Montana LLC (6-Step Guide) – How to Start an LLC in Montana

Form a Montana LLC With Professional Help

If you are looking to start a new business or take your existing one to a new level, then a Montana LLC may be right for you. A Montana limited liability company or LLC can protect your personal assets and significantly reduce your tax burden.

Plus, Montana has been rated as one of the best states for entrepreneurs in the country and has one of the top ten highest rates of startups in the country. Not only does this state have a high rate of entrepreneurial activity but also a high survival rate for these new businesses.

Now, let’s take a closer look at why you would want a Montana LLC, some of the pros and cons, and then how you can start a Montana LLC in only six steps.

If you want to skip the hassle of starting a Montana LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Form a Montana LLC With Professional Help

- Why Would You Want a Montana LLC?

- Quick Montana LLC Pros & Cons

- How to Form Your Montana LLC in Six Easy Steps

- Step 1: Choose a Name for Your Montana LLC

- Step 2: Designate a Montana LLC Registered Agent

- Step 3: File Articles of Organization for Your Montana LLC

- Step 4: Obtain an EIN (Employer Identification Number)

- Step 5: Draft an Operating Agreement for Your Montana LLC

- Step 6: Get A Business Bank Account in the state of Montana

- Steps for Growing and Maintaining Your Montana LLC

- Start a Montana LLC with Professional Help Today

- Conclusion

Why Would You Want a Montana LLC?

There are several reasons you might want a Montana LLC, from the stability of the state’s economy to the low taxes the structure can offer. However, here are a few of the biggest reasons:

Quick Montana LLC Pros & Cons

We know you are busy, but with such an important decision, it is important to consider a few pros and cons. So, let’s look at a few of the most important factors to consider before we move on.

Pros

There are quite a number of pros to a Montana LLC, and the most important include:

Cons

There are few disadvantages to choosing a Montana LLC. Perhaps this is why Montana is rated as one of the happiest states in the country. Here are the important disadvantages or, in this case, disadvantage to consider.

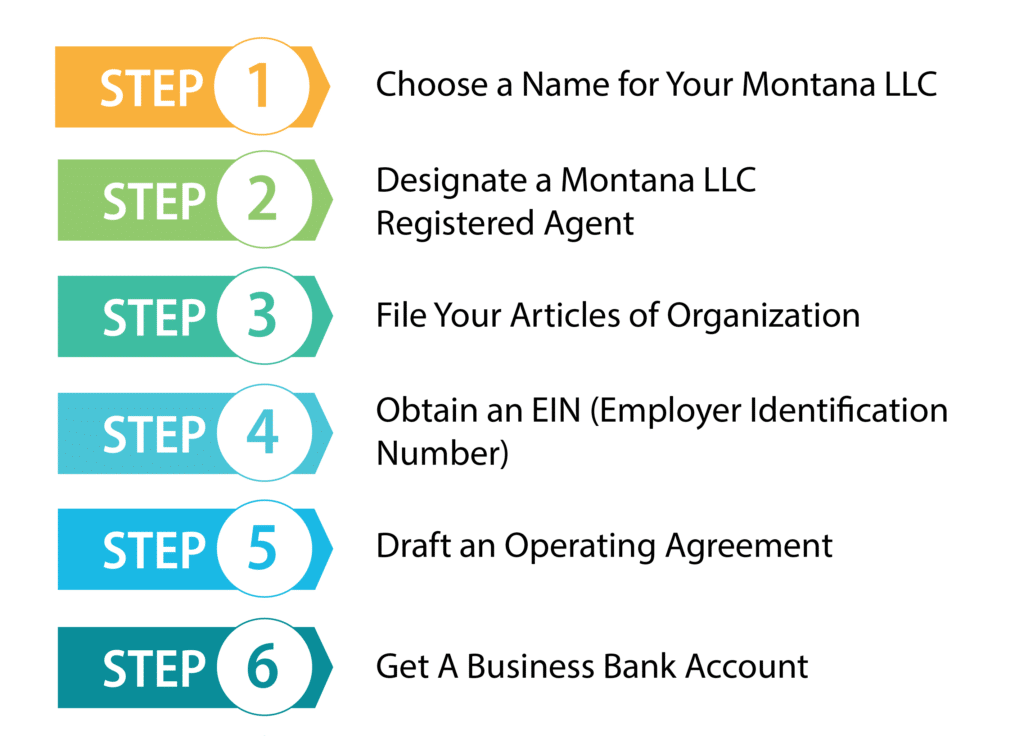

How to Form Your Montana LLC in Six Easy Steps

Now assuming you have weighed the pros and cons and feel that a Montana LLC is right for you, it is time to discuss how to form your Montana LLC. Luckily, this is a relatively easy process that you can complete in only six easy steps.

Step 1: Choose a Name for Your Montana LLC

The very first step in forming your Montana LLC will be to choose a name for it. This name should be creative and descriptive of the product or service you will provide and unique to your business. This last one is a requirement in the state of Montana, so be particularly careful.

There are few rules you will need to follow in choosing a name. The first is that this name must be unique and easily distinguishable from all other business names already registered in the state of Montana. This is a common rule that you will find in every state in the country. To guarantee the name you choose is unique, you can check the Montana Secretary of State Business Search tool.

To use this, take keywords from the name you choose and enter them into the search tool. Look at the results, and if there are none that resemble the name you have chosen too closely, then your name is likely unique enough.

Now you will need to add a designator. This simply means adding the words “limited liability company” to the end of your name. You can also use “limited company” or either of the abbreviations “L.L.C.” or “LLC.” You may also choose to swap in “Ltd.” for limited or Co. for company.

Also, if, after settling on a name, you do not decide to file your Articles of Organization right away, you may file for a reservation of name. This will cost $10 and protect the name you choose from use by others for 120 days. This is not renewable, though, so it is important to plan to file within this time period to ensure your name will not be taken.

Step 2: Designate a Montana LLC Registered Agent

The next step is to choose a registered agent for your Montana LLC. This agent will receive official correspondence for your business, such as tax notices and service of process.

You have a lot of options when it comes to who you can select to represent your business as a registered agent. This can be pretty much anyone with a valid street address located within Montana who can be there and capable of receiving correspondence during all regular business hours. It is important to remember that a P.O. address does not qualify as a street address.

You could act as your own LLC’s registered agent, or you can select another member of your LLC, pretty much any willing individual, or a registered agent service. This last option is the most popular option, and there are a lot of good reasons for it. Let’s take a look at some of them.

Step 3: File Articles of Organization for Your Montana LLC

The next thing you should do is to file your Articles Of Organization with the Montana State Corporate Commission. This is the step that will actually form your LLC. There are a number of things you will need to include on the document to file for your LLC:

You can file the Articles of Organization online at the MONTANA.GOV website. It will cost $70. You will typically receive a response by email within one to two weeks. If this is too long, there are two options for expediting the process. For $20, you can receive approval within one day, and for $100, your documents can be approved within one hour.

Step 4: Obtain an EIN (Employer Identification Number)

An EIN is a nine-digit number often known as a Federal Tax Id. This number is similar to a Social Security Number and is used by the IRS to identify your business for tax purposes.

Most businesses will be required to obtain an EIN. If your business has two or more members, or if you hire employees, you will need an EIN. You will also need this number to open a business banking account or file your taxes.

You can apply for this number through the IRS website, and it’s free. You’ll just need a Taxpayer Identification Number; a Social Security Number will work fine.

You can also apply by mail, fax, or for international applicants, by telephone. If you choose to apply by mail or fax, just fill out Form SS-4, and then to file by mail, send it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you are filing by fax, fill out the form and fax it to (855) 641-6935. International applicants can apply by phone by calling 267-941-1099 from 6 a.m to 11 p.m. Monday through Friday Eastern Time.

Step 5: Draft an Operating Agreement for Your Montana LLC

Montana does not require an operating agreement, but your business should still have one. It could save a lot of trouble in the future and maybe even some lawsuits. There aren’t any specific requirements for what needs to be included in an operating agreement, but there are some things you should include, which we will discuss next.

The profits and losses are typically based on the percentage of ownership. So, if someone owns 50% percent of the business, they will get 50% of the profits or losses. But, the members of your LLC can choose a different method if they want. Just include the method in the operating agreement.

You’ll also want to include how often the profits will be distributed, such as monthly or quarterly. Also, remember that members will need to pay taxes on any profits, whether they are distributed or not.

The other type of management is manager-managed. With this type of business, the members agree on a manager to run the business for them. This manager runs the day-to-day affairs of the business and makes the decisions for the business. Although, the members can reserve some decisions for themselves if they put this in the operating agreement. The manager could be a member of the LLC or an outsider.

- You should include how many votes each member will get. This is usually based on the member’s percentage of membership. But the members of your LLC can choose whatever method they want. Just be sure to include this in the operating agreement.

- You should also include what type of vote will be required for different decisions. This could be a majority, a supermajority, or in some cases, even a unanimous vote. You’ll probably want a supermajority or unanimous vote for more serious decisions.

Step 6: Get A Business Bank Account in the state of Montana

Although you are not required to obtain a business checking account, it is still a very important step. This is because it is absolutely necessary to keep your business and personal finances separate. If you use your personal bank account for business transactions, you risk having the court believe your LLC is not a separate entity should you be sued. You need to have a business bank account to keep your business as a separate entity and retain your limited liability. If you don’t keep your business and personal finances separate, you could lose your limited liability. A business bank account can help you do this by keeping your LLC’s finances totally separate. You’ll be able to see all of your business bank transactions in one place without having to separate them from your personal transactions.

A business bank account has several other advantages as well. It will help you form a relationship with a bank which could be helpful in the future should you ever want a loan or a line of credit. It will also allow you to take credit cards, which many people prefer to use. So, this could help increase your business. Additionally, it will help your business appear more professional to both customers and suppliers when they write checks out to your business instead of you personally.

Steps for Growing and Maintaining Your Montana LLC

Now that you have formed your Montana LLC, it is time to grow it and make sure it meets all the legal requirements. Let’s look at a few suggestions.

1. Obtain any Necessary Business Licenses and Permits

The state of Montana does not have a general business license, but there are certain licenses required depending on your industry and location. The best way to find out what licenses you need is to check on the Montana License Lookup tool. It’s important to obtain any licenses your business needs to avoid any penalties.

2. Business Insurance

Business insurance is a must to protect your business from loss in many situations. Here are three that you should consider depending on your situation and type of business.

General Liability Insurance

An LLC will protect your personal assets from being taken to satisfy your business debts in most cases. So, you’re not likely to lose your home, car, or personal savings if you are sued. But, the same is not true of your business assets. If your business is sued, it is possible your business assets could be used to satisfy any debts. This could be very difficult for your business and even cause you to lose your business. This could be particularly difficult if the business is your livelihood. Even if it isn’t your livelihood, you probably don’t want to lose your investment. This makes it a good idea to get general liability insurance for your business to protect your business assets.

You’ll also want liability insurance for all of the members of your LLC since there is still a possibility your personal assets could be at risk in some situations. If you don’t keep your personal finances separate from your business finances, the court could remove your business’s limited liability, and your personal assets would be at risk. Also, if a business is sued due to a situation in which a member is considered negligent or to have done something illegal, the member could be held responsible, and their personal assets could be at risk.

Professional Liability Insurance

If you’re a professional, you may also need to get professional liability insurance. This insurance will protect you if you make a mistake or fail to do something you should have. It will also protect you should one of your employees make a mistake.

Worker’s Compensation Insurance

In most cases, if you hire any employees, you will be required to purchase worker’s compensation insurance. This insurance will cover your employees in case of injury, illness, or death on the job.

Start a Montana LLC with Professional Help Today

It is easy for entrepreneurs to find there just isn’t enough time in the day to figure out how to file for an LLC But, this doesn’t need to stop you! There are a number of services out there that can help you file for your LLC, and here are two of the best.

#1: Form a Montana LLC with ZenBusiness

ZenBusiness hasn’t been around as long as many LLC formation services, but it’s become one of the most popular services out there. They have reasonable prices and great customer service. Customers are also quite happy with how quick and easy the process is. Additionally, if you need a registered agent service, they give 25% off of this service with all of their packages.

#2: Form a Montana LLC with Incfile

Incfile is popular, and no wonder it’s hard to beat free. Incfile’s lowest tier option is free. All you need to pay is the state fee. Very few LLC formation services have this option. Additionally, you’ll get a year of free registered agent service with any of their packages. You’ll also get lifetime company alerts with any of their packages. With these alerts, Incfile will inform you about any state filing requirements that will be coming up, so you can remain in compliance with the state.

Conclusion

A Montana LLC could be just the way to upgrade your business plans. With a Montana LLC, your business can reap significant financial rewards, and even if the worst comes to pass and your business suffers from a failure, your personal assets will be protected in most circumstances. So, don’t delay in forming your LLC today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs