Missouri LLC (7 Step Guide) – How to Form an LLC in Missouri

Create a Missouri LLC Fast & Hassle-free [Scroll Down]

One of the first business structure choices for most Missouri entrepreneurs is a limited liability company (LLC). An LLC is a hybrid business structure that combines many

of the features of corporations and sole proprietorships.

If you are in Missouri and looking to start a new business or upgrade your existing one, a Missouri LLC is an excellent choice. An LLC can shield you from personal liability in case of business failure and potentially lower your tax burden.

Plus, though Missouri may not be the first state that comes to mind when you think of incorporating, they are actually a very strong choice for LLC formation due to their established rules. Let’s look at how you can form a Missouri LLC in seven steps.

If you want to skip the hassle of starting a Missouri LLC yourself, consider using professional help:

- Missouri LLC (7 Step Guide) – How to Form an LLC in Missouri

- Create a Missouri LLC Fast & Hassle-free [Scroll Down]

- What is a Limited Liability Company (LLC)?

- The Reasons You Should Consider a Missouri LLC

- Missouri LLC Pros

- Missouri LLC Cons

- 7 Steps on Forming an LLC in Missouri

- Step 1: Choose a Name for Your Missouri LLC

- Step 2: Designate a Registered Agent in Missouri

- Step 3: File Your MO Articles of Organization

- Step 4: Draft an Operating Agreement for Your Missouri LLC

- Step 5: Obtain an Employer Identification Number (EIN)

- Step 6: Acquire Any Necessary Licenses or Permits for Your Business in Missouri

- Step 7: Open a Business Bank Account For Your LLC in Missouri

- Create a Missouri LLC with Professional Help Today

- Final Thoughts

What is a Limited Liability Company (LLC)?

A limited liability company, or as they are better known LLC, is a type of business structure that gives business owners many of the benefits of corporations and sole proprietorships. An LLC gives business owners the flexibility of a sole proprietorship, giving business owners the ability to manage their company how they choose.

An LLC structure also gives businesses the tax standing of a sole proprietorship, potentially offering owners considerable benefits. With this form of taxation, the business entity is untaxed at the entity level. This allows profit and loss to “pass-through” the business to its owners, where they will pay taxes on their personal returns. The owners of an LLC can choose how they will be taxed; however to achieve maximum benefits. If an LLC owner chooses, they can be taxed as an S or C corporation as well. There is no limit on the number of owners an LLC can distribute its profits amongst.

These are considerable benefits, but the biggest benefit an LLC provides is the liability protection this structure provides its owners. If a sole proprietorship or general partnership takes on debts it cannot repay or is sued; its owners are liable. However, with an LLC, the owners are not held liable for any of the business’s debts. This means that following ordinary business conditions, an owner’s assets are safe from liability.

An LLC also need not keep minutes, perform annual meetings, or perform most other burdensome requirements a C-type corporation must perform. However, it still provides the same protection to every owner allowing the company to grow. This is the primary reason LLCs are such a popular choice for entrepreneurs.

The Reasons You Should Consider a Missouri LLC

A Missouri LLC has numerous advantages, including:

- low costs of operating (see our full Missouri LLC costs guide here)

- available tax credits

- and easy access to numerous grants and loans in order to expand your business

Missouri provides an excellent environment for financial sector businesses and provides rich opportunities for workforce growth. This state also has a healthy tax climate promising good long-term opportunities to keep costs low.

Missouri LLC Pros

There are several pros to a Missouri LLC, and many of these are expressly guaranteed in the act that created the structure. The Missouri LLC Act grants these structures the freedom to include in their contract the rights and duties of each member, the specific distributions, profit, and loss attributable to each member, and their tax election.

In Missouri, members have the freedom to customize the obligations for every member. This allows particular members to retain their control over the LLC while bringing in new members for investments and a share of the profits. This is a strong reason why local businesses tend to choose to form their LLCs in Missouri instead of forming in other states.

An LLC itself offers many pros, including:

Missouri is Full of Entrepreneurs

Every year more than 30,000 LLCs are formed in Missouri. With over 177,000 active LLCs, Missouri is ranked 6th in entrepreneurial activity in the US.

Freedom of Contract

In Missouri, LLCs benefit from the Missouri LLC Act’s freedom of contract rules. This gives LLCs a powerful right to include in the LLC’s operating agreement a wide range of clauses and expect them to be enforced.

This includes restrictions on the ability of members to transfer their interests as well as to provide other members the right to sell or purchase the interests of other members. This can ensure that the control and interest of the LLC are kept within the hands of its members and protect the company in the long term.

The Missouri LLC Act also allows companies to create different classes of membership with distinct voting rights, membership interests, rights, and obligations. These provisions allow for future growth and the creation of additional classes of members to be created with equal or greater rights, obligations, and powers.

This can be excellent for growing businesses that require complexity similar to a corporation but without double taxation. It’s also good for passing down control as part of an estate and granting financial rights without necessarily giving control.

With these financial controls, the LLC can also better attract investors. By customizing their income streams and risk, members can be sure in advance of what they are receiving and what their contribution of capital is to be. This can allow an LLC far greater control of its assets than other structures.

Freedom of Formation

Filing a Missouri LLC does not require the names of any of its members. In fact, just about any individual or legal entity can file for an LLC.

The members can have a separate entity or individual do the work of filing the Articles of Organization for them with the Secretary of State.

Prevents Unwanted Members

A Missouri LLC’s operating agreement can have rules allowing members to control how, when, and to who membership interests are sold. This can include outright prohibiting members from reassigning their membership interests. If there are no prohibitions or other guidance included, however, an assignment of interest does not automatically entitle an assignee to become a member. It only grants the individual the right to that share of the profits and losses the assignor would have received. To become a full member, the other members must consent. This also applies if a creditor gains control of a member’s interest. The creditor will only have the same rights as if they were an assignee.

The act also provides mechanisms for removal. First, unless the LLC agreement provides rules otherwise or the members provide written consent, an individual is removed from membership when they assign membership to creditors, is judged insolvent, files a petition of bankruptcy, or does not contest petitions seeking their liquidation or other relief of a similar nature. You are not likely to encounter these rules regularly, but it is a good idea to know these rules in order to provide a firm ground to manage your LLC how you choose.

No Annual Report for Missouri LLC

A Missouri LLC is not required to file an annual report. This is a significant advantage over LLCs in most states which require annual reports from both LLCs and corporations. This can often be a lengthy process that takes precious time away from working on growing your business. But in Missouri, after forming your LLC, you will not have to register again.

Missouri LLC Cons

There aren’t many cons to forming a Missouri LLC, but there are a few, so let’s look at them before you decide if this structure is right for you.

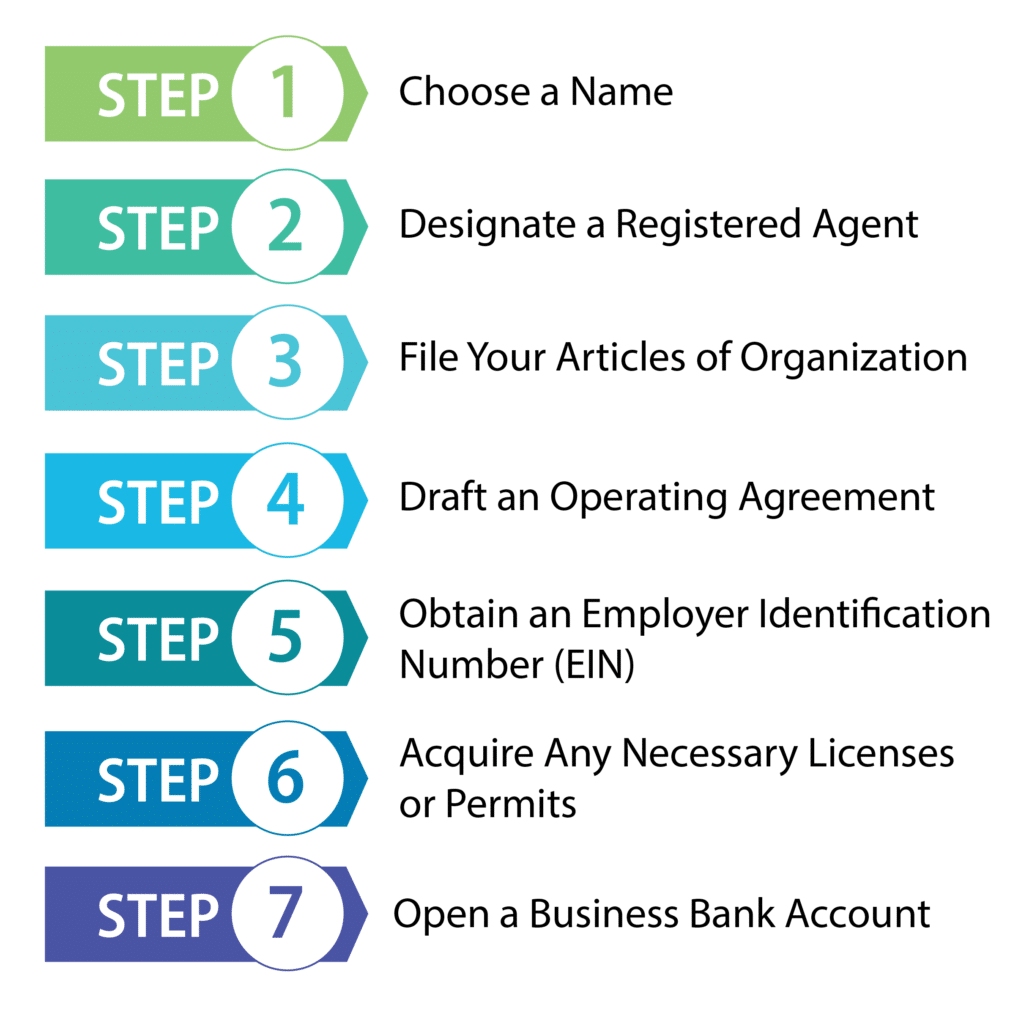

7 Steps on Forming an LLC in Missouri

Now that you know the pros and cons of a Missouri LLC, you are probably wondering how you can get started. Luckily, it’s easy, and there are only seven steps to it. Let’s get started!

Step 1: Choose a Name for Your Missouri LLC

The first step is one you have probably already thought of, and this is choosing a name for your LLC. This is an important step because the name you choose is how customers will see your business.

The name you choose must represent your business, and Missouri, like most states, requires your business name to be unique. This means it must be readily identifiable from other business names already registered with the state.

To be certain the name you have chosen is unique, you can make use of the Secretary of State’s Website. This will allow you to check for registered business names to see if the name you have chosen is taken or too close to an existing one.

Required and Restricted Words

The state of Missouri requires LLC names to contain the words “Limited Liability Company” or “Limited Company.” Alternatively, you may use the abbreviations “LLC,” “L.L.C.,” or “LC.”

You may not use terms that may result in confusion with another type of entity, such as a corporation, nonprofit, or trust.

Reserve a Name

If you wish to reserve a name to form a business in the future, Missouri allows this. You can file an Application for Reservation of Name with the Missouri Secretary of State. You will need to include a $25 filing fee, and this will secure your name for up to 60 days. You may file again upon expiration for up to a maximum of 180 days.

Step 2: Designate a Registered Agent in Missouri

The state of Missouri requires LLCs to designate a registered agent. Your business’s registered agent will be your point of contact with the state and thus must be publicly listed with the Missouri Secretary of State.

Your registered agent must be available during all regular business hours in order to receive legal correspondence and other official mail. The registered agent you select must have a valid address located in Missouri.

Your registered agent can be any resident of Missouri, including a member of your LLC. This can also be an organization hired to act as your registered agent. These can be an excellent choice for most LLC owners to prevent embarrassment if your business is ever served with a lawsuit. It can also potentially keep your address private if you work from home, and if you work irregular hours or travel, you may not be able to be available during normal business hours. This is why many business owners choose to hire a professional registered agent service to represent their business.

Step 3: File Your MO Articles of Organization

Articles of Organization are the official documents filed with the Missouri Secretary of State in order to officially form your LLC. These official documents, known in some states as a Certificate of Organization, can be completed by filling out Form LLC1 and mailing it in or by creating an account and completing it on the Missouri Secretary of State’s website.

This is not a difficult process, but you will need to include a large amount of information about the LLC you are forming. This will help your LLC to get approved, and the process completed quickly. If you do not include all the requested information, the approval may be delayed.

Filings by mail must be accompanied by a $105 state filing fee. Generally, your application will be approved in 5-10 business days. Filing online will cost only $50, and approval is immediate. For most business owners, online formation is a better option to save time and money.

Step 4: Draft an Operating Agreement for Your Missouri LLC

Missouri requires all LLCs to have an operating agreement, although the agreement can be oral. But, it’s really a good idea to have a written agreement, since it can help avoid disagreements between members by specifying their rights and responsibilities. An operating agreement details the structure of your LLC as well. There are certain things that should be included in your operating agreement, which we will discuss.

It can be a good idea to discuss your operating agreement with an experienced professional to ensure it contains everything it should to protect you and your business.

Step 5: Obtain an Employer Identification Number (EIN)

An EIN is a nine-digit number that the IRS uses to identify your business for tax purposes. Not all businesses are required to get an EIN, but most businesses will want to do so. Also, if your LLC has two or more members or is planning on hiring any employees, your business will need an EIN. An EIN is also generally required for opening a business bank account.

You can obtain an EIN for free on the IRS website. You can also apply by mail by filling out Form SS-4 and mailing it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Or, you can fax the form to (855) 641-6935. You will need a Tax Identification Number to apply. If you are using an LLC formation service to help form your LLC, you could have them obtain an EIN for you for a fee, or in some cases, as a part of one of their packages.

Step 6: Acquire Any Necessary Licenses or Permits for Your Business in Missouri

You may need a license or permit to operate your LLC in Missouri. This will vary depending on the business you are in as well as the location of your business. You may need a professional license or a basic license that is required to do business in the town or city you want to operate your business in. You can check with the local government to see what it requires to keep your LLC in compliance.

Step 7: Open a Business Bank Account For Your LLC in Missouri

In order to protect the limited liability of your LLC, you should open a business bank account. It’s crucial that you keep your LLC’s finances separate from the members’ personal finances. Should your business be sued, if your LLC’s finances are not entirely separate from your members’ finances, the court could remove your company’s limited liability, leaving the members responsible for any settlement.

A business bank account will also help your business to present a more professional appearance. It will look good when you write checks to your suppliers and when you have customers write their checks out to your LLC rather than a member’s account.

There are other advantages to having a business bank account as well. You can establish a relationship with a bank, which may improve your ability to get a loan or a line of credit. You could also obtain a business credit card through the bank. Having a business bank account will also allow you to accept credit cards from your customers, which is important since so many people use credit cards.

Create a Missouri LLC with Professional Help Today

As a business owner, you’re busy, and if you don’t have the time to form an LLC on your own, these LLC formation services can help. These two services offer low-cost formation options as well as registered agent services.

#1: Forming an MO LLC With ZenBusiness

ZenBusiness will form your LLC for a very reasonable price, and they get very good customer reviews. They also provide an operating agreement template with each of their packages, which is quite useful since Missouri requires all LLCs to have an operating agreement. They also offer 50% off of registered agent service for the first year with each of their packages.

#2: Forming an MO LLC With Inc Authority

Inc Authority is an excellent choice for LLC formation. If you choose their Free Formation Package, your only cost will be the state filing fee. This package even includes a free year of registered agent service. They also get excellent customer reviews.

Final Thoughts

There are a number of reasons to consider a Missouri LLC for your business. By lowering your tax burden and liability without increasing the complexity of managing your business, an LLC can be an excellent choice for just about any business owner.

Additionally, Missouri’s unique, highly detailed LLC laws can help your business to customize its operating agreement to whatever your members’ needs are. This makes a Missouri LLC an excellent choice, and it is easy to get started today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs