Connecticut LLC (6-Step Guide) – How to Form an LLC in Connecticut

Start an LLC in Connecticut Today With Help of Professionals

If you are looking to start a business or upgrade your current one, then it may be time for you to consider forming a Connecticut LLC. With a Connecticut LLC, you can provide your business with a potentially far lower tax burden. Plus, you can shield your personal assets in case of lawsuits or business failure.

There is nothing to lose with this structure, and Connecticut has some of the highest availability of venture capital in the country, making it easier to get the funding you need. Now let’s take a look at why you should consider this structure, some of its pros and cons, and then how you can form your own Connecticut LLC in only six steps.

- Start an LLC in Connecticut Today With Help of Professionals

- Why Would You Want a Connecticut LLC?

- Quick Connecticut LLCs Pros & Cons

- How to Form Your Connecticut LLC in Six Easy Steps

- Step 1: Choose a Name for Your Connecticut LLC

- Step 2: Choose a Registered Agent in CT

- Step 3: File Your Connecticut LLC Certificate of Organization

- Step 4: Draft an Operating Agreement for Your Connecticut LLC

- Step 5: Obtain an Employer Identification Number (EIN) in CT

- Step 6: Obtain a Business Bank Account in Connecticut

- Additional Steps for Growing and Maintaining Your Connecticut LLC

- Form a Connecticut LLC With Professional Help Today

- Final Thoughts

Why Would You Want a Connecticut LLC?

So, this is the big question, why would you want a Connecticut LLC. Let’s take a look at some of the biggest reasons.

Quick Connecticut LLCs Pros & Cons

Chances are you are a busy person like most entrepreneurs, and you don’t have a lot of time. So, we will make this quick and show you some of the biggest pros and cons of a Connecticut LLC so you can make an educated decision.

Pros

Though a Connecticut LLC may not be for everyone, there are certainly a lot of pros to consider for this business structure.

Cons

Now it is time to consider the cons, and here are some of the biggest.

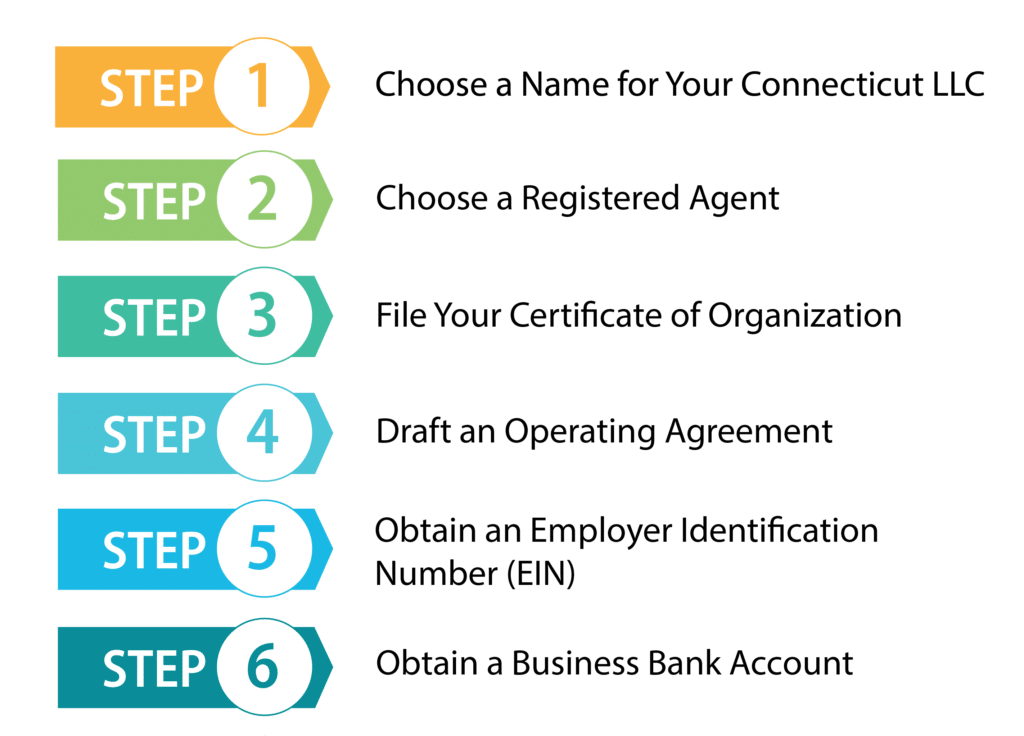

How to Form Your Connecticut LLC in Six Easy Steps

Now, hopefully, you are still with us and have decided that a Connecticut LLC is right for you. Luckily, forming your own Connecticut LLC is a simple, manageable process. With some work and a full understanding of the process, you will be done in no time. So, let’s get started.

Step 1: Choose a Name for Your Connecticut LLC

Your first step in forming your Connecticut LLC will be to select a name for it. This is a crucial step for every business because this will be the first impression you make on all of your future customers. It is important to pick a name that will stand out, give customers an idea of what your business can do for them, and is unique from all other names that have been registered with the state.

Once you choose a name for your business, there are a few searches you will need to make before you can be sure you’ll be able to use your chosen name. To be sure that your name is truly unique, you can search for it on the Connecticut business name search tool.

Select keywords from your name and enter them into the search tool to ensure your name is distinct from those that have already been registered with the state. If it appears that the name you have selected is distinct, then you can likely use it, so now choose an LLC designator to place at the end of your name.

A designator will allow others to know that your business is an LLC, and you can choose from options such as “limited liability company,” “LLC,” or “L.L.C.” Also, it is important to remember that your name is not allowed to use designators for other business structures that could confuse others, such as corporation, Inc., or any others. Additionally, to use terms such as a bank, university, or certain other restricted words, you will generally need to file some additional paperwork and have individuals holding certain licenses be a part of your LLC.

Step 2: Choose a Registered Agent in CT

All Connecticut LLCs must have a registered agent to receive service of process and other official documents and notices from the state. You can choose to be your own registered agent, or you could choose a friend, family member, or another LLC member. There are just a few requirements listed below.

Although there are very few restrictions on who can be your registered agent, there are a number of advantages to having a registered agent service. So, to help you decide if you would like a registered agent service to act as your registered agent, we will discuss some of these advantages.

Step 3: File Your Connecticut LLC Certificate of Organization

The next step you need to take is to file your Certificate of Organization. This is the step that actually forms your LLC. You will file this document with the Connecticut Secretary of State. The filing fee for this is $120. You can file your Certificate of Organization online, by mail, or in person. The quickest way to file is online at the business.ct.gov website.

If you want to apply by mail, you can download the form and then fill it out and mail it to:

Connecticut Secretary of State.

Business Services Division

Connecticut Secretary of the State

P.O. Box 150470

Hartford, CT 06115

Step 4: Draft an Operating Agreement for Your Connecticut LLC

Connecticut does not require an LLC to have an operating agreement, but you should still have one, especially if your LLC has more than one member. An operating agreement details the structure of your business as well as the rights and responsibilities of the members. Having this document can help avoid arguments between members, which can help your LLC run more smoothly. There are no specific requirements for what you must include in your operating agreement, but we list some important details that would be good to include below.

If the members of an LLC want, they can choose a manager to run the business for them. This option is called manager-management. It is more common with larger LLCs. With this type of management, the manager runs the day-to-day business as well as making decisions for the business. The owners serve in an advisory role. Although if the members of the LLC want, they may reserve some decisions for themselves by including them in the operating agreement.

Step 5: Obtain an Employer Identification Number (EIN) in CT

You will probably want to get an Employer Identification Number for your business. This number is a nine-digit number that is used by the IRS to identify your business for tax purposes. It is also often called a federal tax identification number. This number is similar to a Social Security Number. Your business will be required to have one of these numbers if your LLC has more than two members or intends to hire employees. You will need this number when you file taxes or if you want to open a business bank account.

An EIN is free, and you can easily obtain your EIN from the IRS. Just apply by mail, fax, online, or by phone if you are an international applicant. Make sure you have a Taxpayer Identification Number. A Social Security Number will work fine.

You can apply by mail or fax by filling out Form SS-4 and sending it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

It will take about four weeks to process. If you want to apply by fax, fax the form to (855) 641-6935. It should take four business days to receive a fax back.

You’ll want to apply online at the IRS website if you want the fastest service. If you apply online, you will get your EIN as soon as you fill out and submit the application. Just make sure you finish the application in one session. It will not save; so, you won’t be able to start it then finish it later. If you are an international applicant, you have the option of applying by phone. You can apply on weekdays from 6 a.m. to 11 p.m. Eastern Time.

Step 6: Obtain a Business Bank Account in Connecticut

Likely one of the main reasons you formed an LLC in Connecticut is to protect your personal assets. However, in order to make sure your personal assets stay secure, you need to make sure you keep your personal assets separate from the LLC’s assets. This will help ensure that any court will see that the LLC is its own separate entity. If you don’t keep your business assets separate from any personal assets and you get sued, the court could decide to remove your business’s limited liability. Therefore it’s essential you keep your business finances separate.

One of the best ways to keep your business finances separate is to obtain a business bank account. This will help keep your business transactions totally separate from your personal transactions and ensure that your LLC is seen as a separate entity.

There are some other advantages to a business bank account as well. One advantage is it can make your bookkeeping and tax preparation easier. It can do this by keeping your business transactions separate. This way, you don’t have to hunt through your personal bank account and separate all the business transactions from the personal transactions. This also makes it easier around tax time. Your business transactions will already be separate, and you’ll be less likely to miss any deductions as well.

Another advantage of a business bank account is the opportunity to form a relationship with a bank. This can come in handy if you ever want a loan or a line of credit for your business. Also, with a business bank account, you will be able to accept credit cards which can increase your business.

Necessary Documents

There are a few documents the bank is likely to require when you go to open your business bank account. So we will discuss these, and you will probably want to make sure you have them on hand when you go to open your account.

Additional Steps for Growing and Maintaining Your Connecticut LLC

Now that you have finished forming your Connecticut LLC, it is time to enjoy running your business. Here are a few tips to help you both grow and maintain your business from here.

1. Business Licenses and Permits

In order to maintain your business, you need to get the licenses and permits necessary to operate your business. You can find out the licenses and permits you need by searching on the Connecticut Department of Consumer Protection website. Just look in the business section to see which ones you need; some business licenses and permits are based on location, whereas others may be based on the industry you are in. It’s important to obtain these permits to avoid any penalties.

2. Business Insurance for Your CT LLC

Another important part of maintaining your business is obtaining business insurance. An LLC will protect your personal assets from being taken to satisfy your business’s debts, but by having general liability insurance, if your business is sued, you can help protect your business assets as well. You’ll also want liability insurance for the members of your LLC as well since if they are sued due to negligence or wrongdoing, their personal assets could be at risk.

If you provide a professional service, you may need to acquire professional liability insurance. This insurance will protect you in case you are sued for negligence or mistakes in the course of your work.

If you have employees, you will probably be required to purchase Worker’s Compensation Insurance. This insurance will cover your workers in case of illness, injury, or death on the job.

3. Start a Business Website (optional)

Every business should have a business website even if they don’t conduct their business online. It’s important to have a website to allow people to learn about your product even if they need to purchase it at your brick-and-mortar store. If people look for your business’s website online and don’t find it, they can easily find a similar business’s website.

But, you should have no trouble building a website. There are many tools online to help you build your website, and you don’t need any past experience to use them. It shouldn’t even take very long to get your business website up and running.

Form a Connecticut LLC With Professional Help Today

Forming your Connecticut LLC is most definitely worth the time and effort. However, many entrepreneurs struggle to find enough time to handle all the aspects of getting their business started. Luckily, there are a number of services out there that can help do the hard work of forming an LLC for you. Here are some of the best.

#1: Start a Connecticut LLC with ZenBusiness

ZenBusiness is one of the newer LLC formation services, but it is already one of the most popular. It has very reasonable prices and offers great features. They include a free operating agreement with all of their packages, and they will file your annual report for you if you want. Additionally, they will give you 25% off of registered agent service with any package you purchase.

#2: Start a Connecticut LLC with Incfile

Incfile is a very affordable LLC formation service that provides excellent features as well. Incfile provides a year of free registered agent service and lifetime company alerts with all of their packages. These alerts will keep you informed of upcoming filing requirements with the state, so your LLC can stay in good standing with the state. The best thing about Incfile is their free package; all you have to pay is the state fee.

Final Thoughts

A Connecticut LLC may be a great choice for getting your business off the ground. With liability protection, reduced tax rates, and an ample supply of business funding, this business structure has a lot to offer. So, why not get started forming your Connecticut LLC right now? You can do it yourself with the helo of our guide; or just use a professional service suggest above. Good luck with your new business endeavors!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs