use it to register your LLC.

Another thing you may want to check is whether the domain name you would like to use for your business website is available. If it is not available and you don’t have a suitable substitute, you may want to reconsider your name choice.

Step 2: Pick a Registered Agent

In addition to choosing a name, you will need to pick a registered agent. Your registered agent will need to be available during all business hours to accept service of process or other legal documents. You can choose a person or a business that was incorporated in Indiana to be your registered agent. Their address needs to be their actual address and not a post office box. Also, you cannot choose your own business to be your registered agent. Many businesses choose a registered agent service to be their registered agent, which has a number of benefits that we will explain.

- The biggest benefit of choosing an agency for your registered agent is the privacy it provides. A registered agent’s name and address will be available to everyone as they will be part of the public record.

- You won’t have to worry about being available during all business hours. This can be particularly beneficial for businesses that are not open during traditional business hours.

- If you have a registered agent service, you won’t have to worry about receiving service or process in front of your customers, family, or friends. This could help prevent damage to your business in addition to avoiding embarrassment.

- It will also be convenient should you move since, with an agency serving as your registered agent, you won’t have to worry about changing your address with the state.

Step 3: File Your Articles of Organization for Your Indiana LLC

To form your LLC, you must file your Articles of Organization with the Indiana Secretary of State. These articles are a vital document for your business and include basic information on how you will form your LLC. Once you fill out your Articles of Organization, the Secretary of State will process the documents, and your LLC will be officially formed. Although if you don’t fill out your documents correctly, your application will be rejected, so be careful.

You can file your Articles of Organization by mail or online. The cost of filing will vary as it depends on the method of filing you choose.

To file by mail, you need to fill out State Form 49459. Make sure you include a check or money order for $100. Then, send the form to:

Secretary of State Business Services Division

302 West Washington Street

Room E018

Indianapolis, IN 46204

The processing time when filing by mail is approximately four business days. If you want to file online, you can do so at INBiz. You’ll need to create an account before you can file. Then you choose to start a business and follow the directions. It will cost you $95 to file. Once you’re finished filing, it should take about an hour to process.

Step 4: Draft Operating Agreement for Your Indiana LLC

The state of Indiana does not require LLCs to create an operating agreement. However, you should make sure your LLC has one. Your LLC’s operating agreement will detail the management structure of your LLC, how your LLC will be run, as well as the rights and responsibilities of all of its members. Having a legal document with these details can help avoid arguments between members in the future. You can include anything you think is important in your operating agreement, but there are several things you should include, which are explained below.

With a member-managed LLC, all of the members manage the LLC. They handle the day-to-day operations along with any other decisions pertaining to the LLC. They can choose to divide the responsibilities among themselves, but they are all responsible for managing the business. This works best for smaller LLCs or ones in which the members want to take an active role in running the business.

Whereas a manager-managed LLC works well for larger businesses or businesses in which the members are more interested in the business as an investment and don’t want to take a very active role in the business.

Voting rights are often based on the percentage of ownership, but you and the other members of the LLC are free to use whatever method you want to distribute voting rights. You just need to include it in your operating agreement.

You’ll also want to include how the voting will work. Will you require a majority or supermajority vote when making a decision? You could require a majority vote for some decisions and a supermajority vote for others. For very important decisions such as dissolution or bankruptcy, you could even require a unanimous vote.

Step 5: Obtain an EIN For Your IN LLC

An EIN is an Employer Identification Number, also known as a Federal Tax Identification Number. It is a nine-digit number the IRS will use to identify your business for tax purposes. There are many times when you may be required to have an EIN or when it would be useful, which we will list below.

Why Obtain an EIN?

If your LLC has two or more members, you will need to file a partnership return and supply each of the members of your LLC with a K-1, and to get a K-1, you’ll need an EIN. You’ll also need an EIN if you want to hire any employees. An EIN will allow you to file and pay payroll taxes.

An EIN can even be useful if you have a single-member LLC (more about it here) and you don’t want to hire any employees. This is true because you’ll be able to use the EIN instead of your Social Security Number in many cases, which will reduce the chances of identity theft.

Another reason you should apply for an EIN is so you’ll be able to open a business bank account. Most banks require an EIN before they will let you open a business bank account. The bank uses the EIN to confirm your business’s identity and its legitimacy. Many banks also require an EIN to obtain a business loan, although an EIN is not required for obtaining a loan.

An EIN can also help your business in another way. An EIN is used to track your business’s credit the way a Social Security Number is used to track your personal credit. So, if you get an EIN for your business and take care of your business finances, you can develop a good credit history for your business. This could help you obtain a loan or line of credit for your business in the future.

How to Apply for an EIN

When you’re ready to get an EIN, it will be easy. You can obtain an EIN for free by mail, by fax, online, or, if you are an international applicant, by phone.

If you want to apply by mail, you’ll need to fill out Form SS-4, which you can get on the IRS website. To fill out the form, you’ll need a Taxpayer Identification Number. You can use your Social Security Number for this if you have one. After you fill the form out, the address you send it to is:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It will take around four weeks for the form to be processed. If you want to apply by fax, the number you’ll fax the form to is (855) 641-6935. You should get a fax back in approximately four business days.

The quickest way to obtain your EIN is to apply for one on the IRS website. If you apply for your EIN online, you will get your EIN as soon as you complete the online application. However, you need to remember to complete the application in one sitting since if you leave the website, the application will not be saved. So, you will be unable to return and complete the application if you leave the website.

International applicants have the option of applying by phone. They can apply by calling the number 267-941-1099 from 6 a.m. to 11 p.m. Eastern Time on weekdays. It is important to make sure that the person calling for the EIN has the authority to answer any questions they are asked about Form SS-4 and then be given the EIN.

Step 6: Get Any Necessary Business Permits or Licenses for the State of Indiana

You will not need a general business license to operate a business in Indiana, but some areas do have certain licenses or permits they require. Many cities and some counties as well require businesses to apply for a business license.

Also, if your business sells goods or tangible personal property as well as certain services, it will need to obtain a Registered Retail Merchant Certificate so that your business will be able to collect sales taxes. You can do this at INBiz, as well as finding out anything else your business needs to do to stay in compliance with Indiana’s regulations and laws. Once you obtain the Registered Retail Merchant Certificate, you will need to display one certificate at each of your business’s locations.

Growing and Maintaining Your Indiana LLC

Once you form your LLC, there are certain things you should do to protect your business and help it to grow. We will list a couple of these things and how they can help your business.

1. Open a Business Bank Account

One important thing you’ll want to be sure to do as soon as you form your LLC is to establish a business bank account. There are many advantages to doing so, such as:

2. Obtain Business Insurance

Business insurance probably wasn’t one of the first things you thought about when starting your business, especially with the limited liability LLCs provide. But, business insurance is a crucial part of protecting the investment you and any other members of your LLC have.

The limited liability your LLC provides will generally protect your personal assets from being taken for any business debts or liabilities, but you will probably want to protect your business assets as well. Business liability insurance can help you do this. It can help protect your business assets should your business be sued.

You will probably want liability insurance for the members of your LLC as well. The limited liability for your business will not cover your members in cases of negligence or wrongdoing, so this insurance can provide extra protection for your personal assets.

There is one type of insurance you will be required to have if you have any employees. You’ll be required to obtain Workers’ Compensation Insurance if you have any employees. This insurance will cover your employees on the job in case of sickness, injury, or death.

Form an Indiana LLC With Professional Help Today

You’re probably busy enough getting your business underway without doing all the work filing for your LLC. So, if you need a little help, try one of these LLC formation companies.

#1: Create an LLC in Indiana With ZenBusiness

ZenBusiness hasn’t been around as long as many other LLC formation services, but they have become one of the top LLC formation companies because of the excellent service they provide. ZenBusiness gets very good reviews from their customers. They also provide a free operating agreement with all of their packages, which is very useful because you will definitely want an operating agreement for your LLC. They will also file your annual report for you if you answer a few simple questions, and this could save you some time which is certainly a valuable commodity for any small business owner.

Read our full review of Zenbusiness here.

#2: Create an LLC in Indiana With Incfile

Incfile is one of the best LLC formation companies you could choose to help you form your LLC. They are one of the few companies that will form your LLC for free. All you have to pay is the state filing fees. Additionally, even with their free package, they will provide you with a year of free registered agent service. You also won’t have to worry about missing important deadlines because Incfile will provide you with lifetime company alerts. These alerts will inform you of any approaching filing deadlines, thus helping you to stay in good standing with the state.

Read our full review of IncFile here.

Final Thoughts

Forming an Indiana LLC can be a great way to save money, protect your personal belongings, and take advantage of the excellent business environment Indiana can provide your business. By following these six easy steps, you can quickly and easily get your business up and running in no time. So, don’t delay and file for your Indiana LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs