How to Form an LLC in Florida? (6 Step Guide) for Florida LLC

Jump to Best 3 LLC Formation Companies for Florida LLCs

When it comes to forming an LLC, each state has its own requirements and steps that businesses will have to go through. Florida has several steps for LLC formation that new business owners will have to go through. These steps can either be done yourself or with the help of a company that specializes in various legal work and sometimes, just solely LLC formations.

If you’re wondering how much will all of that cost – here’s our full guide on Florida LLC costs.

Let’s dive into the guide.

Don’t Feel Like Reading? Here’s a Quick Video Guide on Florida LLC

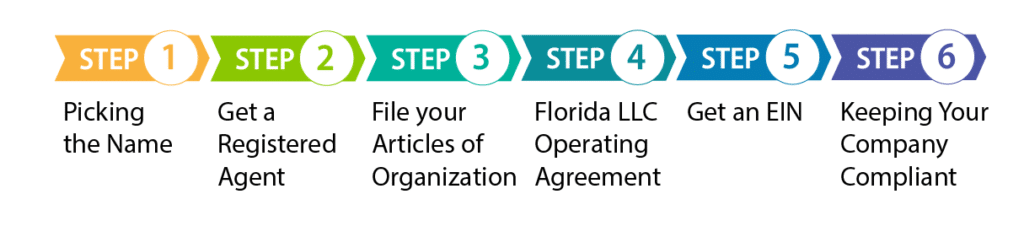

6 In-depth Steps for Forming an LLC in Florida

Step 1: Picking the LLC Name in Florida

One of the biggest rules in Florida when it comes to picking a name for an LLC is that it must contain the words ‘Limited Company’ or ‘Limited Liability Company at some point in the name. It is also acceptable for just the abbreviations of these words to be used. In order for a name to be accepted, no other LLC in the state of Florida can have the same or very similar name, it must be recognizably different.

You are able to check whether your desired name is already in use by searching the Department of State: Division of Corporations’ business name database to see what is already on file. It is possible to conduct this search by yourself, but there are also companies that will do this task for you for a small fee.

When picking a name, you should always follow the state’s laws and requirements, while also making sure the name is searchable. While you are looking for and choosing a name, it may also be worth seeing if the URL is available. Even if you don’t plan on creating a website straight away, chances are you will somewhere down the line, and a website URL is a big part of many businesses. If you find that your desired URL is still available, you could always buy it to prevent problems further down the line.

Step 2: Get a Registered Agent

All LLCs are required to have a registered agent, regardless of what state it is being formed in, and Florida is no different. For those that are new to the business world, a registered agent is simply the individual or business entity that is responsible for receiving a range of documents for the business. This can include things like important tax forms, legal documents, a notice of lawsuits, and other official government correspondence on the behalf of your business. An easy way to think about it is to think about a registered agent as your LLC’s point of contact with the state.

A registered agent will take care of everything, from taxes and lawsuits to maintenance requirements. Even when you are out of the office or out of state, you can rest assured that all your important documents are still being taken care of and received.

There are lots of things to consider when picking a registered agent for your business, as you could choose yourself, a friend or colleague, or registered agent services are also often used.

So who can be a registered agent? First and foremost, they must a full-time resident of Florida, or they can be a corporation. There are pros and cons to both options.

Being your own registered agent or having someone you know do it for you will save you money, as you won’t have to pay a company to be your registered agent, however this the more stressful and time-consuming option. Often, attorneys and consultants are used as registered agents, although usually the more expensive option. Using a registered agent service, and there are many out there, is the much easier option. There are many LLC formation services that will throw in a year of registered agent service for free as part of the formation package.

Step 3: File Your Articles of Organization for Your Florida LLC

One of the main sets of forming an LLC is to file Form LLZ-1 Articles of Organization with the Florida Articles of Corporations. There are several ways you can apply. It can be done in person, by mail or one of the more common methods is online. If you want to file it by mail, you are able to download it online to print and send off. The state filing ost is $125 which is non-refundable and payable to the Florida Department of State.

The articles are processed in the order that they are received. There is no set time scale, but they will usually be processed within 2-4 weeks.

Step 4: Florida LLC Operating Agreement

It is not completely necessary to have an Operating Agreement in Florida, and you can still form LLC without one, but it is good to have one. The document outlines the operating procedures and ownership of the LLC. Having everything clear and outlined will reduce the risk of future conflict, as everyone in the business are all on the same page. It serves as your company’s bylaws and is very important when it comes to your business’ success.

For example, if a company has multiple owners (like Multi-member LLCs), the operating agreement will show how the assets of the LLC will be distributed in the case of dissolution.

There are several ways you can go about creating an operating agreement. If you feel confident, you can write it yourself. There are several online templates that you can use as a guide, or some LLC formation packages will offer an LLC operating agreement as part of their formation package. Another option is to hire an attorney. Although this is a more expensive option, you will be sure that no important details are missed. Even if they don’t write it for you, they can review it once you have completed it to ensure it includes all the necessary information.

Step 5: Get an EIN in FL

An EIN stands for an Employer Identification Number and is a 9 digit number issued by the Internal Revenue System. The number is used to keep track of a business’s tax reporting, and all LLCs need one. An EIN is needed to open a business bank account, to hire employees and for federal and state tax purposes. If you pay any business taxes, it is particularly important to have one.

It doesn’t cost any money to obtain an EIN and it can be done either online or by mail. Online is the best method if you need to get this stage done quickly, as you can complete the process at any point from 7am to 10om Monday to Friday, and as soon as you have finished, you will receive your number. Some companies prefer to have an EIN in paper form, therefore it is possible to download the form and fax it or mail it. Mail is the slowest option and can take around 4 weeks.

Step 6: Keeping Your Company Compliant to Florida Law

Once you’ve formed your LLC, three are still processes you have to go through to keep your LLC compliant. Annual reports are filed online between January 1 and May 1. In order to maintain active status, these reports must be filed annually. The cost of this annual report is around $138.75, and you are able to pay it via debit card, credit card, check, or money order.

The annual report of businesses is how the state keeps its records up to date and accurate and can easily be done online via the e-Filing portal. When filling out the form, use the document number that should have been sent in a reminder email before the deadline, or can be found using the online business search tool.

Be warned that if you still haven’t filed your report before the third Friday in September, as well as being fined, the state can actually dissolve your LLC. If you are late in paying your annual report, you could be fined around $400.

In addition to the annual report, as an LLC owner, you will also be required to pay state taxes.

Depending on the type of business you are running, there are different types of tax you may need to pay to the state.

There may be a few other taxes you have to pay. If you sell any merchandise then you may be required to pay Sale or Use taxes, or if you hire employees then you will need to pay Unemployment Insurance Tax. Also, depending on where your LLC is located, you may also have to pay a tax to the county, city, or municipality.

Things To Consider After Forming Your Florida LLC

Unfortunately, the work doesn’t end once you have formed your LLC, there are still lots of different things to consider.

- General Liability Insurance – This is a very broad insurance policy that is used to help protect your company from lawsuits. It is very common for small businesses to take out this type of insurance.

- Professional Liability Insurance – This type of insurance is used for service providers, such as accountants or other businesses that offer a service rather than a product. It will aim to cover claims of a range of business errors.

- Worker Compensation Insurance – This type of insurance can be used to cover the company if your employees have any job-related illnesses, injuries or deaths.

TOP-3 Best LLC Formation Services for Florida LLCs

If you want to ensure that your LLC is formed well and efficiently, it is often worth using an LLC formation service. There are many reliable and affordable LLC formation services out there that can take care of the process.

Here are some of the best that will do all the hard work for you.

#1: Start a Florida LLC With Zenbusiness

Zenbusiness is one of the best LLC services out there. It has been around for a while, therefore has formed an impressive portfolio of businesses, most of which have given the company hugely positive reviews. It is also one of the most cost-effective LLC services available, able to form an LLC for just $39. Although this is the most basic package, it comes with everything you need to form a business effectively. They also offer services to take care of your annual report filing and other ongoing company compliance to make running your LLC as stress free as possible. If you go for their Pro Package, this is part of their worry free guarantee.

You may also want to check out our full review of ZenBusiness here.

#2: Start a Florida LLC With IncFile

IncFile really is the most cost-effective LLC formation service, as you can get your LLC created for free. This is perfect if you’re on a strict budget, as they also offer some really good features along the way. They offer a full year of registered agent service, and lifetime company alerts when it comes to important filing deadlines. Since forming in 2004, they have helped over 250,000 businesses form, so you can rest assured you are in safe hands.

Just keep in mind that the company does have to make their money somehow, so although the primary service is free, chances are you are going to have to deal with more upsells, and some of their other services may be more expensive than you would expect.

Feel free to check our full IncFile review here.

#3: Start a Florida LLC With Northwest Registered Agent

Northwest Registered Agent is a little more expensive than the above options, but it is one of the best, and will give you a lot for your money. What really sets them apart from the rest is their customer support. The team behind the scenes will go above and beyond to help you with any questions you may have.

It will cost you $225 to have an LLC formed, but with this higher price tag comes exception service and a range of other benefits including a full year of registered agent service, which usually costs $125 a year alone. There are so many good reviews online that back this up.

Here’s our full review of Northwest.

Conclusion

For those that are new to forming LLCs, all this may seem like a lot to take in. If you have the time and the knowledge, or you don’t mind putting the research in, it is possible to go through the whole process yourself and get a functioning LLC in Florida. Many people, however, choose to get a little help along the way.

If this is the route that you are going down, it is advisable that you get a good LLC formation company to do the work for you (like the 3 ones mentioned above). There are so many good, reputable, and affordable companies out there that have lots of experience and thousands of online reviews to back them up. By using an external provider, you will have the time to put your energy where it needs it most, your business. Plus you can rest assured that everything will be submitted correctly and on time.

An LLC formation service can usually do so much more than just form your LLC in Florida. Most also have other services such as handling the maintenance, such as filing annual reports, and being the registered agent for your new business.

FAQs

Should I form an LLC in Florida?

If you are basing your business in Florida, it may be a good idea to form an LLC. They usually offer more flexibility with factors such as management, taxation and ownership. They also limit your liability as the owner for business debts and lawsuits. All states have different processes when it comes to forming an LLC, but Florida’s process is not too difficult or time consuming, and can be done either on your own or with help from an external provider.

Is forming an LLC in Florida expensive?

There are a few different costs involved when it comes to forming an LLC in Florida. For a start, the Florida Division of Corporations charges a flat rate of $125 for LLC formation to file the Articles of Organization. On top of that, you will be required to pay $50 if you are looking to reserve your LLC name. Every year you will then also have to pay the fee for filing an annual report.

These could be the only main costs if you are forming the LLC yourself, so this is definitely the cheapest option if budget is a big issue. Hiring a lawyer is the most expensive option, and you could even see a bill mounting up into the thousands. A good middle ground is to use an LLC formation service provider. Each company charges different amounts, but are much cheaper than hiring a lawyer.

How do I dissolve my LLC in Florida?

When it comes to the time to close your business, then you should properly dissolve your LLC rather than leave it operating. This will limit your need to pay fees and your liability for lawsuits. There is are several steps you will need to take to properly dissolve your LLC in Florida, so it is best to follow the state’s guidelines completely.

Do I need to obtain a business license in FL?

You may need to obtain a business license depending on a few factors such as what sort of business you are running and where it is located. There are a range of different local and state businesses you may need, and the best place to read up on these is the state’s website, which is filled with helpful information.

Do I need to have an Operating Agreement?

Your LLC does not need an Operating Agreement in Florida, but it is very much advised that you have one, as it will help you to protect your limited liability status. Most LLC formation services are also able to help with Operating Agreements, either as an added payable service or as part of the LLC formation package that you picked. The agreement will also help to prevent any managerial and financial misunderstandings.

I have picked my business name, but how do I find out if I can use it?

One of the most important things about a business name in Florida is that it needs to be very distinguishable from the names of existing businesses in the state. It doesn’t cost any money to conduct a name search on the Florida Division of Corporations website, so you can check if your desired name is still available or not.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs