How Much Does an LLC In Texas Cost? (All Fees Revealed)

Form Your Texas LLC for The Best Price (from $0 + state fees)

When forming an LLC in Texas, you first have to file a Certificate of Formation with the office of the Texas Secretary of State, which costs $300. If you opt to file this certificate via mail, the turnaround time would normally be 7-10 business days but, if you do it online, it will only take 2-3 business days.

However, the process and your expenses do not end here. Again, $300 only covers the Certificate of Formation. On top of this, there are a few other costs that you have to consider and prepare for.

If you want to skip the hassle of starting a Texas LLC yourself, consider using professional help for the best price in the market:

Below is a breakdown of the requirements and fees that you have to secure when forming an LLC in Texas.

| Requirements | Cost |

|---|---|

| LLC Name | $0 |

| Registered Agent | $0 – $125 (annually) |

| Certificate of Formation | $300 |

| EIN Number | $0 (free on IRS site) |

| Franchise Tax Reports | $0 (for most LLCs) |

| Taxes | Varies |

Costs for Starting an LLC in Texas

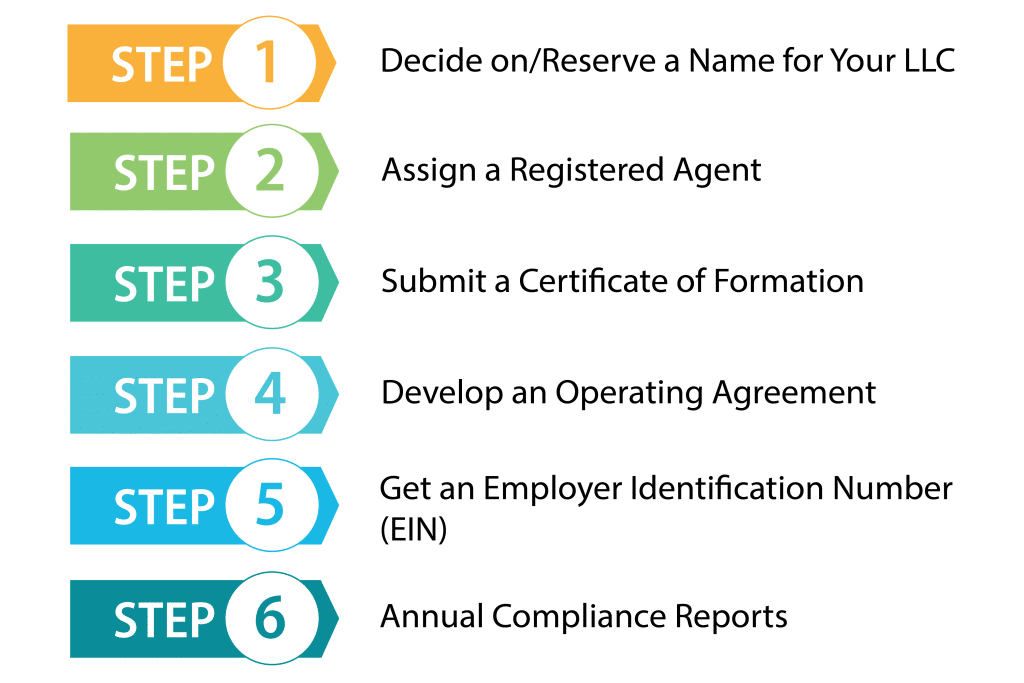

Following are the essential steps that you have to take in putting up a limited liability company (LLC) in Texas. You’ll see how much each step will cost you.

And if you’re looking to start a Texas LLC yourself — see our guide here.

1. Decide on/Reserve a Name for Your LLC (cost: $0)

In choosing a name for your LLC, keep in mind to assure that it is distinguishable from the names of other business entities already listed on the database of the Texas Secretary of State. If you wish to check the availability of your preferred LLC Name, just access the website of the Texas Secretary of State directly.

Aside from ensuring its originality and availability, it is also significant to note that under the Texas law, any LLC name must include the words “Limited Liability Company” or “Limited Company.” If not, you may just add the acronyms “L.L.C.,” “LLC,” “LC,” “L.C.,” or have “Limited” abbreviated as “Ltd.” and “Company” as “Co.”

In case you are not yet ready to put up your LLC but you have a name in mind, you must consider reserving the name for 120 days to make sure that no one will be able to use it within that period. Through filing online or via mail an Application for Reservation or Renewal of Reservation of an Entity Name (Form 501) with the Texas Secretary of State, which costs $40, you will be able to reserve your LLC name prior to filing the Certificate of Formation.

2. Assign a Registered Agent (cost: $0 – $125)

A registered agent is responsible for receiving and delivering all critical documentation on your behalf, as well as keeping your information private. Furthermore, if you need to submit a court document or reply to an IRS inquiry, your registered agent will act as your representative and guarantee that you receive and respond to them on time.

Every Texas LLC is required to have an agent in the state for service of process. The LLC, on the other hand, may not be its own registered agent. Therefore, you must appoint a registered agent who is a Texas local or a business entity registered in Texas, since a registered agent must have a physical street address in Texas.

3. Submit a Certificate of Formation (cost: $300+2.7%)

The actualization of your Texas LLC truly begins through filing a Certificate of Formation for a Limited Liability Company (Form 205) with the Secretary of State. It is necessary to state the following information:

- LLC’s Name and Designation

- Name and Address of Chosen Registered Agent

- Member-managed or Manager-managed

- if member-managed, indicate the name and address of each member

- if a manager-managed, indicate the name and address of each manager

- General Purpose Clause

- Name and Address of the LLC’s Organizer

- Effective Date of the Certificate

- Signature of the Organizer

To file an LLC Certificate of Formation, the Texas Secretary of State levies a $300 filing cost plus a state-mandated 2.7% convenience fee.

In case you are a veteran, you should be aware that if you are starting a 100 percent veteran-owned LLC, the Secretary of State will waive the filing fee for eligible veterans (honorable discharges only) who file directly by mail, in person, or by fax.

4. Develop an Operating Agreement (cost: $0)

An operating agreement is a confidential agreement between the LLC’s members or owners that outlines each person’s ownership, rights, duties as well as certain ground rules for how the LLC will run.

Honestly, this is not a requirement in Texas. However, this is strongly recommended, especially if you are a new entrepreneur, because in its absence, state LLC law will regulate how your LLC functions.

The operating agreement essentially contains:

- Members’ Percentage Interests in the LLC

- Members’ Rights and Responsibilities

- Members’ Voting Powers

- Profits and Losses Allocation

- Rules and Regulations Governing Meetings and Voting

- Buyout or Buy-sell Provisions

5. Get an Employer Identification Number (EIN) (cost: mostly free)

Even if your LLC has no employees, it must obtain its own IRS Employer Identification Number (EIN) if it has more than one owner. And, if you incorporate a one-member LLC, you must obtain an EIN only if it will have staff or if you choose to have it taxed as a corporation rather than a sole proprietorship.

All you have to do to obtain this is fill out an online application on the IRS’s website. This does not require any filing or convenience fee.

6. Annual Compliance Reports (cost: mostly free)

In contrast to the majority of states, Texas does not demand LLCs to submit yearly reports with the Secretary of State. LLCs, on the other hand, are required to file yearly franchise tax reports. As a result, the procedures for calculating the tax you have to settle can be complicated and may be heavily influenced by the nature of your LLC and its size.

How Much Does an LLC Actually Cost in Texas?

LLC Filing Fee: $300

Again, in order to incorporate an LLC in Texas, you must file the Certificate of Formation (Form 205). The Texas Secretary of State charges a fee of $300 to process and enter this information in their database.

Annual Report Fee: Free

You can send this form on the website of the Texas Comptroller of Public Accounts. It is FREE and is due every 15th of May but if you fail to file on time, Texas will charge a $50 late fee.

Registered Agent Fee: Varies

Registered agent fees start at$0 up to $39 for the first year, depending on the provider you opt to. This could be $99 to $125 annually.

Incorporating a Foreign LLC: $750

If you currently have an LLC established in another state and want to venture into Texas, you will need to form a foreign LLC in Texas. You can file a foreign LLC in Texas by submitting an Application for Registration of a Foreign Limited Liability Company (Form 304) and paying the $750 application fee.

Other LLC Filing Costs:

- Business Permits and Licenses: Varies

- “Doing Business As” (DBA) Name: $25

- Certified Document Copies: $30

- Certificate of Status: $15

Using LLC Formation Services

Self-filing is frequently the least expensive choice, but preparing all of the paperwork and submitting them yourself can be extremely challenging. Hiring a lawyer is yet another alternative, but it will usually cost you hundreds to thousands of bucks. Fortunately, these days, a lot of online LLC formation services are already available and willing to assist entrepreneurs like you in filing all the necessary paperwork and finally putting up your desired business on your behalf.

However, before dealing with any of these online formation services, it is best to consider the following so you can make the most out of every dollar you will spend for their services.

Pros and Cons of Online LLC Formation Services

Pros:

Cons:

Recommended LLC Formation Companies to Get Your TX LLC Started for The Best Price

#1: Start an LLC in Texas With ZenBusiness

ZenBusiness is a very popular LLC formation service that gets great customer reviews. Their packages are reasonably priced and include some excellent features. ZenBusiness provides a free operating agreement with all their packages which is something all LLCs should have. They also will file your annual report for your LLC if you want them to, which will save you some time and trouble. Additionally, they offer 25% off of registered agent service with all of their packages.

#2: Start an LLC in Texas With Northwest

Northwest Registered Agent has one of the best customer support in the whole industry. And You can’t go wrong if you choose them!

Tips When Using an Online LLC Formation Service

Focus on Your Business’ Needs

When considering using an online formation service, you have a range of bundles and products to select from. Although these bundles were mainly well-curated, not all of the services offered are necessary for business incorporation. Articles of incorporation, a registered agent, an operating agreement, or an annual report may be required depending on the size and type of your business.

However, many LLC creation service providers provide such services in addition to “not so relevant” services. Almost every provider offers customized products such as company seals and binders. While all of these are nice, neither of them are absolutely necessary.

Registered Agent Service Inclusion

All LLC and other business entities in the United States must have a registered agent. Many LLC formation providers include a registered agent service by default, while others do not have or will never let you unsubscribe. So, if you already have a registered agent service provider in mind, make sure to read their terms and conditions, which must include an opt-out option.

Be Mindful of Recurring Payment Services

Many formation-related services, such as registered agent services or yearly report submission and compliance services, are billed on a recurring basis. Given this, it is critical to keep track of billing dates to mitigate any potential complaints and disagreement with your preferred formation service.

Know the Difference of State-expedited and Internal-expedited Filings

There are two types of expedited filings in terms of incorporating an LLC: state-expedited and internal-expedited.

In some states, you can pay extra to move ahead in line and shorten the turnaround time. Waiting periods can be shortened from 3-4 weeks to 3-5 days in this setup.

Meanwhile, some LLC formation services charge an extra amount for faster internal filing. This, however, has no effect on your application’s interaction with the state. Internal expediting means that the LLC formation service will expedite your registration within their own system so that it can be delivered to the state more quickly.

If you require a short turnaround time but do not want to bear additional spending, numerous providers offer plans that include same-day delivery.

Check if Your Company is S-Corporation Status Eligible

S-corporation is a tax categorization that can be used for both LLCs and C corporations. To be classified as one can help you save money on income taxes as well as offer you other tax benefits.

Frequently Asked Questions (FAQs)

Should I start a limited liability company in Texas?

If you are just starting out or have been operating as a sole proprietor, you might think about incorporating an LLC. LLCs minimize an owner’s personal liability for business debts and litigation and provide a great deal of freedom in terms of business control, management, and taxation.

How do I find out if the name of my LLC is available?

It is critical that the name of your LLC be distinct from the names of other current businesses on file with the Texas Secretary of State. To ensure that your desired name is available, you can initiate a free name search on the Texas Comptroller of Public Accounts webpage. Before registering your LLC, you can also verify the availability of business names on the Texas Secretary of State website, albeit the SOS will charge a $1.00 fee for these queries.

Do I have to pay Texas business taxes?

In some situations, such as if you want to sell items and receive sales tax, you must sign up with the Texas Comptroller of Public Accounts. Majority of LLCs in Texas are also subject to an annual franchise tax. Depending on the tax, you may be able to register online, by mail, or in person at a Comptroller field office.

Can foreign LLCs operate in Texas?

All LLCs formed outside of Texas must sign up with the Texas Secretary of State in order to conduct business in the state. For service of process, foreign LLCs must establish a registered agent. The agent may be a Texas resident or a business organization registered in Texas.

To register, simply submit an Application for Foreign Limited Liability Company Registration (Form 304). The application can be submitted either online or by mail. There is a filing cost of $750.

Is it possible to register a single-member LLC in Texas?

A Texas single-member LLC is treated just as much as a multi-member LLC for most purposes of incorporation. When it comes to submitting a tax return, single-member LLCs have more leeway.

Is it possible to incorporate a professional LLC (PLLC) in Texas?

If you wish to organize an LLC in Texas and provide a licensed professional service, you must do it as a professional LLC. In general, if you provide a service that necessitates the acquisition of a Texas state license before practicing, you are a professional service. To form a PLLC, each member of the business must be licensed.

Is it necessary for me to hire an attorney in order to incorporate an LLC in Texas?

In Texas, you do not need to employ a lawyer to incorporate an LLC, although you absolutely can if you really want to. A lawyer will typically charge between $800 and $2,500 to incorporate your Texas LLC, which is in addition to the $300 state application fee. If you form an LLC personally, you could save a significant amount of money.

Should I use an LLC formation service?

Depending on the company, an LLC filing normally costs between $40 and $400. To save time, you can simply employ a professional or an online formation services provider to form an LLC in Texas.