Kentucky LLC (6 Step-Guide) – How to Form an LLC in Kentucky

Start a Kentucky LLC With Professional Help [scroll down]

If you are looking to form or upgrade a business, then you should consider a Kentucky LLC (especially if you reside in this state). A limited liability company (LLC) business structure can offer you protection for all of your personal assets and reduce your tax burden. This means you can take home more money and be sure you can keep it no matter how your business venture works out.

With a low cost of doing business, a business-friendly environment, and less than a day’s drive to 65% of the US population, Kentucky can be a great location for many businesses. Let’s take a close look at more of the pros and cons of a Kentucky LLC to help you determine if this is the right structure for your business and then how you can form one in only six easy steps.

If you want to skip the hassle of starting a Kentucky LLC yourself, consider using professional help:

- Start a Kentucky LLC With Professional Help [scroll down]

- Why Would You Want a Kentucky LLC?

- Quick Kentucky LLCs Pros & Cons

- How to Form Your Kentucky LLC in Six Easy Steps

- Step 1: Choose a Name for Your Kentucky LLC

- Step 2: Pick Your Kentucky LLC’s Registered Agent

- Step 3: File Your Kentucky LLC’s Articles of Organization

- Step 4: Make an LLC Operating Agreement

- Step 5: Obtain An Employer Identification Number for Your Kentucky LLC

- Step 6: Obtain A Business Bank Account in Kentucky

- Steps for Growing and Maintaining Your Kentucky LLC

- Form a Kentucky LLC With Professional Help Today

- Final Thoughts

Why Would You Want a Kentucky LLC?

As we said, choosing a Kentucky LLC for your business is a big choice, so before anything else, let’s take a look at why you would want a Kentucky LLC.

Also, forming a Kentucky LLC isn’t that expensive. To know all the costs associated with it – read our Kentucky LLC costs guide.

Given the number of disasters we have all seen, from recessions, natural disasters, pandemics, and wildfires, it has shown how any business can fail from the largest multi-billion dollar corporation to the smallest local business. So, the protection that an LLC can offer you is a priceless asset. This is the biggest reason why small business owners choose a Kentucky LLC.

However, with a Kentucky LLC, you can avoid this double taxation. A Kentucky LLC as a pass-through entity does not have to pay a corporate tax rate. The only tax that applies to the business as a whole is the limited liability entity tax. For Kentucky LLCs earning less than three million dollars, this will only be a set $175 annually.

Generally, that is going to be a whole lot less than paying the corporate tax rate on all of your earnings. After this, all your profits or losses can be transferred to you and any other owners to simply be accounted for on your personal tax returns. Plus, if for any reason you decide that a corporate tax rate would be better than an LLC, you can choose to be treated as a corporation for tax purposes.

But, with a Kentucky LLC, you can structure your business any way you choose with no rules on how it must be managed. Plus, there are no required meetings between owners and relatively minimal paperwork. This makes it easy to run your business however you choose.

Quick Kentucky LLCs Pros & Cons

We know as an entrepreneur you are busy enough without going through creating a long list of the pros and cons of forming a Kentucky LLC. But, this is a big decision, so we collected the most important pros and cons for you to consider before deciding if this structure is right for you.

Pros of a Kentucky LLC

There are a number of pros to a Kentucky LLC, and here are a few of them.

The individual forming the business does need to include their name and address. However, this does not necessarily need to be you or any of your LLC’s other members. Kentucky’s rules allow a business to be the one filing to start an LLC, and this means that the business’ information can be used for this instead. This means that the service you hire can be placed on the public record-keeping your own information private.

Cons of a Kentucky LLC

Like any major decision, there are cons to consider, and here they are:

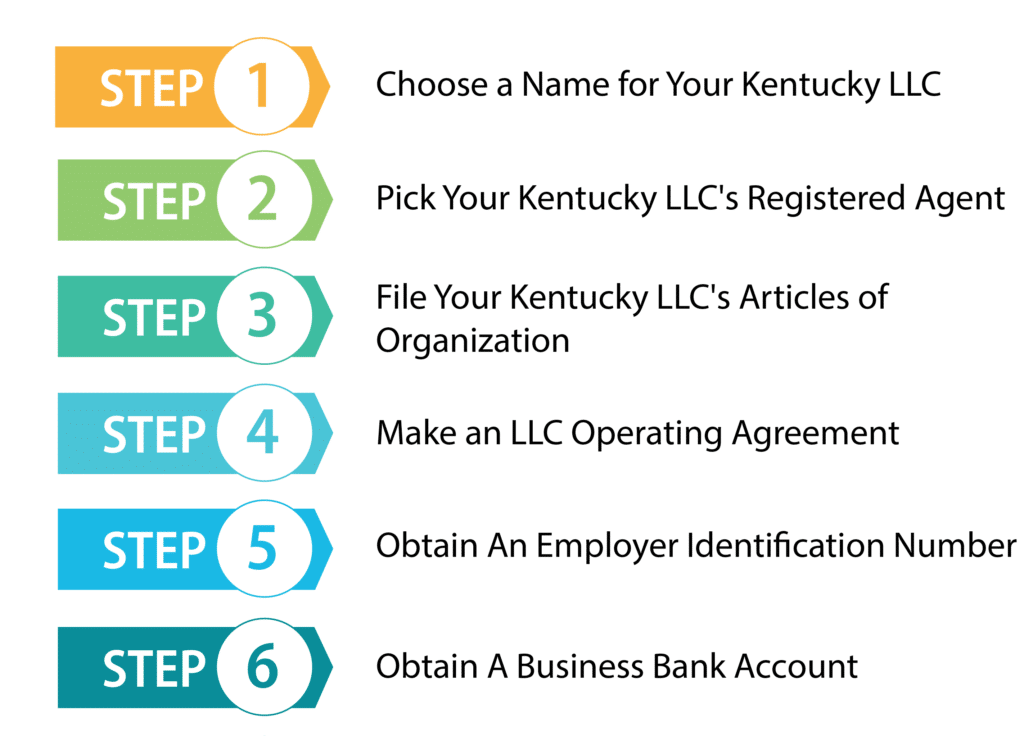

How to Form Your Kentucky LLC in Six Easy Steps

So, now you have had the chance to see why you would want a Kentucky LLC and the pros and cons of this structure. So, if you have decided to settle on this structure, congratulations! Now we can get started on forming your Kentucky LLC, and luckily it is only six easy steps away.

Step 1: Choose a Name for Your Kentucky LLC

The first step to forming your Kentucky LLC is to choose a good name for it. Though you may have some ideas in mind, it may not be quite as easy as you thought.

Every business name registered with Kentucky’s Secretary of State must be unique and easily distinguishable from any other. So, in addition to picking a catchy name that describes what your business does, you will need to make sure that it is unique from any other.

Luckily, it is easy to search and make sure your chosen business name is unique by using the business entity search tool on the Kentucky Secretary of State’s website. Simply enter keywords and see if any existing business names are too close to your own ideas.

You will then be required to attach a designator to the end of your chosen name. You may use “limited liability company,” “limited company,” or the abbreviation “LCC.” You may also use “LTD CO.” in place of limited company.

Once you have chosen a name, you may choose to file to reserve the name with the Kentucky Secretary of State. This would prevent anyone else from choosing the name for 120 days giving you the time to file your own business if you weren’t intending on doing it right away. Fill out and submit a Reservation or Renewal of Name form with the Secretary of State along with the $15 filing fee. This can be renewed as well if you choose.

If you become dissatisfied with your name later or if you have another service you would like to provide under another name, you can file a DBA later. A DBA “doing business as” is also known as a trade name, and this is another business name your LLC can operate under. This will need to be registered with the state of Kentucky, but then you can operate under the name freely. File a Certificate of Assumed Name form with the Secretary of State along with the $20 filing fee, and your registration will last for 5 years before you will need to file again.

Step 2: Pick Your Kentucky LLC’s Registered Agent

This is one of the most important choices you will have to make in forming your Kentucky LLC. Your registered agent is the individual or organization responsible for receiving official correspondence on behalf of your LLC.

The registered agent you choose can be just about any Kentucky resident with a physical address, including yourself, your family or friends, any other member of your LLC, or a service paid to serve as your registered agent. The one you choose will be responsible for receiving all official correspondence on behalf of your business, including service of process.

As such, they must be available during all regular business hours at the supplied address in order to receive service of process as well as any other official correspondence. If the registered agent you select is not available to receive correspondence at any time during these hours, your business could get in some serious trouble.

If you take this role yourself, then you must be available during regular business hours, which can be difficult for businesses that work outside of regular business hours as well as for those that need to travel for their work. You would also need to put your business address or personal address down depending on where you would be during business hours which for those working at home could again mean putting your home address out there on public record.

However, by choosing a registered agent service, you can avoid all of these problems. The registered agent service you choose will register their name and address with the state keeping your own off the record. Also, they will always be available to receive official correspondence and forward it to you.

Step 3: File Your Kentucky LLC’s Articles of Organization

This crucial step will establish your business as a legal entity with the state. You can file online or by mail, and either way will require the same information and filing fee of $40. To do it online, you can go to the Kentucky Business One Stop Portal page and make an account. There you can file for your business.

To file by mail, you will need to fill out the Articles of Organization form (Kentucky SOS Template), which you can do on your computer and then print it out and mail it to the Secretary of State.

Once you file it with Kentucky’s Secretary of State, the state will process, approve, and file it. This is a crucial step, so let’s take a closer look at the filing process.

Your Kentucky LLC’s Address

You will need to supply the state with your business address, and this is a step many small business owners dread. This is because this business address will then be listed on public record on the Secretary of State’s website just like your registered agents.

However, if you chose to have a company file this for you or to use a registered agent service, you can typically avoid this issue by listing the companies address instead. This is particularly advantageous for many business owners who work from home.

After all, if you do not have a separate physical street address for your business, you would have to list your home address. This can lead to a lot of annoying sales visits and bother that you don’t want to deal with when you are trying to build your business.

One thing to keep in mind is that you cannot use a PO Box as your business address. However, as long as you use one of these services’ addresses, you do not have to worry about the address being traced back to you, and your privacy will be secure.

Finish and File

Now that you have chosen what name, registered agent, and address you will use on your Articles of Organization, you will need to fill these in as well as a few more pieces of information. These are:

Now you and the registered agent will sign and date the articles, and they will be submitted to the Kentucky Secretary of State. Alternatively, if you pay a service to do it, you will supply this information, but they will sign and submit it for you keeping your name off the record.

If you are filing by mail, you can send the Articles of Organization along with your $40 filing fee to:

Michael Adams

Office of the Secretary of State PO Box 718

Frankfort, KY 40602-0718

Depending on whether you filed by mail or online, you will receive notice back by mail or email informing you of whether your filing has been approved. Generally, this will take between one to three business days.

Step 4: Make an LLC Operating Agreement

Even though your Kentucky LLC is not required to craft an operating agreement, it is critical to do so, particularly if you are not a single-member LLC. An operating agreement sets forth the rules for how your business will be operated.

This includes setting forth what percentage of the business belongs to which members, how decisions will be made, and how profit and loss will be distributed. A well-crafted operating agreement should contain all of this information and more, all customized to the needs of your business to ensure it runs smoothly.

The LLC operating agreement should include provisions such as the rights, roles, and powers of its members and how disputes will be settled between them. Also, if your LLC will be manager-managed, you will need to set out the rights, powers, and duties of the manager as well as what will happen if a dispute arises between a manager and any members.

Another important topic is procedures for how members can leave, what will happen to their share of ownership, and how new members can be welcomed in. Finally, a last important topic of any operating agreement should include rules for dissolution. By providing how assets will be distributed once debts are settled, you can avoid months of arguing and litigation. Is a particular member entitled to a specific asset, or does a particular member have the right to continue the business after the others leave? These are all important topics to include in addition to any that will help your business run, and your members can all agree to.

Step 5: Obtain An Employer Identification Number for Your Kentucky LLC

Most businesses will need to obtain an Employer Identification Number (EIN). Not all businesses are required to obtain an EIN, but any business that intends to hire employers will need one, as will any LLC with two or more members. You will probably also need one if you plan to open a business bank account, which you should definitely do.

An EIN, which is also known as a Federal Tax Identification Number, works a lot like a Social Security Number and is used by the IRS for tax purposes. You can obtain an EIN for free online, which is the quickest way to get an EIN. You will receive the number as soon as you submit the application online.

You can also apply by mail or fax. To apply by mail, fill out Form SS-4, which you’ll find on the IRS website. Once you fill out the form, you can send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It should take about four weeks to process.

Or, if you choose to fax the form, the number is (855) 641-6935. It should take about four business days to receive a fax back.

If you are an international applicant, you have the option of applying by phone. You can call from 6 a.m. to 11 p.m. Eastern Time on weekdays. The person calling needs to have the authority to answer the questions on Form SS-4 as well as receive the EIN.

Step 6: Obtain A Business Bank Account in Kentucky

If you want to make sure that your business maintains its limited liability, you must keep your business finances separate from your personal finances as well as the finances of any of your LLC’s members. One of the best ways to do this is to open a business bank account.

You’re not required to do this, but if you are ever sued, it is an excellent way to show the courts that you are keeping your business’s finances separate from the finances of any of its members. There are also a number of other advantages, which we will discuss below.

What Documents Are Required To Open a Business Bank Account?

The requirements for opening a business bank account vary depending on the exact type of account you want and the bank at which you choose to open your account. But, there are some documents that you will probably need no matter which bank you choose. We will discuss these documents below.

Steps for Growing and Maintaining Your Kentucky LLC

Your Kentucky LLC is now formed, but that doesn’t mean the work stops here. Now is the time to grow and maintain your new LLC, and here are some ways to do it.

1. Get Business Insurance

Every business should have business insurance, including LLCs. An LLC will help protect your personal assets should your business be sued. However, it will not protect your business assets. So, it will likely be worth the cost to purchase business insurance to protect your investment in your business. This is especially true if you depend on your business for a significant portion of your income. There are reasons you should obtain business insurance, and we will discuss some of these below.

Although business insurance is sometimes not required, you’ll want to make sure you have it to protect your business assets as well as your personal assets. If you are sued, you could lose your business assets if you are not adequately protected.

2. Start a Business Website

Most businesses today will want a business website. A business website will help give your business a professional image and help draw customers to your business. Oftentimes today, when people see a business they are interested in, they will look it up online. So, you will want a website where potential customers can learn more about your business and hopefully decide they want to buy your product or service. This works for brick and mortar businesses as well as online businesses. You’ll want people to have a chance to learn about your business.

Fortunately, it is not hard to create a website. You’ll find a wide variety of tools online to help you build a website. Additionally, if you decide to get help forming your LLC from an LLC formation company, they may provide a website for you as one of their services.

Form a Kentucky LLC With Professional Help Today

Forming a business is hard work, and you don’t have to go it alone. These are some of the best services for helping you form your Kentucky LLC.

#1. Create a Kentucky LLC With ZenBusiness

ZenBusiness has very good customer reviews and offers some excellent services with their lowest tier package, such as a free operating agreement and filing your annual report for you. They also offer 25% off of registered agent service with any of their packages.

#2. Create a Kentucky LLC With Incfile

Incfile is one of the best LLC formation services out there, and this is especially true if you are trying to form your LLC on a tight budget. This is true because their lowest tier package is free; you just pay state filing fees. Incfile also provides a year of registered agent service for free. Along with the registered agent service, Incfile will provide your business with free lifetime company alerts. These alerts will let you know of any upcoming state filing requirements, so you can stay in good standing with the state.

Final Thoughts

Forming a Kentucky LLC is a great idea for many business owners, and, as you have now seen, it is quite manageable to form one. Plus, between the limited liability and the cost savings this structure can offer you, it is definitely worth the effort. So, don’t put it off and form your Kentucky LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs