Hawaii LLC (6 Step Guide) – How to Start an LLC in Hawaii

Start an LLC in Hawaii With Professional Help (Jump Down to Offer)

When you think of Hawaii, you probably think of amazing beaches and tourists, but for some, this state may offer a great business option, a Hawaii LLC. With this business structure, your business can receive an extremely high degree of protection for your personal assets, a lower tax cost, and a great location for many travel and entertainment-oriented businesses. Let’s take a closer look at some of these advantages and see what they can offer you, and then see how you can get your own Hawaii LLC started in only six easy steps.

If you want to skip the hassle of starting a Hawaii LLC yourself, consider using professional help:

Why Would You Want a Hawaii LLC?

So, why would you want a Hawaii LLC? This is a good question, and there are several reasons to choose this legal business structure. Here are the biggest.

Also, if you’re wondering how much will it cost you — we’ve prepared a comprehensive Hawaii LLC costs guide here.

Quick Hawaii LLC Pros & Cons

Now you have an idea why you might want a Hawaii LLC, but it is important to think about the pros and cons of this structure before you settle on it. So, before you get started on formation, let’s quickly consider the pros and cons.

Pros of a Hawaii LLC

First off, let’s consider the numerous pros, which include:

Further, members may opt-out of these rules for the most part by adding provisions in their LLC operating agreement to modify these responsibilities. Notably, the duty of loyalty cannot be completely removed, nor can the duty of care but, it can be limited. The operating agreement may include particular types of activities and provide that they do not violate the duty of loyalty and simply provide for a vote with a specified threshold needed to permit an activity that would otherwise breach the threshold of duty. This provision is intended to permit activities that would be considered “interested” activities, which are those between the members or managers and the LLC itself.

Further, should a court order that a member’s interest be sold, control of the business will still be protected. The purchaser of the interest will still only gain the right to distributions, not to participate in management. These remedies are the only ones that a creditor may seek. Lastly, should an individual willingly transfer their interests to another, including creditors, they will no longer be considered a member of the LLC.

Cons of a Hawaii LLC

Unfortunately, wherever there are pros to consider, there are bound to be cons. So, let’s look at a few of them.

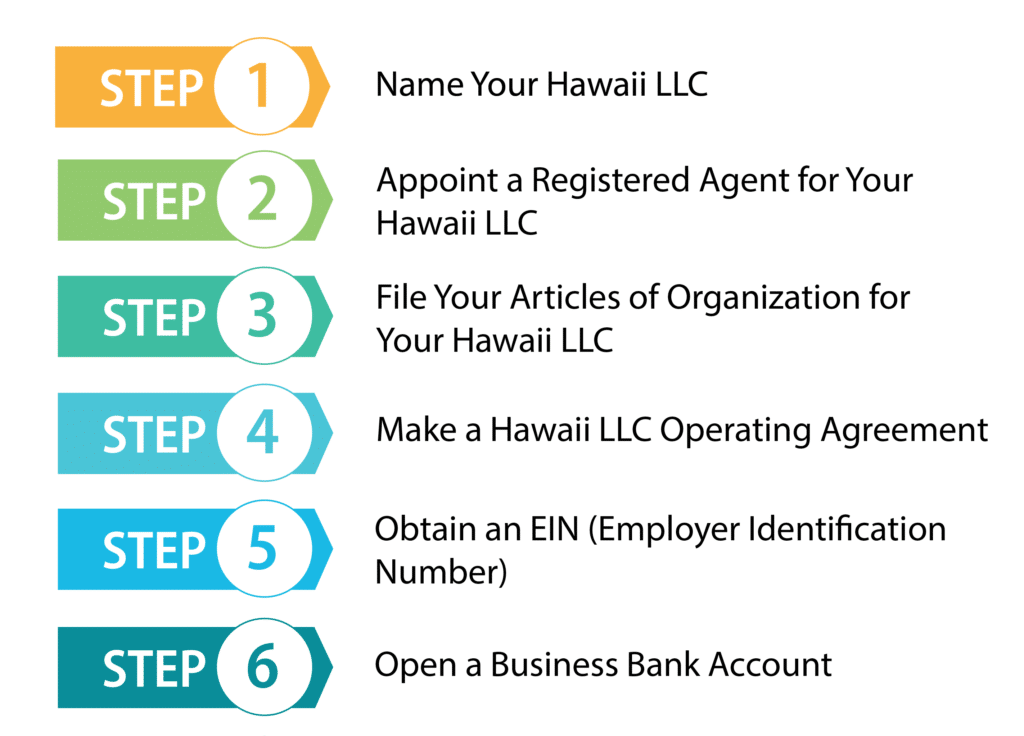

How to Form Your Hawaii LLC in Six Easy Steps

Now that you have had a chance to see the benefits of a Hawaii LLC, it’s time to see how you can form one of your own. Forming a Hawaii LLC is a quite manageable task, and you can form one in only six easy steps. Let’s get started!

Step 1: Name Your Hawaii LLC

Your first step to forming your Hawaii LLC is to pick a name for it. This is an important step that will give your future customers their first impression of your business. That is why it is important that your business’s name gives them an idea of what your business does.

The state does place some requirements on your business name, and the first of these is that it must be unique. Luckily, this is not a bad requirement when you would certainly want to pick a creative name anyway. This name should stand out on search engines as well to help you find more customers.

To see if your name is unique, you can do a business name search on the Hawaii Business Express website. Select “contains” in the search mode box and try entering keywords from any names you are considering. Hit search and see if there are any matches. If not, the name is probably okay to choose.

Next, try doing a web search and see if there is a domain name available that is suitable for your LLC’s name. It is important to make sure before you settle on a name to ensure that customers can easily find your business online. Remember that if the .com version of your name is taken, you can always check for another TLD such as .biz. Remember that just because you aren’t ready to start a business website today doesn’t mean you might not want to down the line. If a domain name is available, it would be wise to snap it up fast.

On a similar note, remember to check if there are suitable social media handles available as well. Check on at least a few of the most major social media websites such as Facebook, Twitter, and Instagram to see if there is a suitable handle available. If not, you may want to reconsider your choice.

State Rules

Now it is time to consider a few rules the Hawaii Department of Commerce and Consumer Affairs places on naming LLCs. These include attaching a designator such as “Limited Liability Company” or any of its abbreviations, including “LLC” or “L.L.C.” This is to allow consumers to identify your business as an LLC, and on the same note, this means that you cannot include designators for another business type such as Corp. or Inc. You also are prohibited from including terms such as “bank” or “law center” unless you obtain the proper permission from state officials, and generally, you must have members that possess certain licenses.

You should know that the most common reason for an LLC’s Articles of Organization to be turned down is because of issues with their names. So, just remember to follow these rules, and you will likely be just fine. Also, make sure that you do think you will be happy with the name you choose for the long term. Renaming your LLC can be quite the pain, and there are some filing fees involved too. If you do choose to change your LLC’s name, it is often easiest just to use a DBA (“doing business as”). A DBA, also often known as a trading name, is easy to file with the state and can be done online on the “Hawaii Business Express Website.”

Step 2: Appoint a Registered Agent for Your Hawaii LLC

Your Hawaii LLC will be required to appoint a registered agent to represent it. Your LLC’s registered agent will receive all official correspondence on its behalf. This includes tax forms, notices, and notably service of process. You can choose a wide range of individuals to serve as your business’s registered agent, including family, friends, other members of your LLC, and even business entities.

For a person to serve as your registered agent, they must possess a physical street address within the state of Hawaii. Next, they must be ready at the provided address at all ordinary business hours in order to receive correspondence. This individual will be included on the LLC’’s Articles of Organization which means that their name and any address which you provide will be on the public record.

Now many people starting a Hawaii LLC have the same question, and that is, “should I be my own registered agent?” The answer is that though it is possible, generally, it is not the best choice. First of all, the privacy that a Hawaii LLC can offer you will be lost because of your name, and if you work from home, likely your personal address will be on the public record. This will mean a lot of junk mail and often solicitors ending up at your doorstep. Also, though this is not an issue for a lot of business owners, if you are running your business from out of state, you will still need an address that is located within the state.

Luckily a registered agent service which is generally the preferred route for most business owners anyway can solve all of these issues. A registered agent service will allow you to use their name and address on the state filings keeping your own private, and this means that you do not need to live within the state just to form your LLC. In fact, because these services hold offices in every state in the US, you will find them very convenient for forming LLCs in multiple states, and they are available for very low prices with annual subscriptions.

Step 3: File Your Articles of Organization for Your Hawaii LLC

Now that your Hawaii LLC’s registered agent is chosen, it is time to file your Articles of Organization with the Hawaii Department of Commerce and Consumer Affairs. This step will certify your business as a legal entity with the state. You have two options to complete this filing, and that includes doing it online or by mail. Filing online is generally preferred and will certainly be the faster and generally easier option.

To file online, you can do it through the Hawaii Business Express website. You will need to create an account on the site and then answer the questions about your business that would be included on the official form. Then you pay a $50 filing fee, and you’re done.

To file by mail, you will need to download the form “Articles of Organization Form LLC-1” from the state’s website. Fill it out completely and send it along with the $50 filing fee and a $1 State Archive Fee to the following address:

Business Registration Division – Hawaii Department of Commerce and Consumer Affairs

335 Merchant St.

P.O. Box 40

Honolulu, HI 96810

Step 4: Make a Hawaii LLC Operating Agreement

Now that your Hawaii LLC’s Articles of Organization are filed, it is time to create an operating agreement. This document will provide rules for how you’re your new business will be structured and run. This will be signed by all of the LLC’s members and is important to prevent and solve any disputes between members.

Though the state does not require you to complete this step, don’t think that this means you should skip creating one. This document is the first thing that the state will look to in order to solve any disputes that do arise, and it is critical to protect the interests of everyone involved with the LLC.

Now there are topics that every Hawaii LLC should contain in its operating agreement, including:

If your Hawaii LLC is manager-managed, make sure to specify the manager’s rights in decision making, their role, and the compensation they will receive. Make sure to include how any disputes between the LLC’s members and management will be resolved as well.

Step 5: Obtain an EIN (Employer Identification Number)

The next step you should take is to obtain an EIN. This is a nine-digit number similar to a Social Security Number that the IRS will use to identify your business for tax purposes.

You will need this number if your LLC has two or more members or intends to hire employees. It is also often necessary for opening a business bank account.

It’s not hard to get an EIN, and it’s free. You can apply for one by mail, by fax, or online. Also, international applicants can apply by phone. You will need a Taxpayer Identification Number, or if you have a Social Security Number, it will work fine as well.

In order to apply with the IRS by either mail or fax, you will need to download and fill out Form SS-4. This form can be found on the IRS website. Once you are done filling out the form, just send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

This will take about four weeks before you receive your EIN.

For a faster response, you can also file by fax by sending the form to the number (855) 641-6935. Generally, you can expect a return fax in about four business days.

However, the fastest means by far to receive your EIN is to file using the IRS website. By filing online, you will receive your EIN instantly as soon as you are done. A word of caution though, remember to finish the process in one sitting because there is no way to save your progress if you leave the website.

For any international applicants, there is also an option of applying by phone. Call Monday through Friday any time between 6:00 AM to 11:00 PM Eastern Time. The one performing the call must have the authority to answer all of the questions included on the application in order for the IRS to provide your business with an EIN.

Step 6: Open a Business Bank Account

This step is not required to open your LLC, but it is still important. In order to maintain your business’s limited liability, you must keep your business’s finances totally separate from your personal finances. If you don’t do this and your business is sued, the court could remove your business’s limited liability, which could put your personal assets at risk. This is called piercing the corporate veil. The best way to avoid this problem is to open a business bank account. It will keep your business transactions totally separate from your personal transactions. This also has the added advantage of making your taxes and bookkeeping easier.

Documents You Will You Need To Start a Business Bank Account

There are several documents you may need when you go to open a business bank account. The exact documents will vary depending on the bank. But there are some documents you will likely need, and we will list these below.

Growing and Maintaining Your Hawaii LLC

Just as important as forming your LLC in the first place is maintaining it and helping it grow. Here are a few tips to help give your business a headstart.

1. Create Your Business Website

Most businesses today will want a business website. It’s a great way to help people to learn about your business and, if you have a brick and mortar business, to encourage them to visit your business. Most people today will search online before making a purchase, so you want them to find your business. If they don’t, they will find another business.

Additionally, there is no need to worry about building or maintaining your website. There are tools online that will help you to build and maintain your website with no previous experience.

2. Get Business Insurance

After you are finished forming your business, you should make sure you have the insurance policies your LLC needs. Some insurance is likely to be required by the state or your landlord, and other insurances are just a good idea to protect your business and its members. We will list some of the typical insurance policies that businesses purchase.

Form a Hawaii LLC with Professional Help Today

If you struggle to find enough time in the day without the burden of forming an LLC, you don’t have to go it alone. Here are two of the best services out there that can help form your Hawaii LLC for you.

#1: Start a Hawaii LLC with ZenBusiness

ZenBusiness is an excellent LLC formation service that gets great customer reviews. They have very reasonable prices and offer some excellent features with their packages. All of their packages provide a free operating agreement which is something every LLC should have. ZenBusiness will also file your operating agreement for your LLC if you want them to. Additionally, they offer 25% off their registered agent service with any of their packages.

#2: Form a Hawaii LLC with Incfile

Incfile is a popular LLC formation service that is quite affordable. In fact, they have a free package. You just have to pay the state fee. This makes Incfile a very good choice for any business trying to form an LLC on a budget. Incfile has some excellent features with their packages as well. All of Incfile’s packages provide a year of free registered agent service which separately could cost an average anywhere from $100 to $300. They also provide lifetime company alerts that will inform you of any upcoming filing deadlines, which will help you to stay in good standing with your state.

Final Thoughts

A Hawaii LLC can be a big step in the right direction for many businesses. With a Hawaii LLC, your business can reduce its tax burden and provide protection for all of its members. If you are considering forming a Hawaii LLC, then don’t hesitate to get started today.

FAQs

How Long Will It Take for the State of Hawaii to Process My LLC?

It will probably take approximately 6 to 10 business days to process your Articles of Organization. Although if you pay the extra $25 to expedite the process, it should take only two to three business days.

What Is the Cost of Forming a Hawaii LLC?

It will cost $50 to file your Articles of Organization. If you want to expedite the process, it will cost $25 extra.

Do I Need a Business License for My Hawaii LLC?

Every business in Hawaii must have a General Excise License. Hawaii does not require you to obtain a General Business License for your LLC. However, cities and counties have their own requirements. So, it is best to find out what licenses are required in your local area.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs