Tennessee LLC (6-Step Guide) – How to Form an LLC in Tennessee

Get Professionals To Form a TN LLC for You (from $0+state fees)

A Tennessee LLC is one of the top choices in the country right now for entrepreneurs. This is first of all because of the unique advantages that an LLC offers those looking to start a business, most importantly protection from personal liability.

Additionally, forming your LLC in the state of Tennessee comes with a number of benefits, such as no statewide personal income tax and some of the lowest local rates in the country. Plus, as a right-to-work state with generally business-friendly laws, the regulatory environment is definitely good for business formation. So, let’s take a closer look at why a Tennessee LLC might be right for you and how to get started.

If you want to skip the hassle of starting a Tennessee LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Get Professionals To Form a TN LLC for You (from $0+state fees)

- Why Would You Want a Tennessee LLC?

- Quick Tennessee LLC’s Pros & Cons

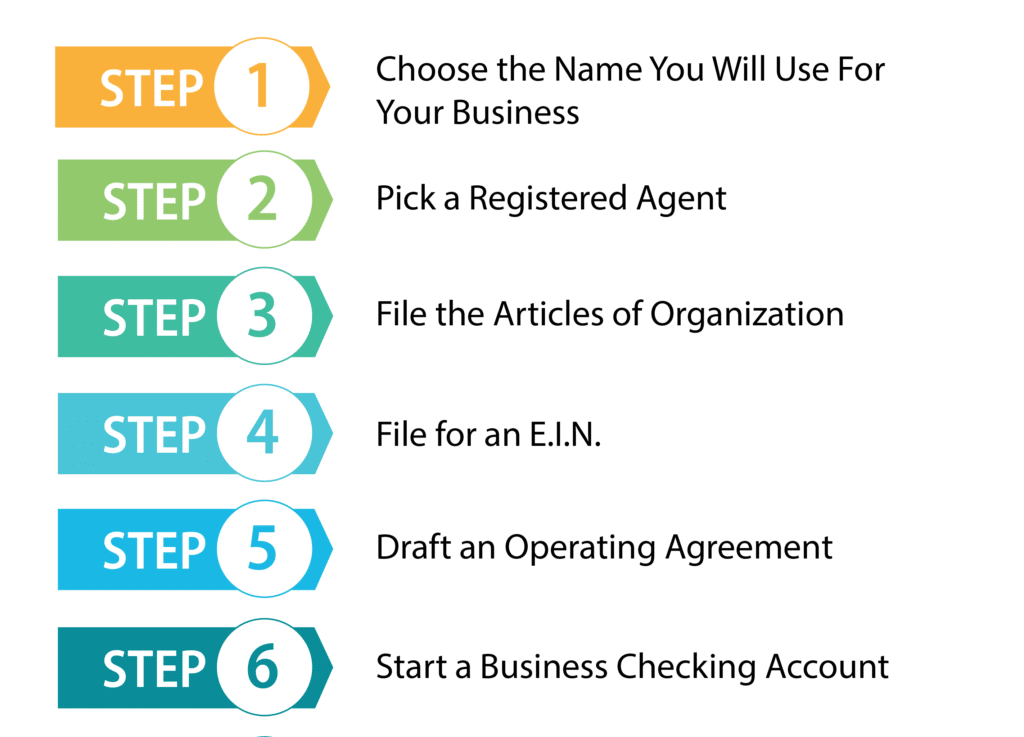

- How to Form Your Tennessee LLC in Six Easy Steps

- Step 1: Choose the Name You Will Use For Your Business in TN

- Step 2: Pick a Registered Agent In Tennessee

- Step 3: File the Articles of Organization

- Step 4: File for an E.I.N. for Your Tennessee LLC

- Step 5: Draft an Operating Agreement for Your LLC (optional)

- Step 6: Start a Business Checking Account in Tennessee

- Growing and Maintaining Your Tennessee LLC

- Get Professional Help Forming Your Tennessee LLC

- Final Thoughts

Why Would You Want a Tennessee LLC?

There are a number of reasons to want a Tennessee LLC. First of all, the Tennessee LLC Act grants an LLC’s members considerable freedom to customize their contributions and distributions of profit and loss, as well as their rights in the company.

This includes the ability to customize the duties that any member owes to the other parties in the business. This can protect minority members’ interests from the actions of majority members. Also, it can protect the ability of members to protect their control while encouraging potential investment in the business.

One of the best reasons to choose a Tennessee LLC, however, comes in the success this state has in encouraging business formation. Tennessee has over 54,000 existing active LLCs and forms more than 12,000 new ones every year. Plus, you will be able to keep more of your profits because, in addition to no statewide personal income tax, the Chamber of Commerce ranks this state second for the cost of living.

Quick Tennessee LLC’s Pros & Cons

You are probably busy enough getting your business started, but before you settle on a particular business structure and state of formation, it is important to understand the pros and cons. So, let’s take a quick look at the pros and cons of a Tennessee LLC.

Pros

There are a number of pros to forming a Tennessee LLC, and for most entrepreneurs and business owners, these likely outweigh the cons. These Advantages include:

Plus, non-voting and minority members can feel secure due to the Tennessee LLC Act’s requirements for duty of loyalty. This duty can be limited in the operating agreement but never fully removed. The limitations can include specific categories or examples of activities that will not violate this duty of loyalty as long as they are reasonable.

The act also lets a member of the LLC determine what duties any one member of the LLC owes to the other members. The act does have limited duties of loyalty it requires of all members. However, these duties can be narrowed, but the act does not allow them to be eliminated. Thus, the act allows members to specify in their LLC’s operating agreement certain activities that would not violate the member’s duty of loyalty as long as the activities are reasonable. The members may also allow a member or members to engage in an activity that would normally violate the duty of loyalty by specifying that if full disclosure is given and a specified percentage of members approve of the activity, it will be allowed.

This act protects both majority and minority members of an LLC. It makes an LLC a safer investment for minority investors by requiring a minimum duty of loyalty. But, it also protects majority members by allowing them to peruse activities in their own interest with proper disclosure, approval or by meeting the minimum fairness requirements.

If a member chooses to transfer their financial rights, the individual receiving them is entitled to any profits or losses to which the individual transferring would have been entitled. However, this does not come with any governance rights at all. If a member chooses to transfer their governance rights, the transferee does not become a member or gain any ability to exercise these rights unless all other members unanimously agree to it. Members may approve or decline completely at their discretion.

Cons

There are not that many cons to doing business in or forming and running an LLC in Tennessee. However, downsides do exist, so let’s take a look at some.

How to Form Your Tennessee LLC in Six Easy Steps

Now that you have seen the reasons that you might choose a Tennessee LLC as well as the pros and cons of this option, hopefully, it has turned out to be the right choice for you. If this is the case, that’s great because here are the six easy steps to take to start your Tennessee LLC.

Step 1: Choose the Name You Will Use For Your Business in TN

Now that you are starting the process of forming your LLC, you will need a name for it, and there are a number of specific rules to follow to do this. Also, this will be how customers and other businesses will identify your company, so it is important that the name represents your business well.

So, let’s cover some basic guidelines and rules for naming your Tennessee LLC.

In the modern-day, it is almost always a good idea to obtain a business website and to do this, it is a good idea to check if a suitable URL is available for the name you have chosen. If one is not available, it may be a good idea to reconsider your naming choice. Remember that even if you do not intend to launch a business website immediately, there is a good chance you will soon.

Once you are satisfied and have checked if your name is available from Tennessee’s Secretary of State website, you are done.

Step 2: Pick a Registered Agent In Tennessee

In order to form a Tennessee LLC, you will need to select a registered agent. Your registered agent will be a person or company that is available during all regular business hours in order to accept the service of process or legal documents. The registered agent you select must possess a physical address located within Tennessee; however, this may be a member of your LLC.

You can select any person 18 years or older who is a resident of the state of Tennessee. However, they will need to be available during all business hours. If you select a company to be your registered agent, they must be registered in the state of Tennessee or possess a Certificate of Authority allowing them to conduct business within the state.

In general, the latter choice is preferred by most small businesses because choosing a company to act as the registered agent for your LLC possesses numerous advantages for owners. Here are some of the reasons why many entrepreneurs choose this route:

Step 3: File the Articles of Organization

So, now it’s time to register your LLC with the TN state, and to do this, you will file the Articles of Organization with Tennessee’s Secretary of State. This registration can be done online or by printing it and filling it out on paper and sending or handing it off in person to the Secretary of State.

In order to file your LLC with the state, you will need to pay a filing fee of $50 for every member.

You will need to include a fairly considerable amount of information on your Articles of Organization. This information includes:

- Your Business Name (Include name consent if needed)

- Name of Registered Agent and Office Address

- Closing Month of Your LLC’s Fiscal Year

- Management Structure (Member-managed, Director-managed, or Manager-managed)

- Effective Date

- Period of Duration

- Quantity of LLC Members

- Principal Business Office Address (Include mailing address if different)

After completing the Articles of Organization, you can mail it and your payment to:

6th floor – Snodgrass Tower

Attn: Corporate Filing

312 Rosa L. Parks Ave.

Nashville, TN 37243

If you choose to submit it in person, you may take it to:

6th floor – Snodgrass Tower

312 Rosa L. Parks Ave.

Nashville, TN 37243

After the Articles of Organization are submitted, you can expect a processing time of within a day for online submission, and for mail submission, expect between three to five business days.

Step 4: File for an E.I.N. for Your Tennessee LLC

One of the first things you should do now that your business is officially registered is to file for an Employer Identification Number, often also referred to as a Federal Tax Identifier. This nine-digit number is one of the most important identifiers for your business and is used by the I.R.S. to identify your business for tax filings. This number will be required if you want to hire employees and if your LLC will have greater than one member. This number is generally also needed by most banks in order to open a business checking account.

Luckily, this number is very easy to file for and can be gotten for free. The application can be completed online, through fax, mail, or phone (phone can only be for international applicants). In order to apply, you will need a form of Taxpayer Identification Number which can be your Social Security Number.

The fastest way to apply and receive your E.I.N. is to file online. Immediately after you finish the process, you will receive your E.I.N. number. Keep in mind that you will need to complete the process in a single sitting. There is no way to save the application and finish it later.

To complete the process by fax or mail, you will have to complete Form SS-4. To file by fax, send the form to (855) 641-6935, and you will generally receive a response in about four business days. To file by mail, send the completed form to:

Internal Revenue Service

Attn: E.I.N. Operation

Cincinnati, OH 45999

For international applicants, you have the option to file by phone by calling 267-941-1099 between 6 a.m. and 11 p.m.

Step 5: Draft an Operating Agreement for Your LLC (optional)

Tennessee does not require an LLC to have an operating agreement, but every LLC should have one. An operating agreement details the structure of your LLC as well as the rights and responsibilities of the members. It also gives LLCs an opportunity to make some decisions that are often controlled by state default laws. An operating agreement is also a good way to decrease arguments among members.

An operating agreement can include whatever you want, but we list some things that should be included in your operating agreement.

In a member-managed LLC, all of the members make decisions about the LLC and run its daily operations. The members can split up the responsibilities the way they want, but they are the ones in charge of the business.

This can be a lot of work for larger LLCs or for owners that don’t want to be very involved in the business. So, some LLCs choose to have a manager-managed LLC. In this type of management, the members of the LLC all choose a manager or managers that will manage the business for them. The owners of the LLC then act in an advisory role.

Another option for LLC management in Tennessee is director management. With this option, the business is managed by one or more directors. Any decisions for the LLC will be made by the director or directors. If there is more than one director, any decisions will be made through a majority vote. These directors will be appointed or removed through a majority vote of the LLC members.

You should also include which decisions will require a majority vote and which will require a supermajority. It may be easier to have more minor decisions require a majority vote and have serious decisions such as bankruptcy or dissolution require a supermajority. A decision such as dissolution could even require a unanimous vote.

Profits and losses are generally distributed on the basis of a member’s percentage of ownership. But, if the members choose, they can be allocated differently. However, if the members have chosen to be taxed as an S-corporation or C-corporation, then it must allocate profits and losses based on ownership percentage.

You should specify in the operating agreement whether a majority, supermajority, or unanimous vote will be required. You’ll also want to include how any assets that remain after all of the debts are paid will be divided.

Step 6: Start a Business Checking Account in Tennessee

Every LLC should open a business checking account. A business checking account provides many benefits for an LLC, but the most important advantage it provides is keeping your business and personal finances separate. This is crucial for maintaining your LLC’s limited liability. If your LLC is ever sued and the court finds that your LLC’s finances have been mixed with any of your members’ finances, the court could decide to remove your LLC’s limited liability. This is called piercing the corporate veil. If the court does this, the personal assets of the LLC’s members could be accessed to satisfy the LLC’s debts.

This is not the only advantage of a business checking account. Keeping your personal and business finances separate will make bookkeeping easier as you won’t have to worry about separating your personal transactions from business transactions. Opening a business checking account is also a great way to start a relationship with a bank which could be useful should your business want to open a line of credit or take out a loan. It may even help your business obtain a business credit card. A credit card would help your business to start establishing a credit history as well as helping to separate your business and personal finances.

Another benefit your business will receive from having a business checking account is a more professional appearance. Your business will appear more professional if you have your customers write out a check to your business rather than to you or one of the other members of the LLC. Your business will also appear more professional to your suppliers when your checks are written out from your business’s checking account.

Growing and Maintaining Your Tennessee LLC

Once you form your Tennessee LLC, you will want to maintain it and help it to grow. There are some requirements, such as taxes, that you need to keep up with. But, there are other services such as a business checking account and business insurance that you may not be required to have that you should really consider in order to protect your business and help it thrive.

1. Pay Your Taxes

For purposes of federal taxes, an LLC operates as a pass-through entity meaning your LLC will be taxed as a partnership if it has two or more members or a disregarded entity if the LLC has only one member. In either of these cases, the money passes through the business and is taxed on each member’s individual tax return.

Tennessee does not have a state income tax, but it does have a one to two percent tax on interest and dividends. It also has a 7% state sales tax as well as local-level taxes. As a business owner, it’s important to find out about any of these local taxes, as you will likely be responsible for collecting some of them. So, it’s a good idea to contact the local government and find out about any local taxes or other business requirements that may affect your LLC.

Franchise and Excise taxes

LLCs in Tennessee must pay both a franchise tax and an excise tax. These taxes must be paid to the Department of Revenue on or before the 15th day of the fourth month after an LLC closes its books for businesses with a calendar year; the taxes will be due by April 15th the following year.

For businesses with at least $5,000 in combined tax liability for both the prior and current tax years, they will need to pay estimated taxes by the 15th day of the fourth, sixth, and ninth months of the year. In the following year, the business will need to pay estimated taxes by the 15th day of the first month as well.

Tennessee Tax Rates

The franchise tax is .25% of the value of any tangible real property. Whereas the excise tax is 6.5% of your LLC’s taxable income.

2. Create a Business Website

Most businesses today will want a website. A website will not only help to draw new customers to your business, but it will also help your business to appear more professional. This is true even for businesses that do most of their business offline. For these businesses, the website can help potential customers learn about your business and encourage them to visit your business’s physical location. A business website is a good idea even for those businesses that already have social media accounts.

Creating a website may seem difficult if you’ve never started a website before. But, there are plenty of tools online that you can use to help you create one. Also, if you’re using an LLC formation service to help create your LLC, a business website may be a feature in some of their packages.

3. Purchase Business Insurance

LLCs should always have business insurance even though they have limited liability. This limited liability does protect the owners’ assets from being taken to satisfy their business’s debts; it does not stop the business’s assets from being accessed to satisfy any debts. Should your LLC be sued and you lose the case, your business’s assets can be accessed to satisfy the judgment. So, to protect your business, you should get liability insurance for your business.

You should also purchase liability insurance for the members of your LLC. This insurance is necessary for your members since the LLC’s limited liability does not cover members in cases of negligence or wrongdoing.

If your business has any employees, you will also need Worker’s Compensation Insurance, which will cover your employees on the job in the case of injuries, sickness, or death. Also, professional LLCs should have professional liability insurance to cover them for any claims of malpractice or for other errors.

Get Professional Help Forming Your Tennessee LLC

Although forming a Tennessee LLC is a good choice for many business owners, the process can be time-consuming, and it’s easy to make mistakes. But there are a number of LLC formation services that can help you form your LLC, and we list two of the best.

#1: Form Your TN LLC With ZenBusiness

ZenBusiness will help you form your LLC for a reasonable price, and customer reviews show that most people are very happy with the service. You can also get their registered agent service for 50% off with any of their packages. They also include a free operating agreement with all of their packages, which is something every LLC should have. Additionally, if you purchase any of their packages, all you have to do is answer just a few questions, and ZenBusiness will file your annual report for you. To find out more about ZenBusiness, take a look at our review here.

#2: Form Your TN LLC With Incfile

Incfile is an experienced LLC formation service that offers excellent service at reasonable prices. They even offer a free package for which you only pay state filing fees. They also provide a year of free registered agent service with all of their packages, even their free package. In addition to this, you’ll get lifetime company compliance alerts. These alerts will inform you of any approaching filing deadlines to help keep your LLC in good standing with the state. To find out more about Incfile, take a look at our review here.

Final Thoughts

A Tennessee LLC is a great choice for most business owners (and especially if you live in this state). This structure offers protection for your personal assets while offering a flexible and low-maintenance structure. The state of Tennessee itself offers a great location for most businesses to thrive with no statewide personal income tax and a very business-friendly environment. So, don’t delay in forming your Tennessee LLC.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs