Chicken Road 2 – Play Online for Real Money

Play Chicken Road 2 for real money and win up to £20 000. Start today and claim your welcome bonus of up to £5,200 + 425FS in this upgraded sequel!

Chicken Road 2 is the exciting sequel Chicken Road that’s taking players worldwide by storm. It blends the fast-paced thrill of the original crash game with upgraded graphics, good animations, and even bigger win potential.

Where to Play Chicken Road 2?

How to Start Playing the Chicken Road 2 Game?

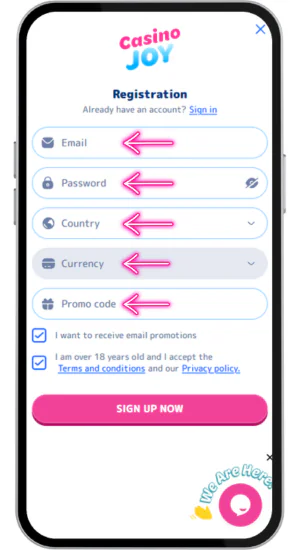

Getting started with Chicken Road 2 is quick and simple. UK players can join in just a few steps – follow these easy steps to join the action and experience the upgraded version:

Chicken Road 2 brings enhanced gameplay, good controls, and new road environments. Starting your adventure takes only a few minutes. Follow these steps:

-

Choose a licensed casino.

Pick a trusted casino from our list to enjoy safe gaming and the best bonuses.

-

Create your account.

Register a new account to access Chicken Road 2 instantly.

-

Make your first deposit.

Add funds to activate your welcome bonus for Chicken Road 2 bets.

-

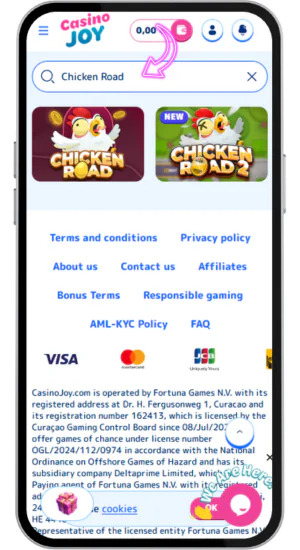

Launch Chicken Road 2.

Open the game, set your bet amount, and explore new road themes and improved visuals.

-

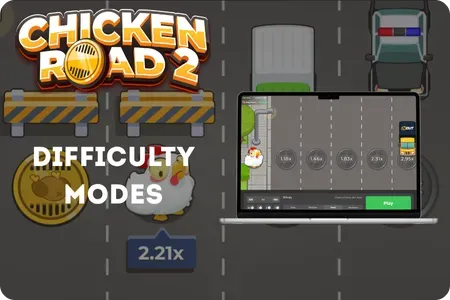

Pick a difficulty mode.

Choose from Easy, Medium, Hard, or the Hardcore mode for higher rewards.

-

Play and withdraw your winnings.

Enjoy dynamic gameplay, unlock achievements, and cash out your prizes anytime!

Rundown of the Game

Chicken Road 2 takes the excitement to a new level with enhanced visuals, good motion, and greater win potential. The gameplay remains intuitive yet more dynamic, giving a fast and thrilling gambling experience. In this sequel, the fearless rooster now faces new hazards like lasers, cars, and meteor showers across multiple environments.

| Game Type | Crash Game |

| RTP | 95.5% |

| Difficulty Modes | Easy, Medium, Hard, Hardcore |

| Multiplier Range | 1.01x – 3,608,855.25x |

| Min – Max Bet | £0.01 – £200 |

| Max Win | £20,000 |

| Geographical Availability | UK, CA, NZ, AU, IN, SA, PH and 40+ more countries |

| Currencies | GBP, USD, CAD, NZD, AUD, INR, ZAR and more |

Chicken Road 2 keeps the spirit of the original but adds more adrenaline, improved balance, and a fresh design that enhances every moment of play.

Chicken Road 2 RTP

The RTP (Return to Player) for Chicken Road 2 is 95.5%, giving a balanced mix of risk and reward. This value reflects the game’s high-volatility nature, making it ideal for players who enjoy bigger payouts and more intense sessions. Although slightly lower than the first version, the improved gameplay and enhanced win mechanics keep excitement levels high.

98%+ ABOVE AVERAGE

95% – 98% AVERAGE

92% – 94% BELOW AVERAGE

90% – 91% LOW

90% and less

Volatility and Difficulty Modes

In Chicken Road 2, players can fine-tune the game’s intensity by selecting from multiple difficulty modes that directly affect volatility and reward potential. The sequel introduces rebalanced odds and a “Hardcore” mode for those seeking maximum thrill and payout potential.

- Easy: Low volatility with lower multipliers (1.01x to 23.24x) – ideal for beginners.

- Medium: Balanced gameplay and moderate multipliers (1.08x – 2257x).

- Hard: High volatility mode with bigger risks and multipliers (1.18x – 62,162.09x).

- Hardcore: New in Chicken Road 2 – very high volatility with huge multipliers (1.44x – 3,608,855.25x).

Each mode provides a distinct experience, letting players control their own balance between safety and excitement. The higher the difficulty, the greater the possible rewards – and the bigger the challenge.

The Hardcore mode brings record-breaking multipliers and intense gameplay, making it perfect for experienced players looking for the ultimate risk-reward balance.

How to Increase Your Chances of Winning?

To maximize your chances of success in Chicken Road 2, apply these expert tips designed for the game’s updated mechanics and faster pacing:

- Start small: Begin with smaller bets to get used to the new physics and faster reaction times in Chicken Road 2.

- Master timing: Success depends on knowing when to cash out. The sequel’s enhanced animations make it easier to read the rooster’s rhythm – use that to your advantage.

- Use volatility to your benefit: Choose the right difficulty mode for your playstyle. Higher volatility can deliver bigger rewards if managed wisely.

- Claim your bonuses: Many casinos offer special bonuses for Chicken Road 2 – use them to extend playtime and test advanced strategies without extra risk.

- Stay disciplined: Set limits for your bankroll and stick to them. Managing your funds effectively is key to long-term success.

By applying these strategies, you can maximize your results and fully enjoy the fast-paced thrill of Chicken Road 2. Whether you play safe or go all-in, every move counts toward the next big win.

Game Screenshots

95.5%

95.5%