New Hampshire LLC (6-Step Guide) – How to Start an LLC in New Hampshire

Form Your LLC Today With Professional Help (from $0+state fees)

Forming a New Hampshire limited liability company (LLC) may just be one of the best business decisions you can make (especially if you live there). A New Hampshire LLC can offer you an incredible degree of protection for all of your personal assets allowing you to pursue business plans without fear.

You may also be able to lower your tax rate, which is always a plus in the northeast. Let’s take a closer look at why you might want this business structure and how you can form your own.

If you want to skip the hassle of starting a New Hampshire LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form Your LLC Today With Professional Help (from $0+state fees)

- Why Would You Want an LLC in New Hampshire?

- Quick New Hampshire LLCs Pros & Cons

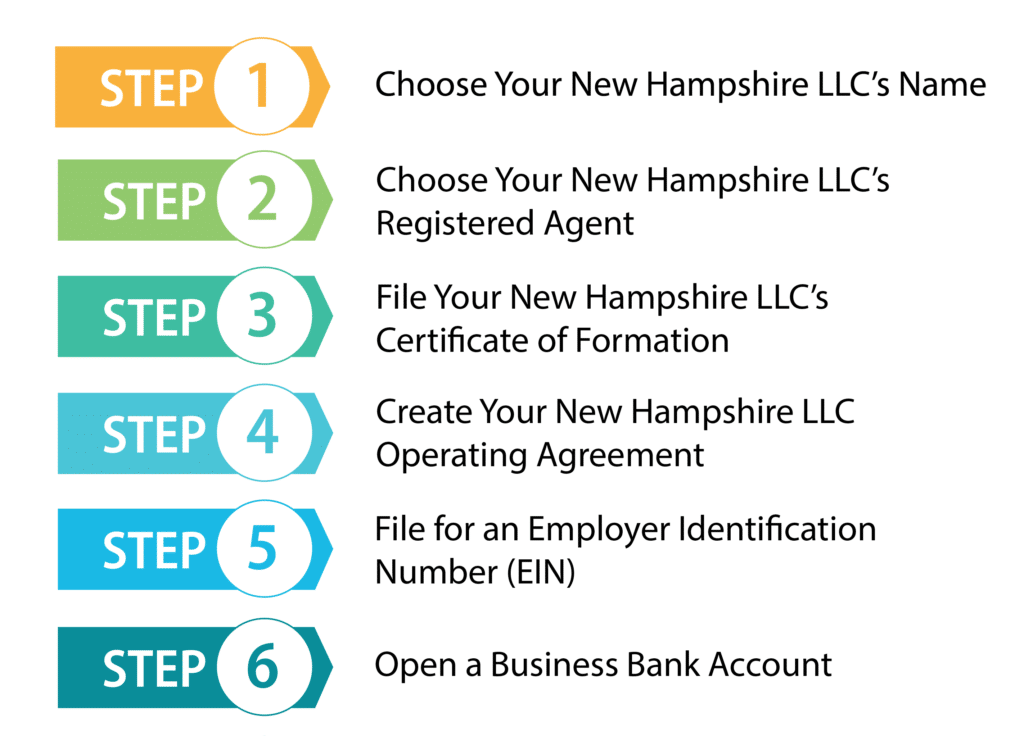

- How to Form Your New Hampshire LLC in Six Easy Steps

- Step 1: Choose Your New Hampshire LLC’s Name

- Step 2: Choose Your New Hampshire LLC’s Registered Agent

- Step 3: File Your New Hampshire LLC’s Certificate of Formation

- Step 4: Create Your New Hampshire LLC Operating Agreement

- Step 5: File for an Employer Identification Number (EIN)

- Step 6: Open a Business Bank Account

- Steps for Growing and Maintaining Your New Hampshire LLC

- Form a New Hampshire LLC With the Help of Professionals

- Final Thoughts

- FAQs

Why Would You Want an LLC in New Hampshire?

A New Hampshire LLC can be a great option for many entrepreneurs, so let’s take a closer look at the reasons why you would want a New Hampshire LLC.

Quick New Hampshire LLCs Pros & Cons

Before doing something as important as forming a business, it is important to consider the pros and cons. Since we know most entrepreneurs struggle with finding time, we will make it quick and take a look at the most important advantages and disadvantages.

Pros of a New Hampshire LLC

First, the biggest pros of forming a New Hampshire LLC include:

Cons of a New Hampshire LLC

Now let’s take a look at a few cons to consider, including:

How to Form Your New Hampshire LLC in Six Easy Steps

Now that we have taken a look at why you should consider this structure, let’s consider how you can form your own. Starting a New Hampshire LLC is as easy as following six easy steps, so let’s get started.

Also, if you’re wondering how much will everything cost if you choose to do it yourself — read our New Hampshire LLC cost guide. You’ll get a very good understanding of all the fees and taxes in this state.

Step 1: Choose Your New Hampshire LLC’s Name

The first step to forming a New Hampshire LLC is choosing a name for it. You may have already given this step some thought, and it can be a fun step. However, keep in mind that this is an important decision and needs to be done before any other step to ensure your other documents will have the right name.

Also, keep in mind that the state does have some requirements you will need to account on, and the first of these is that your name must be unique and easily identifiable from all names registered with the state before it.

To make sure the name you choose is unique, you will need to do a business name search. To do this, you can use the Business Entity Search tool on the New Hampshire Secretary of State’s website. By searching here, you can ensure that no business with a similar name has already been registered.

First, type in some keywords from your business name idea in the “Business Name” search box and select “contains.” Hit search and see what comes up. If it is “no data found with your search criteria,” then you are fine, and the state does not think that any names were previously registered with the keywords you have entered.

However, if any names do appear, then you will need to consider if they are too close. Look over the names if any appear and compare them with your own choice. Do they contain essentially the same words but with a different grammar. If so, your name is likely not unique enough to register.

However, if none sound much like your own, then you are likely all right choosing the name. Simply consider how easy it is to distinguish your name from any of the ones on the list.

Next, you will need to add an identifier to the end of your chosen name in order to let people know that your business is a limited liability company. Luckily, this is as simple as putting limited liability company or any of its abbreviations like “LLC” or “L.L.C.” onto the end of your business name.

Also, remember that you are not allowed to include an identifier for another business structure such as corp. or nonprofit. This could confuse people into believing that your business is another structure and will result in your Certificate of Formation being rejected.

Step 2: Choose Your New Hampshire LLC’s Registered Agent

Now that you have settled on a name for your New Hampshire LLC, it is time to choose who will represent your business as its registered agent. This is an important choice because your business’s registered agent will receive official correspondence from the state as your official point of contact. This correspondence will include tax forms, service of process, and other important forms and notices from the state.

You have a lot of options when it comes to who you choose to serve as your business’s registered agent. However, there are a few rules that your business will have to follow in who can serve in this role. First of all, they must be at least 18 years of age or older and possess a street address within the state of New Hampshire. Keep in mind that a post office box will not be accepted for this. Lastly, your registered agent must be at the address you provide and ready to receive correspondence during all regular business hours, which essentially means 9:00 a.m. to 5:00 p.m.

Business owners are allowed to serve as their own registered agents, and other options are to choose family, friends, or a registered agent service. Out of these options, a registered agent service is the most popular choice for most business owners.

This can offer a lot of advantages, particularly for business owners who will not have a physical presence in the state. This way, you can use the street address of the registered agent service. This is also a good choice for those interested in increasing their privacy.

Your New Hampshire LLC’s registered agent will be listed on the public record, meaning particularly if you work from home, you may not want to place your own information out there. This can result in a lot of sales visits and bother.

Now, a final reason you may want to consider using a registered agent service is if you will work at anything other than traditional business hours or from anywhere other than the address you provide. If this is the case, then you may want to consider a registered agent service that will always be present during the required hours.

To make your life a lot easier — we have a guide that ranked the best Registered Agent services. You can be 100% sure that you’ll get the best service if you select either one of them from the list.

Step 3: File Your New Hampshire LLC’s Certificate of Formation

This is the step that will make your business a legally registered entity. It is time to file your LLC’s Certificate of Formation with the New Hampshire Secretary of State. This document which details your business and the people starting it, will allow you to start doing business, and we know you’re in a hurry, so let’s get started!

The Certificate of Formation must contain certain information in order to be approved, and this includes:

The information will be the same however you choose to file, but you have a choice of filing either by mail or online. Generally, filing online will be your best choice as you will generally receive a response in less than a week and can easily be done from the comfort of your home.

If you choose to file by mail, you can download the form and fill it out. Send the form along with the filing fee to:

Corporation Division, NH Dept. of State, 107 N Main St, Rm 204, Concord, NH 03301-4989 Physical Location – State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH

Whichever method you choose, you will need to pay a $100 filing fee. However, online transactions will have to pay a separate $2 handling fee on top of the filing fee. Once your Certificate of Formation is approved, make sure to save a copy of this important document to keep it around for when it is needed.

Step 4: Create Your New Hampshire LLC Operating Agreement

Now that your New Hampshire LLC is officially in business, you will need an operating agreement. This is not required by the state; however, it is a very important step that will protect the business and its members. It is also often required for important business activities such as opening a business bank account or receiving a loan.

An operating agreement is effectively a contract between the business’s owners that details the ownership and operation of the business. This will set out rules for how the owners will run the business and set forward how the LLC will be financed.

A well-written operating agreement is great for settling disputes between members, particularly if an argument ends up in court. However, even if your LLC is only a single-member LLC, it is still a good idea to create an operating agreement to help establish your business as a separate entity and to allow you to open a business bank account.

Now let’s take a look at what items should be included in a New Hampshire LLC operating agreement. Important items include:

These are just some of the most important points that your New Hampshire LLC’s operating agreement should include. Remember that your operating agreement can have all of these and anything more that will help your business to run smoothly.

Also, remember that your operating agreement is capable of being updated with time to ensure that it always remains relevant to your company. This ensures that it will always help your business to run smoothly and meet your member’s needs.

Step 5: File for an Employer Identification Number (EIN)

An EIN is an important nine-digit number that identifies your business for tax purposes. This nine-digit number issued by the IRS for free is kind of like a Social Security number for your business.

This number will be used for a lot of filing and tax purposes with the government and for numerous business purposes such as to open a business bank account, receive a loan, and perhaps most importantly, hire employees.

So, to file for an EIN, you have multiple options, which include doing it online, by mail, through fax, or for international applicants by phone. Generally, the easiest way is to file online at the IRS website. You or any other member that is filing for your LLC will need to have an SSN or ITIN and be willing to act as the responsible member to the IRS for your LLC.

In order to file by either mail or fax, you can fill out Form SS-4. For filing by mail, you can send the form to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

In order to file by fax, complete the form and send it to (855) 641-6935. International applicants may file by phone and can call 267-941-1099 between the hours of 6 a.m to 11 p.m. Eastern Time Monday through Friday.

Step 6: Open a Business Bank Account

Starting a business bank account is again not legally required by the state, but it is extremely important for New Hampshire LLC’s that need to separate their business finances from their personal ones. Without properly separating these, you could lose your limited liability status putting your own assets at risk if your business is ever sued or incapable of paying its creditors. This is often referred to as “piercing the corporate veil.”

Plus, in addition to protecting your limited liability status, there are several other advantages, so let’s take a closer look at some of the other reasons why you should open a business bank account.

Documents Required To Open a Business Bank Account

The documents you will need to open a business bank account will vary depending on which bank you open your account at and the type of account you choose. However, there are several documents you are likely to need in order to obtain a business bank account at any bank, and we will discuss these.

Steps for Growing and Maintaining Your New Hampshire LLC

Ensuring that your New Hampshire LCC grows and stays on top of the regulatory requirements is just as important as forming it in the first place. So here are some of the steps that can keep your business going strong.

1. File an Annual Report

After you’ve filed your Certificate of Formation with the state and it’s been approved, you’ll need to start thinking about maintaining your LLC. One of the things you’ll need to do to maintain your LLC and keep it in good standing is to file an annual report with the New Hampshire Secretary of State. There is a filing fee of $100 for filing your annual report, and the report is due by April 1st each year. You will need to file your first annual report the year after your LLC is formed.

You can file this report online or by mail. You can file your annual report online by using New Hampshire’s QuickStart filing system. You’ll need to create an account to use the system, but it’s easy to file your annual report, and after the first year, you can use One-click annual report filing if you haven’t changed your business and your principal information hasn’t changed. You should get an immediate response when filing online.

If you choose to file by mail, you can send an email to [email protected] or call 603-271-8200, and they will send you a form to fill out for your annual report. After you fill out the form and mail it in, it takes approximately one to three weeks to process.

There is a penalty for not filing your annual report, and your LLC’s status will be “not in good standing.” Additionally, if you do not file for two years, your LLC could be dissolved by the state. Also, if you make any errors on the annual report, the state will notify your registered agent, and you will have 30 days to correct the errors. You will then need to re-file the form in the allowed time period.

2. Get Any Necessary Business Licenses and Permits

Depending on your type of business, you may or may not need additional licenses and permits. These may be required by the local and county government where your business resides. If you fail to obtain them, then the state could issue a penalty, and in addition to fines, this could forbid your LLC from doing business in the state. So, make sure to check if there are any permit requirements for your industry.

Form a New Hampshire LLC With the Help of Professionals

When you’re a busy entrepreneur, starting a business may seem like a lot of work that you really don’t have enough time for. If this sounds like you, then don’t worry! There are a number of services that can help take the burden off of your shoulders and make it easy to get started. Here are two of the best.

#1: Start a New Hampshire LLC with ZenBusiness

ZenBusiness is one of the newer LLC formation services, but it has already become very popular. It has very reasonable prices and gets excellent customer reviews. In addition to the good prices they offer on their packages, they include a number of useful features. ZenBusiness offers a free operating agreement with all of their packages, which is something every LLC should have. They also offer 25% off of their registered agent service if you purchase one of their packages.

#2: Start a New Hampshire LLC with Incfile

Incfile is a very popular LLC formation service, and this is not surprising considering they are one of the most affordable LLC companies out there. In fact, they have a free formation package. All you have to do is pay the state fee. They even provide a year of free registered agent service with all of their packages. This is a very good deal considering registered agent service typically costs between $100 to $300 a year if you buy it separately. They also include lifetime company alerts with their packages. With this service, Incfile will inform your company of any upcoming state filing requirements, which will allow you to stay in compliance with your state.

Final Thoughts

A New Hampshire LLC can be a great way to get your business going in the right direction. With protection for all of your personal assets coupled with lower taxes and being in a great state for doing business, there is a lot to love in this business structure. So don’t hesitate to get started forming a New Hampshire LLC.

FAQs

Does New Hampshire Require a Business License?

New Hampshire does not require a general business license. But, the local area your business is operating in may require certain licenses or permits. So, it’s a good idea to check with the area you are in to see what they require.

How Are a Domestic LLC and a Foreign LLC Different?

A domestic LLC is a limited liability company that does business in the state in which it was formed. Typically, when people talk about an LLC, it is a domestic LLC. A foreign LLC is generally an LLC that is formed by an LLC in a different state that wants to expand into other states. To learn more read here.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs