Multi-member LLC — What Is It & Is MMLLC Right For You?

Jump to Top-2 Services to Create Your Multi-member LLC

When starting up a business, one of the first steps you need to consider is your business framework, as this framework can help ensure long-term stability and protection. An MMLLC is just one type of framework you could consider. Although an MMLLC is a good business entity type, not everyone needs to form a multi-member LLC, so let’s take a look at the advantages and disadvantages, and how it may or may not work for your business.

What is a Multi-Member LLC?

To put it simply, a multi-member LLC is a Limited Liability Corporation that has multiple owners. Each of the owners shares the control of the company. Your company has the freedom to allocate a percentage of the business’s profits and losses among the different owners as they chose. This gives you the freedom to share out the earnings not just in how much money was invested into the business, but you could also think about other factors, such as how much time and work certain individuals have put into the LLC. It is a good option for anyone who is looking to legitimize your business and establish a little more structure.

The requirements for a multi Member LLC are pretty broad, in fact, the only really strict requirement is that all the members must be 18 or over. There are no citizenship requirements, and other business entities can also be members of LLCs. Although it is a separate legal entity from the business owners, it is not a separate tax entity.

Advantages of Multi-Member LLCs

- Multi-member LLCs come with lots of advantages. One of the biggest advantages is that members of their LLCs are not individually responsible for what their LLC does.

- Another advantage is that when an LLC loses money, its members are able to claim these business losses on their tax returns.

- Flexibility is one of the biggest reasons that people chose to form a multi-member LLC. You are almost able to run the business completely how you want to, whether that to choose whether you want to manage an LLC on your own or appoint other managers. Managers can even be people outside of the LLC or other LLC members. They are relatively easy to upkeep. The basics of forming the multi-member LCC is similar in all states, although each will have their own variations.

Disadvantages of Multi-Member LLCs

- The formation process is not the simplest, and it can be a little bit complicated and time-consuming to handle. This is especially when you think that other business types may not require any formation process at all. Therefore, if you’re eager to get your business up and running, then an MMLLC might not be the best way to go, and you can always form this further down the line when things have settled down.

- Setting up an MMLCC costs money, and depending on what state you are forming it in, it can be an quite expensive process. There are both formation fees and ongoing maintenance fees to consider, so it is worth looking into how much the whole process is going to cost you before getting started. It is definitely more expensive than forming a general partnership but are cheaper than corporations. If your budget is pretty tight, it might be worth waiting to form an MMLLC if this is what you want to do.

Ownership of MMLLC

As the name suggests, a multi-member LLC has more than one member. You are then able to choose how the profits and losses of the businesses can be split. There is a lot of flexibility in most states when it comes to who owns the LLC, which makes it a good, flexible option to consider.

The profit distribution should be outlined in the operating agreement. Usually, the distributive share of each member will be proportionate to the amount of interest in the company they have. You don’t have to use the percentage interest to determine this, however.

Taxes for Multi-member LLC

Although there are many perks to forming an LLC, there are also some drawbacks to having a company with this business structure. The main drawback has to do with taxes, as all multi-member LLCs have to file a partnership tax return, which has some difficult and complicated rules.

All multi-member LLCs are required to file a tax return and give its members K-1 forms which they will have to file along with their returns. It is not only the company that has to pay taxes, the shareholders also have to.

There is a little flexibility in how your business income taxes are handled, but generally, the members all individually pay income tax which is based on their shares of the profits. Members are able to choose to have the business taxed as a C corporation, so standard tax rules will apply, or S corporation tax treatment. This means that you would be taxed as a partnership would be.

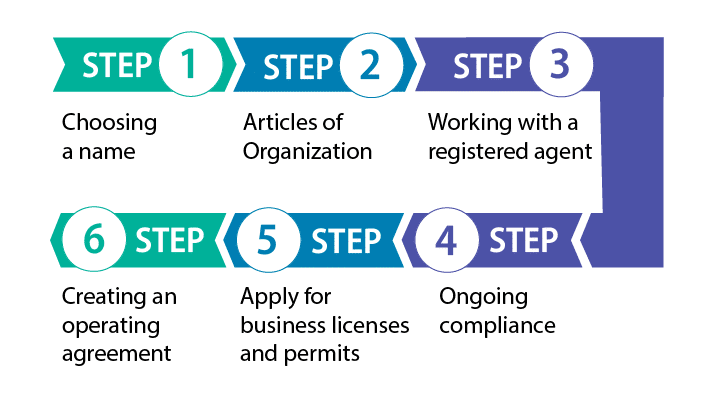

6 Steps on How to Form an MMLLC

Forming an MMLLC is similar to forming an LLC. The process differs slightly from state to state, although in general it is pretty similar.

Step 1: Choosing a Name for Your Multi-member LLC

The first step is choosing a business name. In all states, your business name has to include some kind of variant of the words “limited liability company”, so for example, you could use the abbreviated version. You should be aware that different states may have different conditions, for example, some will only allow using a business name if it is not currently in use in that state. Some also will charge a small fee if you want to reserve your business name so that no other company can use it.

Step 2: Writing Articles of Organization for Your MMLLC

To form an MMLLC, you must file Articles of Organization. The exact process varies from state to state, but all must have the Articles of Organization filed with the Secretary of State located in the same state that you wish to conduct business in. This legal document provides the state with basic information about your LLC. It should include things such as the address of your LLC, the address and name of your registered agent and various other pieces of information.

When submitting your LLC, you will have to also pay a filing fee, which is different from state to state.

Step 3: Working With a Registered Agent

All MMLLCs are required to work with a Registered Agent. This could be a member of the company, an individual outside the company or alternatively, you can hire an outside provider to do the work for you. Essentially, a registered agent is someone or a company who will be your point of contact with the state, meaning they will receive state legal documents on behalf of the LLC. The biggest requirement is that the registered agent is based in the same state that your MMLLC is based in.

Step 4: Creating an Operating Agreement for Your Multi-member LLC

Not all states require a MMLLC to have an operating agreement, but it is very much advised that all businesses should have one. It is a document that contains financial and managerial information, so that there is no confusion or problems later down the line. It can detail things such as what will happen with the distribution of losses and profits, what the management structure of the MMLCC is like, the responsibilities of each of the members and the voting power of the members.

Step 5: Apply for Business Licenses and Permits

Depending on where you are located and the type of business you are running, you may need certain business licenses or permits in order to operate. If you do a little research, you should be able to find out what applies to you.

Step 6: Multi-member LLC Ongoing Compliance

Once you have registered your MMLLC, there are still some ongoing compliance issues you will have to stay on top of. Be sure to continue renewing your licenses and permits, file your annual reports, update the state about any major changes that are taking place within your company, such as if you add any new members or if any old members leave, and also be sure to always stay on top of your taxes. Ongoing requirements vary from state to state, so check what applies to you.

Top 2 LLC Creation Services for MMLLCs

Although it is possible to form an MMLLC by yourself, the process can be long and complicated, especially if you are new to business creation. It will take up a lot of your precious time, which you could be spending on running your business, plus there is always the chance that it will not be formed properly, which could lead to problems or fines later down the line.

The answer to this is to get someone else to do the work for you. There are many different businesses out there that can help you create your MMLLC in just a few steps, and it doesn’t have to break the bank. Two of the best MMLLC formation services are Zenbusines and IncAuthority.

#1 — ZenBusiness

Zenbusiness really is one of the best LLC formation services. Not only is it one of the cheapest service providers out there, with their pricing starting at just $39, but they have tons of great reviews online, so you can rest assured you’ll be working with a good company. Not only do they provide complete LLC formation, but this always comes with a full year of registered agent service included in the price. If you want more than what the free package can offer, they also have a Pro and a Premium package, which offer faster formation, worry free compliance, and even a business website.

If you want to know more — here’s a review of ZenBusiness.

#2 — IncAuthority

IncAuthority attracts a wide range of businesses from all states, especially those with a limited budget. You are able to apply for an LLC business through IncAuthority for free, so all you have to pay are your state filing fees. The free formation package comes with a business name search, document preparation and filing, plus a year of registered agent service. If you want more, the packages go right up to the ‘Tycoon’ package, which is charged at a huge $799 plus state fees. There are some very positive customer reviews online for it, so you are able to hear firsthand from the people who have actually used this service.

We also encourage you to check the full review of Incauthority here.

Conclusion

To decide whether an MMLLC is right for you and your business, you need to think about how it would impact you legally, administratively and operationally. You would also have to consider what it would mean about the taxes you have to pay. All business structures offer different advantages and different disadvantages. If you are not sure what to do, it may be worth talking to an attorney or another accounting professional for a little guidance.

FAQs About Multi-Member LLC

How do I pay myself as an MMLLC?

In order to pay yourself and the other members, you will take ‘capital distributions.’. A capital distribution is taken from the LLC bank account and given to each member. The amount received depends on how much of the business each member owns.

Can I get an EIN for an MMLLC?

If you have an MMLLC, it is possible to get an EIN, and the process is relatively simple. EIN stands for Employer Identification Number. The process is free, and it is possible for you to apply yourself online in just a few simple steps. Plus, if you use the online method, you should receive your EIN straight away, allowing you to carry on conducting business.

How much will it cost me to form an MMLLC?

There is no set answer to this question, as the answer depends on many variables. For a start, the filing fee will depend on what state you are forming your MMLLC, as the rates can vary dramatically. Some states are relatively cheap, charging under $50, while others charge multiple hundreds. There are also additional fees to pay if you wish to reserve your name. These should be the main costs if you are forming your MMLLC yourself, but if you hire a company to do it for you, you’ll also have to pay them.