South Carolina LLC (6-Step Guide) – How to Form an LLC in SC?

Hire Professionals to Form an LLC For You (from $0+state fees)

If you are looking to start a business or upgrade an existing one, a limited liability company (LLC) is a great choice. An LLC is a popular business structure that can protect your personal assets.

This is because an LLC combines many of the best aspects of a corporation and a sole proprietorship into one. So, if you would like to see how to form your South Carolina LLC, read on.

If you want to skip the hassle of starting a South Carolina LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

In case you’re wondering how much will it cost you to form your own LLC in SC — don’t worry, we have you covered. You can read our South Carolina LLC costs guide here. You’ll learn how to save some $$!

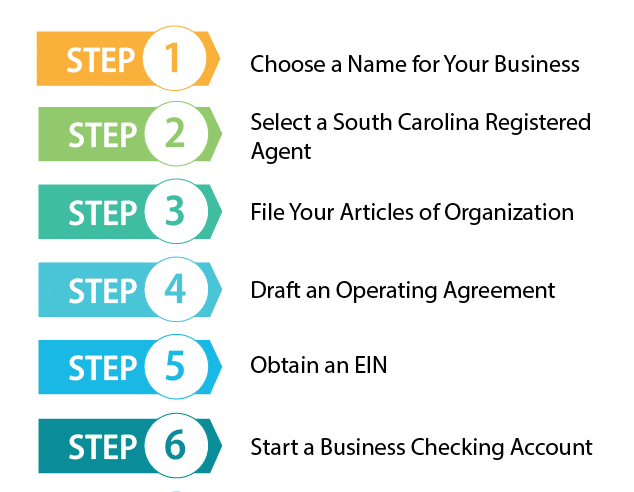

6 Steps for Forming an LLC in South Carolina

Step 1: Choose a Name for Your South Carolina Business

The first step in forming your South Carolina LLC is choosing a name for your business. This is an important step, and your name should comply with South Carolinas requirements, be easily found by potential clients, and be satisfactory to you.

South Carolina’s requirements include:

To check if a name is available and isn’t already taken, you can perform a business entity search on the South Carolina Secretary of State’s website. Another thing to consider is whether or not a suitable URL for the name you choose is available. If it is, then you may want to consider purchasing the URL to prevent others from using it even if you do not intend to file your Articles of Organization immediately.

Name Reservation

If you have chosen the perfect name with an available URL, it’s possible you may want to make sure it is there when you are ready to file. To do this, you can file an “Application to Reserve a Limited Liability Company Name.” This application will be filed with the Secretary of State and will require a $25 filing fee.

Step 2: Select a South Carolina Registered Agent

The next step is to select a registered agent based in South Carolina. A registered agent is an individual or business that will receive correspondence from the government such as tax forms, service of process, legal documentation, and other government correspondence.

This means that the registered agent you select will serve as your business’s point of contact with the state. A member of your company may serve this role or any other resident or corporation authorized to perform business in South Carolina.

Factors to Consider When Choosing a Registered Agent

There are some factors you should consider when choosing your company’s registered agent, whether it is yourself, a member of your company, or a paid service. These include:

When your company designates a registered agent as their representative, the name and address of this business or person will be placed on public record attached to your company. This is public so that a process server can locate a representative of your business. This will allow them to serve your business notice of a lawsuit.

This means that this information is publicly available for anyone to see. This is a particular problem if your business address is your private home address. This can be a loss of privacy and lead to junk mail and unwanted sales visits. The problem can be reduced by giving a business address, but by hiring a service to act as your registered agent, this problem can be avoided completely.

If the loss of privacy from having your name and address made public isn’t an issue, there is another risk to consider from acting as your own registered agent. It isn’t pleasant to think about, but it is possible your business will eventually suffer from a lawsuit.

If this occurs, your registered agent will receive the service of process. If this is your business, you may be served in front of your customers and patrons. This could greatly harm your reputation. If it is at your home address, this could be even more embarrassing in front of family and friends.

By using a registered agent service, you can retain not only your personal privacy but also keep legal matters private as well.

South Carolina requires your registered agent to be available during all regular business hours at the provided address. This can be a considerable limitation on certain types of businesses with different operating hours, such as bars or restaurants, as well as businesses that do not operate in one location, such as consulting firms.

This can also make it hard for small business owners accustomed to performing errands during work hours or who wish to take a vacation that will leave them unavailable. Even if this is not a hardship, it can be inconvenient to stop work, accept documents, and properly secure them.

But with a registered agent service, they will always be there during business hours to accept and store documents for when you are ready to read them.

For businesses that operate out of multiple states, they are required to have a registered agent based within each state. In this case, it is impossible to act as your own registered agent personally. This will make it necessary to hire another entity to serve as your registered agent.

For business owners looking to form an LLC, you likely already have enough on your plate. Often this already involves performing several roles in your company. As a registered agent, you must be available during all regular business hours, and you must consider whether you have the time.

You also must keep up to date with any new legislation or rules affecting the way the service of process is accepted. By hiring a service, you can focus on more important things like your business.

Step 3: File Your Articles of Organization For SC LLC

Filing the Articles of Organization with the Secretary of State is what forms your LLC. There are several things that need to be included in this agreement, including:

Management Type: You will list whether your LLC will be member-managed or manager-managed. In a member-managed LLC, the members run the LLC and make all the decisions about how it will be run. Whereas, in a manager-managed LLC, the members choose a manager to run the LLC. The manager can be someone outside of the LLC or a member.

In either case, the manager makes all of the decisions for the LLC. The members can advise the manager on decisions, but the manager doesn’t need to take the advice. However, the members can reserve the right to make certain decisions if they specify these decisions in the operating agreement.

You can file your Articles of Organization online at the Secretary of State’s website or by mail. The address to mail the articles to is:

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC. 29201.

You need to send two copies of the Articles of Organization along with a check made out to the South Carolina Secretary of State for $110 and a self-addressed stamped envelope.

Step 4: Draft an Operating Agreement For Your South Carolina LLC

You are not required to have an operating agreement to form an LLC in South Carolina, but it is a good idea. An operating agreement is a legal document that details the structure of your LLC along with the rights and responsibilities of the members.

This can help avoid arguments among the members of the LLC while running the business. An operating agreement also gives the members of an LLC more control over the business by stating the rules it will operate by instead of simply following state default rules.

There are several things that should be included in an operating agreement, such as:

You will probably need a vote to admit a new member, and you should specify the percentage of members required to approve the admission. You should also include the procedure for member withdrawal.

This may be a little more complicated than admitting a new member. You’ll need to include any restrictions on what a member can do with their shares of the LLC, such as whether the member buying or being given the shares needs to have any particular qualifications and whether or not the current members have the right to purchase the shares before they can be given away or sold to anyone else.

Step 5: Obtain an EIN

An EIN is an Employer Identification Number, also sometimes called a Tax Identification Number. It’s a nine-digit number that the IRS uses to identify businesses for tax purposes.

You’ll need to obtain one of these numbers for your LLC in order to file your state and federal taxes, hire employees, or open a business bank account. Fortunately, it is easy to obtain an EIN, and it’s free. You can apply for one online on the IRS website, or through the mail, by fax, or for international applicants by phone. If you apply by mail, fax, or phone, you will need to fill out Form SS-4.

Then if applying by mail, send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The process will take approximately 4 weeks.

If you choose to apply by fax, fax the form to Fax: (855) 641-6935. This process will take about 4 business days.

If you are an international applicant, you can apply by phone at 267-941-1099 between 6 a.m. and 11 p.m. Eastern Time. However, keep in mind, this is not a toll-free number.

Step 6. Start a South Carolina Business Checking Account

As a sole proprietor or general partnership, it is sometimes unnecessary to start a business bank account. But, as an LLC, it can be quite important, and these are some reasons why:

Get Professional Help When Creating Your LLC in South Carolina

If you’re kinda’ of overwhelmed by the information given here and/or really have no time or experience in doing everything yourself — do not worry. You’re not alone. In fact 95% of people choose various LLC formation services to get the job done for them. In order to form your LLC in South Carolina — we really recommend Zenbusiness or Northwest. They have pretty amazing customer support and overall they do an impressive job of helping people get their LLCs.

#1 – Northwest Registered Agent will form an LLC for you

Northwest has vast experience in creating LLCs and Corporations. They by far have the best support and client satisfaction rate. We’ve used and tested them ourselves and can guarantee that they’ll do an exceptional job for you.

You can read our full & extensive Northwest review here.

#2 – ZenBusiness can help you form an LLC in South Carolina

ZenBusiness is one of our top-rated LLC services as well. They have a super value-to-price ratio. And it’s perfect for those who are looking for the cheapest option to form their LLCs. When we tested their service — they’ve done a great job, so we can honestly recommend them.

To know more about them — read our full ZenBusiness review here.

Final Thoughts

By forming an LLC, you can combine the best aspects of a sole proprietorship and a corporation and help protect your personal assets in case of business failure. By doing this, your business can retain a flexible structure and avoid the double taxation that corporations face. And if you’ve been wondering how to start an LLC in South Carolina – we hope that we helped answer your question briefly and effectively.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs