Kansas LLC (7 Step Guide) – How to Form an LLC in Kansas

Get Professional Help & Form Your Kansas LLC Hassle-free

If you are looking to form an LLC in Kansas, in this article you will find plenty of information on the steps required to form the LLC in KS, frequently asked questions, steps to follow after your LLC has been formed and where you can get help to form your LLC if required.

If you are aware of the process, it can be simple and affordable to do, however, if you don’t have enough time in your day, or the knowledge required to do it yourself, there are plenty of options for services that will form your LLC for you (which we will cover later as well).

- Get Professional Help & Form Your Kansas LLC Hassle-free

- To Begin With – What is an LLC?

- Why Would You Want a Kansas LLC?

- Kansas LLC Main Pros and Cons

- 7 Step Guide on Forming an LLC in Kansas

- Step 1: Name Your Kansas LLC

- Step 2: Choose a Resident Agent in Kansas

- Step 3: File Your Articles of Organization

- Step 4: Prepare an Operating Agreement for Your Kansas LLC

- Step 5: Get an EIN for Your Kansas Business

- Step 6: Apply for Any Necessary Kansas Business Licenses and Permits

- Step 7: Separate Your Personal and Business Assets

- Create a Kansas LLC with Professional Help Today

- Kansas LLC FAQ

To Begin With – What is an LLC?

First things first! An LLC is a type of business entity. It is owned by one or more individuals, and these are referred to as ‘members’. If you are the sole owner of an LLC, then this is known as a single-member LLC, and if an LLC has more than one member, then it is known as a multi-member LLC.

In business entity types like sole proprietorships or partnerships, the owner can be personally liable for lawsuits against the business. An LLC is different, as it is a separate legal entity, which is what helps protect the business owner’s personal assets and keeps them separate.

Why Would You Want a Kansas LLC?

There are many reasons that an LLC is a popular business entity choice for those starting a business in the state of Kansas. It provides personal liability protection for those that are running the business and also has the potential to save money on taxes.

Most people choose Kansas LLCs if they live there or plan to do business there specifically.

Many people to chose to form this type of business as it is also relatively easy to manage, it is one of the easiest business entities to form and there is flexibility in the management structure.

Kansas LLC Main Pros and Cons

Pros

Cons

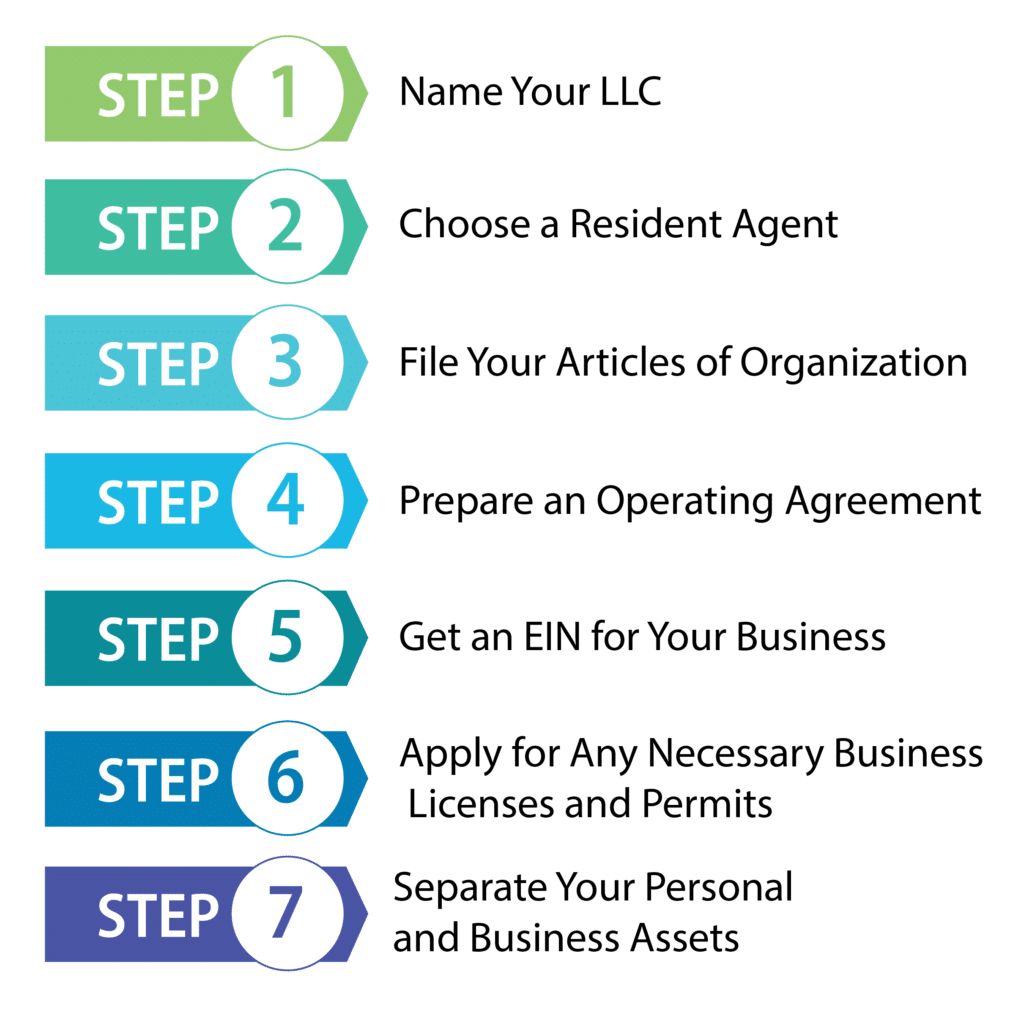

7 Step Guide on Forming an LLC in Kansas

Creating an LLC in KS is fairly simple and straightforward if you know what you’re doing. We’ll try to explain it in a simple manner as possible. So let’s start!

Step 1: Name Your Kansas LLC

The first, and likely most important step in the process is to name your LLC. You should think deeply about what you name your LLC. Ideally, it should be a name that is searchable and outlines the sort of thing your business does to make it easy for potential clients. You must also make sure that your LLC name meets all the Kansas LLC naming guidelines. The guidelines can be found below:

Once you have come up with a name that you feel is suitable, and meets all of the Kansas naming requirements, it is time to see if your chosen name is still available. You can do this by doing a name search on the government website, which is free and easy to do.

At this point, it might be a good idea to check that the business name URL is available. Even if you are not planning on creating a business website any time soon, it might be a good idea to purchase the web domain so that others do not acquire it.

Step 2: Choose a Resident Agent in Kansas

The state of Kansas requires you to have a Resident Agent (also known as “Registered Agent” in other states) when you are filing your LLC, the same as most states. For those new to the business world, the term could be a little confusing, as it is usually known as a registered agent.

A registered agent is an individual, which could be yourself, someone you know, another member of the LLC, or a business entity that is responsible for receiving important legal documents on behalf of your business. In other words, they are the point of contact with the state for your business.

Who can be a registered agent is relatively flexible, and there are only a few requirements. For a start, they must be a resident of Kansas or a corporation that is authorized to conduct business in the state. They must also be over 18 and be available during business hours.

Step 3: File Your Articles of Organization

Now comes the time to actually file your Articles of Organization with the state, which is a vital step. The Articles can be filed both online or by mail. It costs $160 to file online, and $165 to file by mail, and must be submitted to the Kansas Office of the Secretary of State.

The Articles of Organization is a legally binding document that once filed with the Secretary of State, is used to officially and legally form your LLC. Without this document, your Kansas LLC is not a legal business entity.

Different things can be included in an Article of Organization, but usually, they will contain the following:

Step 4: Prepare an Operating Agreement for Your Kansas LLC

An operating agreement is a document that essentially governs the framework of the LLC. It outlines a range of items include the ownership rights for the LLC, the responsibilities of the members, how the LLC will be dissolved, and how the profits and losses are distributed.

Some states require you to have an operating agreement before you can conduct business, but Kansas is not one of these states. Although it is not required to have an operating agreement, it is still advisable that you create one.

If you create an operating agreement properly, they can be invaluable for a business and they ensure that the business owners are on the same page, reducing the chance of conflict further down the line.

As you are not required to submit an operating agreement, it does not need to be filed with the state. Instead, it should be kept safe as an internal document with other important business documents, ready to be used if needed.

Again, what is included in your Operating Agreement can differ, but usually, these documents will include some form of the following information:

Step 5: Get an EIN for Your Kansas Business

When going through the formation process, it is usually a good idea to get an EIN at this stage. An EIN stands for Employer Identification Number and works in a similar way to a Social Security, but for a business. An EIN is 9 digits long and is free and easy to acquire. You should apply and be assigned one from the Internal Revenue Service, and is used to help identify the business for tax purposes.

There are certain circumstances that require you to have an EIN, so you might as well get one as soon as possible. For example, you will need one if you want to open a business bank account, if you are planning on hiring any employees, and to file and manage Federal and State Taxes.

You can either request an EIN from the IRS online, or alternatively, you can apply by mail or fax. If you apply online, however, it is pretty instant, so this is the method to use if you want the number sooner rather than later.

Step 6: Apply for Any Necessary Kansas Business Licenses and Permits

Depending on what type of business you have and where is located, there might be some licenses and permits that you need in order to conduct business. The state of Kansas as a whole does not require businesses to have licenses, however, some cities in the state of Kansas may require business licenses, so it is always worth checking.

Some specific service businesses, such as a contractor, bed and breakfasts, and businesses that sell on the internet require licensing, so you will have to apply for these before getting started.

File the Annual Reports

In Kansas, if you own an LLC, you will have to file an annual report every year. These have to be filed with the Secretary of State and is dues on the 15th day of the forth month which follows the LLC’s tax closing month. There is a $55 fee for filing your annual report by mail, and $50 if you are filing it online.

If you miss state filings, then your business could face fines or automatic dissolution. A registered agent can help with this, as they will be able to notify you when there are any upcoming filing deadlines, ensuring you don’t miss them.

Step 7: Separate Your Personal and Business Assets

One of the main reasons that people chose to have an LLC is because it can help to protect your personal assets, so once you have formed your LLC, you should do what you can separate your personal and business assets.

If your business and personal assets are mixed, your personal assets could potentially be at risk if something happens to your business, such as if it is sued or if you come into debt. There are a few processes you can do to stop this from happening.

Create a Kansas LLC with Professional Help Today

Although it is possible to form an LLC on your own by following the steps outlined above, some people prefer to get some professional help. Not only will this save time, but it can also take the stress out of the whole process, so you can concentrate on your business and rest assured that your LLC will be formed properly. There are many companies that offer the LLC formation service, some of which are better than others, so it is worth doing a little research to find out which is right for you. Below are a couple of the best in the industry.

#1: Start a Kansas LLC With Zenbusiness

Zenbusiness is one of the most popular LLC formation services as they are not only one of the cheapest, but also one of the best. They have some seriously good reviews online, and lots of them, despite not being around as long as some of the others. You can get their basic package for just $39, which includes everything you need to successfully form an LLC, and the helpful customer service team is always on hand if you need help or guidance through the process.

#2: Start a Kansas LLC With Northwest

In comparison to Zenbusiness, Northwest is a lot more expensive, charging $225 for its service, which includes a full year of registered agent service. Although they are one of the more expensive options, sometimes you get what you pay for, and the company are known for their exceptional customer service and offers real quality to their customers.

Kansas LLC FAQ

How long does it take to form an LLC in Kansas?

The time it takes to form an LLC in Kansas varies case by case, and is determined by a number of factors such as how many applications are in front of you and how complicated your LLC applications is. On average though, it will take around 24 hours for LLC approval if you are filing online, or 3-5 days if you are filing by mail. If you want your LLC formed a little quicker, then there is always the expediting option, which means your LLC filing will be prioritized, and this is available for a small fee.

Is a registered agent service worth it?

Whether it is worth using a registered agent service is entirely dependant on your personal services. It is however, an affordable way to manage your government filing for your LLC, saving you the time and hassle. Although it is possible to be your own registered agent, or get someone you know to be your registered agent, the advantages of using a professional service generally outweigh the price, which is usually paid annually.

How do I dissolve my LLC in Kansas?

When it comes to the time you want to cease business, it is vitally important that you follow the proper dissolution process to avoid tax liabilities and penalties. You could even end up in legal trouble, so it is important that you dissolve it in a timely fashion.

You should have outlined how you are planning on dissolving your LLC in your Articles of Organization, but broadly they will follow the same process. You should close your business tax account and also file the Articles of Dissolution.

Should I form an LLC in Kansas?

If you are just starting a business, or you are already operating a business, then it is always worth considering filing as an LLC. This type of business entity comes with a lot of benefits, including limiting the owner’s personal liability, and it has a lot of flexibility when it comes to the business management, taxation of the business and the business ownership.

Can I use a fictitious business name?

Once you have formed your LLC, you don’t always have to use the name that you have registered in your Articles of Organization when you are doing business. It is possible to use a fictitious business name, which is also known as a ‘doing business as’ name. This name can be used if you want to branch out and do a different type of business or make your business name more searchable or memorable.

How much will it cost to form an LLC in Kansas?

To file your Articles of Organization, which is likely the most expensive part of the process, will cost $165. If you want to reserve your business name to stop others from using it, then this is an additional $30 when you are doing it online, and $35 if you want to apply by mail. You then have to think about the ongoing upkeeping costs of running an LLC, such as filing your annual report. Forming the LLC yourself is the cheapest option, but can be complicated, so you may want to consider hiring an LLC formation company to do it for you, and prices can vary.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs