Form 8832 Filing Guide – LLC Taxed as C-Corporation (Beginner-friendly Guide)

Start Your C-Corp Today Only From $0 + state fees!

Unless you specify otherwise, a limited liability company (LLC) is given a “default” tax status when it is created. If an LLC has only one member, it is typically treated as a sole proprietorship; if it has several members, it is taxed as a partnership.

To optimize your tax savings, however, it’s crucial to have your limited liability business (LLC) classified under the appropriate tax law. So, after analyzing your alternatives, you could determine that changing your LLC’s tax status is favorable. By submitting Internal Revenue Service Form 8832, you can do this.

You can select a different tax status for your organization than the default status by submitting Form 8832 to the IRS. You can choose to have your LLC taxed as a sole proprietorship, partnership, c corporation, or s corporation depending on your goals. A business may occasionally be able to reduce its annual tax burden by changing its tax status and saving thousands of dollars.

- Start Your C-Corp Today Only From $0 + state fees!

- Who Created Form 8832?

- The Value of Form 8832 From the IRS

- The Use of IRS Form 8832

- Which Business Types are Required to Submit Form 8832?

- What Else Should You Understand About Form 8832?

- How Do I Submit Form 8832?

- What Time Frame Do I Have to Submit Form 8832?

- If I’m Not an LLC, How Can I Elect S Corporation Status?

- What if Form 8832 Has Never Been Filed By You?

- Why a C Corp Should Be Used for Your New Business?

- Don’t Have a C Corp or an LLC? – Get Started Today!

Who Created Form 8832?

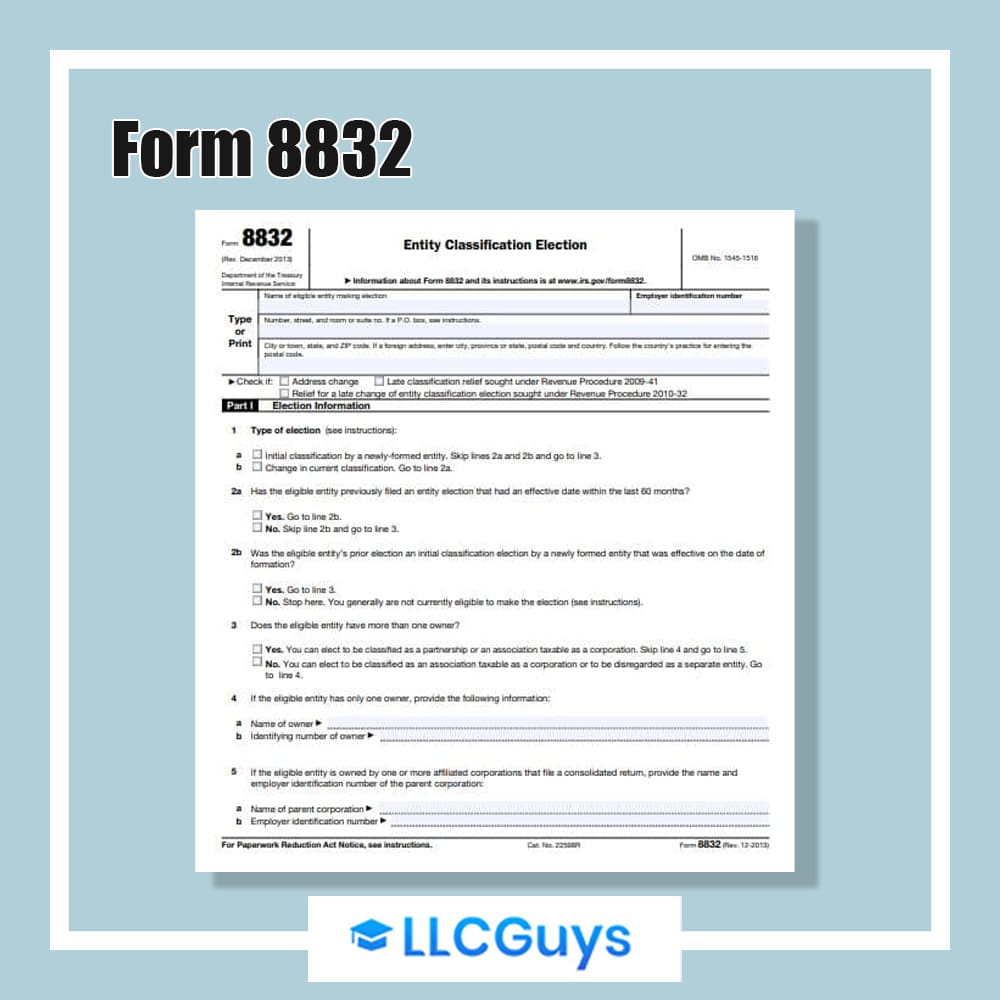

When choosing how they want their firms to be taxed, LLC business owners utilize IRS Form 8832, the Entity Classification Election form.

An LLC can be classified as a corporation, partnership, or disregarded entity for federal tax purposes, meaning that its revenue is reported on the owner’s personal federal income tax return.

When forming an LLC, you have the option of sticking with the IRS tax classification that is currently in effect or choosing a new tax treatment by filing Form 8832.

The Value of Form 8832 From the IRS

Your company will be given a default tax classification if Form 8832, also known as the Entity Classification Election, is not completed. This might lead to you paying more business taxes than required.

If you choose wisely, changing your tax election status can save you hundreds of dollars annually. Typically, an LLC that wants to be taxed as a C-corporation completes and submits IRS Form 8832. A multi-member LLC is classified as a partnership, but a single-member LLC is often viewed as a disregarded company.

You can change the tax status of your company to prevent profits and losses from being transferred to your personal income tax returns by completing Form 8832. Instead, you’ll need to use form 8832 to pay company income taxes.

The Use of IRS Form 8832

Classification of Entities the choice to pay corporate tax. The date specified on line 8 of Form 8832 serves as the effective date of the decision to be taxed as a new entity. A maximum of 75 days before or after the filing date, as well as a maximum of 12 months after the filing date, are allowed for the election to take effect.

Form 8832 contains a permission statement that may be signed by each member individually or collectively. If just one signer is present, form 8832 should be used to document that this election was authorized by all members at the company membership meetings.

You must include the owners’ names and the number of owners (Social Security Number for a single-member LLC, and Employer ID Number for multiple member LLC).

To elect to be taxed as an S Corporation, use IRS Form 2553, Small Business Corporation Election. For the new tax categorization to apply for the whole year, you must submit by March 15th. Each shareholder’s name and address, the amount of shares they own, their Social Security number, the end of their tax year, and a consent statement must be included in the document.

Which Business Types are Required to Submit Form 8832?

Partnerships, single-member LLCs, and multiple-member LLCs can all file Form 8832. If your firm falls under one of these categories and you wish to modify how you are taxed, fill out Form 8832.

What Else Should You Understand About Form 8832?

If you haven’t heard of Form 2553, you might be wondering what makes it different from Form 8832. Some firms may request a change tax classification using both form 2553 and form 8832. The most important distinction between the two forms is the sort of tax categorization you desire.

Using Form 8832, businesses can ask to be taxed as a corporation, partnership, or sole proprietorship. Contrarily, to adopt S Corp tax status, corporations, and LLCs utilize Form 2553.

There are several options for online accounting software that you may use to manage your expenditures and expenses.

How Do I Submit Form 8832?

Form 8832 must be physically mailed to the Internal Revenue Service of the Department of the Treasury. There are two service centers, one in Ogden and the other in Kansas City. Depending on where your company is situated, you may choose which one to send it to. Forms must be sent to the Ogden site by foreign qualifying organizations.

What Time Frame Do I Have to Submit Form 8832?

At any time, you can submit IRS Form 8832. You could opt to file it right once when your firm launches, or you can decide to file it later. Additionally, if you do it within particular time constraints, you can select the election’s effective date.

Typically, your start date is:

- No later than 75 days after you file Form 8832.

- cannot be more than 12 months following the filing of your Form 8832.

The effective date will be the same as the date on the Form if you don’t select a date. You should also be aware that if you’re reclassifying, unless an exemption occurs, you may only modify your election once every five years (60 months).

If I’m Not an LLC, How Can I Elect S Corporation Status?

Form 2553, Election by a Small Business Corporation, must be submitted to the IRS and must be signed by all of your company’s shareholders if you’re choosing to have S corp status as an LLC or C corporation.

What if Form 8832 Has Never Been Filed By You?

The following default selections will be used by the IRS to categorize your company as a foreign-qualifying organization. You would be considered:

- If your company has two or more members and at least one of them does not have limited liability, it is regarded as a partnership.

- If all members have limited liability, the association is regarded as taxable as a corporation.

- If it has a single, non-limited liability owner, it is not taken into account as a separate entity.

Why a C Corp Should Be Used for Your New Business?

Business owners may choose the C corporation tax status for a variety of reasons. Owners who elect corporation tax status benefit most from not having to report all firm revenue on their personal tax returns.

Many venture capitalists solely finance businesses. Venture capitalists frequently decide to invest in companies rather than partnerships since it might be more challenging for them to do so (directly or indirectly). A C corp form is your best choice if your ultimate goal is to draw in private equity or venture financing.

Schedule K-1s are replaced by W-2s for members who work as employees in C corporations. As a result, partnership members receive K-1s from their firm instead of employee salaries. Because financial firms are used to seeing a W-2, it is frequently simpler to acquire funding when you provide one if you want to get financing via a bank (for anything like a car or house).

Don’t Have a C Corp or an LLC? – Get Started Today!

#1: Start a C-Corp or an LLC With Northwest Registered Agent

Create your C Corp or an LLC with Northwest Registered Agent, they currently rank #1 in our top LLC formations services list.

#2: Start a C-Corp or an LLC With ZenBusiness

Start an LLC or C Corp today with the professional help of ZenBusiness. They rank #2 in our best LLC services list.