Illinois LLC (6-Step Guide) – How to Form an LLC in Illinois?

Get Your IL LLC Started Today W/ Professional Help

If you’re thinking of starting an LLC in Illinois, then there are a few steps that you are going to have to take in order to successfully form your business and register it with the state. Although each state has a similar process, each has different costs and requirements involved, so it is important to read up on the steps you have to follow for each individual state. The steps for Illinois is relatively straightforward, and the filing cost is about average.

If you want to skip the hassle of creating an Illinois LLC yourself, consider using professional help from:

If you want to know all the costs associated with an Illinois LLC – read our full Illinois LLC costs guide.

First of All, What is an LLC?

An LLC stands for Limited Liability Company, which is a type of legal structure for a business and is very popular. Its popularity stems from its lack of formality and its flexibility, which you don’t tend to get with many other business structures such as a partnership or a sole proprietorship. It also has the benefit of limiting the personal liability of the business owner for business debts or lawsuits.

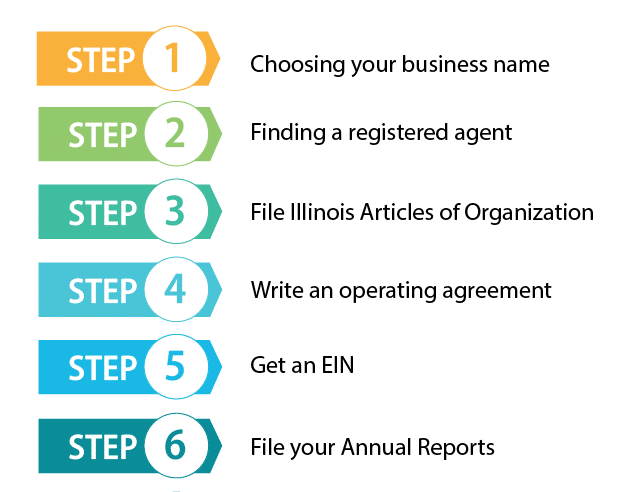

How to Form an LLC in Illinois – 6-Step Guide in Creating an IL LLC

Step 1: Choosing your Illinois business name

The first step of the process is to choose a name for your business. This may sound like a relatively easy step, but there is a lot to think about. For a start, under the law of Illinois, a business name must contain either ‘limited liability company’, ‘L.L.C., or LLC as the last words of the name. You must also make sure you avoid the terms ‘Corporation’, Corp.’, Incorporated’, ‘Inc.’, ‘Ltd’, ‘Co.’, ‘Limited Partnership’ or ‘L.P’. If the business name includes any of these terms, then it will not be accepted.

Another very important requirement is that it must be very different from any other business name that is already on file with the state. If you have come up with a name that you want to use, you should first check with the Illinois Secretary of State to see if your desired name is still available. This can be achieved by searching the state’s Business Services Name Database. Although it is free to search the database, if you find that your name is available and you want to reserve it for 90 days, there is a small fee involved. Simply fill out an Application to Reserve a Name and pay the filing fee of $25, so you have a little time to play with, but you can rest assured that no one will take your name.

At this point it may also be worth checking if a domain name for your chosen business name is still available, so people will be able to find you on the web. Even if you don’t want to make a business website right away, many businesses will still purchase the domain name at this point.

Step 2: Finding and Getting a Registered Agent in Illinois

The next step is one that can’t be missed, you need to choose your Illinois Registered Agent. A Registered Agent is an individual or company that is responsible for receiving all the important tax forms and other correspondence with the state on behalf the business. These could include a range of legal documents and even notices of lawsuits.

Who can actually be your registered agent is very flexible. There are, of course, a few guidelines, but you could even be your own registered agent, or have a friend or someone else in the business be the registered agent. They must either be a resident of the state of Illinois or be a corporation that is authorized to conduct business in the state of Illinois. You can choose your registered agent, so you might want to think about costs and reliability. Obviously if you are your own registered agent, this could end up taking up a lot of your time, plus you need to be available during business hours.

Step 3: File Illinois Articles of Organization

Now comes the most formal part of the process, actually filing your Articles of Organization with the state. You are able to apply for this either online or by mail for a few of $150, which is non refundable and payable to the secretary of state. You are able to file the Articles either online or by mail, but online is much quicker, and is often handled within 24 hours.

Articles of Organization differ slightly state by state, but an Illinois Articles of Organization must include the following:

Step 4: Write an Operating Agreement for Your Illinois LLC

Step 4 of the process is to write and set up an operating agreement. This is not a mandatory step in the state, but is highly advised, and will help prevent any problems or disagreements in the future.

It should be considered an internal document, which means you don’t need to file it with the state. It should be kept with all of your important business documents for future reference.

If you decide not to have an operating agreement, then the state LLC law in Illinois will govern how your business operates, which may not always be how you would like. It also could lead to some disagreements in the future if the LLC members have not all agreed on the best course of action for the business.

An operating agreement is a document that will set out the rights and responsibilities of its members and managers. This includes information such as how the LLC will be managed, how it will be dissolved, and more.

It will also show that your LLC is a separate business entity, which will help to preserve your limited liability. The process of writing an operating agreement can be a little confusing, which is why there are many companies out there that can help you to write it. There are also plenty of templates online which you can follow.

Step 5: Get an EIN

An EIN stands for Employer Identification Number. LLC’s must get one if it has more than one member, even if it does not yet have any employees. Obtaining an EIN in illinois is a very easy and straightforward process. All you have to do is simply fill out an online application on the IRS website, which is completely free to do.

Step 6: File Your Annual Reports

When forming an LLC, you have to look ahead, and this means filing an annual report every year. All LLCs that do business in the state of Illinois must fill out and file an annual report to the Secretary of State on the first day of the LLC’s anniversary month. So, for example, if you formed your LLC in the middle of September, then your report would be due on September 1 the following year.

You can either file the report online, or choose to send it via mail. Just bear in mind that choosing the mail option will always take longer. You will have to pay a $75 filing fee every time you file your annual report, and if you report late, then you will be fined an additional $100. More than 60 days after the due date is considered late.

Additional steps once your business in Illinois is formed

1. Get a Business Bank Account in Illinois

It is advisable that you get an IL business bank account once you have formed your LLC, as that will help to keep your personal and business assets completely separate. Not only is this important for personal asset protection, but also makes accounting and tax filing much easier.

2. Get a Business Credit Card

It will also be beneficial to you if you have a business credit card, as again, this can help to separate your Illinois business and personal expenses, stopping things from getting messy and confusing. Having a business credit card will also help to build up your company’s credit history, which is especially important if you are a new company.

3. Get Business Insurance for Your Illinois LLC

When you have an LCC in Illinois, you should get business insurance. This will help you with business associated risks, so you won’t have that worry, and you can focus your attention on growing your business. There are several different types of business insurance you should look into and consider which is right for your business.

Get Professional Help in Forming an LLC in Illinois

Although it is completely possible, you don’t have to form an LLC on your own. For those that are new to the game and have never formed an LLC before, the process could be confusing, and it may be difficult to know whether you have done everything correctly. It is also a very then consuming process, with lots of paperwork and checks to be made. It is for these reasons that many new business will hire another company to form the LLC for them. There are many businesses out there that will be more than willing to take on this service. Each comes with their pros and cons, so it is worth doing some research to find out which is right for you. Here are a couple of the best.

#1: Start an LLC in Illinois With ZenBusiness

Zenbusiness is one of the most popular LLC formation services out there, and for good reason. They are extremely affordable, with their cheapest package coming in at just $49, despite the fact that you’ll get everything you need to form your business successfully and thoroughly. Plus, they make the whole process as easy for you as possible, with a helpful customer service team and additional add ons which you are not pressured at any point to use. If you feel you need more information — feel free to read our full review of ZenBusiness here.

#2: Start an LLC in Illinois With Northwest Registered Agent

Although Northwest Registered Agent is not the cheapest LLC formation service company. It is, however, not the most expensive, and you get a lot for your money. When you use one of their LLC formation packages, you’ll also get a full year of their registered agent service. One of the key things the company prides itself on is their customer service, as their support is quick, efficient, and the team will go out of their way to help you. Also, unlike many of their competitors, they will not sell your information to other companies, as they take privacy very seriously. If you want to know more about Northwest — we recommend reading a full Northwest Registered Agent review.

FAQs About Illinois LLCs

When I am done with my business in IL, should I dissolve it?

When your business comes to an end, it is always best if you dissolve it formally, following the correct process. This will avoid any penalties, fees and unnecessary costs in the future. There are several steps you will need to take to properly dissolve your LLC, which involves looking at your operating agreement, which should contain rules on how to dissolve your LLC as a company.

Do I need a business license in Illinois?

You may need to obtain a business license to run your business, but this depends on the type of your business and where it is located. These could either be state or local business licenses, or both. After forming you LLC, you should check with the city clerk in which the business’s primary place of business is located. You can find more information on state licenses with the Department of Commerce First Stop Business Information Center.

How much will it cost to form an LLC in the state of Illinois?

There are several costs involved with forming an LLC in Illinois. The most expensive part is likely to be the filing fees which go to the Illinois Secretary of State when you are filing your Articles of Organization, as this costs $150. You can then decide if you feel like it is beneficial to reserve your business name, which will cost an additional $25.

These could be the only costs you need to pay, especially if you are choosing to form your LLC yourself. If you don’t feel confident doing it yourself, or you don’t have the time, you could use a third party to form your LLC for you, which will cost you a little more money. There are some very affordable options out there though. If you choose to hire a lawyer, then this is likely to be the most expensive option.

Lastly, you need to see if there are any business licenses you will need to pay, as this will vary depending on business type and location.

Is it worth using a registered agent service?

It is completely up to you whether you want to use a registered agent service. Usually, they are relatively affordable, and will help you manage government filing for the stage, so you will have more time to concentrate on running your business.

How long will it take to register an LLC in the state of Illinois?

There is no set timeline when it comes to registering your LLC, as some processes will take much longer than others. Filing the Articles of Organization will usually take around 10 days, but if you need them filed a little quicker, they can be expedited for an additional fee to speed up the process.

Is a foreign LLC able to do business in Illinois?

If you have a business outside of Illinois, but want to do business within the state, then you must still register with the Illinois Secretary of State. Foreign LLCs must also appoint a registered agent for service that has a physical address located within the state of Illinois.

In order to register for a foreign LLC, you must file an Application for Admission to Transact Business, and there is a filing fee of $150. In addition to filing out the application, you must provide a Certificate of Good Standing from the home state of the LLC, which is dated no more than 60 days prior to the filing of the certificate.

You need to also make sure that the LLC’s name is available in the state of Illinois, which can be done on the state’s business name database. If the name is not available, then an assumed name must be used in its place.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs