California LLC Costs – Fees & Costs Revealed for CA LLC

Start Your California LLC For the Best Cost With These Professional Services

One of the biggest worries holding entrepreneurs back from forming their California LLC is fear of how much it will cost. Though this is a very understandable worry, it may be very unfounded.

There are a number of fees and costs to consider, but most of them are likely a lot less than you might think. So, before you rule out your hopes of forming an LLC, take a look at the fees and costs of forming a CA LLC below.

- Start Your California LLC For the Best Cost With These Professional Services

- Various Costs of Forming a California LLC

- California Articles Of Organization Filing Fee ($70+$15)

- Statement of Information for California LLCs ($20)

- California Business Name Reservation ($10+$10)

- Acquiring a Business Domain Name and Website ($10-$1000+)

- California LLC’s Business License and Permit Fees ($50-$100)

- Cost of Filing a DBA For your California LLC ($23-$42)

- LLC Formation Services ($49+)

- Franchise Tax ($800)

- Legal Advice (Cost Varies a Lot)

- Application to Register a Foreign LLC ($70+$15)

- Quick California LLC Pricing Guide

- The Five Steps to Starting Your California LLC

- Form a California LLC with Our Recommended LLC Services

- Final Thoughts

Various Costs of Forming a California LLC

As we said above, there are a few fees and costs to consider when forming your California LLC. So, let’s take a look at each of these costs and just how much they will set you back.

California Articles Of Organization Filing Fee ($70+$15)

This is typically the biggest fee associated with filing your LLC and the biggest step. These are the papers you must file to officially register your LLC with the state. If they are accepted, your business will officially be considered a limited liability company.

The cost for this is $70, plus $15 if dropped off in-person, and to complete the document, you must include the official name for your company, the official business address located in the state of California, your LLC’s registered agent’s, also known as an agent for service of process, name, and address, whether or not it is a member or manager-managed LLC (if manager-managed indicate whether just one or multiple), and finally your own name and signature.

This part of filing can be very intimidating for new business owners but don’t worry; there are a lot of LLC formation services that can help with this step.

Statement of Information for California LLCs ($20)

Every California LLC is required to file an Initial Statement of Information after it files its Articles of Organization. Your Statement of Information can be filed online, and it will cost $20.

This step must be completed within 90 days of your Articles of Organization, and thereafter it must be filed every two years again. This can be easier to remember if you just try to remember that if you filed in an even year, then you only have to file every even-numbered year.

A California LLC is provided a window to file. This window ends on the month in which the LLC was formed and began 6 months before this date. This means that if your LLC was formed in December, then you must file your statement of Information between July 1 and December 31.

California Business Name Reservation ($10+$10)

Once you find the right name for your business, you might be worried that someone else will settle on the same name and claim it before you do. In order to prevent this, there is an option, file a business name reservation. Filing a business name reservation is not a required step for forming your business, but it can help to protect your business name idea if you aren’t planning on filing your Articles of Organization for a while.

This will cost a $10 filing fee and will protect your name from use by others for 60 days. If you choose to file the paperwork in person, there will be an additional $10 fee.

You are not required to file a name reservation, and you can simply file for your LLC without one. But, if you have already settled on a name you really want, it is a perfectly good option so consider it, particularly if it has a good web domain name option available.

Acquiring a Business Domain Name and Website ($10-$1000+)

In order to spread the word about your business and help let customers know you are legitimate, a business website is becoming a must nowadays. To start with, every business website needs a good domain name, and this should correspond closely with the name of your business. Purchasing a domain name can typically be done for between $10 to $20.

Building a business website varies considerably in cost depending on the size and complexity of the website you want. On the low end, a professionally made small business website might go for $1,000, and this can go very high on the upper end. In fact, a good small business website might go up to $10,000.

You do not absolutely need a business website, and it is certainly not necessary to create one the moment you start out, but it is a good idea to build one in time.

California LLC’s Business License and Permit Fees ($50-$100)

Whether or not a business license will be necessary and the exact costs of these licenses will depend on the particular type of business you are forming. Also, depending on the particular type of business, you may even need to acquire multiple types of licenses from both the city (often different depending on the city) and higher levels of government. Though the costs vary considerably, generally, these will cost between $50 to $100. To help you find what business licenses you will need, you can check on the California Business Portal website and the CalGold website

Some of the most common types of business licenses are professional licenses for those in a regulated industry, where this will be necessary for compliance with state laws. For municipal laws often building permits, zoning permits, and even alarm permits are often necessary. The state of California also requires business licenses; however, it is the responsibility of the local government to set fees and administer them. It is important to check with the city or a lawyer whenever you are in doubt about what permits and licenses you need.

Cost of Filing a DBA For your California LLC ($23-$42)

A DBA or “doing business as” is a name your business uses other than its legally registered one. This is also often known as a fictitious business name or FBN. These must be registered in the local area in which your business often operates at the county level, so individual costs vary considerably. Here are a few examples:

| County | Filing Fee |

| Los Angeles | $26 |

| San Diego | $42 |

| Orange | $23 |

LLC Formation Services ($49+)

For many entrepreneurs looking to get started and small business owners looking to grow, forming an LLC can be a confusing and time-consuming endeavor. So, if the process seems too intimidating or you want to spend more time focusing on your business and less on filling out paperwork, there are a number of services that can help you to file your LLC.

These services will typically charge a flat fee in order to file your LLC and perform the entire registration process. This will generally save a lot of money on all the research, filling out the paperwork, and filing it with the state.

With Incfile, their cheapest LLC package is actually free, and both they and ZenBusiness offer a number of services. However, we will talk more about these later. For now, all you need to know is Zenbusiness can help you get your LLC formed for a minimum of $49 plus state filing fees.

Franchise Tax ($800)

California LLCs must pay an annual $800 franchise tax by the fifteenth day of the 4th month after they are formed and annually thereafter. This is greater if your business earns greater than $250,000.

Other than this tax, an LLC is a pass-through entity, meaning you do not have to file for other taxes with the state or federal government on the entity level. This franchise tax can be filed using Form FTB 3522.

An LLC can opt to be taxed as a corporation and would not have to pay this tax. However, then you will be responsible for filing and paying corporate taxes.

Legal Advice (Cost Varies a Lot)

If you have questions about forming your LLC or other legal concerns about starting your business, it is often best to consult an attorney. This can be quite costly, but they can provide excellent advice and help you to file your LLC worry-free.

Often an initial consultation may be free; however, afterward, you will generally be charged by the hour. Generally, this will cost between $100 to $300 every hour. Sometimes attorneys will provide a set fee for forming an LLC, which can range from as low as $400 to as high as $2,000.

Application to Register a Foreign LLC ($70+$15)

If you are attempting to file an LLC that was formed in another state, then you will file an Application to Register a Foreign Limited Liability Company (Form LLC-5) instead of Articles of Organization. This will involve similar steps, and the fee will remain the same at $70 plus $15 if filed in-person

Quick California LLC Pricing Guide

In order to help you see all of the costs of forming your California LLC quickly, here is a quick chart to see each of them.

| Formation Need | Cost |

| Articles of Organization | $70 plus $15 if filed in-person |

| Initial Statement of Information | $20 |

| Business Name Reservation | $10 ($20 if filed in-person) |

| Business Domain & Website | Varies: Typically, between $1,000 to $10,000 |

| Business Licenses | Varies: Typically, between $50 to $100 |

| LLC Formation Services | Varies: Can be gotten for as low as $0 |

| Franchise Tax | Minimum $800 Annually |

| Legal Advice | $100 to $300 hourly or $400 to $2,000 total |

| Application to Register a Foreign LLC | $70 plus $15 if filed in-person |

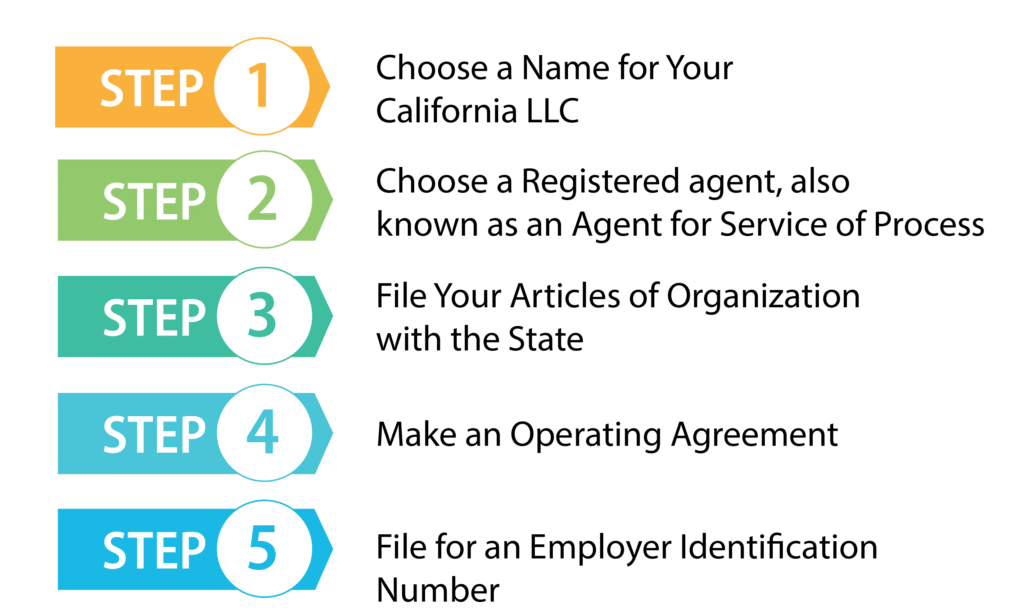

The Five Steps to Starting Your California LLC

Now that you know the costs of starting your California LLC, you may be ready to get started. Luckily forming your California LLC is easy and can be done in only five easy steps, so let’s take a quick look at how you can get started.

Step 1: Choose a Name for Your California LLC

Every California LLC needs a name, and this must be unique to your business. So, before you get started, make sure to do a business name availability search which can be done on the California Secretary of State website.

By using this website, you can enter terms from the name you are choosing to ensure that no existing companies are already using a name similar to the one you are considering.

You must also avoid using any words that would lead to confusion with any public entities or would mislead the public about your business’s purpose. You may also want to ensure that before you lock yourself into any name that there is a suitable domain name available for it.

Reserving a Name

Once you have the perfect name picked out, you may want to consider protecting it until you are ready to file your Articles of Organization. To do this, you can file a Name Reservation Request form. This can be filled out, printed, and then mailed or dropped off with the Secretary of State.

Required Identifier

Every California LLC must include words or abbreviations in its name to identify it as an LLC. These include Limited Liability Company, LLC, or L.L.C. You may also abbreviate limited as Ltd. and company as Co. if you wish.

Step 2: Choose a Registered agent, also known as an Agent for Service of Process

California requires every LLC to select an agent for service of process, known in most states as a registered agent. This agent will serve to receive official correspondence from the state. Most importantly, they will receive notice on behalf of your LLC if it is being sued.

The requirements to serve as your Agent for Service of Process include:

Age: Must be 18 years of age or older

Local Address: Must reside in the state of California

Available: Must be present during all regular business hours

You may also use a registered corporate agent to act as your Agent for Service of Process, and this is often the preferred option.

Should You Act as Your Own Agent for Service of Process?

A member of your own LLC may act as the Agent for Service of Process for your business. However, there are many reasons this may be inconvenient. Let’s take a look at some of the reasons why.

Public Records

First of all, to make it possible for the general public to contact you in order to serve due process in case of a lawsuit, your agent’s name and address will be made public.

This means that anyone can contact you. This often results in a number of unpleasant sales visits and a lot of junk mail. This is easily solved by hiring a registered agent service to act as your Agent for Service of Process.

Personal Reputation

If your business ever receives service of process, would you like this information presented in front of your friends, family, employees, or even customers? If your home or business address is listed, this will likely happen if you are ever served, and this can be extremely embarrassing.

Would your customers understand if they saw you being sued? This can damage you and your business’s reputation. However, by listing a registered agent service, you can be sure that only you and the service will receive this notice. This can help protect your reputation and avoid a lot of embarrassment.

Availability During All Regular Business Hours

This requirement may seem simple; however, for many businesses, it will be extremely inconvenient to have someone available to receive official correspondence at all regular business hours.

After all, many bars, restaurants, and other hospitality providers are not open for business during regular business hours. This can involve paying extra employees just to be present or risking serious fines and other repercussions for failing to be present if correspondence does arrive.

This also can be a problem if you or your employee ever fails to be present due to an emergency or chooses to run an errand, or even goes on break without someone else present to take over.

Finally, some businesses do not maintain one location they intend to be at regularly. This includes consulting firms and many others that travel most of the time. When any of these sounds like your business, it is best to hire a registered agent service.

Businesses Without a Physical Address/Multi-state Businesses

For businesses that operate in multiple states, it will be necessary to appoint an agent in every state you operate in. It is impossible to be in multiple places at the same time, so you will need to either maintain a physical address with employees ready to receive correspondence in each state or hire a registered agent service.

If your business does not have a suitable physical address at all, the same applies. Your business must provide a physical address ready to receive correspondence. Though a home address will work for the reasons you have already seen, this may not be the best choice.

Focusing on Your Business

Most small business owners already have enough to worry about without spending time figuring out how to be present to receive official correspondence during all regular business hours.

Hiring a registered agent service also avoids having to pay employees to fill the time you cannot be present. It also means that you do not have to keep up to date with the ever-changing laws.

For these reasons, hiring a registered agent service is a good choice for most small business owners that can help you keep track of official correspondence while focusing on growing your business.

Step 3: File Your Articles of Organization with the CA State

You officially register your LLC with the state by filing your Articles of Organization (more about this process here). This can be done online on the California Secretary of State’s website or by filling out and filing Form LLC-1. It is also possible to locate forms for Foreign LLCs as well as many others from this website.

You will need to provide basic information surrounding your business in order to complete this process. This includes your LLC’s official name and address, your Agent for Service of Process (including name and address), management structure, and the name and signature of the LLC’s organizers.

Step 4: Make an Operating Agreement

Unlike many states, California requires LLCs to create an operating agreement. However, this is no hardship because this document is important even when it is not required. An operating agreement is a legal agreement guiding how the LLC will be owned and operated.

By maintaining a proper operating agreement, an LCC’s members protect themselves from unnecessary arguments and ensure all the members know their rights and responsibilities.

Here are some of the things that should be addressed in any operating agreement:

Owners

The operating agreement should address the LLC’s owners and their percentage of ownership. Generally, this is based on the amount of capital the member invests into the company to start it, but this does not have to be the case. However, the company’s ownership is being divided. Make sure to address this in the operating agreement.

How the Company Will be Managed

The LLC’s members can manage the company themselves, and this is the most common management strategy. But, they have the option of appointing a manager to run the company instead. This will be chosen when you file your Articles of Organization. However, here is where you will specify rules guiding the rights and responsibilities of both the members and, if applicable, the manager(s). This should include rules for settling any disputes between parties.

Allocation of Earnings

It is important to specify how profit and loss will be distributed amongst the LLC’s members. Most often, this will be done based on the percentage of ownership of each member. This means if a member owns half of the company, they will receive half of the profit or loss to report on their tax return, but this does not have to be the case if it is specified otherwise in the operating agreement. Members have the option to specify other rules for distribution if they choose.

Changes of Ownership

It is important to include rules for what happens if a member withdraws from the LLC or chooses to give away their ownership. If they choose to leave, how will their ownership be distributed, will the former member receive compensation, and is some form of paperwork required to do so?

It is extremely important to cover if and how ownership can be transferred. If it is allowed, is it only for other members? If it can be transferred, will recipients become full members or only receive financial distributions?

Dissolution

You may not want to think of the day your business ends, but it is important to consider rules to guide how it would be performed if members should choose to do so. This will include how the company’s remaining assets will be divided after all obligations are paid. It should also clarify if certain members are entitled to specific parts of the business, such as to allow certain members to continue after the others leave.

Step 5: File for an Employer Identification Number

An Employer Identification Number or EIN is a nine-digit series of numbers used by the IRS to identify individual companies for tax reporting. As indicated by the name, this is particularly used for identifying businesses that wish to hire employees. However, it is also important for other purposes, such as opening a bank account.

This can easily be completed on your own online using the IRS website. All you have to do is fill out some information, and you’re done. It can be completed in only a few minutes but can be critical for making running your business easier down the line.

Form a California LLC with Our Recommended LLC Services

As stated earlier, starting an LLC on your own can be intimidating for many small business owners. These services can take the responsibility off your hands and allow you to focus on running your business.

#1 – ZenBusiness

ZenBusiness has only been in business since 2015, but they have become one of the most popular LLC formation services out there. They have excellent customer reviews and reasonable prices. ZenBusiness also offers half off their registered agent services with all of their packages. Additionally, they offer an Annual Report Service with all of their packages. With this service, ZenBusiness will alert you when your annual report is due. Then, once you answer a few simple questions, they will file your annual report for you.

#2 – Incfile

Incfile is a top LLC formation company that has competing prices and a number of good features included in their packages. They even have a package that is free other than the cost of state fees. Also, all of their packages include a year of free registered agent services.

Final Thoughts

Now that you have seen how much it costs to form a California LLC, hopefully, you realize that it is not as much as you expected. Though starting an LLC is not cheap, it really is not that bad, all things considered, and it can greatly help to protect you from liability and potentially lower your tax burden. So, do not hesitate to get started living your dream and form a California LLC today!