Georgia LLC (7-Steps Instructions): How to Form an LLC in Georgia?

Get Professionals to Form a Georgia LLC For You (Hassle-free)

An LLC (limited liability company) is a very popular structure for businesses. This is for a great reason, LLCs offer an amazing array of benefits for business owners. LLCs do this by combining some of the benefits of both a sole proprietorship and a corporation.

The most important benefits include protection from personal liability for business failure and potentially reduced taxes. So, if your business is looking to file as an LLC or you would like to start your business as one now, Georgia is a great state for it. Georgia is often considered one of the most business-friendly states in the country. So, read on to learn how to form an LLC in Georgia.

If you’re interested in finding out all the costs and fees associated with it – read our full Georgia LLC costs guide.

If you want to skip the hassle of starting a Georgia LLC yourself & save a great amount of time, consider using professional help:

- Get Professionals to Form a Georgia LLC For You (Hassle-free)

- 7 Steps on Forming an LLC in Georgia

- Step 1: Choose a Name for Your Georgia LLC

- Step 2: Choose a Registered Agent in GA

- Step 3: Write Your Articles of Organization for Your Georgia LLC

- Step 4: Draft an Operating Agreement

- Step 5: Obtain an EIN For Your Georgia LLC

- Step 6: Open a Business Bank Account in Georgia

- Step 7: Obtain Business Insurance

- Annual Registration for Georgia LLCs

- Get Professional Help in Forming an LLC in Georgia

- Conclusion

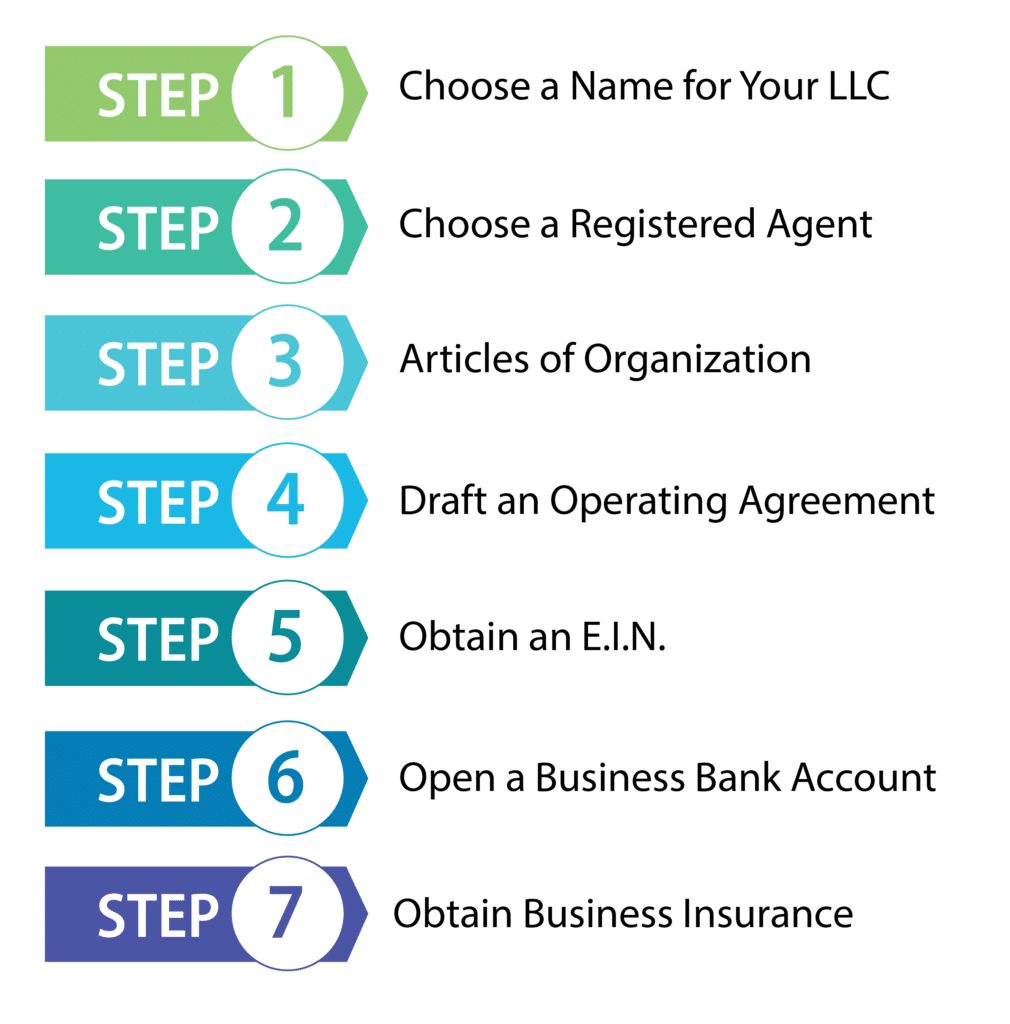

7 Steps on Forming an LLC in Georgia

Step 1: Choose a Name for Your Georgia LLC

This is an important decision both for forming your LLC and for the future of your business. The name should suit your business, let everyone know what your business is about, and be unique to your business.

In addition to helping your business, Georgia requires any business filing for an LLC to be unique from other Georgia business names already in use. Some conditions that will cause Georgia’s Secretary of State to reject a name include:

Your LLC must also use certain words or abbreviations for LLC in its name, and acceptable versions include “limited liability company,” “limited company,” “ltd. Liability company,” “limited liability co.,” “LC,” “L.L.C.,” or “L.C.”

There are also some restricted words as well that may require additional approval from applicable state agencies to use. These include the words: “bank or any variants of the word,” “bankruptcy,” “insurance,” “reinsurance,” “assurance,” “surety,” “fidelity,” “credit union,” “savings and loan,” “trust,” “university,” and “college.”

To find possible names, you can use the Georgia Secretary of State’s business name search on their website. You can use the business name search tool to find businesses with similar names. This can allow you to avoid using a business name that is similar to other existing names. This will allow you to meet the legal requirement for a distinct name and choose a name that will avoid litigation from other Georgia businesses.

Reserving a Name

Though your name will be protected once you file your Articles of Organization, you can reserve a name by filing with the Georgia Corporations division. You can submit a name reservation by creating an account on the Georgia Corporation Division website, completing the online filing process, and paying a $25 filing fee.

You can also complete a name reservation by filing a paper Name Reservation Form printable from the Georgia Secretary of State’s website. After completing it and paying a $35 fee, you can mail it to:

Office of Secretary of State, Corporations Division

Name Reservation Request

2 Martin Luther King Jr. Drive SE

Suite 313 West Tower

Atlanta, GA 30334

After your name reservation gets approved, you’ll receive a reservation number by email. The reservation is good for 30 days or until you register your business, if sooner. When you go to register your LLC, you’ll use this number to claim your business name on the Transmittal Information Form.

Using a DBA

While you are choosing your LLC’s name, you might want to choose a DBA (doing business as – check out our full guide) name as well. A DBA is a name other than the registered name for your business. There are some good reasons for having a DBA.

Having DBAs for a few different types of businesses can allow you to operate these businesses under one parent company. Doing this is cheaper than forming several LLCs.

A DBA is also useful if you want to sell related products to different types of customers. Having different names can make this easier to do.

You’ll need to register your DBA should you decide to have one. There are three steps you’ll need to follow to register it.

- Choose your name. Choosing a DBA name works the same as choosing a name for your LLC. You’ll want to make sure your chosen DBA is not already taken in your state.

- Register your DBA. This is different for a DBA than it is for an LLC name. You’ll need to register your DBA in the county where your business is located. File the trade name application form in the Office of the Clerk of the Superior Court. The filing fee will vary depending on the county you are filing in.

- Publish Your Notification: After you file your notification and it gets approved, you are required to publish notification of your DBA in a newspaper in the county you filed for a DBA in. The notification is required to be filed for two weeks, once a week.

Partnerships and sole proprietorships can register a DBA without registering an LLC, but this will not give you limited liability. This would still require forming an LLC with or without a DBA.

Some LLC owners also choose to register their business name as a trademark. If you want to do this, you can apply for a trademark online at the United States Patent and Trademark Office website. The fee is $15. Make sure your business name is not already trademarked. Also, if you are registering a mark, you must already be using it.

Step 2: Choose a Registered Agent in GA

All LLCs in Georgia must choose a registered agent to accept legal documents on behalf of their business. These documents could be service of process or other documents from the state. Your registered agent must have a physical address in your state and be available during all business hours.

A registered agent can be an individual or a business registered with the state to act as such. Though an individual member of your business can act as the registered agent for your business, there are several disadvantages to this.

If your business ever suffers from a lawsuit and is served, this could quickly become embarrassing in front of your family, employees, or even your customers. This could also mean surrendering the privacy of your home address to public records if you work from home. Finally, your registered agent must be present at the address given during all regular business hours in order to receive service of process. This can be extremely inconvenient if your business operates at odd hours or requires travel.

By hiring a service to act as your registered agent, these problems and more can be solved. A registered agent service can receive legal notices for your business and save or record them for you to view later. Using a registered agent service can help you meet the legal requirements and give you peace of mind knowing your important documents will be received while you focus on growing your business.

Step 3: Write Your Articles of Organization for Your Georgia LLC

Filing the Articles of Organization is what actually starts your LLC. So, it’s best to have everything you need to fill out the form together and be careful not to make any mistakes. However, if you do make a mistake, the state will send you a notice telling you what you need to do to correct the form. But, this could slow down the process.

You’ll need to decide a couple of things to fill out the form, and we will list these below.

To form your LLC, you must file a Transmittal Information Form as well. To fill out this form, you’ll need:

- Your LLC name reservation number, if you have one

- The name of your LLC

- The name and address of the person filing the Articles of Organization

- The name and address of the principal office of your LLC

- The name and address of your registered agent

- The name and address of all organizers

You can file these forms online at the Georgia Secretary of State’s website for $100 or by mail for $110 at:

2 Martin Luther King Jr. Dr. SE

Suite 313 West Tower

Atlanta, Georgia 30334

Step 4: Draft an Operating Agreement

Business owners forming an LLC in Georgia aren’t required to create an operating agreement. But, you should still create one for your business. The operating agreement is a legal document that specifies the structure of your business along with the rights and responsibilities of its members.

You can also specify many of the rules for your LLC instead of being subject to the state’s default laws. Additionally, including the specific rules for your LLC can help avoid arguments between members later. You should include a number of details in your operating agreement, and we will discuss these.

Manager-managed LLCs are managed by a manager who is chosen by the members. The manager will make the decisions for the LLC. The members can advise the manager. But, the manager is not required to take the advice. The members may reserve certain decisions themselves by specifying this in the operating agreement.

Step 5: Obtain an EIN For Your Georgia LLC

An EIN is an Employer Identification Number (EIN). This is a nine-digit number used by the IRS to identify your business for tax purposes. Not all LLCs have to have an EIN; some sole proprietorships don’t have to have one. But, most businesses should get an EIN, and an LLC with two or more members is required to have one. There are also several other cases where a business will need to have an EIN, which we will list.

If you decide to get an EIN, it’s easy to do. You can obtain an EIN on the IRS website for free. You can also apply by mail; fill out Form SS-4 and for applicants from the 50 states, mail it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

For international applicants, mail it to:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Step 6: Open a Business Bank Account in Georgia

Once you form your LLC and get an EIN, you’ll want to open a business bank account. There are several reasons why this is an important step, and we will discuss these.

Step 7: Obtain Business Insurance

Many business owners believe that if they have an LLC, they don’t need business insurance because of the limited liability an LLC provides. But, this isn’t the case; it’s true that your personal assets are generally protected, but not your business assets. Also, your personal assets are not always protected.

If your business hurts someone or causes financial harm to another business, your business can be sued. If your business is held responsible, its assets can be taken to satisfy the debt.

Also, there are situations in which your personal assets are at risk. If you personally hurt someone, are negligent, do something illegal, or mix your personal and business finances, your personal assets could be at risk.

Annual Registration for Georgia LLCs

Once you form your LLC, Georgia requires all LLCs to file an annual registration to stay in compliance with the state. This registration costs $50/year. There are a number of things you need to include in your registration. We will list these items below, so you can have them ready before filling out your registration.

- The name or control number of your LLC

- The name of the person filing your annual registration

- The name and address of your registered agent (must have a physical address in Georgia)

- Email address

- The mailing address of your principal office

- The names and addresses of your LLC’s officers

Get Professional Help in Forming an LLC in Georgia

Forming an LLC can be difficult and time-consuming. It can be good to have some help, and we list two of the best LLC formation services that you could choose to help you.

#1 – Start an LLC in GA With ZenBusiness

ZenBusiness offers LLC formation services at a very reasonable price with some great features. Two of these features are particularly useful for most LLCs. ZenBusiness provides a year of free registered agent service with all of their packages. They also provide worry-free compliance with their Pro and Premium Packages. With this guarantee, ZenBusiness will file your annual report and alert you about anything else you need to do to stay in compliance with the state. Those with the starter package can purchase worry-free compliance for $119/year.

To know more about it — check out our full ZenBusiness review here.

#2 – Start an LLC in GA With Northwest Registered Agent

Northwest Registered Agent is an excellent LLC formation service with decades of experience. They provide very good, knowledgeable customer service. But, their best feature is the privacy they offer. None of their services are outsourced to third parties, they don’t sell your information, and they even write their own code.

For more — here’s a full Northwest review.

Conclusion

Forming a Georgia LLC is a great way to protect your personal assets in case of a lawsuit or business failure. Luckily Georgia makes it easy to file for your LLC and provides a great business environment. If you would like to form a Georgia LLC, just follow the above steps, and you will be ready for business in no time.

Alternatively — just use the professional services listed above and have everything done for you hassle-free.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs