Oregon LLC – How to Form an LLC in Oregon? (8-Step Guide)

Jump to Top-2 Oregon LLC Formation Services

An LLC is one of the best and most popular ways to structure a business. Forming an LLC grants business owners the flexibility to manage their business however they choose while giving them a degree of legal protection and lower taxes than corporations.

So, if you are considering forming an LLC in Oregon, you are in luck! Oregon is often considered one of the best states in which to form an LLC. The reasons for this are many but to start with: no sales tax and a low-income tax rate probably sounds pretty nice. And if you’re wondering how much will it cost to incorporate in Oregon — here’s our full Oregon LLC cost guide.

But now, let’s get right to it and show you how you can form an LLC in Oregon.

If you want to skip the hassle of starting an Oregon LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Jump to Top-2 Oregon LLC Formation Services

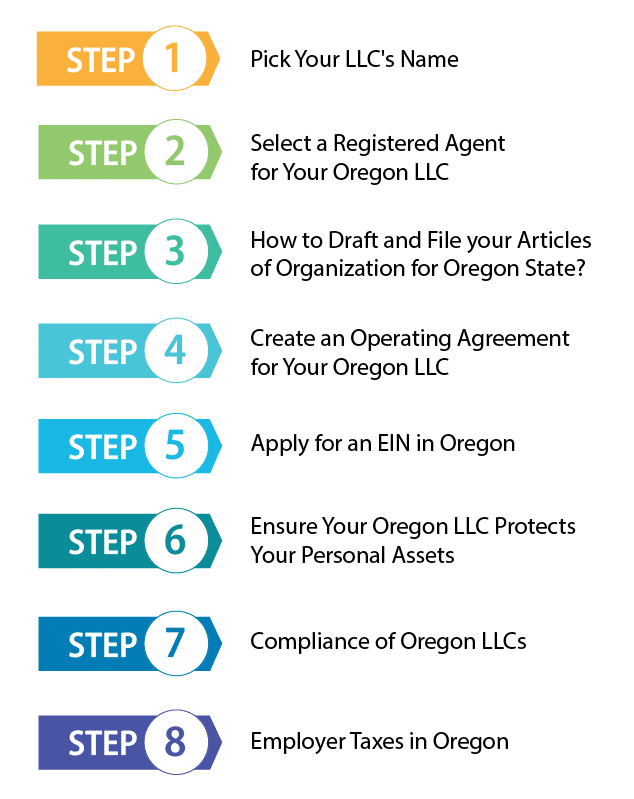

- 8 Steps on Forming an LLC in Oregon

- Step 1: Pick Your Oregon LLC’s Name

- Step 2: Select a Registered Agent for Your Oregon LLC

- Step 3: How to Draft and File your Articles of Organization for Oregon State?

- Step 4: Create an Operating Agreement for Your Oregon LLC

- Step 5: Apply for an EIN in Oregon

- Step 6: Ensure Your Oregon LLC Protects Your Personal Assets

- Step 7: Compliance with Oregon LLCs

- Step 8: Employer Taxes in Oregon

- Consider Getting Assistance and Saving Time When Forming Your Oregon LLC

- Conclusion

8 Steps on Forming an LLC in Oregon

Step 1: Pick Your Oregon LLC’s Name

The first step to forming an LLC in Oregon or elsewhere is pretty easy; you may have even gotten a headstart on it. You need to choose your future LLC’s name. If you haven’t, don’t worry. It just needs to follow a few rules to be allowed in Oregon. Here they are:

- Required Words: The state of Oregon requires the words limited company, limited liability company, the abbreviation L.L.C, or LLC to be contained in the name of any registered LLCs.

- Restricted Words: No LLC may contain any words or phrases that would imply that the LLC provides banking or related financial services unless prior written permission is given by the Oregon Division of Finance and Corporate Securities.

- Be Distinct: Your name must be unique and easily distinguishable from the name of any other business, trade name, or other registered entity in the state of Oregon. This means you cannot choose the same name that any other business has chosen unless they have failed to maintain their registration. However, you may choose the same name as a business in other states that have not registered in Oregon, as well as domestic businesses that simply have not registered the name with the state.

Oregon’s law requires the Secretary of State to accept names that follow these rules and are distinguishable from ones previously on record. Most states require the last rule, being distinct; however, Oregon is particularly generous. In general, as long as the name is even a letter off from those already taken, it may be distinct enough to be accepted. Also, keep in mind that all assumed business names are associated with a particular county in Oregon, so there can be several identical names as long as they are filed in separate counties. However, this does not mean that you can legally use these names only that they will be accepted by the state, but we’ll talk more about that later on.

For more information on picking a name for your Oregon LLC, check out the Secretary of State website. You can also use the Business Registry Database to search for names to see if the name you have chosen is available. One thing you may want to consider before you settle on a name is whether a suitable URL is available for it. If so, consider purchasing it before registering your business to ensure it remains available.

Name Reservation

If you find a name you want to use, but you aren’t ready to file your Articles of Organization yet, it is possible to reserve your name. This is not required, and it will cost you a $100 filing fee to do so, but you may consider it worth it if you are attached to a name, and you are worried it might be taken by the time you register your business. If you choose to, just print and fill out this form, attach your payment for $100, and file it with the state.

For Doing Business With a DBA in Oregon

If your chosen business name includes the actual names of any owners, then you do not have to perform a “doing business as” (DBA) registration. As an example, if you are John Smith and you want to open John Smith Architecture, then you’re fine. If this is the case, there is no need to register it beyond what you were already doing when you registered your business. But, if this is not the case, be sure to register the assumed name with the state of Oregon for your LLC.

This means if instead of John Smith Architecture, you wish to open Best Value Architecture, this is an assumed business name, and you will need to register it as an assumed business name.

Just Because You Register the Name Does Not Mean You Can Use It

This may shock you, but Oregon does not guarantee that the name you have chosen is legally available, only that it is not actively registered with the state itself. The name you choose must be carefully considered and researched to guarantee it is actually available, and then you must use it and defend it legally if necessary to assert your right to it.

One potential issue is registering a name already in use. For example, if you choose the name Walmart, then you may be able to register it in a county located in Oregon. However, that does not mean that you could not be sued for attempting to use this name.

Additionally, you may find that other businesses choose names similar to your own, perhaps even only one letter off. Just because they registered does not mean you cannot take legal action against them. The only way to establish your right to a business name for your LLC is by first registering it, then using it, and finally by legally defending it as necessary.

For help in ensuring the name you choose is legally available and for more information on defending it, consulting a lawyer is suggested. Their advice can be invaluable in preventing unnecessary legal action.

Step 2: Select a Registered Agent for Your Oregon LLC

Once you start filing your Articles of Organization, you will find that you have to select a registered agent. This registered agent will be the one responsible for receiving legal correspondence, tax forms, service of process, and any other correspondence from the state.

This means that the registered agent you choose must reside in Oregon, and it can be you if you choose. However, if you choose another person to be your registered agent, that is also an option, and it can be both an individual resident of the state or any business legally authorized by the state of Oregon to act as a registered agent.

If you aren’t sure whether to hire a professional registered agent or do it yourself, here is some information to help you decide.

- Regular Business Hours: All registered agents in the state of Oregon must be available during regular business hours at the stated address. This means 9 am -5 pm regardless of when your business actually is open.

- Damage to Reputation: If your business acts as its own registered agent, and it is ever served, then this may occur in front of your customers, coworkers, and employees. This can be an embarrassing and damaging experience.

- Public Address: By acting as your own registered agent, your address will be a part of the public record. This can be a problem for some if you run your business from home as it means that anyone can see your address on public databases connected to your business.

Professional Registered Agent

If you choose to use a professional registered agent, there are several options available. One is to hire an attorney to act as your registered agent, but this can be very costly.

Another is to use one of a variety of online services that maintain registered agent addresses in every state. These are far more affordable, and some even offer the first year free if you choose to file your LLC with them. We will talk about some of the best options later on.

Step 3: How to Draft and File your Articles of Organization for Oregon State?

To officially start your LLC, you’ll need to file your Articles of Organization. You can do this yourself or with the help of an LLC formation service or lawyer. If you choose to file on your own, you can print the form from the Oregon Secretary of State website, fill it out, and send it in. The address to mail it to is:

Secretary of State, Corporation Division

255 Capitol St. NE

Suite 151

Salem, OR 97310

The processing time should be three to five days. You could also file online at the same website. If you choose to file online, the processing time should be about 24 hours.

You’ll want to have some information on hand to fill out the Articles of Organization, and we will list what you’ll need below.

- Name of Your LLC: You will need to put the name you’ve chosen for your LLC. Be sure to include LLC, L.L.C., limited liability, or Limited Liability Company in your chosen name.

- Duration of Your LLC: You could have a specific end date, or it could be perpetual.

- Registered Agent Name and Address: You need to have a person who is available during business hours to accept legal paperwork on your business’s behalf in case it is involved in a court case or lawsuit. This is your registered agent. A registered agent can be a person or a service that handles this for your LLC. Many LLC formation services are willing to do this as a part of an LLC formation service package or for a separate fee.

- Mailing Address: List the address where your business is carried out, or its records are stored. You are required to list a physical address, not a P.O. Box. Also, it cannot be a mail receiving service.

- Names and Addresses of the LLCs Organizers: You need to list the names and addresses of all the people that organized your LLC.

- Type of Management Structure: Your LLC can be member-managed or manager-managed. A member-managed LLC is run by its members. Whereas a manager-managed LLC is managed by a manager or managers chosen by the members of the LLC.

- Description of Professional Service: If your LLC is providing a professional service, you need to describe it here. Otherwise, leave this space blank.

- Optional Provisions: Theseare provisions you can select for your LLC if they are appropriate. If your LLC benefits society and the environment but still earns a profit, you can select for your business to be a benefit company. Although, your business will need to meet certain standards of an approved third-party organization.

- You can select the indemnification provision if you’d like your LLC to indemnify its managers, members, owners, or agents. This provides extra liability for these people. It will protect them personally against legal liability for their own actions. To fully understand this protection, it is best to consult an attorney.

- Names and Addresses of Members and Managers: Oregon does not require that you list the names and addresses of your members and managers. However, a bank may require this when opening an account to prove ownership.

- Signatures of LLC Organizers: All organizers of the LLC must sign and print their names in this section along with their titles.

- Name and Phone Number of Contact Person: You need to put the name and phone number of a person who is authorized to speak for the LLC in case the Oregon Secretary of State has questions about the filing.

Step 4: Create an Operating Agreement for Your Oregon LLC

The state of Oregon does not require an operating agreement for LLCs. However, it is a good idea to draft one for your LLC and have all LLC members sign it. This document can work as a contract for LLC members. It can detail the structure of the LLC along with the rights and responsibilities of the members. This helps avoid disagreements among the members of the LLC. When you draft your operating agreement, it should contain a number of details which we will list below.

- Ownership Interest: Ownership interest is something you’ll definitely want to include in your operating agreement. Although a member’s ownership in the LLC is typically based on the amount of money he or she invests in the LLC, other arrangements are possible. Some members may bring other things of value to the LLC, such as ideas or experience, which may entitle them to a larger share in the LLC than their financial investment would indicate. However, it is important to specify the percentage of the business each member has to avoid misunderstanding. This is especially important when the percentage of ownership is not based entirely on the percentage of investment.

- Profits and Losses: Profits and losses are generally distributed according to the percentage of the business the member owns. The losses or earnings will pass through the LLC to the member. The member will then report the profit or loss on their personal tax return. However, the law does not require the profits and losses to be distributed based on the percentage of ownership. The members can agree to distribute the profits differently, but this should be spelled out in the operating agreement.

- Rights and Responsibilities: The rights and responsibilities of the LLC’s members will be different depending on whether the LLC is member-managed or manager-managed. So, it is best to specify in the operating agreement which form of management your LLC will have. Then, you should specify the responsibilities and rights of each member and manager. This should include how to choose or change managers as well as how to handle any disagreements the members may have.

- Changing Owners: In many states, if members don’t specify what will happen if a member leaves the LLC, the default action is to dissolve the LLC. This would be unfortunate if the other members would prefer to maintain the LLC. Therefore, it is best to prepare ahead and specify what will happen to the LLC should one or more of its members leave the LLC and the remaining members want to continue the LLC. You should put in the agreement whether any notice will be required and how the member’s share of the LLC will be distributed among the remaining members. Also, you should specify if the member will receive any compensation for his or her share of the LLC and, if so, what it will be.

- Dissolving Your LLC: Unless you planned for your LLC to last for a limited time period, you might not think you need to prepare for the dissolution of your LLC. But, it is best to plan ahead in case you do need to deal with this situation. You’ll want to specify how any assets will be divided. Specifying what will happen if the LLC is dissolved could avoid not only arguments but lawsuits as well.

Step 5: Apply for an EIN in Oregon

An EIN is an Employer Identification Number and is used by federal and state agencies to track your business. This number is very useful when filing taxes. Also, you’ll need an EIN to open a business bank account or if you are going to hire employees. You can obtain an EIN for free on the IRS website or apply for it by mail. Also, if you have an LLC formation service help you form your LLC, they will often obtain an EIN for you for an additional fee.

Step 6: Ensure Your Oregon LLC Protects Your Personal Assets

Once you form your LLC, you need to make sure you keep your business and personal finances separate, or you risk losing your personal asset protection if your business is ever sued and you have mixed your personal and business finances. This is because your business may not be seen as an independent entity when you mix your personal and business finances. The courts could set aside the limited liability of you and any other members of your LLC and make the members of the LLC personally responsible for the LLC’s debts. This is called piercing the corporate veil. There are some steps you can take to keep your LLC finances separate from your member’s personal finances to avoid having this happen. We list some of these steps below.

- Get a business bank account. Opening a business bank account can help keep your business and personal assets separate, which will help protect your personal assets. It will also make bookkeeping and taxes easier.

- Choose an authorized representative. If you designate an authorized representative for your LLC and have them sign any official documents for your LLC, it could help keep your LLC’s liability separate from your personal liability.

- Obtain a business credit card. This is an additional step you can take to keep your business finances separate from your personal finances. It can also help build your LLC’s credit history.

Step 7: Compliance with Oregon LLCs

Once you form your Oregon LLC, you need to make sure you stay in compliance with any state or local laws. You need to pay any required taxes, obtain any required licenses or permits, and file any necessary reports. If you don’t pay the correct taxes or file the needed reports, you may need to pay fines or penalties or even have your LLC dissolved.

Annual Report

One report you’ll need to file each year is the annual report. All Oregon LLCs are required to file this report. You could face fines if you fail to file this report or even have your LLC dissolved if your report is more than 45 days late. An annual report for Oregon includes:

This report is due each year by the date on which your LLC was formed. The filing fee is $100. You can file it online at the Oregon Secretary of State website or mail it to:

Secretary of State, Corporations Division, Public Service Building

255 Capitol St. NE

Suite 151

Salem, OR. 97310

Business Licenses and Permits in Oregon

If you are going to operate an LLC in Oregon, you will need to comply with all federal, state, and local requirements. This means you may need to obtain various business licenses and permits for your business. You can check the Oregon Secretary of State website, and you can also check with your local county clerk to be sure you have any licenses or permits you need.

Step 8: Employer Taxes in Oregon

If your Oregon LLC hires any employees, then you will go to the State of Oregon website and register for the Employee Withholding Tax and the Unemployment Insurance Tax.

Oregon does not have a state sales tax, so you don’t need to worry about that.

Consider Getting Assistance and Saving Time When Forming Your Oregon LLC

There are many LLC formation services that can help you make the process fast and easy. Here are two of the most respected providers you can consider using.

#1: Start Your LLC in Oregon With IncAuthority

IncAuthority is one of the few LLC formation services that offers a free option, although this does not include state fees. They also include a free year of registered agent service and provide lifetime alerts to help you stay in compliance with state laws.

#2: Start Your LLC in Oregon With ZenBusiness

ZenBusiness is one of the best LLC formation services out there. It has very reasonable prices and allows people to choose a two-installment payment plan. It has several great features, but two of the best are worry-free compliance service which helps you stay in compliance with your state’s laws, and a free year of registered agent service.

Conclusion

Now you know how to form an LLC in Oregon following 8 easy steps. Forming an LLC is one of the best ways to lower your liability yet prevent the double taxation associated with forming a corporation. Luckily, Oregon is one of the best states in which to register your business with a low personal tax rate and no sales tax. So, go ahead; there’s no reason not to form an LLC in Oregon today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs