North Carolina LLC (6-Step Guide) – How to Start an LLC in North Carolina?

Form a North Carolina LLC W/ Professional Help (from $0)

If you’re looking for a way to give your new or existing business the step up it needs, you need to consider a North Carolina LLC. This business structure is a great way to give yourself protection from personal liability and keep your tax burden low.

With North Carolina, your business can benefit from the business-friendly policies this state offers. This state is one of the highest-rated states for business in the country, and it is easy to see why.

With some of the best business taxes in the country, a large base of highly skilled workers, and a diverse assortment of industries. Let’s take a look at whether a North Carolina LLC is right for your business and how you can form your own in only six easy steps.

If you want to skip the hassle of starting a North Carolina LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form a North Carolina LLC W/ Professional Help (from $0)

- Why Would You Want a North Carolina LLC?

- Quick North Carolina LLCs Pros & Cons

- How to Form Your North Carolina LLC in Six Easy Steps

- Steps To Grow and Maintain Your North Carolina LLC

- Form a North Carolina LLC With Professional Help Today

- Final Thoughts

- FAQs

Why Would You Want a North Carolina LLC?

The reasons why you would want a North Carolina LLC are many. But let’s take a look at some of the core reasons that you should consider:

Quick North Carolina LLCs Pros & Cons

Now before you settle on this structure for your business, it is important to give quick consideration to the advantages and disadvantages it can offer your business. So, let’s take a look at some of the most important.

Pros of a North Carolina LLC

As we said, North Carolina is regarded as one of the best states for business in the country, and there is certainly a reason for it. This includes:

This specifically means that North Carolina LLC owners will have the ability to customize the investments of capital that every member will contribute, what share of earnings they will receive, and what rights they will receive as a member. This offers those forming an LLC an incredible ability to customize how their business is owned and run.

Cons of a North Carolina LLC

As with any state and business structure, there are some disadvantages that you should consider as well before forming your business here. This includes:

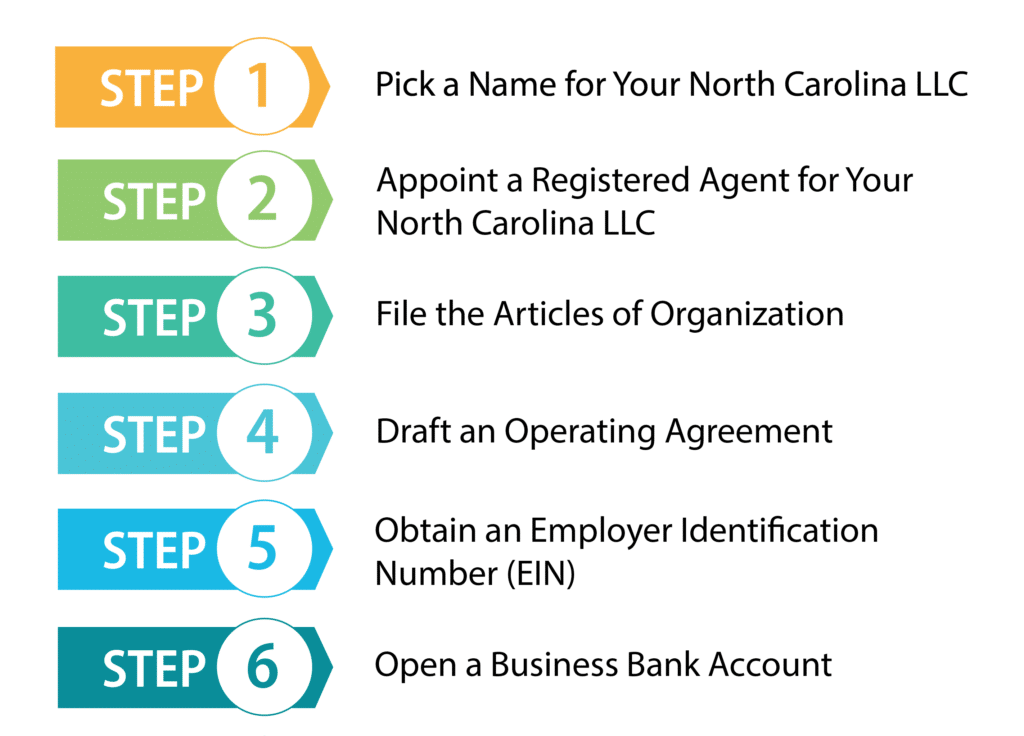

How to Form Your North Carolina LLC in Six Easy Steps

Now that you have given some thought to a North Carolina LLC, let’s talk about how you can form one. Fortunately, it is a completely manageable process that you can do in only six steps. So, let’s get started

Step 1: Pick a Name for Your North Carolina LLC

Naming your North Carolina LLC is the first step you need to accomplish. This is generally one of the most fun parts of starting your business, and chances are you have already given it some thought. Some things to keep in mind are that you will need to add a designator onto the end of your business name, and your LLC’s name must be unique. Otherwise, it will be turned down when you go to file for your LLC. To prevent this from happening, you will need to do a business name search.

Perform a Business Name Search

To perform a business name search, you will use the search tool on the North Carolina Secretary of States website. Simply select a company and your search criteria generally “any words” will be best, and type in keywords from your chosen name. Hit search and check the results.

If there are any results, take a look at their names and see if they are too close to the one you are considering. If so, then you will need to pick another name. However, if there are no results or they are easily distinguishable from your own, then you are good, and your name can likely be registered.

However, to ensure you can actually use your business name freely, it is a good idea to check if any part of it has been trademarked as well. First, go ahead and check the North Carolina Secretary of State’s Trademark Registry. This will help you to ensure that no part of your name has previously been registered as a trademark or service mark by another business.

You can go a step further by checking the U.S Patent and Trademark Office and see if there are any nationally registered trademarks or service marks that may conflict with your chosen name. This is always good to check before you go making any branded merchandise.

Also, though it is not ordinarily an issue, remember that you cannot include words that might lead customers to mistake your business as providing certain services or possessing another structure. This means no words such as a bank, university, realtor, or university unless you provide additional documentation showing that you are actually going to perform the service.

Plus, unless you change your mind and go to form a different structure, no words such as Inc. or nonprofits. You will need to add the proper identifier to the end of your name. This can be a Limited Liability Company or its abbreviations such as “L.L.C.” or LLC.

Check For An Available Domain

For most businesses, you are going to want to have a business website. You may not want one now, but down the line, it is a good idea so that you can connect with customers and let potential customers find your business. For this reason, you will want to check if there is a suitable domain available that will match your chosen name. That way, customers can easily find your website.

Similarly, you will likely want to create social media accounts for your business as well. This is critical for many businesses and can help to connect with customers and get an idea of how people are reacting to your business. So, check if a suitable handle is available on major platforms such as Facebook. If you can’t find a suitable domain and handle, you may want to reconsider your chosen name.

Reserve your Chosen LLC Name

You do not need to reserve a name at all if you are going to file your Articles of Organization soon. However, if you are going to wait a while before filing, it may be a good idea to reserve your chosen business name to ensure it will still be there when you go to file. You can fill out the name reservation form and submit it to the Secretary of State with a filing fee of $30 and reserve your name for 120 days. After this time, you will not be able to renew the reservation, and anyone will be permitted to use the name.

Step 2: Appoint a Registered Agent for Your North Carolina LLC

You will need to choose a registered agent to receive official documents on your LLC’s behalf. This important position will be listed with the state on the public record and will serve as the contact point for all official correspondence. These official documents may include tax forms, reminders of official filing deadlines, service of process, and many other important documents.

Your options are pretty open when it comes to whom you can choose as your LLCs registered agent. You and pretty much anyone else you choose can serve as the registered agent so long as they have a physical street address within North Carolina. The registered agent must then be at that address during all regular business hours in order to receive any delivered correspondence; as long as an individual is over 18 and meets these qualifications, they may serve as your official registered agent.

However, most business owners go another route and choose a registered agent service to act as their official registered agent instead. There are several reasons for this, including:

Step 3: File the Articles of Organization

This is the step that will actually form your LLC. You can file your Articles Of Organization online on the Secretary of State’s website or by mail. It will cost $125. Whether you choose to file by mail or online, you will need the form, which can be downloaded on the Secretary of State’s website.

To find out the full costs and all the fees associated, read our full North Carolina LLC cost guide here. Then you’ll have a better understanding how much everything will cost you.

There is some information you will need for filling out your Articles Of Organization, which include:

If you file online, which is the far faster method, you will generally receive a response within five business days. However, if you choose to file by mail, give it up to two weeks for a response.

If you do file by mail, remember to include a check or money order for the filing fee. If you file online, you will need to download and fill out the documents before submitting them online, along with the filing fee. You can pay online with a credit or debit card.

If you file online, which is the far faster method, you will generally receive a response within five business days. However, if you choose to file by mail, give it up to two weeks. Keep in mind that if you are filing for your business near the end of the current year but do not intend to open for a while, it can be a good idea to set the effective date ahead up to a maximum of 90 days to the start of the next year to avoid the hassle of filing tax returns and other paperwork for a business that is not even running.

Notably, if you want to include more than three members on your Articles of Organization, you will need to attach another approved form in order to include everyone. However, keep in mind that not all of your members need to sign the form. In fact, none of your members need to at all. Another individual or business entity can act as the organizer of your LLC, and this is a popular choice that, in addition to a registered agent, can avoid your name and address ever having to be on public record. You can include all of your LLC’s members in your operating agreement instead, which is a good idea for maximum privacy.

Step 4. Make an Operating Agreement for Your NC LLC

An operating agreement is something that every North Carolina LLC should have. This agreement will outline the structure of the business, the rights, and responsibilities of your members, as well as how the business will be run. North Carolina does not require this agreement, but it is still a good idea to have one to avoid arguments between your members.

You want to include a number of details in your operating agreement, such as the names of the members and their percentage of ownership, what type of management your LLC will have, how voting rights will be handled, how profits and losses will be allocated, and what will happen if a member withdraws or you want to dissolve your LLC. Including these details in your operating agreement will not only decrease the chances of having an argument but may even help prevent legal actions.

Although a number of these details apply more to multi-member LLCs, it is often recommended that even single-member LLCs have an operating agreement. Also, you may want to have a lawyer look over your operating agreement to make sure that you’ve included everything you should. You can change your operating agreement if you need to, but you will want to have everyone sign the updated operating agreement.

Step 5. Obtain an Employer Identification Number (EIN)

The next step you should take is to obtain an Employer Identification Number (EIN). Not all businesses need an EIN, but it is a good idea for all businesses to obtain this number. An EIN is a nine-digit number similar to a Social Security number. An EIN is also sometimes known as a federal tax identification number. The IRS will use this number to identify your business. However, this number is useful for other purposes as well, such as opening a business bank account, applying for some business licenses and permits, and processing payroll for your employees.

Applying for an EIN

It is easy to apply for an EIN, and it doesn’t cost anything. You can apply online at the IRS website or by mail. Applying online is the quickest and easiest way to get your EIN. When you apply online, you receive your EIN as soon as you complete the process. You just need to complete your application in one sitting as there is no option to save your progress.

If you choose to apply by mail or fax, you will need to fill out Form SS-4 and send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you choose to apply by fax, the fax number is (855) 641-6935.

For international applicants, you can apply for an EIN by phone. Just call between the hours of 6 a.m. and 11 p.m. Eastern Time. Also, make sure that the caller has the authority to answer the questions on Form SS-4 as well as receive the EIN.

Step 6: Open a Business Bank Account in NC

One of the biggest benefits of forming an LLC is the limited liability it provides for its owners. With an LLC, people can start a business without worrying about losing all their personal assets should the business fail. However, to maintain this limited liability, it is essential to separate any members’ personal finances from the business finances.

One of the best ways to do this is to open a business bank account. By opening this account, you’ll be able to keep your business transactions totally separate from your personal transactions. Although, there are a number of advantages to opening a business bank account which you can see below.

Steps To Grow and Maintain Your North Carolina LLC

The work doesn’t stop with forming your North Carolina LLC. Here are a few steps you will need to take down the line to grow and maintain your business.

1. File your Annual Report

North Carolina LLCs are required to file an annual report each year. These reports provide the state with some basic information about your LLC and also give you a chance to update any information about your LLC that has changed. When you file your annual report, you need to pay the $200 annual filing fee to the state of North Carolina. The report is due by the fifteenth of April of the year after you form your LLC. The state will provide a reminder of few weeks before the due date. If you do not file your annual report, your LLC will be automatically dissolved. Although, if you don’t file your report by the fourteenth of June, you may be notified of the pending dissolution of your LLC.

You can file your annual report online or by mail. If you file by mail, be sure to include a check or money order for $200 for the annual filing fee. You can send your annual report to:

Secretary of State

Corporations Division

PO Box 29525

Raleigh, NC 27626-0525

2. File Your Taxes in North Carolina

You may need to register your LLC with the North Carolina Department of Revenue. This will really depend on what type of business you are starting. You will be required to file state income taxes along with any other tax documents that are appropriate for your business. You can contact your local government officials to see which taxes you do need to pay, or you can ask a tax professional.

3. Consult a Tax Professional

It’s important to get your taxes right to avoid any penalties. You also want to make sure that you are not paying any more than you need to. So, to do the best job possible on your taxes, it can be a good idea to consult with a tax professional.

Form a North Carolina LLC With Professional Help Today

Often entrepreneurs are hard-pressed to find time between work and family. So, if you need a little help forming your North Carolina LLC, these are some of the best services to help get your business started.

#1: Start an LLC in NC With ZenBusiness

ZenBusiness hasn’t been around as long as a number of the other LLC formation services. But, they provide excellent service, and their good customer reviews show this. ZenBusiness has reasonable prices and good features. They offer a free operating agreement with all of their packages, which is something every LLC should have. Additionally, they include worry-free compliance with their packages which alerts you to any upcoming filing deadlines with the state to help you stay in good. ZenBusiness also offers 25% off of registered agent service with any of their packages which will save you money on a service most LLC owners need.

#2: Start an LLC in NC With Incfile

Incfile is one of the best LLC formation services available for people who want to form an LLC on a budget. Incfile is one of the few LLC formation services that offer a free package. You just need to pay the state filing fee. Incfile also provides some great features with their packages. They include a year of free registered agent service with all of their packages and free lifetime company alerts. These alerts will inform you of any upcoming filing requirements with the state. Additionally, the packages include a one-hour free business tax consultation.

Final Thoughts

North Carolina is always near the top of the list when it comes to great states to do business. So, if you are looking for a great state to get started, then look no further! With just a little bit of work, you can get your North Carolina LLC off the ground and start doing business in no time.

FAQs

Can a Licensed Professional Form an LLC IN North Carolina?

A licensed professional can form an LLC in North Carolina, but it needs to be a professional LLC (PLLC). Licensed professionals are people like lawyers, architects, and doctors. Basically, if a person needs to procure a license in order to offer their services, they will probably need to form a PLLC. Also, it’s important to remember that all members of a PLLC need to be licensed.

How Do I Dissolve My North Carolina LLC?

If you decide to dissolve your North Carolina LLC, it will be necessary to obtain and fill out Articles of Dissolution and then submit them to the North Carolina Secretary of State. It will cost $30 to do this.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs