West Virginia LLC (6-Step Guide) – How to Form an LLC in West Virginia

Hire Professionals To Start Your WV LLC (from $0 + state fees)

If you are considering starting a new business or upgrading your existing business structure, then a West Virginia LLC may be a great call for you. West Virginia may not be the first state that comes to mind when it comes to forming a new business, but you may be surprised at what it has to offer.

A West Virginia LLC can offer you protection for all of your personal assets and potentially reduce your business’s tax burden. Plus, with an extremely low cost of living, your earnings can go a lot further. To find out all the costs of the LLC formation itself — see our West Virginia LLC cost guide here.

So, let’s take a closer look at what a West Virginia LLC can offer your business and how you can form your own West Virginia LLC in only six easy steps.

If you want to skip the hassle of starting a West Virginia LLC yourself, consider using professionals:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Hire Professionals To Start Your WV LLC (from $0 + state fees)

- Why Would You Choose a West Virginia LLC?

- Quick West Virginia LLCs Pros & Cons

- How to Form Your West Virginia LLC in Six Easy Steps?

- Steps for Growing and Maintaining Your West Virginia LLC

- Get Professional Help Forming Your West Virginia LLC

- Final Thoughts

- FAQs

Why Would You Choose a West Virginia LLC?

There are a number of reasons you may want a West Virginia LLC, from the protection it can offer you, the tax benefits, and the low costs of doing business it offers. Let’s take a closer look.

Quick West Virginia LLCs Pros & Cons

Like most entrepreneurs, chances are you don’t have much time to spend, but this is a big decision. So, let’s quickly consider the most important pros and cons of forming a West Virginia LLC.

Pros

There are several advantages to this business structure, and here are a few of the biggest.

Cons

As with forming in any state, there are a few disadvantages to consider as well, and here are the biggest.

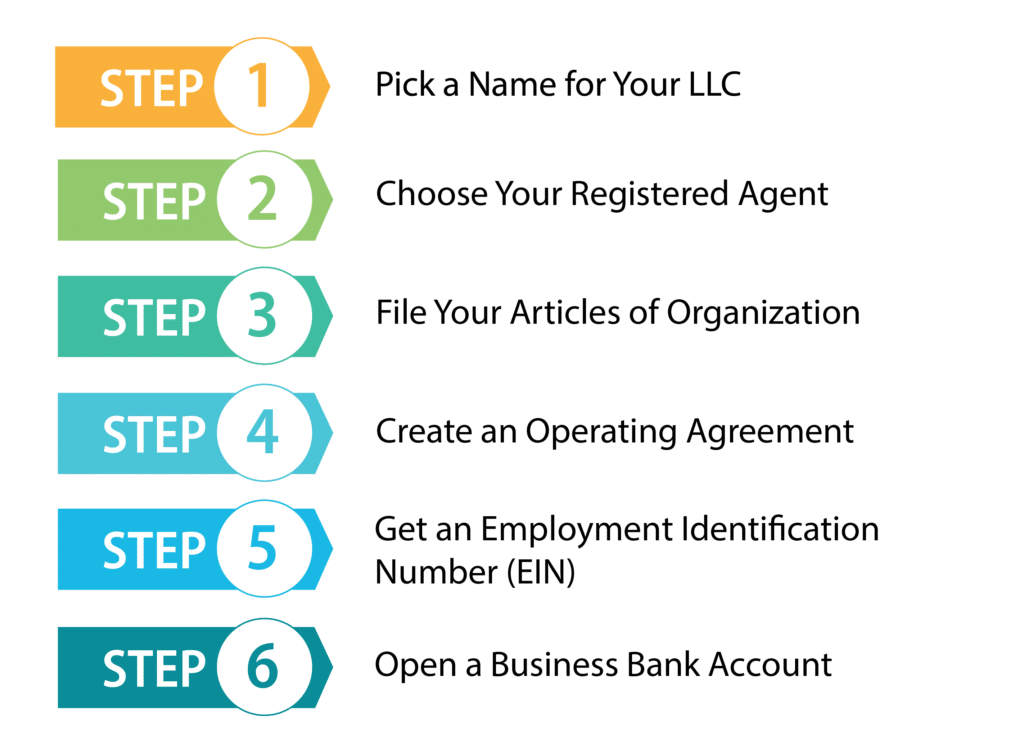

How to Form Your West Virginia LLC in Six Easy Steps?

Now that you have seen the reasons you might want a West Virginia LLC and all of the pros and cons, hopefully, you have decided a West Virginia LLC is right for you. If so, great! Now we can take a look at how you can form a West Virginia LLC in only six easy steps. Let’s get started!

Step 1: Pick a Name for Your LLC

The first step in forming your West Virginia LLC is choosing a name for your business. You want to choose a name that is catchy and also gives people an idea of what your business does. But your name also needs to comply with West Virginia’s guidelines for business names. So, we will list these guidelines below.

- The name you choose must include the words “limited liability company,” L.L.C., LC, L.C., or LLC. Also, the words “limited liability company” can be abbreviated as “Ltd.” and the word “company” can be abbreviated as “Co.”

- You cannot use words such as a bank, university, or attorney in your name unless you have the proper license and you fill out the appropriate paperwork.

- You cannot use words in your business’s name that could cause people to believe your business is a government agency.

You need to make sure your name is available in West Virginia by doing a Business Organization Search on the West Virginia Secretary of State website. If you’ve decided on a name but you’re not ready to form your LLC yet, you can reserve your name for up to 120 days by filling out Form NR-1. You will need to file this form by mail.

It would also be a good idea to see if the web domain for your business name is available since you will likely want to start a business website at some point. If the URL is available, it would be a good idea to purchase it. If you cannot get a web domain using your business name, you may want to consider choosing a different business name.

Step 2: Choose Your Registered Agent in West Virginia

West Virginia requires all LLCs to have a registered agent to accept service of process and other official documents from the state. You can choose a person or a West Virginia agent of the process to be your registered agent. There are some requirements for the registered agent if you choose a person, such as:

Hiring a Registered Agent Service

Most small businesses hire a registered agent service, and there are a number of good reasons for this.

Step 3: File Your West Virginia’s LLC Articles of Organization

Filing your Articles of Organization is what forms your West Virginia LLC. After the Articles of Organization are filed with the West Virginia Secretary of State, your LLC is officially formed. There are some things that you’ll need to include in your Articles of Organization, such as:

Filing Your Articles of Organization

You have a number of options when filing your Articles of Organization. You can file online at the West Virginia One Stop Business Portal, by mail, by fax, by email, or in person. You can mail your Articles of Organization or deliver them in person to any of West Virginia’s three business centers. The addresses are:

One-Stop Business Center

1615 Washington St. E.

Charleston, WV 25311

North Central WV Business Center

200 W. Main St.

Clarksburg, WV 26301

Eastern Panhandle Business Center

229 E. Martin St.

Martinsburg, WV 25401

If you want to email your Articles of Organization, the email address is [email protected].

For those who want to fax their documents, the number is (304) 558-8381.

Step 4: Create an Operating Agreement

You are not required to create an operating agreement for your West Virginia LLC. However, doing so is a good idea as it can reduce arguments between members. The operating agreement is a legal document that details the structure of your LLC along with the responsibilities of its members. It also includes any rules or policies for your LLC that you wish to include. This agreement allows you to customize your LLC and can allow you to choose a lot of the rules for your LLC rather than being subject to the default laws of the state.

There are no specific rules as to what must be included in an operating agreement, but there are a number of things you should include in your operating agreement. We will list some of these below.

Step 5: Get an Employer Identification Number (EIN)

An Employer Identification Number, or as it’s also known, a Federal Tax Identification Number, is similar to a Social Security Number. It is a nine-digit number that the IRS uses to identify your business for tax purposes. You will be required to get one of these numbers if your LLC has two or more members or if you intend to hire employees.

Although even if you are not required to get an EIN, you may want to get one anyway because they can be useful for other purposes such as obtaining a business bank account. Most banks will require an EIN for opening a business bank account. An EIN is also required for multi-member LLCs when filing taxes. The number will be required on the K-1 that the LLC will need to give to each of the LLC’s members.

Applying for an EIN

It’s easy to apply for an EIN, and it’s also free. You can apply by mail, fax, online, or for international applicants by phone. Make sure you have a Taxpayer Identification Number available; a Social Security Number will work fine.

You can apply by mail by filling out Form SS-4 and sending it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

If you want to apply by fax, you will still need to fill out Form SS-4. Then, fax the completed form to (855) 641-6935. You should get a return fax in approximately four business days.

The fastest way to get your EIN is to apply online at the IRS website. If you apply on the website, you will get your EIN as soon as you finish the application process. Make sure you finish the application in one session, as the application will not be saved if you leave before finishing the process.

If you are an international applicant, you can apply by phone. The hours are 6:00 AM to 11:00 PM Eastern Time. You will need to make sure that the person calling has the authority to answer any questions on Form SS-4 and accept your EIN after completing the application.

Step 6: Open a Business Bank Account

Another important step you want to take for your LLC is opening a business bank account. This step isn’t required, but it’s still very important for several reasons, which we will discuss.

Steps for Growing and Maintaining Your West Virginia LLC

Now that you have finished forming your West Virginia LLC, you can take a well-earned rest and know that your business formation is done; the work of growing and maintaining your business can begin. Here are a few steps you can take to get your new business off on the right track.

1. Business Insurance

Business insurance is a great way to protect your LLC. An LLC will generally protect your personal assets, but you should get general liability insurance to protect your business’s assets. If your business should be sued, your business assets could be used to satisfy any judgment against your business. However, by having business insurance, your business should be protected if you get sued.

It is also a good idea to have liability insurance for all of your members since if any of your members are sued and negligence or wrongdoing is involved, their personal assets could be at risk. Also, if you provide a professional service, you will probably want professional liability insurance to protect your business and its members in case of any mistakes or wrongdoing.

Your business may also need Workers’ Compensation Insurance. West Virginia requires most businesses with employees to have this insurance. The insurance protects workers that are injured on the job.

2. Obtain the Necessary Licenses and Permits

You will need to make sure your LLC has any licenses or permits it needs to operate in West Virginia as well as the local area your business is located in. West Virginia does require a state license for businesses that sell a physical product. This license is the Business Registration Permit, or as it is also called a seller’s permit. You can obtain this license online at the West Virginia One Stop Business Portal.

Depending on the industry your business is in, or where it is located, you may need other licenses or permits as well. You may need a professional license, building permit, or possibly a health permit. You’ll want to check with your local area because it’s important to obtain all the necessary permits to avoid any fines or penalties.

3. Pay Your Taxes

An LLC is a pass-through entity meaning that the business is not taxed as an entity. Instead, any profits or losses are passed through the business to the members, where they are taxed on the members’ individual tax returns. This is in contrast to the way in which corporations are taxed where the entity is taxed, and then the shareholders are taxed as well on any dividends.

Both the federal government and the West Virginia State government tax LLCs the same as a partnership. West Virginia does have a state income tax of 3% to 6.5%. Some cities in West Virginia have an income tax as well. So it’s best to check with your local government to see what taxes you or your business might owe. You may want to consult with a tax professional to make sure you are paying your taxes correctly.

Get Professional Help Forming Your West Virginia LLC

Forming a West Virginia LLC is an extremely manageable process, but sometimes it can be hard to get it done with so many other things competing for an entrepreneur’s attention. Luckily you don’t need to go it alone. There are a number of services out there that can help you form your West Virginia LLC, and here are two of the best.

#1: Start Your West Virginia LLC With ZenBusiness

ZenBusiness is one of the newer LLC formation companies out there, but they provide excellent service and get great customer reviews. Their prices are reasonable, and they offer 25% off of registered agent service with all of their packages. They also provide a free operating agreement with any of their packages, which is a good deal since every LLC should have an operating agreement. In addition to this, they will file your annual report for you if you want them to.

#2: Start Your West Virginia LLC With IncFile

Incfile has had a lot of experience forming LLCs, and they do an excellent job. They also have very reasonable prices and even offer a free package. The only thing you have to pay for their free package is the state fee. Incfile even includes a year of free registered agent service with any of their packages. They also provide lifetime company alerts. With this service, Incfile will alert you to any upcoming filing deadlines so you can stay in compliance with the state.

Final Thoughts

A West Virginia LLC is a great way to give your business a meaningful boost while protecting your personal assets and potentially lowering your tax burden. Forming your own West Virginia LLC can be accomplished in only six easy steps, leaving you plenty of time to work on what is most important growing your business. So, don’t hesitate to get started on forming your West Virginia LLC today!

FAQs

Can I Operate a Foreign LLC in West Virginia?

Foreign LLCs are allowed to operate in West Virginia, but they must register with the West Virginia Secretary of State. These foreign LLCs must also appoint a registered agent. Your registered agent can be a West Virginia resident or a business that has been authorized to conduct business in West Virginia.

To register a foreign LLC, you’ll need to file Form LLF-1 with the West Virginia Secretary of State; this form is an Application for Certificate of Authority of Limited Liability Company. You can file this form by mail or online at the West Virginia One Stop Business Portal. You’ll need to include a Certificate of Good Standing or a Certificate of Existence from your LLC’s home state and pay a $150 filing fee as well.

However, before you file for your LLC, check the West Virginia business name database to see if the name of your business is available. If your business name is not available, you can use a DBA(doing business as) name. You’ll want to check your chosen DBA as well to make sure that it is available. You’ll then need to have your managers or members approve a resolution that adopts your DBA and attach this resolution to your application.

Does West Virginia Allow Single-Member LLCs

Forming a single-member LLC in West Virginia is basically the same as forming a multi-member LLC. You follow the same steps as you would for a multi-member LLC. The main difference in a single-member LLC is that you have more options when it comes time to file your taxes.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs