Oklahoma LLC (6-Step Guide) – How to Form an LLC in Oklahoma

Start an Oklahoma LLC With Professional Help

If you are looking to start a business, then you should consider Oklahoma as a state for your LLC. With an LLC business structure, your business can benefit from reduced liability and a potentially reduced tax burden.

Combine this with the low cost of living, low cost of labor, and far below-average energy costs, and it’s hard not to greatly improve your bottom line. So, let’s take a closer look at why an Oklahoma LLC may be right for you and then how you can form an Oklahoma LLC in 6 easy steps.

If you want to skip the hassle of starting an Oklahoma LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Start an Oklahoma LLC With Professional Help

- Why Would You Want an Oklahoma LLC?

- Quick Oklahoma LLC Pros & Cons

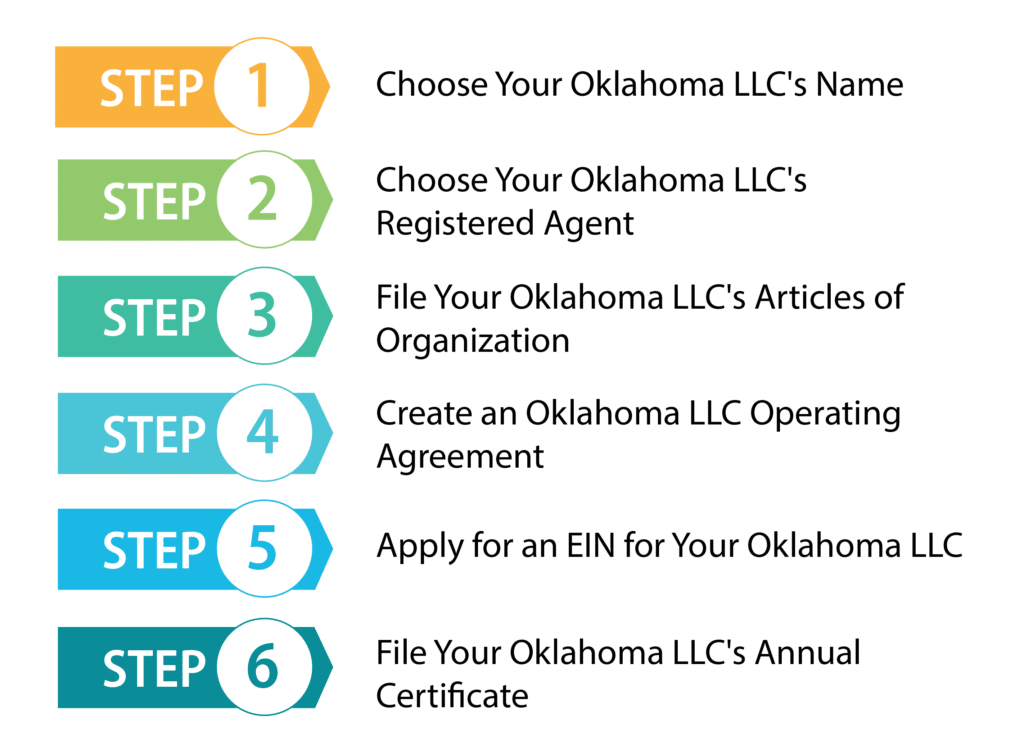

- How to Form Your Oklahoma LLC in Six Easy Steps

- Step 1: Choose Your Oklahoma LLC’s Name

- Step 2: Choose Your Oklahoma LLC’s Registered Agent

- Step 3: File Your Oklahoma LLC’s Articles of Organization

- Step 4: Create an Operating Agreement for Your Oklahoma LLC

- Do I Really Need an Operating Agreement

- Step 5: Apply for an EIN for Your Oklahoma LLC

- Step 6: File Your Oklahoma LLC’s Annual Certificate

- Maintaining Your Oklahoma LLC

- Form an Oklahoma LLC With Professional Help Today

- Final Thoughts

Why Would You Want an Oklahoma LLC?

Perhaps the better question might be, why wouldn’t you? An Oklahoma LLC can offer your business a number of advantages, so let’s take a look at what they can offer your business.

Quick Oklahoma LLC Pros & Cons

Now that you know why you might want an Oklahoma LLC, let’s take a quick look at the pros and cons. This might help you decide if an Oklahoma LLC is right for your business formation.

Pros

There are a number of pros to forming an Oklahoma LLC, and these include:

With this business structure, a business can choose how much capital contribution members are required to make and what share of profit and loss members can expect. With an LLC, a member’s share of earnings does not need to match their share of capital contributions if the operating agreement provides otherwise.

An LLC’s operating agreement can even create multiple classes of membership, each with distinct rights, responsibilities, and power. Most notably, an LLC’s operating agreement can provide for classes of membership with or without voting rights.

An LLC can create new classes of membership even after formation, and this can assist in creating a complex structure that can allow for growth down the line. It also can make it much easier to plan for an estate by giving family members uninterested in running the business non-voting shares while reserving voting interests for interested parties.

It also provides that unless otherwise specified by either the LLC’s operating agreement or Articles of Organization, a manager is accountable to the LLC and must hold all business profits or benefits as a trustee except with the consent of its members.

However, the LLC Act even gives the freedom to include provisions to opt-out of the majority of these default rules with the exception of only three cases that protect minority member interests and make such membership a more valuable prospect. These are that liability cannot be eliminated for: a manager’s breach of their duty of loyalty, intentional acts in violation of good faith or the provisions of law, and any inappropriate acts from which a manager receives a personal benefit.

In that case, a member can only transfer their financial interests, which entitles an individual to the share of profit or loss to which the member would have been entitled. This does not entitle the individual receiving this share of profit or loss to participate in the company in any way. The only way to become a member would be for the rest of the members to consent to a minority vote for such an individual to become a member.

Cons

As with pretty much any big decision, there are a few disadvantages to consider before you make your decision. These include:

How to Form Your Oklahoma LLC in Six Easy Steps

So, now you know why you would want an Oklahoma LLC, as well as the pros and cons it offers. So, if you have decided that an Oklahoma LLC is right for you, we have good news. Forming an Oklahoma LLC is a fast and simple process that you can do in six easy steps. Let’s get started.

Step 1: Choose Your Oklahoma LLC’s Name

The first step to getting your Oklahoma LLC started is to choose a name for it. A good name will generally let customers know what product or service you provide as well as be unique.

This last part is particularly important because the state of Oklahoma requires every LLC to choose a unique name. This means that it cannot resemble any other existing name registered in the state closely enough to cause confusion. We will take a look at how to perform a name availability search on your own in a moment.

However, keep in mind while you think of names that you will not be able to use certain words or abbreviations in your business name that could lead others to confuse your business as another type of entity. These include words such as corporation, incorporated, or Inc. These will cause your name to be rejected when you go to file.

Also, after you choose a good name, you will need to tack a designator onto the end to let people know your company is an LLC. These can include LLC or L.L.C. This is up to you.

Name Availability Search

In order to ensure your chosen name is available, you will need to perform a business name search on the Oklahoma Secretary of State’s website. Here you will find the name availability search tool in the business services section.

To use this tool, you will want to take keywords from the name you have chosen and look at the results. At this point, you don’t need to include any designator. If results come up from your keywords, are they too close to your chosen name? If so, then you will have to think of another name.

If results do not come up for your keywords, that’s great! This simply means that no business is using your keywords, and the name is available to use.

Name Reservation

If you find a name you like but you aren’t ready just yet to start your business, you can file a name reservation with the Oklahoma Secretary of State. This will cost a $10 filing fee and prevent others from starting a business with your reserved name for 60 days.

To do this, you can create an account on the Secretary of State website and file your name reservation online. You may also file by mail by completing the appropriate form, printing it, and mailing it along with the $10 fee to:

Oklahoma Secretary of State

421 N.W. 13th St.

Oklahoma City, Oklahoma 73103

Acquire a Website Domain Name (Optional)

Before settling for good on a name for your Oklahoma LLC, it is a good idea to do a quick web search and make sure an appropriate domain name is available. This domain name should be a close match for your business name so current and potential customers can easily find your business website. If it is available and you are certain it’s the right name for you, then you may want to snatch it up before anyone else does to make sure it is there when you go to file.

Step 2: Choose Your Oklahoma LLC’s Registered Agent

The next step to forming your Oklahoma LLC is to select its registered agent. Your LLC’s registered agent will receive all legal correspondence on its behalf. This means that the registered agent will serve as the one the state of Oklahoma will contact whenever they need to get in touch with your LLC.

The most important correspondence they will receive is service of process, which is notice that your business is being sued, though hopefully, your business will never have to deal with this. Your registered agent will also receive tax notices and reminders for compliance due dates as well.

This role will need to be filled before you go to file your Articles of Organization with the state, and Oklahoma has two rules you will need to follow in selecting your registered agent. The first one is simple and simply requires you to choose a registered agent with an address located in the state of Oklahoma. This address cannot be a P.O. Box; however, the person selected does not need to be a resident.

The second requirement is often a little tougher for new business owners to meet. Your registered agent must be available at all times to receive official correspondence during ordinary business hours, which means 9 a.m. to 5 p.m.

Who Should I Choose?

Your options are pretty open with these requirements for who can be your LLC’s registered agent. You or a family member or friend can even serve as the registered agent for your own business and use your personal or business address. Some even choose the LLC itself to act as its own registered agent. The most commonly chosen option is to choose a commercial service to act as your LLC’s registered agent, and we will talk more about this option in a moment.

Just ensure that the person or service you select is 18 or over, willing to have their name and address listed on public record, and legally allowed to perform business in Oklahoma. This is an important decision and should not be taken lightly as the penalties for not being present when official correspondence is delivered or missing a notice can be severe.

Why Should I Consider a Registered Agent Service?

There are a number of reasons why a registered agent service is the most popular option out there. First of all, if you or a family member choose to act as a registered agent for you, they will need to make their names and addresses a part of the public record, meaning anyone can look at it. This can lead to a lot of unwanted sales visits. For privacy, there is no better option than a registered agent service.

Next, remember that a registered agent must be available at all times during regular business hours to receive official correspondence. This means that if you or others you choose cannot be available during that time, you can get in big trouble. This is a particular problem for businesses that do not operate in a fixed location or during regular business hours.

Lastly, when you are busy starting a new business, it is not always easy to keep everything well organized. This can make it difficult to ensure you actually separate and read all of the official correspondence you receive. Often it’s best to leave this job to the professionals and focus on growing your business instead.

There are a number of services out there to choose from, and many will even scan and store the documents online permanently, so you can read and review them whenever you need them. Once you have chosen whichever option you do prefer, whether it is an individual or a service, you can go on to the next step, filing your Articles of Organization.

P.S. Northwest is offering free registered agent services when forming an LLC with them.

Step 3: File Your Oklahoma LLC’s Articles of Organization

This is a big step. Once you file your Oklahoma LLC’s Articles of Organization, you will officially be in business. This is the legal document that, once filed with the Oklahoma Secretary of State and approved, gives legal standing to your LLC. What this document contains is primarily an overview of the business which you intend to form.

The information this document will contain includes, among other points:

You may file your Articles of Organization online through the Oklahoma Secretary of State website by creating an account, selecting to file a domestic limited liability company, and completing the process, and paying the $10 filing fee completely online. You may also complete the form on your computer, print it out, and mail it along with the $10 filing fee to:

Oklahoma Secretary of State

421 N.W. 13th, Suite 210

Oklahoma City, Oklahoma 73103

Filing online is your best option for an easy process and fast response. By filing online, you will typically only wait between one and two business days for a response. If you choose to file by mail, you often wait up to ten business days to learn whether your Articles of Organization were accepted or not.

If your Articles Of Organization are approved, then the Oklahoma Secretary of State will send to your registered agent’s address:

It is a good practice to store these documents carefully in case they are needed later, especially the Articles of Organization. This last document is official proof that your LLC has been approved and can legally do business in the state of Oklahoma.

Step 4: Create an Operating Agreement for Your Oklahoma LLC

An operating agreement is an important document for every LLC to detail how the business will be run, earnings will be distributed, and much more. This step is not technically necessary as the state of Oklahoma does not legally require LLCs to create an operating agreement.

However, this is a critical step to protect your business, assure all members are treated fairly, and they are typically required if and when you try to open a business bank account or apply for a loan. So, let’s take a closer look at this crucial document.

Do I Really Need an Operating Agreement

This is a resounding yes! If you are a single-member LLC, it is a bit less important, but it will definitely add to your credibility by providing detailed information on how your business will be run. It can also help to prove your LLC is a distinct entity to a court.

However, if you are a multi-member LLC, it is absolutely crucial to protecting your members and the business itself. This agreement should be signed by every member and carefully stored with business records.

If you need to update it as your business grows in the future, this is okay and can be done at any time with the consent of the LLC members.

What Should Be Included in an LLC’s Operating Agreement

A well-written operating agreement will provide many pieces of information, starting with specifications on the percentages of ownership belonging to each member and how much capital each will contribute. Next, make sure to specify how the profit and loss will be distributed amongst members.

- You should include what role members will play in the company as well as their rights and responsibilities. You will also need procedures in place for what decisions will require a vote by members and what the rules are for such a vote, such as the minimum threshold of votes to pass a motion.

- If your LLC is run by one or more managers, make sure to include their rights, duties, and powers in the company. Also, how will your LLC deal with a dispute arising between any members and a manager?

- You should also include rules for how a member can exit the company, including how the exiting members’ shares will be distributed and if the exiting member can expect compensation. Can members transfer their membership? If so, make sure to include rules for this as well as how a new member can be admitted.

- Finally, rules should be included if the company is ever dissolved. This can be unpleasant to think about, but in order to avoid potentially years of disputes and litigation, it is also important to provide rules for how assets will be distributed and whether any particular members will retain the right to continue the business. Your LLC’s operating agreement can include all of these points and any more that its members would like. You have considerable freedom to craft an operating agreement that fits your company.

Step 5: Apply for an EIN for Your Oklahoma LLC

Once your LLC is approved, it is wise to quickly file for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This number is required for your business to hire employees and generally to open a business bank account.

An EIN is often useful for other official tasks as well, such as opening a line of business credit, and it is easiest to think of it as a Social Security Number (SSN) for your business. Just like this other number, it is often used for tax purposes and many other official tasks to identify your business.

You can apply for this number in only a few minutes through the IRS website if you or another member of your LLC have an SSN and are willing to act as the responsible member for your LLC.

You can also apply by mail, fax, or for international applicants, telephone. To apply by mail or fax, fill out Form SS-4, and to file by mail, send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

To file by fax, send the completed form to (855) 641-6935. For international applicants, call 267-941-1099 between 6 a.m to 11 p.m. Eastern Time Monday to Friday.

Step 6: File Your Oklahoma LLC’s Annual Certificate

Every Oklahoma LLC is required to file an annual report, and this is known as an Oklahoma Annual Certificate. In other states, this is generally just known as an annual report. This is a necessary step each and every year for your business to remain in good standing.

This can be filed with the Oklahoma Secretary of State either online or by mail by filling out the form and sending it with the filing fee to:

421 N.W. 13th, Suite 210,

Oklahoma City,

Oklahoma 73103.

Either method you choose will require a $25 filing fee.

The Secretary of State will generally take one to two days to process and approve your Annual Certificate if you file online. However, filing by mail will generally take up to 10 days to be approved.

If You Forget to File

Annual Certificates are always due on the anniversary of your LLC’s approval. If you forget to submit your filing for an Annual Certificate by this date, your LLC will lose its “good standing.”

Past this, your LLC will have 60 days to file for its Annual Certificate. After this point, your registered agent will not be allowed to file legal documents.

If your LLC proceeds to not file for an Annual Certificate for three years, it will be canceled. After the sixth year of not filing for an Annual Certificate, the state will permit anyone to use your LLC’s name.

Maintaining Your Oklahoma LLC

Even after forming your LLC, you will continue to have to take action to run your business and keep it on the right side of the law. Here are a few things to do after forming your LLC.

1. Obtain the Necessary Licenses and Permits

In order to start running your business, you need to make sure you have any licenses or permits required in the area you’ll be operating in. What you need will depend on your location as well as your industry. You may need a tax permit, building permit, or possibly a professional license. You should be able to find out what licenses or permits you need as well as the associated fees by contacting the local government where your business is located.

2. Open Your Business Bank Account

One of the first things you’ll want to do after you’ve started your LLC is open a business bank account. This is not actually required, but it is still very important. If you want to ensure that your business retains its limited liability, you must keep your business and personal finances separate. A business bank account is probably the best way to do this. This account will also help show your LLC is a separate entity, which is essential to keeping your limited liability, thus helping to protect your personal assets.

Should you fail to keep your personal and business finances separate and you get sued, you are at risk of having the court remove your limited liability. This is called piercing the corporate veil. If this happens, your personal assets could be taken to satisfy your business’s debts.

Business bank accounts have other advantages as well, such as having a more professional image. You should find that having your customers write out their checks to your business instead of you will appear much more professional and inspire more confidence in your business. Having a business bank account will also allow your business to accept credit cards, which could help increase your business.

Opening a business bank account is also a good way to build a relationship with a bank. You may find this relationship useful down the line if you should decide to apply for a loan or open a line of credit.

3. Get Business Insurance

Business Insurance is a vital part of doing business for an LLC; even if your personal assets are protected from someone who is suing your business, your business assets are not protected. So, considering how much work and money you put into your business, it is definitely a good idea to get insurance to protect your investment. Also, for some business owners, it would be very difficult to replace some business assets. There are several other good reasons to obtain business insurance, and we are going to explain some of these.

Business insurance is not always required, but it’s best to have this insurance to protect yourself and your business in case of any accidents. If you should be sued and you have no insurance, the results could be devastating for your business.

Form an Oklahoma LLC With Professional Help Today

If you just don’t have enough time in the day between getting your business underway and living your life, you could probably use some help forming your LLC. These are some of the best services out there that take the burden of forming your LLC off your shoulders.

#1: Create an OK LLC With ZenBusiness

ZenBusiness is one of the newer LLC formation services, but this hasn’t stopped them from becoming one of the most popular LLC formation companies. One of the main reasons for their popularity is their great customer service. They also have very reasonable prices, and a free operating agreement is included with all of their packages. Additionally, as a part of any of their packages, they will file your annual report for you.

#2: Create an OK LLC With Incfile

Incfile is a popular service and for a very good reason. Incfile is one of the few companies that will form your LLC for free. All you have to pay is the state fees. Incfile will also provide you with free registered agent service for a year. Additionally, they will include lifetime company alerts. With this service, Incfile will alert you to any upcoming state deadlines, which will allow you to keep your LLC in good standing with the state.

Final Thoughts

Now you know how to form an Oklahoma LLC in a few easy steps. This amazing structure is great for protecting your personal belongings and reducing your tax burden. So, if you want to protect your assets and keep your costs low, there are no better choices than an Oklahoma LLC. Combined with low employment and energy costs, as well as a low cost of living, you can be sure to take home more in this state. So, don’t delay and form your Oklahoma LLC today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs