Colorado LLC – Forming an LLC in Colorado (7 Step Guide)

Get Professional Help in Forming Your Colorado LLC

A limited liability company is one of the best ways to legally structure your business. This structure can protect your assets and lower your tax burden. Luckily for those considering Colorado for their state of formation — Colorado is often considered one of the top ten friendliest states for businesses.

So let’s discuss how you can get started on forming an LLC in Colorado.

If you want to skip the hassle of starting a Colorado LLC on your own, consider using professional help:

A Quick Video Guide for Colorado LLC

For a more extensive guide and details, we advise reading below. Also if you’re wondering how much will it cost you – read our full Colorado LLC costs guide here.

- Get Professional Help in Forming Your Colorado LLC

- A Quick Video Guide for Colorado LLC

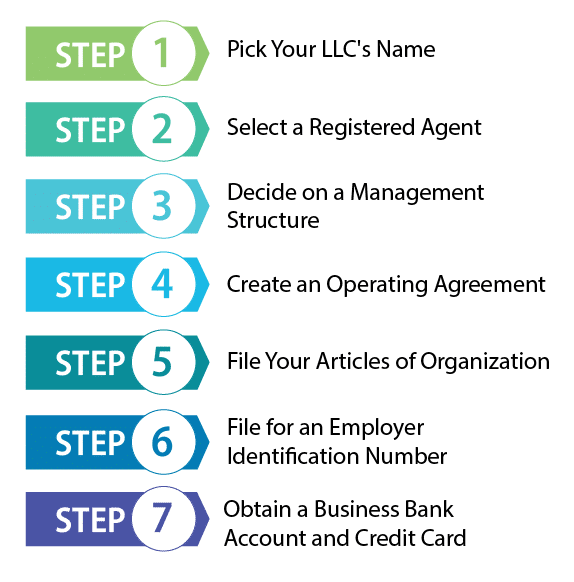

- 7 Steps for Forming an LLC in Colorado

- Step 1: Pick Your Colorado LLC’s Name

- Step 2: Select a Registered Agent in Colorado

- Step 3: Decide on Your CO LLC Management Structure

- Step 4: Create an Operating Agreement

- What Information Do I Need To Included in a Colorado Operating Agreement?

- Step 5: File Your Articles of Organization for Colorado State

- Step 6: File For an Employer Identification Number

- Step 7: Obtain a Business Bank Account and a Credit Card in Colorado

- Why Should I Form a Colorado LLC?

- A Few General Disadvantages of an LLC

- Professional Colorado LLC Creation Services

- Conclusion

7 Steps for Forming an LLC in Colorado

Step 1: Pick Your Colorado LLC’s Name

The first thing you will need to do to form your LLC in Colorado is to decide on a name. This part shouldn’t be too hard; you may have even chosen one. But, before you get too far ahead of yourself, Colorado has a few rules you will need to follow. So here they are:

Business Name Reservation

If it isn’t quite time to register your business, but you are worried your chosen name could be taken, it is possible to reserve a name for your LLC. All you have to do is file a Statement of Reservation of Name online at no charge. This will reserve your name for 120 days, and it is possible to renew your reservation as well.

Step 2: Select a Registered Agent in Colorado

Selecting your registered agent simply means choosing a company or individual responsible for receiving legal correspondence for your business. Your registered agent will be the formal contact the state uses to contact your business for issues such as civil litigation, tax documents, and other official matters, which means they must possess an address in the state of Colorado.

You can perform this duty yourself, and some business owners do, but you will have to be available at all times during ordinary business hours, and you will have to give an address, either your own address or your business address, if different.

This can lead to embarrassment in front of your customers or family if your business is sued, and some people may not be comfortable putting their personal addresses on public records.

This is why many LLC owners choose a professional registered agent service to act as their business’s official registered agent. These services operate nationwide, and you can find a Colorado registered agent service to represent you for an affordable price. Some of the best companies offering this service are IncAuthority and ZenBusiness, and we will talk more about these companies later on.

Step 3: Decide on Your CO LLC Management Structure

There are two choices available for management structure when it comes to your Colorado LLC. You can choose either member-managed or manager-managed.

To decide which is right for you, first remember that an LLC’s members refer to its owners. For a single-member LLC, there is only one owner, and for multi-member LLCs, there are 2 or more owners.

Colorado requires LLCs to designate at least one individual who will run the daily operations of the business. This can be one or more of the LLC’s members, and this would be member-managed, which is the most common choice.

Alternatively, you could opt for hiring a professional manager to run the business operations on behalf of its members. This would be a manager-managed structure.

The difference between these options comes down to who makes decisions on the business’s behalf. In a member-managed LLC, all of the members have the right to make decisions for the business. But with professional manager-managed LLCs, the members give the right to make decisions to the manager the LLC chooses. This manager could be one of the LLC’s members, or it could be a completely unrelated party.

Step 4: Create an Operating Agreement

The state of Colorado requires LLCs to craft an operating agreement. The operating agreement is one of the most important legal documents your LLC will be involved with. As such, the written agreement should be carefully stored with your companies other records. Additionally, as part of opening a business bank account, many financial institutions will require both your business’ EIN and operating agreement.

What Information Do I Need To Included in a Colorado Operating Agreement?

Not only is an operating agreement a required part of forming an LLC in Colorado, but it is also an important part of setting the stage for a successful business. A properly drafted operating agreement will create rules and guidelines that will help your business run for as long as it lasts.

An LLC operating agreement will address a number of topics, but the most important points are those addressing the members’ interests. This includes the member rights in making business decisions, and what management structure the LLC will use, and any further details on how management decisions will be made.

An operating agreement is unique and customized to the needs of the business it is made for, so yours will be unique. Don’t be afraid to include unique points, but here are some specific details that your agreement should cover.

4.1. Distribution of Profits and Losses

The members of an LLC will both share in the profit and the loss of their business. These profits and losses are allocated through what is called distributive shares. The division percentages that will be allocated to the LLC’s owners should always be set out in the LLC’s operating agreement.

Your operating agreement should also set out when distribution will happen. This can set out both whether the profit will be distributed on a schedule or at will when chosen by the LLC’s members. If you choose to have profits distributed on a schedule, then the operating agreement should set out when it will happen, such as monthly or quarterly. A final detail it should set out on this point is how much will be distributed and whether any will be retained by the company.

Remember that the LLC’s members will pay taxes on the profits of the LLC whether or not they are distributed. Consider whether enough money is distributed to allow members to pay these taxes if they can’t access the LLC’s profits.

4.2. Accounting

The operating agreement should set out your business’ accounting method and your business’ fiscal year whether or not it follows the calendar year. Another thing your LLC may want to consider is employing an accountant. This professional can ensure your business’s fiscal statements are in accordance with accounting standards, such as GAAP.

A commonly included point your LLC may want to consider including in its operating agreement is a provision assuring that LLC members and managers will disclose audited balance sheets, cash flows, and statements of operations to all LLC members. This will ensure that everyone knows the health of the LLC and is up to date with its finances

4.3. Withdrawal of Members

It may be sad to see a member of your LLC go, but it is important to include plans for if and when a member leaves either voluntarily or involuntarily. Rules for this can be included in the operating agreement itself, or you can establish a separate agreement called a “Buy-Sell Agreement.”

This agreement will require co-owners who wish to exit the business to sell their shares to the other co-owners or receive their permission to sell. This agreement is pretty flexible and can include how the process of selling a member’s interest will work, as well as details of who is permitted to purchase a member’s shares and who isn’t.

4.5. Colorado LLC Dissolution

Most new business owners probably hope their new enterprise will go on forever, but unfortunately, it probably won’t. Members may choose to split up, or the business may just end up not making a profit; no matter the reason, your business may have to close its doors.

Rather than putting it off until you have other important details, and it may even be too late, it should be planned for in your LLC’s operating agreement. Otherwise, default dissolution rules will apply, and these may not be desirable for your business, especially when things are looking down.

Important details for dissolution that your operating agreement should include are the rules for votes to end the LLC and how the LLC’s final value will be distributed upon dissolving.

If you choose to have a manager-managed LLC, the members can advise the managers about any decisions for the LLC; however, the managers are not required to take the advice. Managers are allowed to make decisions that the members disagree with. To avoid having this happen on any major decisions, the members may want to reserve the right to require a vote by the members on certain types of decisions by a manager.

To do this, the operating agreement should specify what type of decisions will require a vote. The operating agreement should also specify the percentage of members that will be required to approve a decision. Doing this will ensure that the members have a say in any major decisions about the LLC, such as bankruptcy or even large loans.

Or, you could give a member a greater share of the business based on the experience the member brings to the business. There could be a number of reasons to distribute the shares differently.

Step 5: File Your Articles of Organization for Colorado State

The biggest step in filing your LLC with Colorado is to file your Articles of Organization. This will outline the basic facts concerning your business, such as your business name, your business address, the purpose of your business, your registered agent, and the management structure your business will use.

You’ll generally need to include the following:

You will also need to pay a $50 filing fee for submitting the Articles of Organization. You will need to file your Articles of Organization online at the Colorado Secretary of State’s website because no paper forms will be accepted for the time being. Once you finish this step, your business will be official.

Step 6: File For an Employer Identification Number

If your business is hoping to either hire employees or to open a bank account, among other things, then this is a necessary step. Your employer identification number (EIN), also sometimes called a Tax Identification Number (TIN), is the number that your business will use when reporting the employment taxes it has withheld for its employees to the IRS.

Step 7: Obtain a Business Bank Account and a Credit Card in Colorado

This is not a necessary step, but it is an important one. A business bank account can separate your personal finances from those of your business which is crucial to retaining the legal protection LLCs offer your personal assets. Should you combine your personal and business finances, the court could revoke your limited liability protection, which is called piercing the corporate veil.

Having a business bank account will also help you develop a relationship with a bank, which could be helpful as you try and grow your business. You may also want to obtain a business credit card, preferably with the same bank. This will further develop your relationship with your bank while helping to develop a good credit history for your business. All of this will be useful should you want to obtain a business loan in the future.

Why Should I Form a Colorado LLC?

There are many reasons to file for an LLC in Colorado, from the credibility it can offer your business to the flexibility it gives while protecting your assets. Let’s look at a few of the things you should consider when deciding if LLC formation is right for you.

1. Greater Credibility

Receiving Colorado state approval can offer your business a level of credibility that little else can. It essentially tells everyone that your business is a formal organization. This is because an LLC is a far more formal structure than a sole proprietorship or general partnership and requires state approval.

This is because with the tax benefits and decreased liability comes considerably more responsibility, regulation, and paperwork. This means that for many businesses becoming an LLC is a sign of growth and maturity that can distinguish your business from the competition.

2. Flexible Membership and Management of Your CO LLC

A Colorado LLC offers advantages such as a virtually unlimited number and type of owners and flexible management structure. Your LLC’s owners or members can include individuals, businesses, and most other entities.

Your LLC’s members can manage the business as closely or distantly as they wish. This can include direct member management or hiring a professional manager to run the company for them.

3. Easy Distribution of Profit

With a Colorado LLC, profits do not need to be distributed through salaries or dividends. Instead, they are passed to owners through profit distributions. This offers the advantage of pass-through taxation. This means that instead of being taxed when it is distributed, it will be reported on the owner’s personal tax return.

4. Decreased Personal Liability

A limited liability company explains one of the biggest advantages of formation right in the name. The owners of an LLC benefit from a separation of personal and business liability. This means in the case of a business’s financial loss, such as bankruptcy or lawsuit, your personal finances will be protected.

5. Avoid Double Taxation

By forming an LLC in Colorado, you receive the limited liability of a corporation without double taxation. A corporation must pay taxes on any profits. Then, the shareholders pay personal taxes on any dividends they receive.

However, with an LLC, the income passes through the LLC and is reported on the member’s individual tax returns. So, the members are being taxed similar to a sole proprietorship or partnership instead of being double taxed like a corporation is.

A Few General Disadvantages of an LLC

An LLC is a great idea for many, but there are some disadvantages. So, let’s take a look at them.

1. Increased Paperwork

Colorado does require additional paperwork such as periodic reports and filing requirements from LLCs. This can be time-consuming for many already busy business owners.

2. Decreased Investment Options

An LLC has most of the regular options for financing, starting with equity financing from its starting members. They may also seek debt financing from loans or credit as well as fundraising.

However, unlike a corporation, LLCs suffer from a limited ability to receive outside investment. A corporation can issue shares risk and responsibility-free, but the only way for those interested in investing in an LLC to do so is to become a contributing member of the business

Professional Colorado LLC Creation Services

Forming an LLC has many benefits, but creating one yourself can be very time-consuming. It’s also easy to make mistakes. So, if you want some help, we have listed two of the best LLC formation services below that will help you form your Colorado LLC flawlessly and quickly.

#1 – Start a Colorado LLC With ZenBusiness

ZenBusiness is one of the newer LLC formation services out there, but it’s also one of the best. Its customer reviews are overwhelmingly positive. ZenBusiness provides many useful features in their packages, such as an operating agreement, a free year of registered agent service, and a name availability check. Another plus is the limited number of upsells during the formation process compared to other companies.

You may also want to read our full Zenbusiness review here.

#2 – Start a Colorado LLC With IncAuthority

IncAuthority is a great choice for starting up your LLC. They will set up your LLC for free. IncAuthority even includes some great features in addition to filing your formation documents. They include a free year of registered agent service, a business name availability check, and a free business credit and funding analysis.

Here’s a full IncAuthority review here.

Conclusion

Forming an LLC is a great option for most businesses in Colorado. It can not only decrease your personal liability in case of business failure or lawsuits but also potentially lower your tax burden.

So, why not try forming your business in one of the most business-friendly states out there?

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs