Virginia LLC (6-Step Guide) – How to Form an LLC in Virginia?

Start a Virginia LLC With Professional Help (from $0+state fees)

For those looking to start a new business or upgrade their existing one, there is one option you should not overlook, a Virginia LLC. With this business structure, your company can thrive with the pass-through taxation this structure can offer. Plus, should your business ever be incapable of paying its debts, a Virginia LLC can protect your personal assets.

Additionally, Virginia has topped lists of business-friendly states for years with an incredibly positive regulatory environment, numerous incentive programs, and a high quality of life. So if you aren’t convinced yet, let’s take a look at why you would want a Virginia LLC, the pros & cons, and how to form your Virginia LLC in six easy steps.

If you want to skip the hassle of starting a Virginia LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

Why Would You Want a Virginia LLC?

As we just said, there are a number of advantages to forming a Virginia LLC. Though the state has proven beneficial to many structures, an LLC has proven to stand out over other structures such as general partnerships and C corporations. So let’s take a look at why you would want a Virginia LLC.

Luckily with a Virginia LLC, your car, home, bank account, and any other assets are secure from creditors. This applies even if your business is sued due to injuries or any other circumstances and cannot pay for damages. This is an advantage that can help you be more confident in taking chances to make your business grow, knowing that should the worst come to pass, at least your family will still have a roof over their heads.

Unfortunately, with some structures such as sole proprietorships, you have to register your information, such as your home address, with the state to be placed on public record. This means that anyone can do a simple web search to find your information on the public registry of the Office of the Clerk.

But, with Virginia LLCs, there is a way to get around this problem and protect all of your personal information. Virginia allows companies to form an LLC and register their name and address with the state by using an LLC formation service. Virginia LLC’s members can allow the service to register on their behalf and keep their own information secure and private without affecting their ownership of the business.

Double taxation means that your business will be taxed for all its earnings on the business level before earnings are ever paid out. The after-profit and loss are divvied up and distributed to the company’s members. These owners will then pay for earnings on a personal level.

This means that for all of the money the company takes in, taxes will be paid twice. With a Virginia LLC, though, you can enjoy the protection from liability and enjoy “pass-through” taxation. With pass-through taxation, profits will simply pass through the business to your personal tax return to be paid only once. This can save business owners a lot of money.

Plus, it is worth considering whether your business can receive additional tax benefits that the state offers to LLCs, such as the Qualified Business Income Deduction which offers up to 20% in discounts on taxes. These are considerable incentives reserved for Virginia LLCs.

Quick Virginia LLC Pros & Cons

Now that you know why you would want a Virginia LLC, let’s talk about the pros and cons of this structure. We know you are busy, so we will make this quick and look at the most important points to help you figure out if a Virginia LLC is right for you.

Pros

As you would expect, with such a dependably highly rated state for business, there are a number of pros to a Virginia LLC. Here are some of the biggest.

Cons

Despite the many pros, there are still cons to consider in a major decision like this.

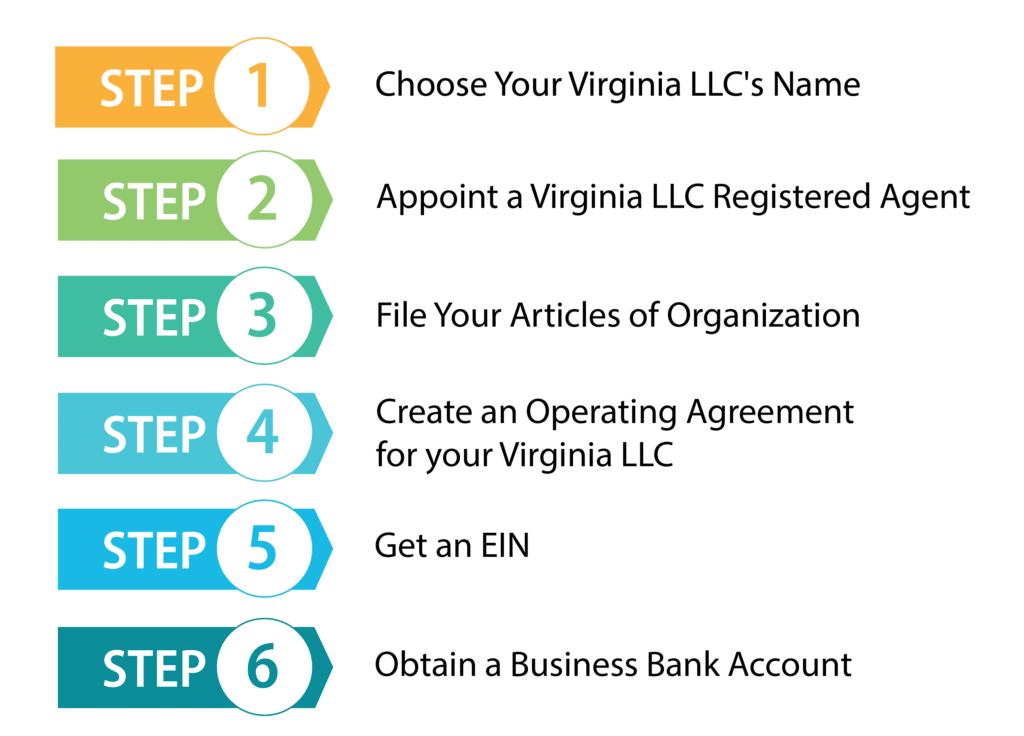

How to Form Your Virginia LLC in Six Easy Steps?

Now that you have learned why you would want a Virginia LLC, as well as the pros and cons of this structure, it is time to show you how you can form your Virginia LLC. In six easy steps, you can get the job done and get your business underway.

Step 1: Choose Your Virginia LLC’s Name

Your first step in forming your Virginia LLC is choosing a name for it. This name should reflect on what your business will provide customers and stand out. A good name should be unique and preferably stand out well in search engines. Your company’s name will be your first chance to make an impression on customers and should not be underestimated. There are a few steps you should take to pick a name.

Now that you have a suitable name, you will have to attach a designator to it. This designator is simply the word “Limited Liability Company” or one of its abbreviations such as “LLC” or “L.L.C.” These words are there just to let everyone know that your business is a limited liability company.

On the same note, make sure not to attach any other designator such as In. or non-profit as this could easily confuse others and, as a result, is prohibited. Similarly, words such as bank or university should only be used if you have suitable permission, which generally will be the case if you have certain professional licenses or charters.

These rules are not that difficult to follow but keep in mind that most rejections of an LLC’s Articles of Organization occur due to issues with the chosen name. So, do yourself a favor and ensure that your chosen name meets the qualifications.

Also, try to pick a name you expect to be satisfied with for the long haul. Though it is not impossible to change your chosen LLC name, it is a pain, and there will be a few fees along the way.

Often if you do become dissatisfied with your LLC’s name for any reason, the easier route is to file for a DBA. This registration, often known as a fictitious name, can be freely used in place of your LLC’s registered name and only costs $10 to file.

Step 2: Appoint a Virginia LLC Registered Agent

Virginia requires every LLC to appoint a registered agent to receive official correspondence on their behalf. This correspondence may include tax forms, regulatory notices, and, most notable, service of process. You will need to make this selection before you file your Articles of Organization as the individual or service you choose will need to be included in the filing.

The individual you choose could be yourself, family or friends, another member of your LLC, or a commercial registered agent service. Your choices here are quite broad and pretty much only limited by whether or not the individual or company in question has a physical street address located within the state of Virginia.

Keep in mind that a registered agent will have to be present at the address you provide during all regular business hours, and no P.O. Box does not count.

Should You Choose a Registered Agent Service Instead of Being One Yourself?

Most LLC owners find themselves considering two options either serving as their own registered agent or choosing a registered agent service. Most end up choosing the latter, and there are many reasons for this.

First of all, a registered agent service means that your name and address won’t be plastered upon public record for everyone to see. Instead, the service you choose will be, and this can avoid a lot of annoying sales visits and your information being stolen.

Plus, keep in mind that if you do choose to serve as your own registered agent, you will have to be at the address you provide during all regular business hours, which essentially means nine to five, for many businesses that work during different hours or involve travel this simply won’t work.

However, with a registered agent service, you don’t have to worry. They will be there every day, rain or shine.

If you want to make the best choice — read our Best Registered Agents list right here.

Step 3: File Your Virginia LLC’s Articles of Organization

Now, this is what it all comes down to, filing your Virginia LLC’s Articles of Organization. Once this document is filed with and approved by the Virginia State Corporation Commission, it will officially form your LLC as a legal entity.

You have two options for filing your Articles of Organization, and these are to file it by mail or to file online. The second of these two options is generally the easiest so let’s take a look at that first.

Filing online can easily be performed through the Clerks Information System on the Virginia State Corporation Commission website. You will have to make an account, but there you can easily input your business information and pay the $100 filing fee online to finish your filing in minutes.

If you would rather file by mail, this is an option. Simply print out the form, “Articles of Organization of a Virginia Limited Liability Company,” and fill it out. Next, mail it to the State Corporation Commission with the $100 filing fee to:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-119

Step 4: Create an Operating Agreement for Your Virginia LLC

Now that your Articles of Organization are filed, it is time to get the ground rules for how your business will operate out of the way. These rules are established in an LLC operating agreement.

Notably, the state of Virginia does not require these to be filed under most circumstances. The exception to this being if you need a Virginia Sales Tax License, in which case you will need to file your operating agreement as a part of the license application.

However, whether required or not, an operating agreement is an important document for preventing and settling disputes between members and will typically be necessary to open a business bank account or receive loans. Plus, if a dispute between members ends up in court, this document is where a judge will look in order to settle it.

Here are some details any good LLC operating agreement should include:

Step 5: Get an EIN for Your VA LLC

Most business owners will want to get an EIN. An EIN is an Employer Identification Number. This is a nine-digit number that the IRS uses to identify your business for tax purposes. You are not required to get an EIN unless your LLC intends to hire employees or has two or more members. However, even if your LLC does not have two or more members and you don’t want to hire any employees, you may find you still need an EIN to open a business bank account. Also, having an EIN is another way to show that your business is a separate entity.

How To Apply

You can apply for an EIN by mail, fax, or online, although applying online is the fastest way to get your EIN. In addition to this, international applicants can apply by telephone. To apply by mail, you will need to complete Form SS-4 and then print it and mail it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

You can also apply by filling out Form SS-4 and faxing it to (855) 641-6935. If you have a Federal Tax Identification Number, such as a Social Security Number, you can apply online at the IRS website. The process doesn’t take very long, and you get your EIN as soon as you are finished. Just make sure to finish the process in one session because your progress will not be saved if you leave the site before finishing.

International applicants can apply by phone for their EIN. Just call 267-941-1099 between the hours of 6 am to 11 pm Eastern Time Monday through Friday.

Step 6: Obtain a Business Bank Account in Virginia

One of the main reasons most business people start an LLC is to make sure their personal assets are protected should their business be sued or fail. However, to ensure you keep this limited liability, you need to keep your personal finances separate from your business finances. This will help ensure that your LLC is seen as its own separate entity. If you mix your personal finances with your business finances and your LLC is ever sued, the court could decide to remove your business’s limited liability. This is called piercing the corporate veil. If this happens, the personal assets of you and the other members of your LLC could be at risk.

The best way to keep this from happening is to open a business bank account. If you have a business bank account, then all of your business transactions should be separate from your personal transactions. This can help make it clear to a court that your LLC is a separate entity.

There are other advantages to a business bank account as well. By keeping all your business transactions in one place, it can make bookkeeping as well as taxes a lot easier. In addition to this, it gives you an opportunity to form a relationship with a bank. This can be helpful if you ever want to take out a loan or open a line of credit. It should also allow you to accept credit cards which can help increase your business.

Steps for Growing and Maintaining Your Virginia LLC

Your business may be started, but that doesn’t mean there is nothing left to do. Here are some ways for you to grow and maintain your Virginia LLC.

1. Business Insurance

You will probably want a number of insurances for your new business. Some insurances such as Workers’ Compensation Insurance may be required by the state, and your landlord may require you to have insurance as well. Others such as liability insurance may not be required, but it is a good idea to have them.

You will probably be required to have Workers’ Compensation Insurance by the state if you have any employees. This insurance will cover these employees on the job in case of injury, illness, or death.

You will probably want liability insurance as well. Liability insurance will help protect you should your business get sued. With an LLC, your personal assets are generally protected should your business be sued, but your business assets can still be taken to satisfy any debts or judgments against your business. But having liability insurance can protect your business assets should your business be sued. This will help you to protect the business you’ve worked so hard for.

It is also a good idea to get liability insurance for the members of your LLC. The members of your LLC could be sued personally if negligence or wrongdoing is involved, and if this happens, their personal assets could be at risk. So it is a good idea to have liability insurance so you’ll be protected.

2. Start a Business Website

Most businesses will want a website these days. This is true even for brick-and-mortar businesses that really don’t conduct any business online. Many people will do a search online before they buy a product, and you want potential customers to be able to find your business. After all, if they can’t find your business online, customers will find another business to buy from.

You won’t have to worry about it being too difficult to build a website since there are so many tools available online to help you build your website. You should have an easy time building your website and getting it up and running quickly. Also, if you are using an LLC formation service, one of their features may be building a website.

3. Get the Necessary Permits and Licenses for Virginia

There are a few licenses and permits that many Virginia LLC owners will need to acquire. Here are some details on what your business may need.

- Offering taxable services

- Selling or leasing personal property

If you need to get a Virginia State Sales Tax Permit, you will find the necessary forms on the Virginia Legislative Information System.

Form a Virginia LLC With Professional Help Today

When you are busy getting your business underway, you may not have the time to handle all the odds and ends of filing for your Virginia LLC. If you need some help to get started, these businesses are some of the best and can help you by handling all the legwork of filing your company with the state.

#1: Start a Virginia LLC with ZenBusiness

ZenBusiness is a great LLC formation company, and its reviews show that. It gets excellent customer reviews. ZenBusiness has reasonable prices and offers 25% off of registered agent service with any of their packages. Their packages all have great features, such as a free operating agreement and filing your annual report for you if you want.

#2: Start a Virginia LLC with Incfile

Incfile is a very popular LLC formation service. One of the reasons for its popularity is its free package. Not many LLC formation services provide a free package. All you need to pay with their free package is the state fee. This free package is particularly good because it has a number of good features as well. You get a year of free registered agent service, which is a good deal since this can often cost anywhere from $100 to $300. They also include free lifetime company alerts in their packages. These alerts will inform you of any upcoming filing requirements with the state to help you stay in good standing.

Final Thoughts

A Virginia LLC is one of the best choices in the country for businesses nationwide. With this structure, you can get the beneficial tax structure your business needs to thrive with reduced liability to provide you with the confidence to pursue your goals. Virginia has been near the top of the charts for nearly two decades for a reason, and forming an LLC in this state is a good call for a large number of businesses.

FAQs

How Do You Get a Certificate of Good Standing in Virginia?

Obtaining a Certificate of Good Standing for your LLC can be useful for a number of purposes, such as:

- Forming a foreign LLC in a different state

- Obtaining or renewing various permits or licenses

- Obtaining loans or lines of credit from a bank

In Virginia, this certificate is called a Certificate of Fact of Existence instead of a Certificate of Good Standing. The certificate shows that you legally formed your Virginia LLC and have correctly maintained it. You can apply for this certificate online.

How Is an LLC Dissolved in Virginia?

You may decide to have your LLC stop doing business in Virginia at some point. If you want your LLC to stop doing business in Virginia, you will need to officially dissolve your LLC. If you don’t properly dissolve your LLC, you could have increased tax liabilities and penalties, and even legal difficulties. To do this, there are two important steps to take. First, close all of your business tax accounts. Next, file your Virginia Articles of Dissolution. You may also want to consult with an attorney to make sure you have done everything necessary.

How Is an LLC Dissolved in Virginia are Foreign LLCs Allowed to Operate in Virginia?

Foreign LLCs are allowed to operate in Virginia, but they must register with the Virginia State Corporations Commission first. They must also appoint a registered agent. This registered agent must be either:

- A corporation that is authorized to conduct business in Virginia

- A member of the Virginia State Bar

- A Virginia resident who is a member or manager of the LLC

- An executive member of a trust or business that is a member or manager of the LLC

In order for your foreign LLC to operate in Virginia, you will need to file Form LLC-1052, an Application for a Certificate Of Registration to Transact Business in Virginia as a Foreign Limited Liability Company. You can file online or by mail, and it will cost $100. You need to include a less than one-year-old copy of your LLC’s original Articles of Organization or similar document with the application, as well as any amendments or corrections to the document. The documents must be marked by the Secretary of State or another similar official as being a correct copy of the original official record.

You also need to make sure the LLC’s name is available in Virginia. If it is not available, you’ll need to choose a different name to use in Virginia. When filling out your application, if you are using a different name in Virginia, you will just mark the name on the first line as being for use in Virginia, followed by the actual LLC’s name.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs