Delaware LLC (5-Step Guide) – Forming an LLC in Delaware

Form your DE LLC With Professional Help Hassle-free & Quick

When starting a business, there are some very important decisions you will need to make, such as the business entity style you are going to use for your business, and what state you should incorporate in. A limited liability company, or LLC, is relatively new to the world of business entities, but is quickly turning into one of the most popular. In this guide, we a show you how to form an LLC in the state of Delaware, as well as other tips and tricks to help you make the right decision on your business journey.

If you don’t feel like doing everything yourself, you can hire a professional service:

In case you want to find out the full costs of Delware LLC, here’s our Delware LLC costs and fees guide.

- Form your DE LLC With Professional Help Hassle-free & Quick

- Don’t Feel Like Reading? Here’s Our Quick Delaware LLC Video Guide

- What is an LLC?

- Why would you want a Delaware LLC?

- Delaware LLC Pros and Cons

- 5 Steps on Starting an LLC in Delaware

- Things to Consider After Your LLC Formation

- Form a Delaware LLC with Professional Help Today

- FAQs About Delaware LLCs

Don’t Feel Like Reading? Here’s Our Quick Delaware LLC Video Guide

What is an LLC?

An LLC stands for the term Limited Liability Company, and is a type of business structure. Many new business owners choose to form an LLC as it comes with many benefits, such as offering a lot more flexibility than a traditional corporation. If you are starting a business or already run a business as a sole proprietor, then you should consider forming an LLC. One of the main reasons that people may choose to form an LLC is they can limit your personal legal liability, and are relatively easy and affordable to run and form.

They can be used to own and run most types of business, and can be used for a business of any size, whether they have one owner or many owners.

Why would you want a Delaware LLC?

LLCs can be formed in every state, so why would you want to choose Delaware? For a start, it has some of the most business-friendly laws in the country. These laws are also regularly updated, meaning that they are always up to date and the state is at the forefront of business law developments.

Delaware state offers some big tax advantages for out of state businesses that are organized as Delaware LLCs. There is no income tax if the LLC does not do business in Delaware, there is also no sales tax if the LLC does not do business in the state and there is also no tax on intangible income.

It is one of the only locations in the US where you can remain relatively private. When you are filling out your formation documents, you don’t have to disclose the name and address of the members or managers of the business, which you have to do for most states. You only need to offer a little bit of information in the certificate of formation, which is the name of the LLC and the name and address of Delaware registered agent.

Another good reason to start an LLC in Delaware is that the state allows businesses to form series LLCs, which are like miniature LLCs.

Delaware LLC Pros and Cons

Pros

Cons

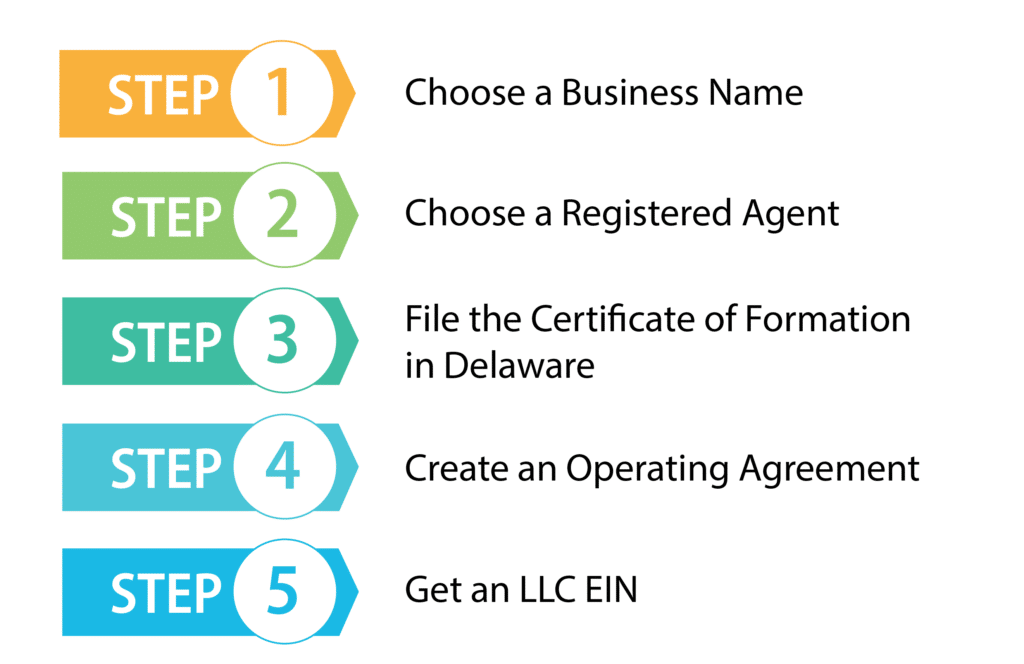

5 Steps on Starting an LLC in Delaware

Step 1: Choose a Business Name for your Delaware LLC

This is the first step of the formation process, and it is a very important one. There are a number of things you need to consider, such as if the name complies with the state’s naming requirements, and if it is easily searchable by potential clients.

Delaware naming guidelines:

At this point, it is usually a good idea for you to check to see if the URL of your business name is still available. Even if you are not planning on creating a business website any time soon, it is usually a good idea for you to buy the URL so that other businesses don’t take it before you get the chance to. These are not too expensive, and are often worth the small expense.

Reserving your business name

If you have found a business name that you want to use, but are not yet ready to file your LLC, then you can always reserve the name to ensure that no one else can use it. For a $75 fee, you can reserve the name for up to 120 day by reserving online.

Step 2: Choose a Registered Agent in Delaware

All LLCs in the state of Delaware are required to have a registered agent. For many new business owners, the term registered agent might be unfamiliar, but essentially they can be an individual person or a specialist business that is responsible for receiving important legal documents from the state. These can be tax forms, legal documents, notices of lawsuits and various other forms of official government correspondence.

The state is pretty flexible when it comes to who can be your registered agent, you just need to be sure that they are a resident of Delaware or a corporation that is authorized to do business in Delaware. You can even be your own registered agent if you feel as though you have the time to spare and will be available during business hours. Alternatively, it could be someone that you know, such as friends or family, or else in the business.

Many people will choose a third party company to be the registered agent for a fee, as this will take the responsibility away from you, giving you more tie mot focus on running your business.

Step 3: File the Certificate of Formation in Delaware

One of the most important steps in the process, and also one of the most time consuming is to fill out and file the Certificate of Formation with the state. There are a few different options available to you when it comes to the filing process. Applications can be made both online or by mail.

File Online

If you are filing by mail, then you need to download the certificate, sign it, and then upload it for filing. Start the process on the state website.

By Mail

The other option is to file by mail. To do this, you have to download the form and post it to the Delaware state mailing address.

No matter which option you choose when it comes to filing, you will have to pay the $90 filing, which is non-refundable and payable to the Delaware Department of State. Filling out the form itself is not too hard, as it needs information that you will already know well, such as the name of the LLC, the name and address of the registered agent, and a signature of an authorized person.

Step 4: Create an Operating Agreement for your LLC in Delaware

Not all states require you to have an operating agreement to file an LLC, and Delaware is one of these states. Although it is not technically needed, it is good to practice to have one, so should be included in the formation steps.

An operating agreement is the document that is used to you outline the ownership of the LLC, along with details about how it is run. As it is not required, you don’t have to file this document with the state, instead, you should file it internally for future use.

An operating agreement can really come in handy when running a business. It will help you ensure that all owners of the business are in agreement on how the company should be run, and having it all down in writing will help to prevent conflict in the future if there is ever any form of internal disagreement.

Once the operating agreement has been drafted and approved, all the members of the LLC should execute it. In multimember LLCs, it is especially important to have a signed operating agreement.

Step 5: Get an LLC EIN

An EIN will help you greatly when it comes to running a business in the state of Delaware. The term stands for Employer Identification Number, and works almost like a social security number for a business. They come in the form of a 9 digit number, and they will be assigned to your business by the Internal Revenue Service. It identifies your business for tax purposes and is required to conduct several necessary tasks.

For example, you will need one if you are planning on opening a business bank account. You will also need one when it comes to hiring employees for your business and when it comes to filing and managing Federal and State taxes.

Even if you already have an EIN for your sole proprietorship, you’ll have to get a new one when you are going through the LLC formation process.

It doesn’t cost any money to get an EIN, and the whole process is very easy and straightforward, and a process you can do by yourself. Again, you can choose if you want to go through the process online, or apply for your EIN by mail. Both are easy, but if you want your EIN almost instantly, rather than having to wait a few days, then applying online is definitely the way to go.

Things to Consider After Your LLC Formation

One of the first steps, once you have formed your Delaware LLC, is to separate your personal and business assets, so your personal assets are not at risk in the event that your business is sued. There are a number of steps you need to follow to make this happen.

Get Business Insurance

It is very important that you get business insurance once you have formed your LLC, as this will help you manage risks and keep your mind at ease. There are few different types of business insurance that you could consider. These include General Liability Insurance, which is a relatively broad insurance policy, Professional Liability Insurance which is the insurance type that tends to be used by professional service providers, and Workers’ Compensation Insurance, which provides cover for employees if they have any hob related illnesses, injuries or death.

Permits and Licenses in DE

When running a business in Delaware, it is very important that you always stay compliant. You can do this by following federal, state and local government regulations. Make sure you have all the business permits and licenses that you are required to have, which can depend on the type of business you are running, and where you are running your business. The fees for these can also often vary greatly.

Form a Delaware LLC with Professional Help Today

Although it is possible to go through the process yourself when it comes to forming an LLC in Delaware, the process can be quite time consuming and confusing to those that have not created a business before. A popular option is to get professional help, and there are many companies out there that offer LLC formation services. Different LLC formation services offer different pros and cons, so you should do your research carefully when it comes to finding a service provider to help you. To help you make your decision, two of the most popular options can be found below.

#1: Creating DE LLC With Zenbusiness

Zenbusiness is one of the most well-known LLC formation companies, and for good reason. For a start, it is one of the most affordable, with a basic package of $49 and relatively few upsells. This includes all the business formation essentials such as Articles of Organization filing, registered agent services, and Operating Agreement and more. They have great customer service, with the team always ready to answer any questions you may have.

#2: Creating DE LLC With IncAuthority

IncAuthority has been around since 1989, and has helped thousands of people successfully form an LLC. They have some great reviews online, and are trusted by plenty of businesses. One of the things that make the company so popular is their cheapest formation package is completely free, so all you have to worry about is the state fees. This package includes a business name search, a full year of free registered agent service, digital and storage and delivery, a tax planning consultation, preparation and filing, and a free business checking account.

FAQs About Delaware LLCs

Can I be a registered agent of my company in the state of Delaware?

Yes, you can be your own registered agent for your Delaware LLC. Although this will save you money, as you won’t have to pay for someone else to be your registered agent, you should be aware that there are some negatives to this option. For a start, you need to be sure that you are always available in business hours, plus it can be time consuming. This is why many people instead choose t pay for a registered agent service.

How long will it take to form an LLC in Delaware?

There isn’t a time frame for forming an LLC in Delaware, as this depends on several factors, such as how many other applications are waiting to be processed. In general, filing the Certificate of Formation will take about 2 weeks, but if you want the process to be quicker, then there is always the option of expediting the process for an additional fee.

How much will it cost to form a Delaware LLC?

The main cost when it comes to forming an LLC in Delaware is the filing fee, and this is $90. There are also other costs that you should consider, although these are optional extras, such as if you want to pay to have the filing process expedited, or if you are paying for a registered agent or for a third party company to file your LLC for you.

How do I dissolve my LLC in Delaware?

When the time comes that you no longer want to conduct business with your Delaware LLC, you should always make sure that you officially dissolve it. If you don’t then this can result in some costly tax liabilities and penalties. You may even get into legal trouble. You need to make sure that you close your business tax account and you file the Delaware Articles of Dissolution.

How will I know if my LLC name is available?

You want to be completely sure that your desired business name is completely distinguishable from other Delaware LLCs. It is completely free to conduct a name search on the Delaware Division of Corporations’ website before getting started with the process to make sure that it is still available.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs