Pennsylvania LLC (7 Step Guide) – How to Form an LLC in Pennsylvania

Form Your PA LLC Today, Hassle-free (from $0+state fees)

A Pennsylvania Limited Liability Company (LLC) is one of the best business structure options for any business in the Keystone State. With the reduced personal liability of a corporation and the pass-through taxation of a sole proprietorship, an LLC is the perfect growth structure for any entrepreneur.

Plus, if you are looking to start your business in the Northeastern U.S., look no further than Pennsylvania. Housed in the heart of the East Coast, Pennsylvania has a large workforce and plentiful higher education opportunities to support growth. If you are looking to form your Pennsylvania LLC, just follow these seven easy steps which we’ll talk about in a moment.

If you want to skip the hassle of starting a Pennsylvania LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form Your PA LLC Today, Hassle-free (from $0+state fees)

- Benefits of a Pennsylvania LLC

- PA LLC Taxation & Fees

- Pennsylvania’s LLCs Pros & Cons

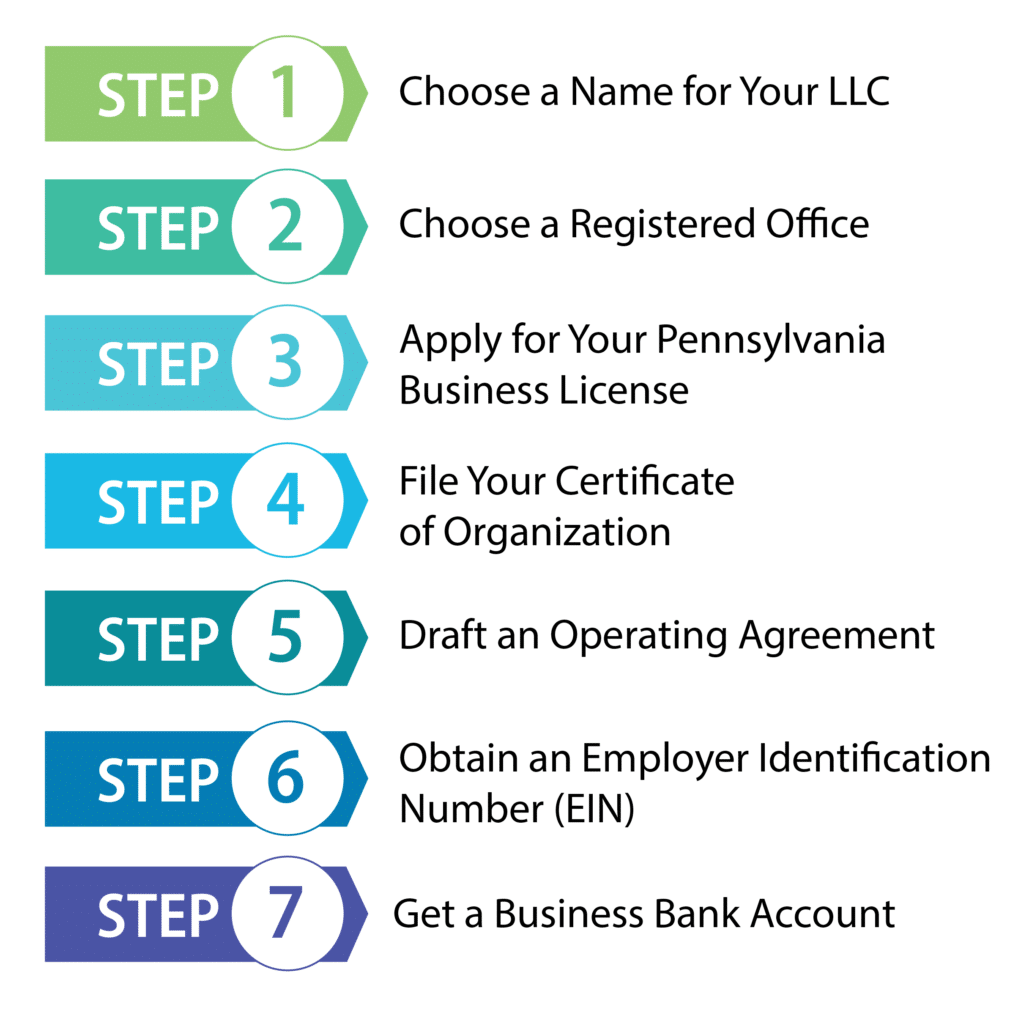

- How to Start Your Pennsylvania LLC?

- Step 1: Choose a Name for Your PA LLC

- Step 2: Choose a Registered Office (Agent) in Pennsylvania

- Step 3: Apply for Your Pennsylvania Business License

- Step 4: File Your Certificate of Organization

- Step 5: Draft an Operating Agreement for Your Pennsylvania LLC

- Step 6: Obtain an Employer Identification Number (EIN)

- Step 7: Get a Business Bank Account in PA

- Form a Pennsylvania LLC With Professional Help Today

- Final Thoughts

Benefits of a Pennsylvania LLC

An LLC offers many benefits, but the biggest of them is that its owner’s assets are protected from loss in any legal issues. If your business is structured as a sole proprietorship and is sued, the owner’s assets could be at risk. However, as an LLC, any judgments passed on the business are separate from the owner. This means that even if the business cannot pay its debts, the owner’s assets are protected.

Another key benefit for many business owners is the flexibility in the management structure it allows. An LLC can choose to be member-managed or management-managed. In member-managed LLCs, the companies’ owners handle the day-to-day management of the business’s operations. Whereas, with manager-managed LLC’s the members will appoint a manager to run the day-to-day operations. This manager can be one of the members or an outside individual.

An LLC can distribute profits however they choose and set out in the operating agreement how it will be distributed. This document is generally not required but is incredibly valuable for an LLC and its members. It sets out how the company will be run and rules for its members and managers. The operating agreement can set out many more points, including how profit will be distributed.

Plus, if you don’t like paperwork, an LLC may be right for you. This structure does not require as much as other options for business structure.

PA LLC Taxation & Fees

The IRS classifies LLCs as disregarded entities. This means that your LLC will not be taxed on the entity level at all. Though, if the LLC elects to, it can be treated as a C corporation. Once the business chooses how it will be taxed, this will determine which tax rules it will follow both for the state and federal tax returns.

Generally, this means that the LLC is not subject to federal taxes as long as it does not elect to be taxed as a C corporation. Instead, as a flow-through entity, the profits and losses are simply directly allocated to the owners of the LLC. These individuals will then pay taxes on any profits through their personal tax returns. This avoids the double taxation faced by C corporations when they pay taxes on any profits, and then business owners pay taxes on any earnings they receive as well.

However, the owners will pay self-employment taxes, and this can result in higher taxes in some cases. In some cases, it can be wise to elect for tax treatment as an S corporation.

And if you’re wondering how much will an LLC cost you all in all — read our Pennsylvania LLC costs guide here. We have laid out all the mandatory and optional fees.

Pennsylvania’s LLCs Pros & Cons

When starting your Pennsylvania business, it is wise to consider if an LLC structure is right for your business. There are numerous benefits, as we just addressed. The biggest being its protection from liability for its owners, meaning they are not liable for the business’s debts on a personal level. They also offer flexible taxation options allowing the business owners to choose between flow-through taxation or a C corporation.

However, there are drawbacks. Often the biggest drawback for many small business owners is the higher startup costs than sole proprietorships and general partnerships. Also, this business structure is worse than C corporations for raising investment money. Let’s take a look at a list of the pros and cons of a Pennsylvania LLC.

Pros

Cons

It’s good to consider the pros and cons of an LLC for your business before making any decisions. Consider your business’s current needs and what they may be in the future. Balance the higher startup costs of an LLC against the tax flexibility and considerable legal protection.

How to Start Your Pennsylvania LLC?

Now that you know what an LLC is as well as the pros and cons of this business structure, let’s take a look at how you can start your own Pennsylvania LLC. There are only seven steps to formation, so let’s get started.

Step 1: Choose a Name for Your PA LLC

The first step is simply choosing a name for your new LLC. Pennsylvania requires that every LLC must maintain a distinct name distinguishable from other businesses filed with the Department of State. This avoids confusion from consumers and other members of the public.

Pennsylvania also requires LLCs to end their names with the words “Limited Liability, Company,” or abbreviations” “LLC” or “L.L.C.” The words limited and company can be abbreviated as Ltd and Co as well. The word corporation cannot be used in an LLC name.

The first step to filing for the name you choose for your business is to check if it is available. You can perform a business entity search on the Pennsylvania Department of States website.

Reserving a Name

You do not need to reserve a name as you will gain sole rights to the name for your business when you file your Certificate of Organization. However, if you want to ensure the name you have chosen is available when you go to file for your business, you can reserve a name for 120 days. A name reservation form can be filled out, printed, and mailed to the Pennsylvania Department of State, Bureau of Corporations, and Charitable Organizations. After 120 days, you may submit additional reservations.

Restricted Professional Company

There are certain licensed professions in Pennsylvania, including doctors, that are required to form a restricted professional company. In most states, this type of entity is referred to as a professional limited liability company (PLLC). The rules for this type of company generally resemble the rules for LLCs.

Step 2: Choose a Registered Office (Agent) in Pennsylvania

All Pennsylvania LLCs are required to designate a registered office. A registered office typically referred to as a registered agent in most states will accept communication from the state on your behalf. This is important because if your business is ever sued or receives communication from the state, this is who will receive it.

Your registered office can be any individual 18 years of age or older with an address in Pennsylvania. This does not include P.O. boxes. It can also be any company that is authorized to do business in Pennsylvania and possesses an address in Pennsylvania.

Don’t want to be your own agent and leave the job to the professionals? Check out our top-5 Registered Agent services list here.

Any member of your LLC can serve as the Registered Office for your business, and it can be your home or business address. However, this can be inconvenient for several reasons, including that an agent will need to be available at all times during regular business hours. This can be a problem for many businesses that operate outside of regular business hours.

Step 3: Apply for Your Pennsylvania Business License

You may need a business license to operate your business in Pennsylvania. It depends on the industry you are in. You may also need local licenses or sales tax permits, among others. The first thing to do is to file a Business Entity Form (PA-100). After this, you should be able to get many of the licenses you need. If you intend to sell taxable products or services, you will need a sales tax permit also acquirable through form PA-100.

Other licenses include zoning permits, regulatory permits depending on the product or service you sell, and potentially a fictitious business name license. A fictitious business name or DBA “doing business as” simply refers to a business name other than your business’s legal name that you will register with the state when you file your Certificate of Organization.

In Pennsylvania, a fictitious business name requires licensure; however, unlike most states, there is no requirement that the name is unique to a specific business. To register a fictitious name, you will need to file a Fictitious Name Registration form.

Step 4: File Your Certificate of Organization

In order to form an LLC in Pennsylvania, you’ll need to file your Certificate of Organization and a docketing statement with the Bureau of Corporations. The cost is $125. You file this form online or by mail. You can download the form here. The address to mail the form to is included in the instructions.

There are a number of things that you will need to include in the form, such as the name of your business, the type of entity, and the names of the members. You’ll also need to include the purpose of your LLC as well as its duration, and whether it is a domestic LLC. You’ll also need to decide whether you want the effective date of formation to be the date the state approves your Certificate of Organization or a later date.

Another important decision you’ll need to make before submitting the form is whether you want a member-managed or a manager-managed LLC. In a member-managed LLC, the members make all the decisions concerning the business and perform the day-to-day running of the business. This is the most common type of management for LLCs.

In a manager-managed LLC, the members choose a manager to run the LLC and the manager will make the decisions for the LLC as well. The members can still advise the manager, but the manager is not required to take the advice. However, the members can reserve the right to make certain decisions or even remove the manager by specifying procedures for this in the operating agreement.

You’ll also need to fill out a docketing statement. The form requires the name of your business and the name and address of the person responsible for your first tax reports. You’ll also need to include a brief description of the purpose of your business, but be specific, or the form could be rejected. An EIN is also necessary, and you will need to include the month and day you intend your tax year to end.

Step 5: Draft an Operating Agreement for Your Pennsylvania LLC

Pennsylvania does not require LLCs to have an operating agreement, but having one can help avoid conflicts between members. It can also allow you to make some decisions about operating procedures for your LLC that would otherwise be determined by state default laws.

There are no specific requirements for what needs to be included in an operating agreement, but there are some things that should be included, such as:

Step 6: Obtain an Employer Identification Number (EIN)

An EIN is an Employer Identification Number, and it is used by the IRS to identify your business for tax purposes. Not all businesses need an EIN, but it is generally suggested for most LLCs. Also, if your LLC wants to hire any employees, you will need to obtain an EIN. You will also need an EIN if your LLC has two or more members, and an EIN is generally required to open a business bank account.

It’s free to obtain an EIN, and you can do so on the IRS website. You can apply online, by mail, by fax, or for international applicants, by phone. However, you will need a Taxpayer Identification Number to apply.

Applying for your EIN online is the quickest way to get your EIN. Once you complete the application, your EIN will be issued immediately. Just make sure to finish the application in one session because your information will not be saved if you leave before finishing. Also, your session will time out if you are inactive for more than 15 minutes.

You can also apply by mail by filling out Form SS-4. After filling out the form, mail it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you choose to apply by fax, you need to fill out Form SS-4. The fax number is (855) 641-6935.

If you are an international applicant, you can apply for your EIN by phone. You’ll need to call between the hours of 6 a.m. and 11 p.m. Eastern Time. Just make sure that if you are the caller, you have the authority to answer the questions on Form SS-4 and receive the EIN.

Step 7: Get a Business Bank Account in PA

An LLC does not have to open a business bank account, but it is always a good idea to do so. If you have an LLC, you need to keep its finances entirely separate from the finances of its members. This is essential for the LLC to be seen as a separate entity. If your LLC is ever taken to court and the finances of the LLC have been mixed with any of its members’ finances, the court could choose to set aside the LLC’s limited liability and hold the LLC’s members personally responsible for any settlement or debts.

There are other good reasons for opening a business bank account as well. Doing so can help you to form a good relationship with a bank, which could be helpful should you want to obtain a loan in the future. It will also allow you to accept credit cards. This could really help your business since not being able to accept credit cards could limit your customers.

Form a Pennsylvania LLC With Professional Help Today

Start Your LLC In PA With ZenBusiness

ZenBusiness is one of the newer LLC formation businesses, but they get very good customer reviews. They also provide 50% off of the first year of registered agent service with all of their packages. Also, if you purchase their mid or upper-tier package, they include worry-free compliance. With this service, ZenBusiness will take care of all of your ongoing filings with the state to help keep you in compliance.

Start Your LLC In PA With Northwest Registered Agent

Northwest Registered Agent has been in business since 1998, and they are one of the top LLC formation services. They provide excellent customer service. Their corporate guides are very knowledgeable and can answer even complicated questions. Also, they provide a free year of registered agent service.

Final Thoughts

A Pennsylvania LLC is one of the best business structures available for entrepreneurs looking to get started and existing small businesses looking to grow. LLC formation can protect your personal assets and potentially lower your tax burden over other business structures. This unique combination of benefits is perfect for small businesses and startups alike. So, don’t hesitate to get started today!

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs