Michigan LLC (6-Step Guide) – How to Form an LLC in the State of Michigan

Form an LLC in MI Quickly With Professional Help (jump down to the offer)

Forming a Michigan LLC is an excellent choice for entrepreneurs and existing small business owners looking to grow. A Michigan LLC combines many of the benefits of a sole proprietorship and a corporation into one easy-to-form business structure. This structure can lower your personal liability, reduce your tax burden, and give you the flexibility to run your company how you choose.

Also, Michigan is an excellent choice for your business formation with a significantly below-average cost of labor, a low corporate and personal tax rate, and a convenient location for shipping across the U.S. So, let’s take a closer look at whether a Michigan LLC is right for you and how you can form one in only six easy steps.

If you want to skip the hassle of starting a Michigan LLC yourself, consider using professional help:

- Form an LLC in MI Quickly With Professional Help (jump down to the offer)

- Why Would You Want a Michigan LLC?

- Quick Michigan LLC Pros & Cons

- How to Form Your Michigan LLC in Six Easy Steps

- Optional Steps for Growing and Maintaining Your Michigan LLC

- Create a Michigan LLC With Professional Help Today

- Final Thoughts

Why Would You Want a Michigan LLC?

The first question you are probably asking yourself is why you would want a Michigan LCC in the first place. This is a good question, and fortunately, there are some easy answers to this.

There are a number of reasons why you would want a Michigan LLC, and the first two are their affordable nature and the lack of obstacles to forming this business structure. In only a few hours, any given individual can gather all the documents necessary, prepare their Articles of Formation, and complete all the work for the formation process. In fact, we will show you how to do it in this very article, but this is not the case in a number of other states.

In addition to ease of formation, this Michigan business structure is classified as completely separate from the company’s owners, preventing the loss of any private assets due to business losses. Plus, a Michigan LLC is a pass-through entity meaning that your business is not taxed on the entity level, unlike a corporation. Instead, the business owners will report any income or losses on their personal tax returns.

Finally, owners of a Michigan LLC face few rules and regulations restricting how they run their company compared to other options. For instance, a Michigan LLC is not required to host annual meetings, establish a board of directors, or structure its management in specific ways.

In order to change the company’s rules or add members, the company’s owners only must complete a minimum amount of paperwork. This is why many entrepreneurs and small business owners find a Michigan LLC to be a smart and easy to manage choice.

And most often than not — the majority of people choose Michigan state to form their LLCs if they’re residing in that state or plan to do business in MI.

Also, if you’re wondering how much will a Michigan LLC cost you – here’s our full MI LLC cost guide.

Quick Michigan LLC Pros & Cons

Now that we know why you would want to form a Michigan LLC, that doesn’t mean that it is necessarily right for you and your business. So, before you rush out to form one, let’s take a quick look at some more pros and cons of this business structure.

Pros of Forming a Michigan LLC

As you have already seen, to some extent, there are a number of pros to a Michigan LLC, and here are some to consider:

This is a big advantage because, in certain states, any incorporated business that intends to exist in perpetuity will be considered to be a corporation for tax purposes as well. This can sacrifice one of the largest benefits of choosing an LLC. However, with a Michigan LLC, this is not the case.

According to Michigan state law, the LLC will only be dissolved upon one of four events. The first is if the LLC’s members have certain provisions in their Articles of Incorporation specifying that the LLC will be dissolved under certain situations. The second is when an event is specified in its Articles of Incorporation or operating agreement followed by the member’s voting to dissolve. The third occurs if the members unanimously agree to dissolve. A fourth situation is if a judge orders the LLC’s dissolution.

A unique facet of a Michigan LLC is that members can choose to require that the manager chosen is a member of the LLC. This can help prevent a manager from being chosen that some members disapprove of.

Plus, Michigan law can help ensure that your manager can do their job effectively by stating that where a manager of an LLC’s powers has been included in the Articles of Organization, they can bind the LLC into a contract. This ensures that others can feel confident negotiating with the LLC’s manager without worrying that a member may object and break the contract.

Cons of Forming a Michigan LLC

Though there are a number of advantages to a Michigan LLC, there are some disadvantages to consider as well. So, let’s take a quick look at these before you spend any time learning how to form one. Here are the biggest cons to forming a Michigan LLC:

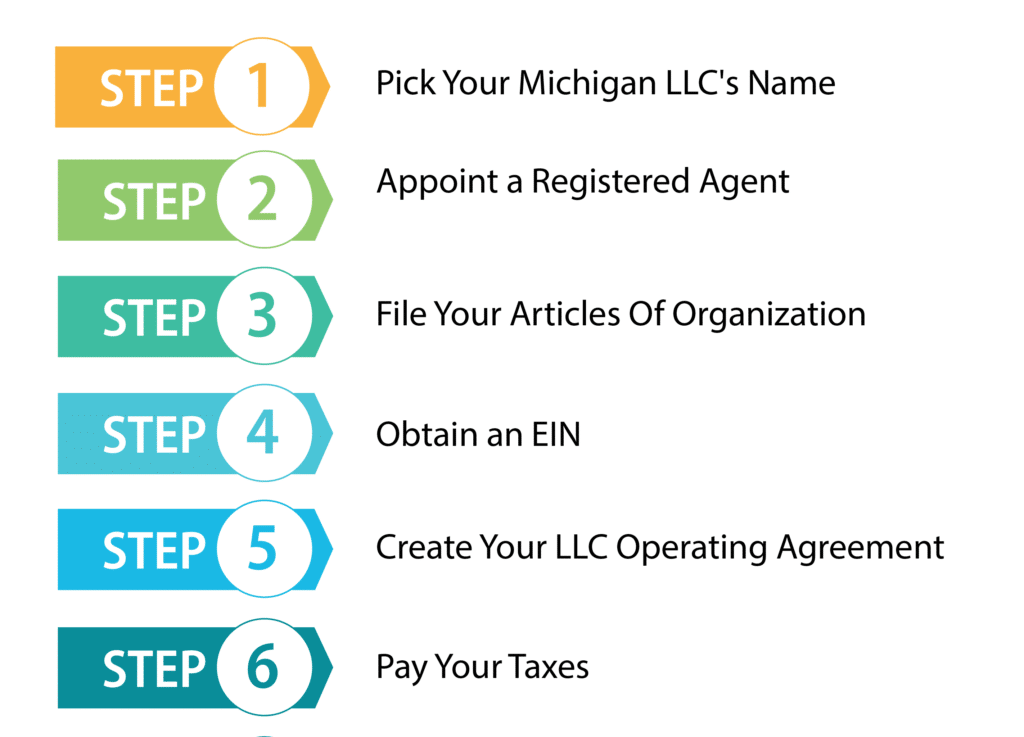

How to Form Your Michigan LLC in Six Easy Steps

Now that you know the pros and cons of a Michigan LLC, hopefully, like countless other entrepreneurs and business owners, you have found that this is the structure for you. Now you can start forming your LLC, and there are only six easy steps standing between you and your new business.

Step 1: Pick Your Michigan LLC’s Name

The first step to forming your LLC is to pick a name for it. There is a good chance that you already have one in mind, but first, you have to ensure it isn’t already taken. According to Michigan law, you cannot have a business name that is already taken by another LLC, corporation, or limited liability company in Michigan. It also cannot be so similar to an already taken name that it may cause confusion.

So, choose a name that is unique, and to help with this, check the Michigan Department of Licensing and Regulatory Affairs business entity search tool. You must also make sure the name of your LLC ends with the abbreviations LLC, L.L.C., L.C., LC, or the words “limited liability company.” You also cannot have the words “corporation” or “incorporate” in your LLC’s name to ensure that no one confuses your business for a corporation.

Reserving a Name

To find out if the name you want is available, you can check on Michigan’s business name database. If you find that the name you want is available, you can reserve it for up to six months. Just fill out Form CSCL/CD-540, the Application for Reservation of Name. The fee for reserving your business name is $25. You can file your name reservation online, in person, or by mail. You can apply in person at:

2501 Woodlake Circle

Okemos, MI

If you want to mail in the form, the address is:

Michigan Department of Licensing and Regulatory Affairs Corporations, Securities & Commercial Licensing Bureau Corporations Division

P.O. Box 30054

Lansing, MI 48909

Naming a Professional Limited Liability Company

People in some professions that choose to form an LLC are required to form a professional limited liability company (PLLC). When naming a PLLC, the name must end with one of the abbreviations PLLC, P.L.L.C., PLC, P.L.C., or the words professional limited liability company. Also, every member that is part of a PLLC must have a license for the professional field the LLC is operating in.

Fictitious Business Names

Fictitious business names are common for businesses. This occurs when a company operates under a name that is different than the company’s legal name. These fictitious names are often called (DBA) or “doing business as” names. If you choose to use one of these names, you need to file Form CSCL/CD-541, a Certificate of Assumed Name. The fee for filing this form is $25.

Step 2: Appoint a Registered Agent in Michigan

If you want to form an LLC in Michigan, you will need to appoint a registered agent. A registered agent is a person or company that is available during all business hours to receive service of process or other important legal documents. The registered agent must have a physical address in Michigan.

If you choose a person, the person can be a member of the LLC or any other resident of Michigan that is 18 or older and available during all business hours. If you choose a company for your registered agent, it must be a Michigan corporation, or, if it is a foreign corporation, it must have a certificate of authority that allows it to transact business in Michigan.

Most small businesses prefer to appoint a registered agent service to act as their registered agent. There are a number of reasons for this.

Step 3: File Your Michigan LLC Articles Of Organization

Filing your Articles of Organization is what will actually form your LLC. You can file your articles by mail by filling out Form CSCL/CD-700 available on the Michigan Department of Licensing and Regulatory Affairs website and submitting it with a check or money order for $50 made out to the State of Michigan. If you are forming a professional limited liability company, you will use Form CSCL/CD-701.

The address to mail them to is:

Michigan Department of Licensing and Regulatory Affairs Corporations, Securities & Commercial Licensing Bureau Corporations Division

P.O. Box 30054

Lansing, MI 48909

You can also submit the form in person at:

2501 Woodlake Circle

Okemos, MI

Telephone: (517) 241-6470

You can pay the fee with a MasterCard, Visa, check, or money order. If you want expedited service, it is available by mail or in-person for an extra fee. You’ll need to fill out Form CSCL/CD-272. The expedited service is $50 for 24-hour service, $100 for same-day service, $500 for two-hour service, and $1,000 for one-hour service. The day of receipt for mail-in applications is the day it is received by the Corporations Division.

You can also submit your Articles of Organization online at the Michigan Department of Licensing and Regulatory Affairs website. To fill out your Articles of Organization, you’ll need certain information available, which we will list below.

The effective date of your LLC will be the date it is filed by the state. But, you can add an article delaying the effective date by up to 90 days after the delivery date.

Step 4: Obtain an EIN for Your MI LLC

An Employer Identification Number (EIN) is a nine-digit number that the IRS uses to identify businesses for tax purposes. It is often known as a Federal Tax Identification Number as well. Your LLC will need this number if it has two or more members or intends to hire employees. You’ll probably also need this number to open a business bank account.

An EIN is easy to obtain, and you can get one from the IRS for free. You can apply for one by mail, fax, online, or for international applicants, by phone. You will need a Taxpayer Identification Number, such as a Social Security Number, to apply.

To apply by mail or fax, you will need to fill out Form SS-4 and send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The processing time is four weeks. Or, to apply by fax, fax the form to (855) 641-6935. You should receive a fax back within four business days.

The fastest way to receive your EIN is to apply online at the IRS website. Once you finish the application process, you will immediately receive your EIN. Make sure you finish the online application once you start. You cannot save the application and return to it later.

International applicants can apply by phone on weekdays from 6 a.m. to 11 p.m. Eastern Time. It’s important to make sure the person calling has the authority to answer questions about Form SS-4 and receive the EIN.

Step 5: Create Your LLC’s Operating Agreement

An LLC in Michigan is not required to have an operating agreement. However, every LLC should have an operating agreement. It allows the LLC to make some choices that would otherwise be controlled by state default laws. Also, the agreement can help reduce arguments between members in the future. Your operating agreement will detail the structure of your LLC, its daily operations and explain the responsibilities and rights of the members.

You can choose what you want to include in your operating agreement, but here are some things it’s best to include:

In a manager-managed LLC, the members choose one or more managers to run the business. The managers can be members or outsiders. The managers then run the daily operations of the business and make decisions for the business. The members then act in an advisory role. However, members can reserve certain decisions for themselves if they specify this in the operating agreement. A manager-managed LLC tends to work well for large businesses or when the members do not want to be involved in the daily operations of the business.

You should decide the vote that will be required to end the LLC. You could require a supermajority vote or even a unanimous vote, or you could just go with a majority vote. It’s also a good idea to specify how any assets that are left after bills are paid will be divided.

Step 6: Pay Your Taxes on Time

Once your LLC is formed, you’ll want to do some tax planning. The default status of an LLC is that of a pass-through entity. As a pass-through entity, your LLC will not pay taxes. Instead, the income passes through the LLC to the member’s individual tax returns, where it is taxed.

Although Michigan taxes any income from an LLC after it passes through to the members, it does require LLCs to file an annual statement. The annual statement is due by February 15. You will get an annual statement form to fill out from LARA 90 days before it is due. There is a $25 filing fee for the form, and it will include current information about your LLC and registered agent.

Tax Status

Although the default tax status of an LLC is as a partnership if it has at least two members or a disregarded entity if it has only one member, there are other choices. An LLC can choose to be classified as an S Corporation or a C Corporation.

As an S-Corp, any members that do more than a minor amount of work for the LLC are paid as employees of the LLC. Thus, employment taxes must be withheld from the employees’ wages, which in this case may be the members’ wages. However, with an S-Corp, the members do not need to pay Medicare and Social Security taxes on the S-Corp distributions they receive. So, they end up paying less Medicare and Social Security taxes. It may seem advantageous in this situation to pay very little wages and give large distributions, but the IRS requires S Corporations to pay employees reasonable wages, which need to be at least what other similar employees are receiving.

Here’s our guide on how to start an S Corp.

An LLC can also choose to be taxed as a C Corporation. If the members of the LLC choose to do this, the LLC will need to pay both the state and federal corporate taxes; then, the members will owe taxes on any dividends they receive. So, the members are being taxed twice, once at the entity level and again on their personal taxes. This is a big disadvantage. But, there are some advantages to being a C Corporation. They can get a number of tax breaks and deductions.

You need to think carefully when deciding which tax status is best for your LLC. In order to make the best choice, it may be wise to consult a tax attorney.

Optional Steps for Growing and Maintaining Your Michigan LLC

Forming your Michigan LLC isn’t the end; it is only the beginning. Your business will benefit from the considerable legal protections and opportunities for growth that Michigan offers, but there are several steps your new LLC can take to get started and flourish. Let’s take a look at a few of these right now.

1. Open a Business Checking Account

A business checking account is useful for keeping the LLC’s finances separate from the members’ finances. Keeping your business’s finances separate from any personal finances is essential for maintaining the limited liability of your business. If your business is ever sued and your LLC’s finances have not been kept separate from any of the members’ finances, the court could remove the business’s limited liability protection, in which case the members could be held responsible for any of the business’s debts.

A business checking account has other advantages as well. It allows you to form a relationship with a bank, which may help you if you want a loan in the future. It may also make it easier to get a credit card, which could also help separate your business and personal finances while helping your business establish a credit history.

In addition to these benefits, a business bank account can make your bookkeeping easier since it does keep your LLC’s business transactions separate. Also, it gives your business a more professional appearance.

2. Obtain Business Insurance

All businesses should have business insurance, even LLCs. Although it’s true that the personal assets of LLC members are protected from being taken to satisfy the LLC’s debts in most cases, this does not prevent the business’s assets from being taken should the business be sued. It also does not protect the members of the LLC from their own negligence or wrongdoings. This makes liability insurance for the business and members crucial.

Your LLC will also need Workers’ Compensation Insurance if your business has any employees. This insurance covers sickness, injuries, and death for your employees on the job.

If your business provides a professional service, you will also want professional liability insurance. This is useful for covering claims of malpractice or other errors by your business.

3. Start a Business Website

Having a website can give your business a more professional appearance. It can also help you attract more customers. Even if your business is mainly offline, you can use your website to help customers learn more about your business and encourage them to visit your brick-and-mortar location.

You may be nervous about creating a website if you haven’t done so before. However, there are many tools online that can help you build a website. Also, if you choose to use an LLC formation service, some of these will include a website in one of their packages. It’s really good for your business to have a website even if you have one or more social media accounts.

Create a Michigan LLC With Professional Help Today

Forming an LLC is definitely worth the effort considering all of the advantages they offer. But, it can be confusing and time-consuming filling out the forms and making sure they’re correct. So, why not consider getting some help. We list two of the top LLC formation companies and a little bit about them.

#1: Form a MI LLC With ZenBusiness

ZenBusiness has very reasonable prices and excellent customer reviews. They also provide a free operating agreement with their packages, along with filing your annual report for you after you answer just a few questions. They also offer 50% off of their registered agent services with all of their packages.

Here’s our full ZenBusiness review.

#2: Form a MI LLC With Incfile

Incfile is a popular LLC formation business, and for a very good reason. It is one of the few LLC formation companies that offer to form your LLC for free. All you have to pay is state filing fees. Incfile will even provide a year of free registered agent services with their free package along with free lifetime company compliance alerts which can help you stay in good standing with the state by alerting you to any upcoming filing requirements.

Here’s our full Incfile review.

Also, you might want to check out our comparison of Zenbusiness vs. Incfile and see which one should work best for you.

Final Thoughts

A Michigan LLC can be a great choice for most businesses. This business structure can offer extensive freedom to run your company however you choose and, particularly unique to Michigan, easily be formed in a matter of hours.

With low formation costs, protection from personal liability for business debts, and a potentially reduced tax burden, there are few reasons not to choose this structure. In only the six steps we have shown you here, you can get all the way from zero to LLC owner. So, don’t delay and get started forming your Michigan LLC right now either on your own or with help of the professionals listed above.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs