Louisiana LLC (Formation Guide) – Starting an LLC in Louisiana, Pros & Cons

Get Professional Help in Creating a Louisiana LLC

It is relatively easy and affordable to form an LLC in Louisiana, which is why it is one of the most popular types of business entity. They are commonly regarded as one of the more simple business structures.

What Is an LLC?

As a new business owner, the term LLC is likely to be pretty familiar to you, but what actually is an LLC, and why might you want your own business to be an LLC? Although most people just call then ‘LLC’, it actually stands for ‘Limited Liability Company’, which is a type of business entity. If you own a business, you can file to be an LLC with the state, which comes with many benefits. Essentially, it takes all the best parts of other business types such as a sole proprietorship, partnerships and corporations.

They are hugely popular for all different types of business, as they provide limited liability while also being relatively cheap and easy to form and run. In some states, some types of professionals must form special types of professional LLCs. There is no maximum size of a business that can be an LLC, be it one with just one owner or a business with many co-owners and lots of employees. Thanks to their liability protection, flexible management structure and tax advantages, they are one of the most common legal entities.

Louisiana LLC Pros and Cons

Pros

Cons

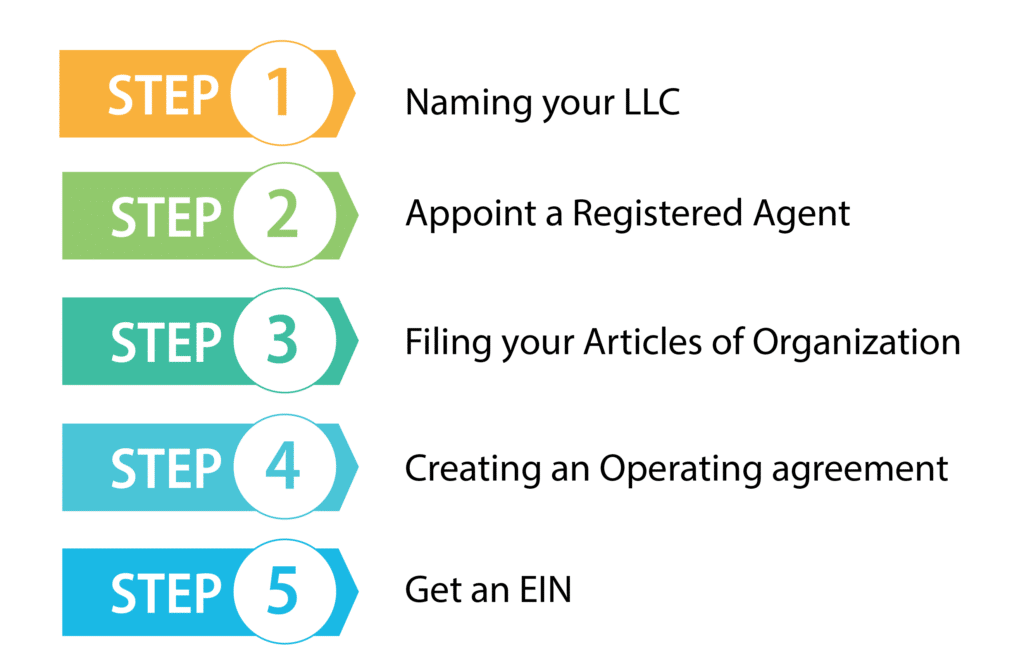

How to Form an LLC in Louisiana?

Step 1: Naming Your Louisiana LLC

A vital step in the formation is actually naming your business, as there is a lot to consider. Before you start coming up with a few names, you should spend some time doing some research. If possible, you should make the business name relevant to the type of business venture, so just by looking at the name, it is very clear to potential customers what you do.

Once you’ve come up with what you feel is a suitable name, you must then consider the naming requirements of the state. In Louisiana, all business names are required to include the term ‘Limited Liability Company’ at the end of the business name. The abbreviations are also accepted, so you could either have L.L.C or L.C at the end of the business name instead if you would prefer.

One of the most important requirements is that your business name needs to be distinguishable from other Louisiana businesses, so you’ll have to first check if your desired name is still available and that other company did not get there before you. You can always check at the Louisiana business entity search database, which is free to use. If you find that the name that you want to use is still available, but you don’t want to form your LLC yet, you may want to consider reserving the name so that no one else takes it. There is a cost to reserve a name, and the application in the state of Louisiana is $25. You will need to fill out a Reservation of Name form, which means your chosen name will be reserved for you for up to 120 days, and the application can either be submitted by post or online.

You should also check that the name you want to use has not been trademarked, and to check this, you can use the US Patent and Trademark Office’s search engine.

Although this can always be done later, while you are picking out a name for your business, you might also want to think about a trade name, which is often referred to as a DBA name, or even a Doing Business As name. This is where you can have a different name for your business which was not the one you registered with. This might be beneficial to you for several reasons, such as if you have a separate branch of your business that you want to differentiate. You will still have to make sure that this DBA name is not in use, and in the state of Louisiana, you will have to actually use your trade name first before you are able to register it, although you can always reserve it first.

Step 2: Appoint a Registered Agent for Your Louisiana LLC

Now it is time to pick a registered agent for your business. Like most states in the US, all LLCs are required to have a registered agent. A registered agent can be a person on their own or an external company that is the business’ connection with the state, helping the state to always have a solid point of contact in order to send important business documents. The registered agent will receive business documents on behalf of the LLC.

Who can be your registered agent is pretty flexible, but there are a few requirements. For a start, they need to have an address in the state of Louisiana, they need to be a person or a business entity and they need to be available during normal business hours.

You are even able to be your own registered agent for your business, but this can lead to some complications and can tie you down, so most people choose a friend, company or another individual to be the registered agent. This gets rid of the headache of having to interact with the state, so you’ll have the time to put all of your effort into your company.

Step 3: Filing Articles of Organization for Your Louisiana LLC

To many, the third stage of the process may seem like the most important, as this is where you actually file your Articles of Organization with the Louisiana Secretary of State. All states charge a fee for the filing, and Louisiana charges $100. You can file online, or alternatively, you can fax or mail the Articles of Organization.

Louisiana differs a little here when compared with many other states, as you’ll also have to submit an Initial Report as well as your Articles of Organization. The report will include lots of information such as information about the managers of the business, members, as well as the business’ registered agent.

Filing online

If you want to file online, you will have to use the state’s ‘geauxBIZ’ system. It is a much faster system than doing it by mail, but it can be a little confusing. Unlike most other states, the system will require you to have an EIN before you can file your Articles of Organization, which can cause some problems if your Articles are not approved.

The main reason that Articles are rejected is the business’ name, so because of this, the state of Louisiana asks you to first register your business name, which eliminates this reason that your Articles will be rejected. It will initially cost you $25 to register your business name, but you will get this refunded when you pay the main filing fee, so you’ll only be paying $100 as a whole. The name registration process usually takes around 24 hours, and if it gets approved, then you can carry on with your online filing.

If you have employees, then the system will also require you to register with the Workforce Commission. You’ll also have to register with the Department of Revenue while filing your Articles of Organization. As a new business, this may get very confusing and you might have to answer some questions that you haven’t even thought about the answer of yet, this is where new businesses may get help from outside services when completing this stage of the process.

Filing by mail

The other option is to file by mail by downloading the form, but this is not a very simple process either if you are filing your Articles this way, you’ll first have to get them, along with your Initial Report, notarized. Your registered agent must also be available to sign your Initial Report, which, although doesn’t sound like much bother, these things all take time and can make the process quite cumbersome and time-consuming. This way though, you won’t have to get your EIN first, so mail is the way to go if you want to skip this part.

Be aware that if you live in specified areas of the state, you are not actually allowed to file by mail, you are only able to file online, so this is always worth checking before you begin.

You’ll be very thankful to know that you only have to go through this whole process of filing your LLC once. If, in the future, you decide to make any changes to the busienss’, all you have to do is file an applicable amendment which comes with the small fee of $25.

Step 4: Creating Louisiana LLC’s Operating Agreement

Although Operating Agreements are recommended in all states, not all of them actually have them as a requirement when filing an LLC. Louisiana is one of these states where you don’t have to have one, but it is very much encouraged. Even if you are forming a sole member LLC, an Operating Agreement is a very helpful document to have, even if you can’t see its benefits right now at the start of your business.

For a start, they will give your business credibility. It can help you separate your personal assets with your business assets and will properly define your LLCs management structure, such as the voting requirements when it comes to making business decisions. It can also help to prevent and resolve conflicts arriving in the future, as it will clearly indicate the roles and powers of each member.

As it is not required of you to have an Operating Agreement in this state, you don’t actually have to file it. It is an internal document, so instead should be filed away with all of your other important business documents for referral later.

Step 5: Get an EIN in Louisiana

Once everything is filed, you’ll have to start thinking about the next steps and compliance with state and federal regulations.

One of the key things you should do is think about getting an Employee Identification Number, which is more commonly known as an EIN. You’ll be able to get an EIN from the Internal Revenue Service for free. There are several reasons you’ll need an EIN, such as if you want to open a business bank account or if you want to hire any employees, so you might as well get it sooner rather than later.

Just head to the IRS website and follow the steps outlined there and within a few minutes, you should receive your EIN. It is a very simple process.

After Forming Your LA LLC

Once you have successfully filed your LLC and been approved by the state, you will still have a few boxes you’ll need to tick to get everything in order.

Make sure you do a little bit of research to see if there are any state permits or requirements for your business in the state. Check this on the Louisiana Secretary of State checklist to see if any of the permits or licenses apply to you, be it because of the type of business that you are running, or the location of where you are running your business.

If you have any employees in your business, then you’ll have to register with the Louisiana Department of Revenue and then report any new hires to state’s Directory of New Hires.

Form a Louisiana LLC With Professional Help (Quick & Easy)

If your thinking of filing your LLC in Lousianna, and the steps involved seem too complicated or time-consuming, there are other options available, meaning you won’t have to do much of the work. There are plenty of third party companies that can help you form your LLC, some of which are better than others. You’ll have to work out what priorities are, whether you want a business that has great customer service, offers lots of additional services, or a combination of all three.

#1 – Start an LLC In Louisiana With Zenbusiness

Zenbusiness is one of the best and most popular of all LLC formation services. It has not been around for as long as other companies out there, but in the relatively short time it has been around, it has definitely made a name for itself in the industry. One of the core reasons it is so popular is that it is very affordable. Its cheapest package offers everything you need to successfully form an LLC, and will set you back just $39, which is one of the cheapest in the market. There are some great customer reviews online, and the customer service team is very helpful and quick to reply.

Here’s our full Zenbusiness review.

#2 – Start an LLC In Louisiana With Legal Zoom

This online legal service is a one-stop shop for all small business needs, with services starting at very low prices. It is one of the oldest and most well known legal services, so it definitely has a reputation on its side, so you can rest assured you’ll be going with a company that knows what they are doing. LLC formation services start at $79, so it is not as cheap as Zenbusiness, but the company also offers many other legal services, so is a good option if you have other legal business needs at the same time.

Check out the full review of LegalZoom.

FAQs About Louisiana LLCs

What are the benefits of using an outside registered agent service?

There are few benefits to having an outside registered agent service. Such as, they are likely to have local expertise about the state, including state law and other formation requirements. It also offers an element of privacy, as you won’t have to make and of your personal information, such as your address, available to the public. Lastly, an outside registered agent will provide you with a fixed, third party address, so you won’t have to worry about any unwanted correspondence at your home or office. You also won’t have to worry about any filing fees if you change office or address.

How much will it cost to start an LLC in the state of Louisiana?

There are several factors that will determine how much it will cost you to set up an LLC in the state of Louisiana. Likely your biggest fee will be the initial filing fee to the Secretary of State, which is a set fee of $100. If you want to speed up the process, then you can pay an additional $30 for an expedited option, so your LLC will be filed much quicker. There is also a different expedited option which costs $50, so you should see which is right for your business and whether you want to spend the extra money.

Then there is also a range of ongoing costs, for example, you’ll have to pay to file your annual report every year, pay for a registered agent and pay if you want to reserve your business name. These are the main costs if you’re going through the process yourself. If you opt for a third party to help you with the formation process, the costs of these vary greatly.

How long will it take for me to form an LLC in Louisiana?

There is not a set time limit for how long it will take to form an LLC in Louisiana. If you don’t rush the order, then it will usually take up to 7 business days, sometimes even longer. If you pay the $30 expediting fee, then it will take 24 hours, or if you want it done even quicker than that, then you could pay the priority expediting option, where it will be done in under 4 hours.

How do I dissolve an LLC in the state of Louisiana?

When you decide you want your business to come to an end, you should make sure that you dissolve it properly. In order to terminate it properly, you’ll need to file an Affidavit to Dissolve with the Secretary of State, which comes with yet another $100 fee. Although many businesses would be tempted to skip this process altogether, it is quite important that you officially dissolve your LLC, so you won’t have to pay any fees, licenses, taxes or fines in the future. Other requirements include having to pay off all your current business debts, sell off any business assets and distribute the remaining profits or losses to the members. This is where an Operating Agreement is vital, as it should make the dissolving process a whole lot easier.

How long will it take to form an LLC in Louisiana?

The turnaround time for forming an LLC in Louisiana can vary depending on a number of factors, including how many applications are already waiting to be processed. If there is a big backlog of applications, then the process will take longer. In general though, the average processing time in Louisiana tends to be around 5 days. If you need your LLC processed quicker than this, then you can always pay an additional fee to speed up the process.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs