Washington LLC – How to Form an LLC in Washington? (8 Steps)

Jump to Best Washington LLC Formation Services (from $0 + state fees)

A limited liability company (LLC) is one of the most popular ways to structure a business. This legal structure combines many of the legal advantages of a corporation and the tax benefits of a sole proprietorship into one flexible package.

Since you are considering forming your LLC in Washington, it may interest you to know the state has one of the fastest-growing economies in the country. Also of note for business owners, you can enjoy a low corporate tax rate and, best of all, for small business owners and their employees, no income tax. This means you can take home even more of what you earn.

So, if you are looking to structure a domestic or foreign business in the state of Washington, you are in the right place. Let us show you how to form an LLC in Washington in 8 easy steps.

If you want to skip the hassle of starting a Washington LLC yourself, consider using professional help:

- Northwest Registered Agent ($39+state fees) (best support)

- ZenBusiness ($0+state fees) (best price)

- Jump to Best Washington LLC Formation Services (from $0 + state fees)

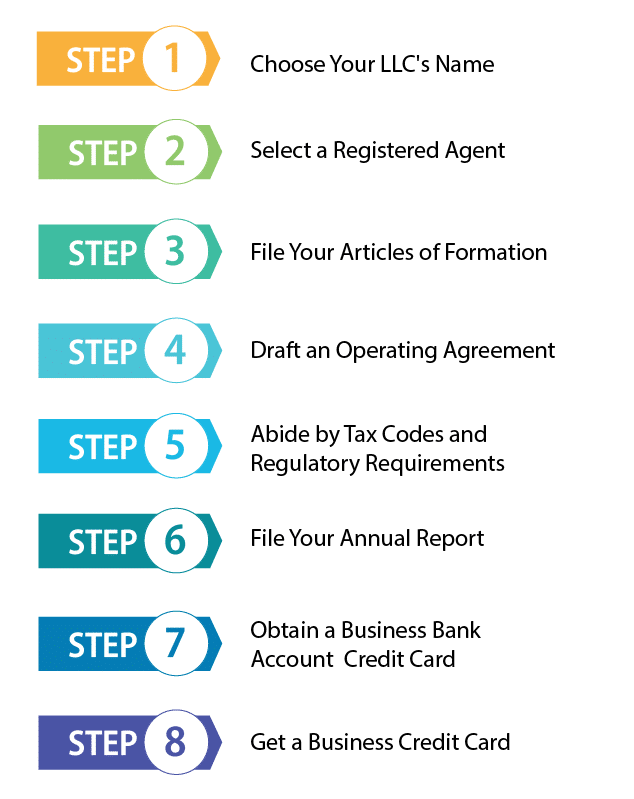

- 8 Steps on Forming an LLC in Washington

- Step 1: Choose Your Washington LLC’s Name

- Step 2: Select a Registered Agent in WA

- Step 3: File Your Articles of Formation for Washington State

- Step 4: Draft an Operating Agreement

- Step 5: Abide by Washington Tax Codes and Regulatory Requirements

- Step 6: File Your Annual Report in WA

- Step 7: Obtain a Business Bank Account & Credit Card

- Step 8: Get a Business Credit Card in Washington

- Best Washington LLC Creation Services

- Conclusion

8 Steps on Forming an LLC in Washington

Step 1: Choose Your Washington LLC’s Name

The first step to forming an LLC in Washington is to choose a name for your business, and there are a few rules you should be aware of. First, the name must include the words “Limited Liability Company,” “Limited Liability Co.,” or either of the-0QQ3 abbreviations “LLC or L.L.C.”

Also, you must choose a name that is easily distinguished from the names of other entities previously filed with the Secretary of State. To help you find a name that isn’t already taken, you may search for availability on the Washington Secretary of State’s business name search.

Finally, if you find a name you like but you aren’t ready to file your business just yet, you may want to reserve your name. If you choose to reserve your chosen name, you can file a name reservation form with the Washington Secretary of state. This will reserve the name for 180 days, but it will cost $30 for most entities and an additional $50 to have it expedited.

Using a DBA

You may wish to use a business name other than the full legal name of the owners, and this is known as a trading name or DBA (Doing Business As) — here’s a full guide on how to file for DBA. Another reason to use a trading name in Washington is that you are operating under a name other than the one you filed with the Secretary of State.

A trade name can be a real advantage if you have different products or services that you would like to provide with a name other than the one you provided on your Certificate of Formation. But, if you want to do this, Washington requires you to file your DBA with the Washington Department of Revenue.

To do this, you must file a business license application with the Washington Department of Revenue and pay a five-dollar fee. You may register as many DBAs as you like and they will remain registered indefinitely. However, this does not protect the name from anyone else using it. To do this, you would need to file a trademark either with the State of Washington (this will only apply in Washington) or with the United States Patent and Trademark Office.

Step 2: Select a Registered Agent in WA

Your LLC is required to appoint a registered agent to receive paperwork from the state or federal government. This person or service needs to be available during business hours to make sure someone is there to sign the legal documents so that the sender knows that your business received them.

The registered agent you choose needs to have a physical address in Washington. You’ll also need to have a registered agent in each state that your business is registered in. Hiring a registered agent service could make this easier because some of these services offer registered agent service in every state, which will help you avoid having to hire a separate registered agent for every state you do business in.

Additionally, hiring a registered agent can keep your home address private if you are running your business from home; otherwise, it will end up on public record. Plus, it can protect you from embarrassment in front of your customers if your business ever ends up getting served. Also, you don’t need to worry about receiving documents on time, even if your business doesn’t have normal business hours.

The best LLC formation services out there will even provide registered agent service for free for the first year if you pay for one of their LLC formation packages. If you purchase this service separately, you will probably pay approximately $100 to $200 a year. What a registered agent service provides varies. Some of these services just provide basic registered agent service. Whereas others will provide alerts for upcoming compliance deadlines and even file some documents for your LLC for an additional fee. You may find this very helpful if you’re busy. It saves you from having to worry about falling out of good standing with your state and possibly incurring fines as well.

Step 3: File Your Articles of Formation for Washington State

Filing your Articles of Formation is how you officially start your LLC. There is certain information you’ll want to have on hand when you fill out your Articles of Organization, and we will list these things below.

Step 4: Draft an Operating Agreement

The state of Washington does not require an Operating Agreement, but it’s generally advised for members to draft one. The agreement details how the LLC will be managed along with the rights and responsibilities of the members. Without an operating agreement, your LLC will be subject to state default laws for operating an LLC. There are several things you should include in your operating agreement, and we will discuss these items.

Also, you may want to reserve some management decisions for the members. If this is the case, it is best to specify which decisions are reserved for members in the operating agreement.

A member may bring certain skills or property to the LLC that may entitle the person to a larger share of ownership. Also, in some cases, members could receive a larger share of the LLC than their investment would indicate based on the amount of work they are expected to do. This is something the members need to decide and put in the operating agreement to avoid misunderstandings.

You do not need to file your operating agreement with your Articles of Formation, but you will want to keep it safe. This document often proves critical if a dispute occurs between members, and courts will often rely on this document to settle them.

Step 5: Abide by Washington Tax Codes and Regulatory Requirements

There are a variety of tax obligations your LLC may have, and you need to make sure your LLC complies with these requirements. We will list a few common requirements below.

Step 6: File Your Annual Report in WA

Every LLC doing business in Washington must file an annual report whether the LLC was formed in Washington or another state (a foreign LLC). The report needs to be filed yearly with the Secretary of State of Washington. Although, the first annual report needs to be filed within 120 days of the date of formation for your LLC.

For future annual reports, the Washington Secretary of State will send a notice to the Registered Agent for your LLC informing you of the due date for the annual report. Your registered agent should receive this notice approximately 45 days before the annual report is due. Annual reports can be filed by mail or online, and the filing fee is $60. There are several details that you need to include in your report, which we will list.

If you choose a commercial registered agent, they must be registered with the Office of the Secretary of State. They must also be in the business of receiving legal documents or permitted on behalf of your LLC.

If you choose a noncommercial registered agent, the person needs to be willing to accept legal documents on behalf of the LLC. If you choose an individual, you must then include the first and last name of the person. If you choose an entity, you need to write the full name. Whereas, for an office, write the president, secretary, or member. Also, be sure to include the physical street address, which must be in Washington.

If your Annual Report is late, there will be a $25 fee. If the report is more than 120 days late, your LLC may be dissolved.

Step 7: Obtain a Business Bank Account & Credit Card

You’ll find there are several good reasons to open a business bank account for your LLC. The best reason is to keep your LLC’s finances separate from any of the member’s finances. Maintaining this separation is vital to ensuring your limited liability. If you do not keep your business finances separate and one of your creditors sues your LLC, the courts could decide to remove the limited liability protection for the members of your LLC. This is called piercing the corporate veil. If this happens, the court could potentially access the members’ assets to satisfy debts.

Another reason you might want to get a business bank account is to make taxes easier. If you use your business bank account for your business transactions, you will have them conveniently separate from any personal transactions.

As a member of an LLC, you will be classified as a sole proprietorship or partnership. So, unlike a corporation, there is no corporate tax. An LLC is a pass-through entity. The income will pass through the LLC, and you will include the income on your personal tax return.

Step 8: Get a Business Credit Card in Washington

Obtaining a business credit card for your business can be a good way to grow your business while increasing your business’ credit. Also, it’s an additional way to keep your personal and business finances separate.

By using a business credit card for your LLC instead of your personal credit card, you help establish a credit history for your business. As you develop a good credit history for your business, you may be able to access other forms of credit, such as bank loans. This can be quite helpful, as new small businesses can have trouble obtaining loans due to a lack of credit history. Obtaining new sources of credit can really help you grow your business. The extra purchasing power will give you a lot more options for your business.

Having a separate business credit card is also another step you can take to help keep your business and personal finances separate. It’s best to keep your business finances totally separate if you want to protect your limited liability. You’ll also have an easier time come tax season if you’ve kept your business finances totally separate.

Best Washington LLC Creation Services

It’s possible you may want help filing your LLC with the state, and there are many LLC creation services that can make the process easy. So, let’s take a look at two of the best.

#1: Start Your LLC in Washington With ZenBusiness

ZenBusiness is one of the most affordable services you can use to file your LLC at only $49, and with their Worry-Free Guarantee, they will continue to handle your annual reports and other compliance deadlines.

ZenBusiness can also file for your DBA and even provide you with a registered agent. Best of all, the registered agent is free for the first year.

#2: Start Your LLC in Washington With IncAuthority

IncAuthority is one of the oldest and most trusted names in LLC formation services. Among the crowd, IncAuthority stands out most of all because their starting package comes at the low price of $0 plus state fees.

Beyond their free plan, IncAuthority offers multiple tiers of paid plans that can provide you with services such as expedited processing and a business website domain. Like ZenBusiness, IncAuthority can provide you with free registered agent service for the first year.

Conclusion

Forming an LLC is a great way to protect your personal assets and potentially lower your tax burden. Forming an LLC in Washington isn’t difficult, and it is known as a great state for doing business with a fast-growing economy. So, it’s time to get started, and now you have the tools to start forming your LLC today.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs