Massachusetts LLC (6-Step Guide) – How to Start an LLC in Massachusetts

Form a MA LLC With Professional Help Today

Countless entrepreneurs have found that forming a Massachusetts LLC is the right decision for their business. An LCC in the Bay State offers many advantages to business owners, including a potentially reduced tax burden and protection for their personal assets.

Plus, with some of the highest venture capital investment and most educated workforces in the country, there are a lot of advantages to forming in Massachusetts. Let’s take a closer look at why you might want to consider a Massachusetts LLC for your business, some quick pros and cons, and how you can form a Massachusetts LLC in only six easy steps.

If you want to skip the hassle of starting a Massachusetts LLC yourself, consider using professional help for the best price in the market:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form a MA LLC With Professional Help Today

- Why Would You Want a Massachusetts LLC?

- Quick Massachusetts LLC Pros & Cons

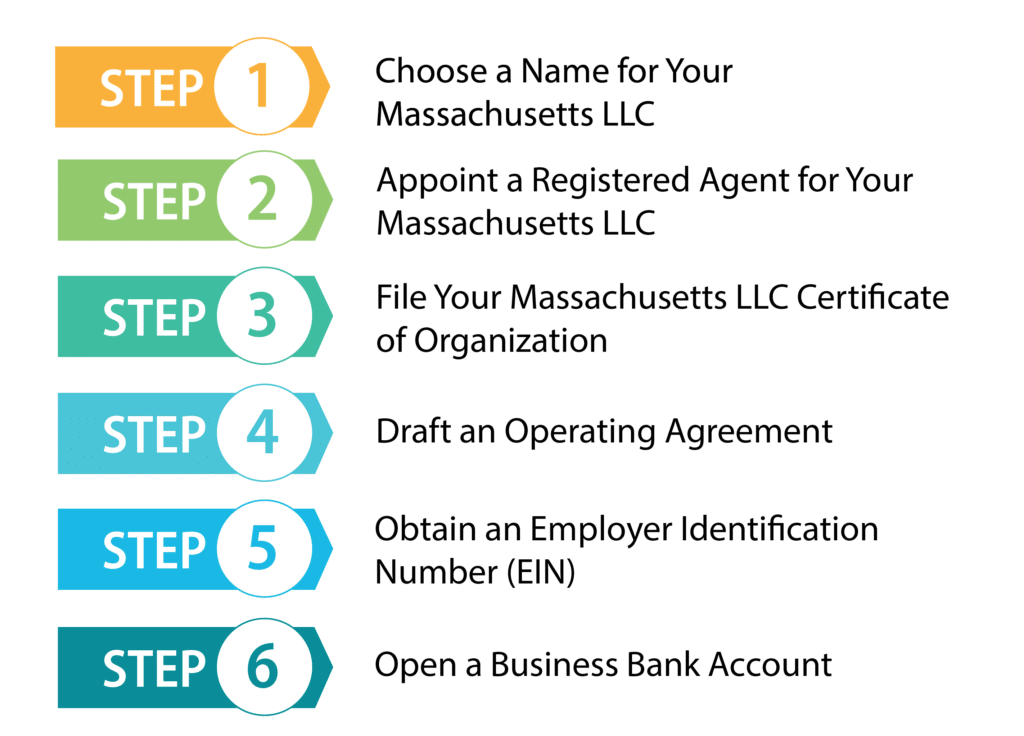

- How to Form Your Massachusetts LLC in Six Easy Steps

- Step 1: Choose a Name for Your Massachusetts LLC

- Step 2: Appoint a Registered Agent for Your Massachusetts LLC

- Step 3: File Your Massachusetts LLC Certificate of Organization

- Step 4: Draft an Operating Agreement for Your MA LLC

- Step 5: Obtain an Employer Identification Number (EIN)

- Step 6: Open a Business Bank Account

- Steps for Growing and Maintaining Your Massachusetts LLC

- Get Professional Help in Forming an LLC in Massachusetts

- Final Thoughts

- FAQs

Why Would You Want a Massachusetts LLC?

There are a number of reasons why you might want a Massachusetts LLC, and here are some of the biggest.

Quick Massachusetts LLC Pros & Cons

Now you know why you might want a Massachusetts LLC. However, this is a big decision, but since you are busy, let’s just take a quick look at the major pros and cons you should consider before settling on this business structure.

Pros

There are quite a few pros to forming a Massachusetts LLC, and it would be hard to contain them all in a shortlist. However, the most major pros to consider for forming a Massachusetts LLC include:

Cons

For all its benefits, there are still a few downsides to doing business in the state of Massachusetts. Here are a few of the most significant.

How to Form Your Massachusetts LLC in Six Easy Steps

Now that you have seen why you would want a Massachusetts LLC and some of the biggest pros and cons, hopefully, these benefits are right for your business. If so, that’s great! Let’s get started forming your Massachusetts LLC in only six easy steps.

If yoiu

Step 1: Choose a Name for Your Massachusetts LLC

The first step to forming your Massachusetts LLC is to choose a name for it. A good business name should be unique, give customers an idea of what your business can offer them, and be catchy. There is a good chance you already had some ideas in mind but remember that it will need to be distinct from any other business names already registered in the state of Massachusetts.

To ensure your name is distinct enough, you can check the availability on the Secretary of the Commonwealth of Massachusetts business entity search tool. Here you can type in keywords from your business name ideas and see if they appear distinct enough.

After typing in your keywords, just click the “search corporations” button and see if anything comes up. If not, your name is probably unique enough, but if they do, simply look through and see how unique their names are from your own. Be careful because the Secretary of the Commonwealth will get the final say on it when you go to file your LLC.

If the Massachusetts Secretary of the Commonwealth does reject your name, you will still lose your filing fee and have to start from the beginning, so it is important to be cautious. So, be diligent and perform a name search, and if you are careful, it is highly unlikely that there will be any issues.

Reserve a Business Name in Massachusetts

If you find a name you like but are not immediately ready to file for your Massachusetts LLC, then you may reserve a business name. This will protect your business name from use by others for sixty days, and you may file again to renew your reservation for another sixty days. Simply fill out the Application of Reservation of Name form and pay the $30 filing fee. To renew, simply file this form again, including the filing fee.

Reserve a Domain Name and Social Media Handle (optionally)

Before completely settling on a name, it is a good idea to do a search online and see if there is a suitable domain name available. Most businesses will want to create a business website at some point, so it is important to have a suitable domain available so it is easy for customers to find you. Remember that if the .com TLD is taken, you can always use other options like .biz if they are available. On the same note, it is important for most businesses to create a social media account to spread the word about their company and connect with customers, so check for a suitable social media handle as well.

By ensuring your online marketing coordinates and matches your business name, it will be much easier to link your business to them. If a domain name and social media handle are not available, you may want to reconsider your chosen name. If they are available, it is important to snatch them up before they are taken.

Step 2: Appoint a Registered Agent for Your Massachusetts LLC

Every LLC registered in Massachusetts is required to appoint a registered agent. This individual or business will receive official correspondence on behalf of your LLC. This correspondence may include tax forms, certified mail, and perhaps most importantly, service of process.

When your registered agent receives this correspondence, you want to know, so this makes your choice of registered agent an important one. You will need to make sure the one you choose is responsible and can be relied upon to dependably send you any correspondence you receive.

To qualify as a registered agent, an individual must have a physical street address located within the state of Massachusetts, and P.O. Boxes will not qualify. An individual must be at least 18 years of age and be present at the given address during all regular business hours without exception.

This means that assuming you physically reside within the state, are a minimum of 18 years of age, and will always be available during regular business hours, you could serve as the registered agent for your own business.

You could also choose another member of your LLC, a family member, or even just a friend as long as they meet these qualifications, including most notably residing in the state and being available at all regular business hours. As long as these qualifications are all met, very nearly anyone can serve as your registered agent.

Registered Agent Service

Most small business owners choose a registered agent service, and there is a good reason for this. First off, it is a simple way to solve your need for a registered agent easily and generally for a low flat annual fee. However, there are a few other significant advantages, including:

Step 3: File Your Massachusetts LLC Certificate of Organization

Your Certificate of Organization is the document you will file with the Secretary of the Commonwealth of Massachusetts that will officially make your business a legal entity.

You will need to fill out your Certificate of Organization with information regarding your member’s and any manager’s names and addresses, as well as information about the business you are forming, including the name of the business, its address, and its duration. Generally, for the duration, you can simply leave it open to indicate it is perpetual. You can complete this online or by mail.

You can fill out the form on your computer and mail it to the Secretary of the Commonwealth at One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512. You can also file online, which will generally receive a response far quicker. Either choice of filing you make, you will need to pay the $500 filing fee. If you file by mail, you can pay by check or money order. If you file online, you can pay by credit card.

Step 4: Draft an Operating Agreement for Your MA LLC

Massachusetts does not require an operating agreement, but you will still want to have one on file. An operating agreement is a legal document that outlines the structure of your business and details the rights and responsibilities of the members. This can help avoid arguments between members. This agreement is particularly helpful if you have a lot of members since with many members, it’s easy for arguments to arise.

There are a number of things you will probably want to include in your operating agreement, such as how profits and losses will be distributed, how any withdrawal by a member will be handled, what type of management your LLC will have, how voting will be handled, and what will happen if you ever decide to dissolve your LLC.

If you decide to change your operating agreement, this is possible. However, you will want to make sure you keep a copy of both the old and new operating agreements. You also need to have any new operating agreement signed to make sure everyone agrees with the new terms. Make sure you keep copies of the agreements safe in case they are ever needed.

Step 5: Obtain an Employer Identification Number (EIN)

One of the first things you’ll want to do after you form your LLC is to get an Employer Identification Number. An Employer Identification Number is a nine-digit number similar to a Social Security number. This number is used by the IRS to identify your business for tax purposes and is sometimes known as a Federal Tax Identification Number.

An EIN will allow your business to hire employees or open a business bank account. You may also need an EIN to obtain certain business licenses or permits. Your business will be required to obtain an EIN if you want to hire any employees or your LLC has two or more members.

Obtaining Your EIN

It’s not hard to get an EIN, and it’s free. You can apply for one by mail, by fax, or online. Also, international applicants can apply by phone. You will need a Taxpayer Identification Number. If you have a Social Security Number, it will work fine.

To apply by mail or fax, you’ll need to fill out Form SS-4. You can find the form on the IRS website. After you finish filling out the form, just send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It will take approximately four weeks to process.

You can also fax the form to the number (855) 641-6935. You should get a return fax in about four business days.

The fastest way to get your EIN is to apply online at the IRS website. You’ll get your EIN as soon as you finish the process. Just make sure you finish in one session because if you leave the website, your application will not be saved.

International applicants also have the option of applying by phone. The hours are Monday through Friday from 6:00 AM to 11:00 PM Eastern Time. You do need to make sure that the person calling has the authority to answer the questions on the application and receive the EIN.

Step 6: Open a Business Bank Account

This step isn’t required, but it’s still a very important step. Most importantly, a business bank account will help your business to maintain its limited liability. But it also has other important benefits, such as helping your business to maintain a more professional appearance and making your bookkeeping a lot easier.

Simplify Your Bookkeeping

Bookkeeping isn’t always easy for new business owners, and for those who don’t separate their business and personal finances, it’s a lot harder. In fact, it can be nearly impossible to just separate all your personal and business transactions when they’re all together in one bank account. Having a business bank account can solve this problem by keeping all your business transactions in one place. This also helps you to see exactly what you are spending, which can make it easier to run your business. In addition to this, you’ll probably find it a lot easier to do your taxes at the end of the year with all your business transactions in a separate bank account.

Keep Your Limited Liability

The most important reason to have a business bank account is to preserve your business’s limited liability. Your business must be seen as a separate entity to maintain this limited liability. To do this, you must keep your business and personal finances separate. One of the best ways to do this is to have a business bank account so that your business transactions will be kept in a separate account from your personal transactions. This can help your business to be seen as a separate entity. If you don’t keep your business and personal transactions separate and you get sued, the court could decide to remove your business’s limited liability, in which case your personal assets would be at risk. Mixing personal and business finances is a common mistake for small businesses, but it’s a risk you probably don’t want to take. So it’s best not to take any chances and to get a business bank account.

What Will You Need To Start a Business Bank Account in Massachusetts?

There will likely be a number of documents you will need when you go to open your business bank account. These can vary from bank to bank and also depend on where your business is located. However, there are some documents you are likely to be asked for. We list a few of these below.

Business License

If your state or local area requires a business license to operate, your bank will likely want a copy of it. It will show the bank that your business has the legal right to operate. So, before going to open your business bank account, be sure to get any licenses you need from the state or local area your business is in.

Steps for Growing and Maintaining Your Massachusetts LLC

Now that you have finished forming your Massachusetts LLC, you can take a step back to admire everything you have accomplished. But don’t forget that you still have some work ahead of you growing and maintaining your business. Here are a few ways to maintain your new Massachusetts LLC.

1. Pay Your Taxes

At the federal and state level, LLCs are taxed as pass-through entities. This means that the entity itself is not taxed. Instead, the money the business earns passes through to the members’ personal tax returns. For single-member LLCs, the owner is taxed the same as a sole proprietorship. For multi-member LLCs, the members are typically taxed as if they were in a partnership.

The area your LLC is located in may have local taxes as well. You will want to check and see if this is the case to make sure you are not delinquent on any taxes. To make sure you are correctly paying all your taxes, you may want to consult with a tax professional.

2. File Your Annual Report

Massachusetts requires all LLCs to file an annual report. This report gives the state relevant information on your LLC and keeps you compliant with the state. You can file your report by mail or online. It will cost $500 to file by mail or $520 to file online.

You will need to file your annual report by April 2nd each year. It’s important to make sure you file this report on time as you don’t want to be delinquent or possibly risk having your LLC dissolved. So it’s best to keep track of this date and make sure you file your annual report. A letter will be sent to your registered agent a few months before the annual report is due informing you of the due date for the report. This will allow your registered agent to remind you of the due date.

Get Professional Help in Forming an LLC in Massachusetts

#1: Start a Massachusetts LLC with ZenBusiness

ZenBusiness is an excellent LLC formation service that gets great reviews from its customers. They have reasonable prices and provide a lot of great features, including a free operating agreement and filing your annual report for you if you want them to. They also offer 25% off registered agent service with all of their packages.

#2: Start a Massachusetts LLC with Incfile

Incfile is a great choice for an LLC formation service to help you form your LLC, and you can even get their help for free. Incfile’s silver package is free; you only pay the state fee. All of their packages include a year of free registered agent service, which is a good deal considering registered agent service can cost anywhere from $100 to $300 a year. The silver package also includes next-day processing and lifetime company alerts. These alerts can help keep you in good standing with the state by informing you of any upcoming filing requirements.

Final Thoughts

As you have seen, a Massachusetts LLC can be a great way to up your game for an existing business or start your business off on the right foot. With a reduced tax burden, great sources of business funding, an educated workforce, and protection from personal liability, if things don’t go as planned, there really is no reason not to get started forming your Massachusetts LLC today.

FAQs

Does Massachusetts Allow Professional LLCs?

Licensed professional services that want to form an LLC in Massachusetts are required to start a professional LLC (PLLC). Professional services are generally things such as doctors, dentists, accountants, and lawyers. If you need a state license, then probably you are a professional service and would need to form a professional LLC. If you decide to form a professional LLC, it’s important to remember that every member of your PLLC must be licensed.

Are Foreign LLCs Allowed To Operate in Massachusetts?

A foreign LLC can operate in Massachusetts, but it is required to register with the Secretary of the Commonwealth Corporations Division. These corporations must also have a registered agent that has a physical office in Massachusetts. If you want to register a foreign LLC, you need to complete a Foreign Limited Liability Company Application for Registration and file it. If you file the form by mail, it will cost $500, and if you choose to file by fax, it will cost $520. Make sure you include a Certificate of Good Standing or Certificate of Legal Existence with the application that is no more than 90 days old.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs