Rhode Island LLC (6-Step Guide) – How to Form an LLC in Rhode Island

Start an LLC in RI Easily With Professional Help (from $0 + state fees)

Starting a Rhode Island LLC can be a great way to get your business off the ground right. Rhode Island has been making its way up the list of business-friendly states in recent years, and many entrepreneurs are starting to take notice of the opportunities a Rhode Island LLC can provide.

Between protection from personal liability for debts, reduced tax burden, and the burgeoning opportunities the state offers, there are many reasons to consider a Rhode Island LLC. Let’s take a look at everything this structure can offer and how you can start your own LLC in only six easy steps.

If you want to skip the hassle of starting a Rhode Island LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Start an LLC in RI Easily With Professional Help (from $0 + state fees)

- Why Would You Want a Rhode Island LLC?

- Quick Rhode Island LLC Pros & Cons

- How to Form Your Rhode Island LLC in Six Easy Steps?

- Steps for Growing and Maintaining Your Rhode Island LLC

- Form a Rhode Island LLC with Professional Help Today

- Final Thoughts

- F.A.Q.

Why Would You Want a Rhode Island LLC?

A Rhode Island LLC can offer your business a lot of advantages that certainly explain why you would want a Rhode Island LLC. Here are some of the biggest:

Quick Rhode Island LLC Pros & Cons

Forming a Rhode Island LLC is a big decision, and you should always consider the pros and cons before you get started. We know you are busy, so we will make it quick and take a look at the biggest pros and cons to help you decide.

Pros

First off, the pros include:

Cons

Where there are pros to a big decision like this, there are always cons, and these include:

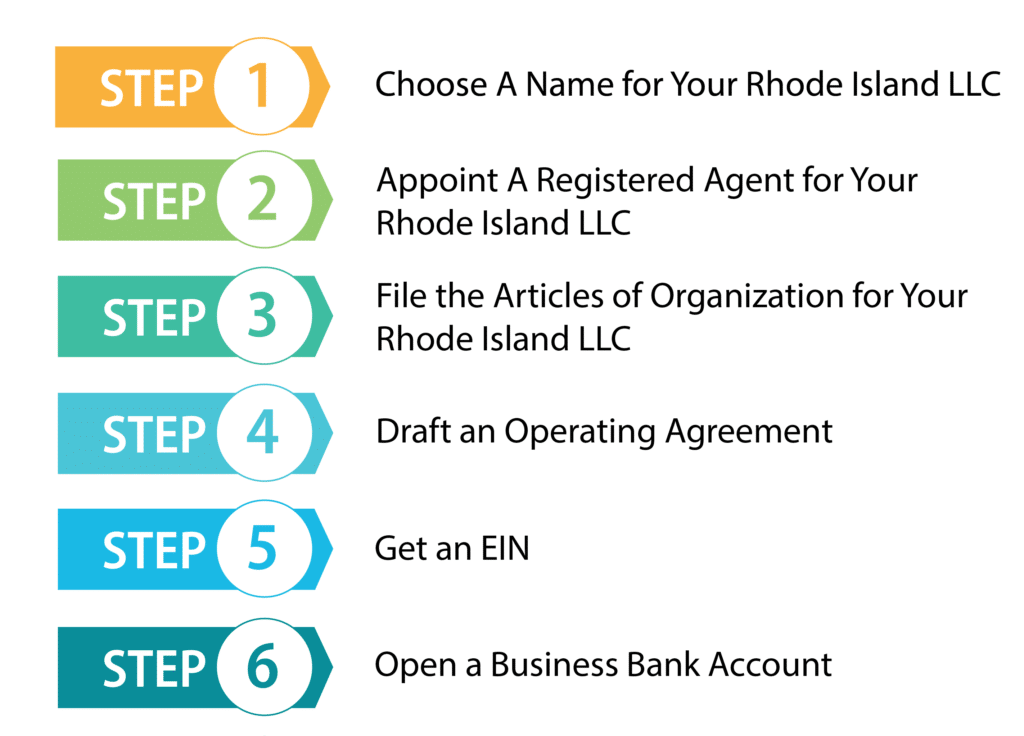

How to Form Your Rhode Island LLC in Six Easy Steps?

If you have settled on a Rhode Island LLC for your formation, then we have got good news for you. Forming your new business is quick, easy, and can be done in only six easy steps, so let’s get started.

Step 1: Choose A Name for Your Rhode Island LLC

The first thing you need to do when forming your LLC is to choose a name for your business. It’s good to choose a name that will catch people’s attention while still giving them an idea of what your business does. There are some rules you will need to follow when naming your business, such as:

Once you’ve decided on the name you want for your business, you’ll need to do a check to see if your name is available. You can do this on the Rhode Island Business Entity Database. If you find your business name is available, you can use it when filing your Articles of Organization. However, before you commit to your chosen business name, you might want to make sure there is a URL available for your business name as well as a good social media handle. If not, you may want to consider choosing a different name.

Step 2: Appoint A Registered Agent for Your Rhode Island LLC

After you choose a name for your business, you should choose a registered agent for your LLC. Every LLC in Rhode Island is required to have a registered agent to accept service of process and other legal documents from the state. This registered agent will need to be available to accept these documents during all regular business hours.

You can choose a person or a registered agent service for your registered agent. You can even act as your own registered agent, but there are a number of advantages to choosing a registered agent service which we will discuss.

Advantages of a Registered Agent Service

There are several advantages to using a registered agent service, such as:

Step 3: File the Articles of Organization for Your RI LLC

Now it’s time to file your Articles of Organization, which will actually form your LLC. You will file your Articles of Organization with the Rhode Island Department of State. You can file online or by mail, and the filing fee is $150.

There is some information you will need to fill out your Articles of Organization, such as:

- The name of your business

- The name and address of your registered agent

- Whether your company will be treated as a corporation, partnership, or disregarded entity for tax purposes

- The address of your LLC’s principal office

- Whether your LLC will be member-managed or manager-managed

You can file your Articles of Organization online by using Rhode Island’s Business Services Online Filing System.

You also have the option of filing by mail. Just download, print, and fill out Form 400, Articles of Organization for a Domestic Limited Liability Company, and then mail it to: Services Online

Division of Business Services

148 W. River Street, Providence

Rhode Island 02904-2615

Step 4: Create an Operating Agreement

Although Rhode Island does not require operating agreements for LLCs, every LLC should have an operating agreement. An operating agreement is a legal document that outlines the structure of your business and details the rights and responsibilities of its members. It also includes information about how the LLC will be run, such as how voting rights will be handled and how profits will be distributed, along with other details. Having this agreement can help avoid arguments between members and make running your LLC easier. This agreement is particularly important if you have an LLC with a lot of members where arguments could become frequent without some sort of guidance.

There are no specific rules for what must be included in an operating agreement, but there are certain items that are generally included in operating agreements, which we will discuss below.

Step 5: Get an EIN

The next step you should take is to get an Employer Identification Number (EIN) for your business. This is a nine-digit number that is very similar to a Social Security number, which the I.R.S. will use to identify your business for tax purposes. This number is also important for filing taxes, hiring employees, and opening a business bank account.

It’s easy to obtain an EIN. You can apply by mail, fax, or online, and it is free. International applicants also have the option of applying by phone. You will need a Taxpayer Identification Number to apply; a Social Security number will do just fine.

The quickest and easiest way to get your EIN is by applying online on the I.R.S. website. If you apply online, you will receive your EIN as soon as you complete the process. You do need to be careful to complete your application in one session because if you exit the process, your application will not be saved. There is no option to save it and return and finish it.

You also have the option of applying by mail or fax. For both of these options, you need to fill out Form SS-4, which is found on the I.R.S. website. If you choose to mail the form, you can mail it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Your application should be processed in approximately four weeks.

To fax the form, the number is (855) 641-6935. You should receive a return fax in about four business days.

International applicants can apply by phone. They can call on weekdays from 6 a.m. to 11 p.m. Eastern Time. It is important to ensure that the person calling has the authority to answer any necessary questions on Form SS-4 and to receive the EIN.

Step 6: Open a Business Bank Account in Rhode Island

This step is a very important one, even though it’s not required to form an LLC. It is important for helping you keep your limited liability. Additionally, it can help your business to appear more professional, which can help attract customers. It should also make your bookkeeping easier, which should help you to do a better job running and maintaining your business. We will discuss how a business bank account can help you with these things.

Easier Bookkeeping

A lot of LLC owners who are just starting out in business haven’t had any real experience in bookkeeping, so it can be a difficult chore for them. This can be even more difficult if business transactions are not separated from personal transactions. It can be practically impossible to conveniently separate these transactions.

However, with a business bank account, they will be kept separate from the start. This will save you the trouble of trying to separate these transactions and allow you to more easily keep track of your revenue and expenses. It could even make it easier for you to stay on a budget. It will also make tax time a bit easier.

Limited Liability

Your LLC has limited liability as long as it is its own separate entity. So, the owners of the LLC are not personally responsible for its debts. If an LLC fails to pay its debts or is sued, the LLC’s assets can be taken but not the owner’s assets in most cases.

However, in order to maintain this limited liability, an LLC must keep its finances separate from the finances of its owners. If the owners failed to do this, a court could remove the business’s limited liability, in which case the personal assets of the owners would be at risk. This is called piercing the corporate veil. Sadly, mixing personal and business finances is one of the most common mistakes small business owners make. But, by having a business bank account, businesses can avoid this problem by keeping business transactions totally separate from personal transactions.

Forming A Relationship with a Bank

Having a business bank account is also a great way to form a relationship with a bank. This relationship could be helpful if you ever want to take out a business loan or open up a business line of credit. A business bank account will also allow you to accept credit card payments which can help increase your business.

Necessary Documents for Starting a Business Bank Account?

You’re going to need some documents for starting a business bank account. The documents you need will vary from bank to bank, but there are some documents that almost all banks are going to ask for, and we will list these below.

Steps for Growing and Maintaining Your Rhode Island LLC

You may have finished forming your Rhode Island LLC, but now it is time to get started growing and maintaining your new business. Here are a few steps to get started.

1. Create a Business Website

It is a good idea to create a website for your business, even if your business is only done offline. This could help draw customers to your business since many people like to look up a business online before they shop at it. It could even hurt your business not to have a website since if a potential customer does not find your business when they’re looking online, they are sure to find another business.

It’s not hard to make a website even if you’ve never done so before. There are many tools online that make it easy to create a website. It shouldn’t even take you very long to get your website up and running. Also, if you’re using an LLC formation service to help you form your LLC, one of their services may be creating websites. So, you may be able to get the service to create your website for you.

2. Obtain Business Insurance

It can be tempting to skip getting business insurance to save some money since you know your personal assets are likely protected by having a limited liability company. However, it’s still a very good idea to purchase general liability insurance to protect your business assets. If your business is sued and you lose the case, your business assets could be used to satisfy the debt. But, if you have general liability insurance, this should protect your business assets.

Another type of insurance that your business should purchase is liability insurance for all of your members. Although the assets of all the members of your LLC are generally protected from being used to satisfy business debts, they can be accessed to satisfy debts from judgments that are a result of negligence or wrongdoing.

Another type of insurance you want to purchase for your LLC is Workers’ Compensation Insurance. Rhode Island requires that all LLCs with employees purchase this insurance to cover their workers. This insurance will cover workers in cases of illness or injury that occur on the job.

Form a Rhode Island LLC with Professional Help Today

Many entrepreneurs may find there just isn’t enough time in the day between family and getting their business ideas started to form a Rhode Island LLC. If this is the case for you, then these businesses can help you get started.

#1: Start an LLC in RI With ZenBusiness

ZenBusiness is one of the newer LLC formation services, but they have become very popular for their great service. Customers tend to give them excellent reviews. They have great prices on their packages and many good features. They include a free operating agreement with all of their packages which is something every LLC should have. They are also willing to file your annual report for you, which can save you some time and trouble. Additionally, they give 25% off registered agent service with all of their packages.

#2: Start an LLC in RI With Incfile

Incfile is one of the most popular LLC formation companies around, and it’s not surprising. Unlike most LLC formation companies, they have a free package. This package even has some nice features that come with it. You will get a year of free registered agent service, which is a good deal considering purchasing registered agent service separately can cost anywhere from $100 to $300 on average. You’ll even get lifetime company alerts that will help keep you informed about any upcoming state filing deadlines. This will help you stay in good standing with the state.

Final Thoughts

When you are considering how to get your business off on the right foot, then a Rhode Island LLC is something you should consider. This structure can keep your personal assets safe, prevent double taxation, and allow your business to benefit from everything the Ocean State has to offer. So, consider getting started and forming your business today!

F.A.Q.

Is It Necessary for My Rhode Island LLC To Have A Physical Office?

Yes. You need to have a principal office, and it has to have a physical address.

Do I Need to List a Duration for My LLC on My Certificate Of Formation?

No. You can list that your Rhode Island LLC will be perpetual.

Can I Reserve the Name I’ve Chosen for My Limited Liability Company If I’m Not Ready to File Yet?

Yes, you can reserve a name for your LLC for up to 120 days if you want. It will cost a $50 filing fee to do so.

Will I Need to Provide an Email Address When Forming My Rhode Island LLC?

Yes, you will need to give an email address when filing for your LLC.

How Much Does It Cost to Form a Rhode Island LLC?

The filing fee for forming an LLC in Rhode Island is $156.

Will I Be Required to File an Annual Report?

Rhode Island does require LLCs to file an annual report, and there is a filing fee of $50.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs