Maryland LLC (6 Step Guide) – How to Form an LLC in Maryland

Start a Maryland LLC Now With the Help of Professionals

A Maryland limited liability company (LLC) is an excellent business structure for protecting your personal assets and potentially lowering your tax burden. This hybrid structure combines some of the best features of a corporation and a sole proprietorship while adding considerable flexibility in how you run your business.

Maryland has one of the most educated workforces in the country and an extremely high population density making for ample business opportunities. So, look no further than a Maryland LLC to get your business started.

If you want to skip the hassle of starting a Maryland LLC yourself, consider using professional help:

Most Importantly – What Is an LLC?

An LLC is one of several different types of business structures that can be used, including sole proprietorships, general partnerships, and corporations. In an LLC and a corporation, the owners of the business are legally distinct from the business.

What that means is that the business owners are generally not legally liable for the business’s debts in case of lawsuits or business failure. As long as the owners act in good faith, they are generally safe from loss of personal assets.

Additionally, a Maryland LLC is a pass-through entity meaning that it is not taxed as an entity. Instead, the owners of the LLC will pay for earnings on their personal tax returns avoiding the double taxation that corporations generally suffer from.

Often times an LLC can raise your business’s credibility as well. Due to the fact the business requires filing and establishes itself as separate from its owners, many customers and vendors are likely to take it more seriously.

Why Would You Want a Maryland LLC?

There are a number of reasons to form a Maryland LLC from its reduced business maintenance, potentially lower tax burden, and reduced liability. Let’s take a look at all of these reasons to file.

And if you’re wondering about the costs you will have to cover when starting a Maryland LLC — here’s our comprehensive guide on Maryland LLC costs.

1. Doing Your Business in Maryland & Reduced Business Maintenance

One of the main reasons why you would want an LLC in Maryland is if you plan to do business in that state or you plan to own some assets there.

In addition, many entrepreneurs prefer an LLC due to its reduced business maintenance. A corporation requires considerable maintenance, including the annual meeting, recording of minutes, as well as a large quantity of paperwork. But LLCs possess very little maintenance of any kind, making it easy for new business owners.

2. Tax Benefits

C type Corporations have to pay taxes on the entity level, and then owners must pay for any earnings they receive on their personal tax returns. This results in the double-taxation corporations are known for. This is rarely desirable; however, if circumstances make it advantageous, an LLC can opt for this tax treatment.

Otherwise, however, an LLC will typically act as a pass-through entity, meaning that earnings and losses pass through the business untaxed and go to the owners, where it is reported on their personal tax returns. This is the same tax treatment as owners and general partnerships receive.

3. Reduced Liability

This is the main reason that many entrepreneurs prefer to form LLCs, and small business owners will upgrade to them. With a sole proprietorship or general partnership, owners are not regarded as distinct from their company. When the business is sued or otherwise has debts it cannot pay, then the owner would be held responsible for repaying them.

But, if the business is an LLC and is sued or otherwise has debts that it cannot repay, it will typically not be held responsible for them. This is a significant benefit that corporations benefit from.

Pros and Cons of a Maryland LLC

There are a number of pros to a Maryland LLC and a few cons to consider as well. Before you get started with formation, make sure to consider these and decide if a Maryland LLC is right for you.

Pros

Cons

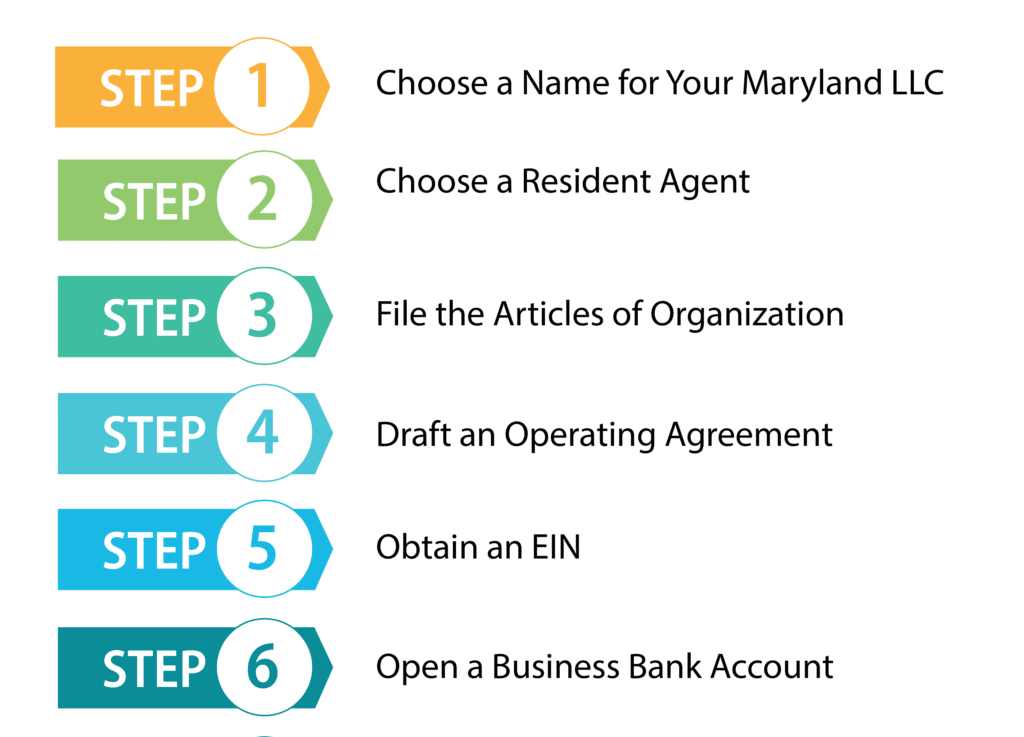

6 Step Guide On Forming an LLC in Maryland

Now that you know what an LLC is and the pros and cons of forming a Maryland LLC, hopefully, you’ve decided that forming one is right for you. So, let’s get started and look at how you can form your own Maryland LLC.

Step1: Choose a Name for Your Maryland LLC

Your first step in forming a Maryland LLC is choosing a name. This will be the first impression you make on customers and others who come in contact with your business, so make sure to put some thought into it.

However, there are some rules for you to follow when you name your Maryland LLC. First of all, the name must be unique from other businesses already registered with the state. This can be done using the Maryland Business Express Website. Use this to search for keywords from your name and see if it is distinguishable from existing business names.

Required Words: Maryland requires you to include certain words or abbreviations in the name of your LLC. These include the options: Limited Liability Company, LLC, L.L.C., LC, and L.C.

Restricted Words: Your name cannot include any words that would cause your business to be confused with a government agency, certain licensed professionals such as lawyers, or certain institutions such as banks or colleges.

Step2: Choose a Resident Agent in The State of MD

Now that you have chosen a name for your LLC, the second step is to choose your LLC’s resident agent. A resident agent, known in most states as a registered agent, is an individual or business that will receive any official correspondence on behalf of your LLC. These include official tax forms and even notices if your business is being sued.

Here you can find out more about Registered Agents.

You can choose a member of your LLC, a friend, a family member, or a resident agent service to act as your resident agent. However, keep in mind that the address of a resident agent is made public. Also, a resident agent needs to be available to receive official documents during all business hours.

These requirements can make the job inconvenient for a person since they may not want their address made public, and it could be difficult for some people to be available during all of the required hours. Also, should the business ever be sued, it may be embarrassing to be served the paperwork in front of friends, family, or customers. For these reasons, many businesses prefer to have a resident agent service act as their resident agent. If you choose to hire a resident agent service, make sure they are licensed to operate in the state of Maryland and have a physical address in Maryland.

Step 3: File the Articles of Organization For Your Maryland LLC

The Articles of Organization are what you need to file to actually form your LLC. So, it’s important to fill them out correctly. The form includes essential information about your LLC, and you will file it with the State Department of Assessments and Taxation. You can do this by mail or online.

To know more on how to file your Articles of Organization and get a free template — click here.

If you choose to file by mail, it will cost $100 and take about four to six weeks to process. You can mail the application to:

State Department of Assessments & Taxation,

301 W Preston St, Room 801

Baltimore, MD 21201, United States

The fastest way to file your Articles of Organization is online. You can do this on the Maryland Business Express Site. There is a $100 fee, but it should be done within seven days.

There are certain things you’ll need to know to fill out your Articles of Organization whether you apply online or by mail, such as:

- Name of Your LLC: Make sure you follow any rules for naming your business. Then, do a search for the name you want to see if it is available. After this, fill in the full name of your business correctly on the form.

- The Purpose of Your LLC: For this question, just write what your business will be doing.

- Business Address: Put the physical address of your business. P.O. Boxes are not allowed.

- Resident Agent Information: This is where you put the name, address, and signature of your resident agent.

Step 4: Draft an Operating Agreement

After you file your Articles of Organization, it’s a good idea to draft an operating agreement for your LLC. Maryland law does not require it, but every LLC should have one. It details the structure of your LLC along with the rights and responsibilities of its members.

Read more on how to get an Operating Agreement here.

An operating agreement can help avoid arguments between members in the future. It can also allow you to make some decisions about your LLC that would otherwise be determined by state default laws. You have a lot of freedom in what you can include in an operating agreement, but there are a few things you should be sure to include, which we will discuss.

Another option for management is a manager-managed LLC. In this option, the members of the LLC choose a manager or managers to run the LLC for them. Once the managers are chosen, the managers run the business and make any decisions for the business. The members can give advice, but the managers are not required to take the advice. The members can reserve certain decisions for themselves, but this needs to be specified in the operating agreement.

Step 5: Obtain an EIN in Maryland

An EIN or Employer Identification Number is a nine-digit number that is used to identify a business for tax purposes. The number is also sometimes called a Federal Tax Identification Number. An EIN is required if you want to hire employees or if your LLC has two or more members.

An EIN has other uses as well. You will probably need an EIN if you want to open a business bank account or obtain a loan.

It’s easy to get an EIN, and you can obtain it for free through the IRS online, by mail, by fax, or by telephone if you’re an international applicant. A Taxpayer Identification Number is necessary to apply. You can file online at the IRS website by filling out the application. Make sure you finish it in one session because if you don’t, it won’t be saved. Once you complete the application online, you will receive an EIN immediately.

You can apply by mail by filling out Form SS-4 and mailing it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Or you can Fax the form to (855) 641-6935

If you are an international applicant, you can apply by phone between the hours of 6 a.m. and 11 p.m. eastern time on weekdays. The phone number is 267-941-1099.

Step 6: Open a Business Bank Account in MD

You are not required to open a business bank account for your LLC, but it is crucial for maintaining your limited liability. Having a business bank account helps keep your business transactions separate from any of your members’ personal transactions. This is especially important if your LLC ever gets taken to court. If the court believes you have mixed personal transactions with your LLC’s finances, the court could pierce the corporate veil, which would allow the LLC’s members to be held responsible for any debts.

Having a business checking account will also give your business a more professional appearance. It will also give you a chance to form a relationship with a bank, which could be useful should you ever want a loan. If you have a business bank account, you can also accept credit cards.

Form a Maryland LLC With Professional Help Today

#1: Create an MD LLC With ZenBusiness

ZenBusiness has very reasonable prices and offers some nice features even with their starter package, such as an operating agreement, which is something every LLC should have. They also offer 50% off of registered agent services with all of their packages. Additionally, if you answer a few questions for them, they will file your annual report for you.

Read a full review of Zenbusiness here.

#2: Create an MD LLC With Incfile

The best thing about Incfile is how affordable they are if you want their lowest tier package; it costs $0 plus state fees. They even include a free year of registered agent service with all of their packages. Incfile also provides lifetime company compliance alerts, which can help you keep in good standing with the state by alerting you about any filings the state requires.

Read our full review of IncFile here.

Final Thoughts

Now you know how to form a Maryland LLC, and as you have seen, it is a manageable process that will result in a number of benefits. With reduced liability, lower tax burden, and a considerable degree of flexibility, a Maryland LLC is a smart choice for most entrepreneurs who do business in Maryland.

Plus, Maryland can offer your business a far greater degree of flexibility and privacy than in many other states. So, don’t delay in forming your LLC and get started today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs