Ohio LLC – How to Form an LLC in Ohio (5-Step Guide)

Get Professional Help in Creating Your Ohio LLC

If you wish to form an LLC in the state of Ohio, there are a number of steps you must take. Forming an LLC is one of the easiest and cheapest business entities to form. You must file Articles of Organization with the state of Ohio and then follow some additional steps. All states have a similar process, but all differ slightly when it comes to needs and requirements. You can find the key steps below.

If you want to skip the hassle of starting an Ohio LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

What is an LLC & Why You Would Want an LLC in Ohio?

An LLC stands for Limited Liability Company, which is one of the most popular business entities available. Essentially, it combines the very best elements of cooperation, sole proprietorship, and partnership into one. It offers the owners of the business liability protection, which is one of its main draws, plus has a very flexible management structure and can even have tax advantages. It is hardly surprising, therefore, that many business owners in the state of Ohio are looking to form an LLC.

And if you wonder why would you want an Ohio LLC? The answer is — mainly people tend to form LLCs in those states that they plan to conduct business. So if you’re planning to do business in OH — it should be your state of choice.

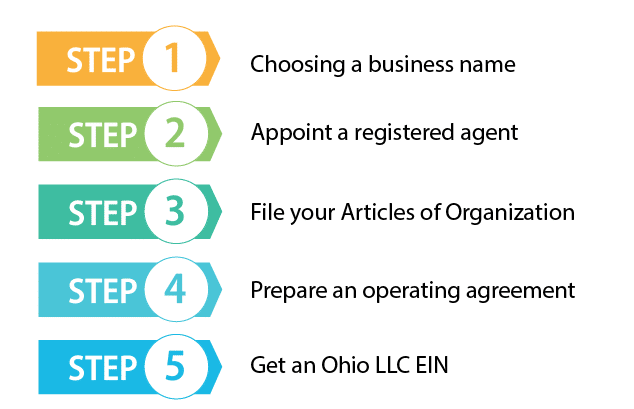

5 Simple Steps for Forming an LLC in Ohio

Step 1: Choosing an Ohio LLC Name

Choosing a business name may sound like an easy decision, but it should take a lot of thought and consideration. This is the name that people will relate to your business, so it should be memorable, easy to find, and ideally, people will know what your business does because of it. Although you are pretty free to pick your own business name, the state of Ohio has a few different regulations that you will need to consider.

For a start, the business name needs to include one of the following terms, ‘limited liability company’, ‘limited’, ‘LLC’, ‘L.L.C.’ ‘ltd.’ or ‘ltd.’ If it does not contain one of these terms, then it will not be accepted.

It also needs to be distinguishable from any other name that is already currently in use in the state. If you have a name in mind that you want to use, you can check it for availability on the Ohio Secretary of State business name database.

Once you have found your name to be available, you can then reserve it for 180 days by filling out a Name reservation form to stop any other new business from taking your desired name. Once you file the form, you will have to pay the $39 filing fee both when filing by mail or online.

Registering a domain name for your website

At this point, it also might be worth checking to see if the domain name for your business name is still available. If it is, you should purchase the domain even if you are not planning on setting up a business website just yet, as this will stop anyone else from taking it before you get the chance.

Using a trade name

If you are not completely happy with your registered name, or if you want to start a second line of business without creating a whole new company, then you could use a trade name. A trade name is also known as an assumed name or a DBA name (doing business as), although this still needs to be registered with the state before you can start using it. Fill out the name registration form and then file it with the Ohio Secretary of State for the fee of $39, and again, this can be done either online or by mail.

Step 2: Appoint a Registered Agent for Your Ohio LLC

The next step of the process is to get yourself a registered agent. Every LLC in Ohio must have an agent for service of process in the state.

What is a registered agent?

A registered agent is the personal or company who will receive legal and other documents on behalf of the business. These documents can include regulatory and tax notices, sibpoenas and other correspondence. They act as the connection between the state and the business. The name and address of the registered agent will be publicly available, which is one of the perks of having one, as it can help keep your personal address more private.

Who can be a registered agent?

There are not many restrictions when it comes to who can be a registered agent, although the laws can differ from state to state, so it is always worth double-checking with Ohio laws. In most states, a registered agent can be someone who is at least 18 years old, has a street address within the state of Ohio and is physically present at the state’s address during business hours. This means a registered agent can be a company, an individual, a friend, someone in the business or even yourself.

Don’t want to be one yourself? — see the 5 best Registered Agent service providers.

Step 3: File Articles of Organization For Your Ohio LLC

This is the key step to forming your LLC, filing your all-important Articles of Organization. In the state of Ohio, you will have to file Form 533A – Articles of Organization either by mail or online. There is a filing cost of $99 when you file, which is not the cheapest but not the most expensive fee in the states. You should be able to fill out and file your Articles of Organization yourself, or alternatively, you can use an external company to help you.

Step 4: Prepare an Operating Agreement

An operating agreement is not something that is strictly required by the state of Ohio when filing an LLC, but it is something that is very much advised. This is the document that outlines the obligations, rights, powers, liabilities and duties of the members of the LLC. The document is put together by the members of the LLC, so that in the future if any decisions have to be made, the operating agreement can be referred back to. This can help to prevent any disagreements and issues in the future.

You don’t need to file your operating agreement with the state, instead, it is what is known as an internal document, which means you can keep it with all your other important business files.

You can easily write your own operating agreement, as there are many templates online available for you to use and guide you through the process.

Step 5: Get an EIN for Your New Ohio LLC

EIN stands for Employer Identification Number, and is a number that is assigned to the business by the Internal Revenue Service. It is used to help identify businesses for tax purposes, much like how a social security number is used. It is completely free to get an EIN for your business, you just have to enquire with the IRS. The process is easy and straightforward, and can be done either online or by mail, although mail will take a lot longer.

An EIN can be used for a number of business-related activities, such as getting a business bank account, filing and managing Federal and State Taxes, and if you want to hire any employees. Even if you have an EIN for your sole proprietorship, then you will be required to get a new one when converting to an LLC.

Next Steps to Consider Once You Have Created Your Ohio LLC

Getting insurance for your LLC

Insurance is a very important part of running a business, as it will help you to not worry about the risks and actually focus on running your business. There are several different types of business insurance to consider, so you’ll have to think about what works best for your business.

Separate your personal and business assets

The whole idea of an LLC is to limit your liability, therefore one of the first things you should do once your LLC has been formed is to take the necessary steps to separate your personal and business assets. You want to avoid your personal assets, such as your home, car, and other valuables, from being vulnerable in the event that your Ohio LLC is sued. This can be achieved by following a few steps:

Create a business website

For most business types, having a business website is vitally important. It makes your business more legitimate, even if your business is very small. If you don’t have one, then you are missing out on a large percentage of potential customers. You don’t need website building experience in order to build a website, as there are many simple website building tools available. Alternatively, there are companies out there that will create your business website for you for a small fee.

Hiring employees

If you have decided that you want to hire employees, you must still stay compliant with the law. There are a few rules you need to follow which include:

Get Professional Help in Forming an LLC in Ohio

If this whole process sounds quite daunting and confusing, which it is likely to for many people, especially those new to the business world, it may make sense for you to hire an LLC formation company to help you through the process. There are many businesses out there that offer this service, each of which charge different fees and offer different packages. You’ll have to decide what makes the most sense for your business, and whether you need any additional add ons. Two of the best and most trusted providers can be found below.

#1: Start an LLC in OH With ZenBusiness

Zenbusiness is one of the most popular LLC formation companies, and for good reason. The company makes the whole process quick, easy and painless. All you have to do is provide the basic information about yourself and your business and they will do the paperwork and file with the state on your behalf. They are one of the most affordable LLC formation services, great customer support, plenty of good online reviews, free registered agent service for a year, and are 100% transparent when it comes to pricing.

#2: Start an LLC in OH With Incfile

Incfile is another good LLC formation service, forming over 250,000 businesses since its beginning in 2004. The company offers a formation service for free, which means all you have to pay is the state fee, making them the most affordable option. Plus, you get a full year of registered agent service with every package, even the free package, and includes lifetime company alerts whenever there is an importable deadline approaching. They also have good customer service and feedback, although you should be aware that there are a number of upsells throughout the process which can be a little annoying.

FAQs About Ohio LLCs

Should I even form an LLC?

If you are creating a business, then you may be considering creating an LLC. Even if you already have a business and are running as a sole proprietorship, it may be worth you looking at other options. They have many benefits associated with them, such as they limit the owner’s personal liability for business debts and lawsuits, they are a very flexible business type in general, such as when it comes to taxation, management, and ownership.

How much will it cost me to form an LLC in the state of Ohio?

There are a few costs related to starting an LLC in the state of Ohio, but the heftiest fee will likely be the filing fee to the Ohio Secretary of State. To file the Articles of Organization, they charge a flat fee of $99 regardless of if you make the filing by mail or online. This is something that has to be paid without question when forming an LLC.

If you want to reserve your business name, then there is an additional $39 for the name reservation application. Then there is also the annual cost of having a registered agent.

Creating your LLC yourself is definitely going to be the cheapest option, as you won’t have to pay anyone else to do it for you. If you decide to use an LLC formation service, there are a range of costs and packages to choose from, although you can find some that charge a very reasonable fee, and some are even free. Getting a lawyer to form your LLC for you will no doubt be the most expensive option.

How do I go about dissolving my LLC?

When you decide it is time for your business to come to an end, it is always worth dissolving it properly, following the correct processes. This will stop the business from having to continue to pay any fees and it will limit your liability for lawsuits. You should first look at the operating agreement, as in most cases, this will section that contains rules on how to dissolve the company. After taking the necessary action, you need to file a certificate of dissolution with the Ohio Secretary of State.

How long will it take to form an LLC in the state of Ohio?

The length of time it takes to file an LLC depends on a number of different factors, but in general, filing your Articles of Organization will take up to 7 business days, depending on the number of filings received. If you need to form your LLC quickly and can’t afford to wait for the 7 days, then there is the option of expediting the process which comes with an additional fee.

What is the difference between a domestic and a foreign LLC?

An LLC that performs business in the state where it was formed is known as a domestic LLC, so for example, if a business is formed in the state of Ohio and also does business in the state of Ohio, then this is a domestic LLC. A foreign LLC is one that was formed in one state, but then wants to expand its business to another. The foreign LLC will still have to register in the new state, which comes with a fee. To find out more go to: https://llcguys.com/domestic-llcs-vs-foreign-llcs-main-differences/

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs