Iowa LLC Guide (6-Step Guide) – How to Form an LLC in Iowa

Start an LLC in Iowa With Professional Help Today (jump down to offer)

If your business is considering where to form, then an Iowa LLC may be one of the best decisions you could make. An LLC, in general, offers protection for all of your personal assets while Iowa potentially offering a reduced tax rate.

With an Iowa LLC, you can benefit from the state’s low cost of doing business and unemployment as well as the high quality of living. This can give your business a big leg up. Let’s take a closer look at why your business may want to consider forming an Iowa LLC and how you can quickly and easily form your own Iowa LLC.

If you want to skip the hassle of forming an Iowa LLC yourself, consider using the help of professionals:

Why Would You Want an Iowa LLC?

An Iowa LLC can be a great option for your business but don’t just take our word for it. Let’s take a look at why you would want an Iowa LLC.

And if you’re wondering how much all of the legal processes will cost you — we suggest reading our full Iowa LLC formation costs guide.

Quick Iowa LLC Pros & Cons

You’re looking to start or upgrade a business, so chances are you are a busy person, and we get that. However, it is important to consider the pros and cons of such a big decision as to where you form your business. So, let’s just take a quick look at the biggest pros and cons to help you make your decision on whether to form an Iowa LLC or not.

Pros

There are a lot of pros to forming an Iowa LLC, and here are some of the biggest.

Cons

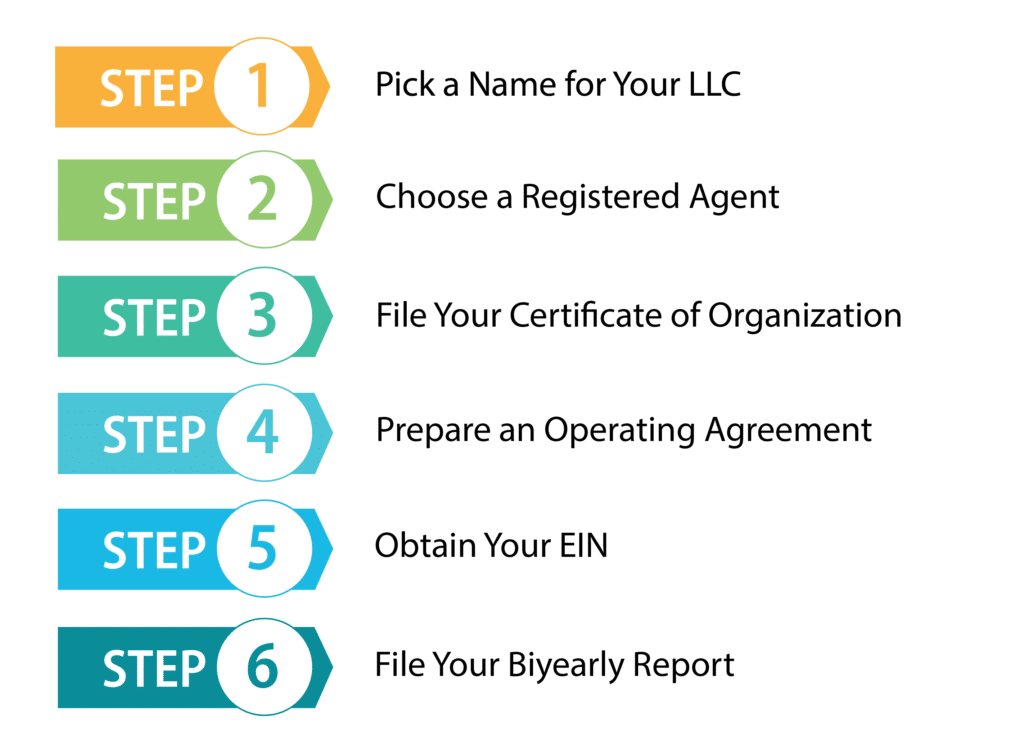

How to Form Your Iowa LLC in Six Easy Steps

If you are still with us, that’s great! Now let’s talk about how you can form your Iowa LLC in only six easy steps!

Step 1: Pick a Name for Your Iowa LLC

First, it’s time to pick a name for your Iowa LLC. A good business name should be creative and express what product or service your company can provide. Also, Iowa law requires any LLC name to contain the words “Limited Liability Company” or the abbreviations L.L.C. or LLC at the end of the name. The word “Limited” can be abbreviated as ltd., and the word company can be abbreviated as “Co.”

You need to choose a name that is noticeably different from any other business names that have been registered with the Iowa Secretary of State. You can check to see if the name you want is available by checking the Business Name Database on the Secretary of State’s website. Then if the name is available, and you want to reserve it by filing an Application for Reservation of Name, you can fill out an application to reserve the name for up to 120 days. The application can be filed online or by mail and will cost $10.

Using a Trade Name

You’ll need to use your business’s legal name on your Certificate of Organization, but you don’t always need to use this name when you’re doing business. You can choose to use a fictitious name for your business, commonly known as a doing business as (DBA) name or trade name. However, to use one of these names, you need to register the name with the Iowa Secretary of State. You can do this online or by mail. Just fill out and file a Fictitious Name Resolution, which will cost $5.

Step 2: Choose a Registered Agent for Your Iowa LLC

Every Iowa LLC needs to appoint a registered agent to receive legal communications from the state, including service of process. This individual or business entity must have a physical street address located within the state of Iowa. If you choose an individual, they must reside in the state, and if you choose a business entity, they must be authorized to do business in the state.

A registered agent service also works well for those who need to do a lot of business travel. With a registered agent service, you won’t have to worry about missing any important documents while you are traveling.

But if you choose to have a commercial registered agent service, you likely won’t have to worry about this since most of these services operate in every state. So if you’re planning on expanding your business, you might just want to hire a registered agent service rather than changing your registered agent later.

Step 3: File Your Iowa LLC’s Certificate of Organization

To form your Iowa LLC, you will need to file a Certificate Of Organization with the Iowa Secretary of State Business Services Division. Unfortunately, this is not as easy in Iowa as it is in most states. Iowa does not provide a downloadable or online form as most states do. So you will either have to make your own form or have a lawyer prepare a form for you. There are certain details the form must include, such as:

- Name of your LLC

- Your LLC’s address

- Your registered agent’s name and address

After you complete your Certificate of Organization, you can upload it and file it online or send it in and file it by mail. It will cost $50 to file your certificate.

Step 4: Prepare an Operating Agreement for Your LLC in Iowa

Iowa does not require LLCs to have an operating agreement, but it is still a good idea. This agreement is a legal document that details the rights and responsibilities of your LLC’s members as well as how your LLC will be run. It will also help show that your LLC is a separate entity, which can help to keep your business’s limited liability.

There are no rules on what must be included in your operating agreement, but there are some that you should include in it, which we will discuss below.

The other type of management is manager-management. This form of management is typically used for larger businesses or those in which the members do not want to be actively involved in running the business. In this type of management, a manager or managers chosen by the members runs the day-to-day affairs of the business and makes the decisions for the business. If the members wish to reserve some decisions for themselves, they should include this in their operating agreement.

Step 5: Obtain Your EIN

An EIN is a nine-digit number similar to a Social Security Number, which your business will need if you are going to hire employees or have two or more members in your LLC. The IRS uses your EIN to identify your business for tax purposes. You may also need this number if you decide to apply for a business bank account.

How To Apply

You can apply for an EIN for free on the IRS website if you have a Federal Tax ID, such as a Social Security Number, or you can apply by mail or fax. Additionally, international applicants can apply by telephone. Applying online is the fastest way to get your EIN; you will receive the number as soon as you finish the application and submit it. You just need to be sure you finish the application in one session as it cannot be saved.

If you want to apply by mail, you can print Form SS-4 and mail it to the IRS. The address is:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

For those who want to fax Form SS-4, just fill it out and fax it to (855) 641-6935. International applicants can call 267-941-1099 from 6 am to 11 pm Eastern Time Monday through Friday to apply for their EIN.

Step 6: File Your Biyearly Report

Your Iowa LLC will need to file a report every two years with the Iowa Secretary of State. You’ll need to file the report by March 31st of every odd-numbered year. However, you should be notified that the report is coming due. If you file online at the Iowa Secretary of State website, it will cost $30. Whereas, if you file by mail, it will cost $45.

Steps for Growing and Maintaining Your Iowa LLC

Now that you have finished forming your Iowa LLC, you can take a step back to appreciate all you have accomplished. But, then it is time to get back to growing and maintaining your new Iowa LLC. Here are some ways to do just that.

1. Obtain a Business Bank Account

After you finish forming your LLC, one of the first things you should do is to get a business bank account. You aren’t required to get a business bank account, but it is still important for your business. If you want to keep the limited liability you get from forming an LLC, your business needs to be a separate entity. This means you need to keep your business and personal finances totally separate. This allows any court to see that your business is a separate entity. If you combine your personal finances and you get sued, the court could remove your business’s limited liability, which is called piercing the corporate veil. If this happens, your personal assets could be at risk. So, opening a business bank account that will keep your business transactions totally separate is important.

You’ll find a business bank account has other advantages as well. Your business will have a more professional appearance because your customers will be able to write out their checks to your business instead of you.

The account will also give you an opportunity to form a relationship with a bank, which may increase the likelihood of being able to obtain a loan or line of credit at a later time. The account will also allow you to accept credit cards.

2. Get Business Insurance

Every LLC should have business insurance. In most cases, having an LLC will protect you from having your personal assets such as your house and car be accessed to satisfy any business debts. However, with all the work and money you’ve put into your business, you probably want to protect your business assets as well. If someone decides to sue your business, your business assets can be taken to satisfy any judgment. In some cases, this could cause you to lose your business. So, it’s a good idea to get business insurance to protect your business assets.

Another type of liability insurance you’ll want is insurance for the members of your LLC. Although in most cases, their personal assets are safe from being taken to satisfy suits related to the business. If a suit involves wrongdoing or negligence, the personal assets of the member could be at risk. Therefore, you’ll probably want to get liability insurance to protect your members in case of an accident or mistake.

You may also need Workers’ Compensation Insurance. Most states require this insurance for any business that hires employees. Workers’ Compensation Insurance will cover these workers in case of illness, injury, or death on the job.

Form an Iowa LLC with Professional Help Today

Forming a business can seem awfully time-consuming, particularly when you are spending all your time getting your ideas off the ground. So, if you need some help forming your Iowa LLC, here are some excellent services to help you do it.

#1: Start an Iowa LLC with ZenBusiness

ZenBusiness is one of the best LLC formation services. They have reasonable prices and a number of great features to offer, such as a free operating agreement and 25% off of their registered agent service with any of their packages. They will also file your annual report for you, which can save you some trouble. In addition to this, they are known as being a very socially conscious business.

#2: Start an Iowa LLC with Incfile

Incfile is one of the top LLC formation companies. The main reason for this is probably their free formation package. All you have to pay is the state fee. But this isn’t all Incfile has to offer; they include a number of good features with their free packages, such as a year of free registered agent service and lifetime company alerts. With these alerts, Incfile will inform you of any upcoming filing deadlines with the state so you can keep in compliance with the state.

Final Thoughts

An Iowa LLC is a great business structure for lowering your costs and protecting all of your personal assets. With all the advantages this structure and state can offer you, it is no wonder that this state is a highly rated place to do business. So, if you haven’t already, don’t delay in forming your Iowa LLC.

FAQs

Will my Iowa LLC be taxed?

Your LLC will be taxed. Although, since an LLC is a pass-through entity, which means the profits pass through the business to the owner’s personal tax returns, any profits the LLC makes will be taxed on the members’ personal tax returns.

All of the members will need to pay self-employment taxes on their share of the LLC’s profits. This works the same way it does in a partnership. Also, just like in a partnership, you can deduct half of the self-employment tax. Additionally, if your LLC is member-managed, you may not be required to pay self-employment taxes. It’s always best to check with a tax professional in this case to make sure you’re paying any necessary taxes.

For state taxes, your business will need to register with the Iowa Department of Revenue. All new businesses in Iowa are required to do this.

How Long Will It Take For My Iowa LLC to Be Approved?

It generally will be approved immediately if you are filing online. However, if you choose to file by mail, it will take approximately 7 to 10 business days.

What Do I Need To Do to Register My LLC In Iowa?

You will need to file a Certificate of Organization with the Iowa Secretary of State. This will cost a $50 filing fee, and once it is approved, your LLC will be formed.

Can I Form an LLC in Iowa if My Business Will Be Located in Another State?

You can form an LLC in Iowa even if the business is located in another state, and the members will live outside of the state. However, it’s likely you will still need to register your LLC in the state it will be located in. This will involve extra work and probably extra fees, and there may not be many advantages to doing this.

It could also make your taxes more complicated and more expensive. If the members live in a different state, they will most likely have to pay state income taxes there and may have to pay taxes in Iowa as well. These members could possibly get a credit in their home state for these income taxes, but there’s no guarantee of that. Also, LLCs often need to pay other taxes such as franchise taxes or use taxes, and you may end up paying more of these when registered in two states. You also need to have a registered agent in both of the states you are registered in. All of these things generally make it more advantageous for small LLCs just to register in the state they are located in or move to Iowa.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs